What leverage should I use for Forex

Learning about how to trade forex can be very exciting and what is most fascinating, especially to new and novice traders is the leverage opportunity, the countless opportunities to catch a handful of pips and the profits that can be gained with their newly acquired knowledge and trading strategies but where most novice traders fall apart or trip off in their early days of trading the forex market is over-leveraging of their trades.

The concept of leverage might seem boring to beginner traders who are enthusiastic about placing a lot of trades, catching a lot of pips, cashing out thousands of dollars and being the latest forex trading rockstar. Leveraging remains one of the most important aspects of risk management that must be taken seriously by traders of all levels (beginner, intermediate and professional traders) to ensure discipline, orderliness and longevity in the forex trading market.

This, therefore, implies that it doesn't matter how good, profitable and consistent a trading strategy might be. Losses are inevitable and one of the contributing factors to why most retail forex traders lose a lot of money is because of inappropriate use of leverage which to some extent, can wipe out all the equity and account balance of a trading portfolio in seconds.

It is very important as a forex trader to understand the whole concept of forex trading but in this article, we will go through specifics on the aspect of leverage, use-cases explaining the risks of high leverage, the benefits of low leverage and then the best leverage to use depending on the account size or available leverage by the broker.

What is the meaning of Leverage in Forex

Leverage in layman’s terms means to ‘take advantage’ of an opportunity to utilize something bigger (usually beyond a person, a tool or financial capacity) to achieve a bigger goal or bigger objective.

The same theory applies to forex trading. Leverage in forex simply means to take advantage of a certain amount of capital provided by a broker so as to utilize more trading volume to gain larger profit. The forex trader acquires a significant amount of capital from his broker (as debt) on initial margin requirement to maximize profit from relatively small changes in price movements.

The basic idea of leveraging in forex trading is that; retail traders' funds are too small to partake in the buying and selling of financial assets or forex pairs. Therefore the broker provides leverage by lending its trading capital to traders in the form of varying leverage ratios as a means to enhance its trader buying and selling capacity.

Forex traders must keep in mind that leverage which is often referred to as a two-edged sword, if used the right way, can significantly increase the profits on the equity and the account balance of a trading portfolio but if used wrongly, it can as well significantly increase the losses thereby reducing the available equity and also the account balance of the trading portfolio.

Let's go through a gradual step by step process to understand the specifics of leverage in forex and how to combine these concepts to arrive at a good understanding of how to use and apply proper leverage to your trades.

Basic sizes of trade position in the forex market

Forex traders must know the basic sizes of trade positions that can be used to buy or sell an asset or currency pair.

There are three basic sizes of trade positions that can be executed in retail forex trading.

They are;

- Micro lot size: this represents 1,000 units of a quote currency pair.

- Mini lot size: this represents 10,000 units of a quote currency pair.

- Standard lot size: this represents 100,000 units of a quote currency pair.

How does price movement relate to the sizes of trade positions

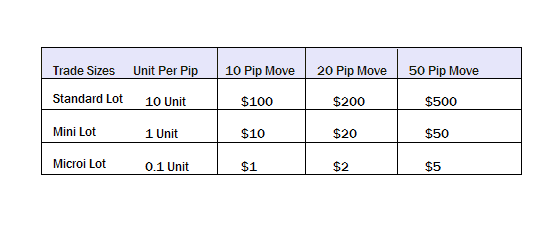

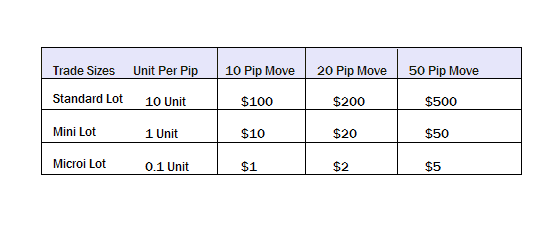

Here is a chart that illustrates how price movement in terms of pips is relative to the 3 basic sizes of trade positions.

Price movements are measured in pips.

Therefore, each pip move of a standard lot represents 10 units per pip. This means that when using a standard lot, every pip move will be a multiple of 10 units (amount of pips * 10 units).

For example, 10 pip move of a standard lot will amount to $100 and 50 pip move of a standard lot will amount to $500.

Correspondingly, each pip move of a mini lot represents 1 unit per pip i.e. every pip move will be a multiple of 1 unit (amount of pips * 1 unit).

For example, 10 pip move of a mini lot will amount to $10 and 50 pip move of a mini lot will amount to $50.

And lastly, each pip move of a micro lot represent 0.1 unit per pip i.e. every pip move will be a multiple of 0.1 unit (amount of pips * 0.1unit).

For example, 10 pip move of a micro lot will amount to $1 and 50 pip move of a micro lot will amount to $5.

How to determine the maximum limit to which an account size can handle relative to the available leverage provided by a broker.

Assume a broker offers its traders leverage of 500:1,

This means that if Trader A has $10,000 trading capital. He or she can manage floating trade positions up to an amount of $5,000,000 because the multiple of the trader's equity and the available leverage (broker’s capital) amounts to $5,000,000. (i.e 10,000 * 500 = $5,000,000).

Also, if Trader B has $5,000 trading capital. He or she can manage floating trade positions up to an amount of $2,500,000 because the multiple of the trader's equity and the available leverage (broker’s capital) amounts to $2,500,000. (i.e 5,000 * 500 = $2,500,000).

The same token goes if the broker offers its traders a lesser leverage size.

Assume the broker offer its traders leverage of 100:1,

This means that if Trader A has the same $10,000 trading capital. He or she can manage floating trade positions up to an amount of $1,000,000 because the multiple of the trader's equity and the available leverage (broker’s capital) amounts to $1,000,000. (i.e 10,000 * 100 = $1,000,000).

Also, if Trader B has the same $5,000 trading capital. He or she can manage floating trade positions up to an amount of $500,000 because the multiple of the trader's equity and the available leverage (broker’s capital) amounts to $500,000. (i.e 5,000 * 100 = $500,000).

Steps to determine how to leverage properly when trading forex

To effectively utilize leverage with the right lot size when trading forex,

- The first step is to identify the available leverage that is provided by the broker. Most brokers usually offer retail traders leverage between the range of 50:1 to 500:1.

- Next is to determine your present account balance or available equity.

- Then you have to find out what type of trader you should be, depending on your level of experience and proficiency in forex trading. You can either be an aggressive trader or a conservative trader. Most professional traders still trade the market conservatively because they are aware of the fact that losses are inevitable and whatever past success they have had with their strategies, may not guarantee the success of future trades. It is therefore important for novice, beginner and developing traders to maintain a conservative approach to trading.

- Then you can decide to leverage with the appropriate risk management that coincides with your equity and account balance

Let's take a practical look at an example of aggressive trading and conservative trading

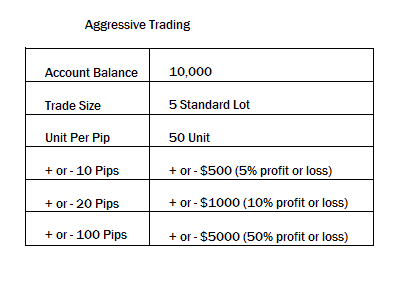

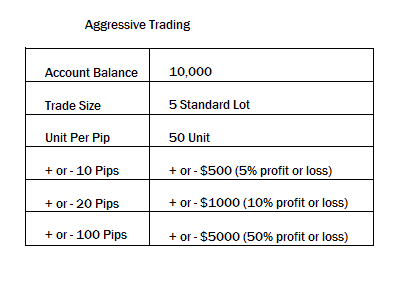

Take, for instance, Trader A in our earlier example is an aggressive trader. He purchased 5 standard lot of EurUsd with his $10,000 account size.

Recall that price movements are measured in pips and each pip move in a standard lot represents 10 units per trade.

This means that each pip move of 5 standard lot of EurUsd will cost $50

(10 unit per pip * 5 standard lot = $50 per pip of 10 standard lot)

Therefore, if the trade goes in favour of Trader A by 20 pips,

20pips * $50 per pip = $1000

The trader will gain $1000, which seems to be very exciting but risky and unprofessional because if the trade goes against the Trader with the same amount of 20 Pips, the trader will lose $1000 which is 10% of the trader's capital gone in just one single trade.

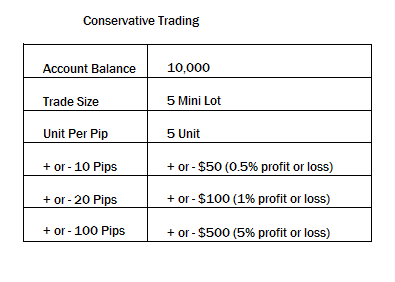

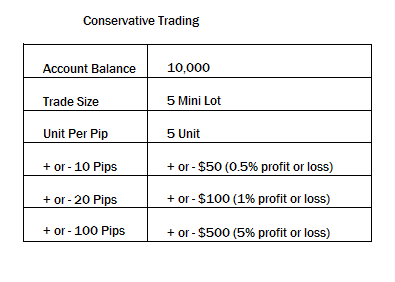

Assume Trader A is not an aggressive trader but is conservative. He purchased 5 mini lots of EurUsd with his $10,000 account size.

This means that each pip move of 5 mini lot of EurUsd will cost $5

(1 unit per pip * 5 mini lot = $5 per pip of 10 miini lot)

Therefore, if the trade goes in favour of Trader A by 20 pips,

20pips * $5 per pip = $100

Summary

Irrespective of the amount of leverage made available by any broker. It is the responsibility of forex traders to utilize leverage wisely with caution.

The trader has to submit to proper risk management to effectively utilize the broker's capital (leverage) to his or her benefit by doing the following.

- Maintain a consistent level of leverage (in terms of trade sizes) to avoid haphazard trading results of profits and losses.

- Minimize losses with effective risk management practices such as trailing stop and appropriate stop loss placement in case a trade setup doesn't go as planned.

- Determine and make sure that the amount and size of risk (like was calculated in the example above) used to open trade positions is the most appropriate with the brokers' available leverage and your floating equity or account balance.

- Make sure that the risk of whatever leveraged position is not more than 5% of your equity or account balance.

Click on the button below to Download our "What leverage should I use for Forex" Guide in PDF