Learn Forex Trading step by step

Content

How does forex work? Basic requirements for Forex trading Steps in Forex trading

Forex Trading FAQs Conclusion

Among the many investment instruments, Forex trading is an attractive way to increase your capital conveniently. According to the 2019 Triennial Central Bank survey by the Bank for International Settlement (BIS), statistics showed that Trading in FX markets reached $6.6 trillion per day in April 2019, up from $5.1 trillion three years earlier.

But how does all of this work, and how can you learn forex step by step?

In this guide, we are going to solve all your questions regarding forex. So, let's get started.

How does forex work?

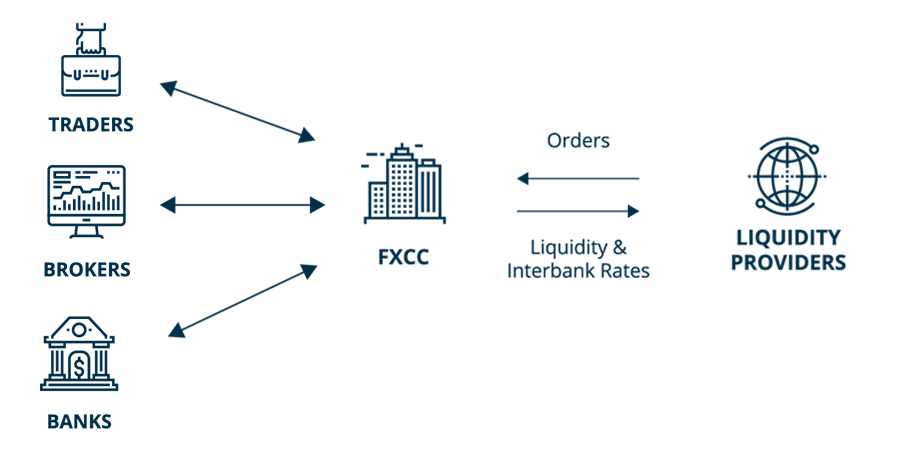

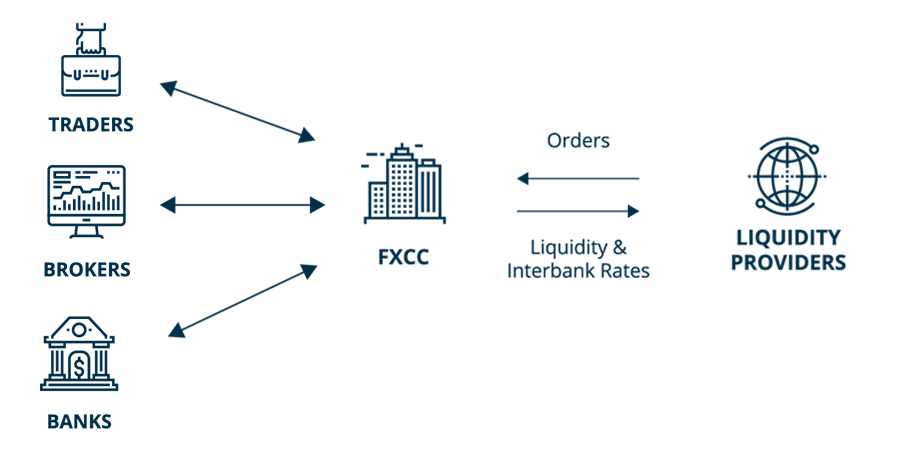

Forex trading does not occur in exchanges like commodities and stocks, rather it is an over-the-counter market where two parties trade directly through a broker. The forex market is operated through networks of banks. The four primary forex trading centers are New York, London, Sydney and Tokyo. You can trade 24 hours a day from Monday to Friday.

There are three types of forex markets that include spot forex market, futures forex market and forward forex market.

Most traders speculating on forex prices will not plan to take delivery of the currency itself; instead they make exchange rate predictions to take advantage of price movements in the market.

Forex traders regularly speculate on rising or falling prices of a currency pair to realize profits.For example, the exchange rates for the EUR/USD pairshows the ratio value between the Euro and the US Dollar. It arises from the relationship between supply and demand.

Basic requirements for forex trading

You have already fulfilled the most important basics of participating in Forex trading if you have a computer and an internet connection.

Now that you have the necessary know-how of the Forex market let's move on to how you can learn Forex trading step by step.

Steps in forex trading

Before starting actual trading, there are few things you need to consider first. These steps are part of your learning process.

1. Choosing the right broker

Choosing the right broker is the most crucial step in forex trading as you cannot perform online trading without a broker and choosing a wrong broker may end up in a really bad experience in your trading career.

You should make sure that the broker offers cheap fees, an excellent user interface, and above all, a demo account.

With the demo account, you can find out whether the broker suits you or not. It also lets you test and refines your forex strategies.

If someone wants to give you something or wishes to offer it at outrageously right conditions, you should be suspicious. You are well-advised to turn to one of the established platforms regulated by the authorities of their countries of origin.

2. Learn the essential terms

You have to learn specific trading terms before starting your journey. Here are the phrases you should try to understand.

- Exchange rate

The rate indicates the current price of the currency pair.

- Bid price

It is a price at which FXCC (or another counter party) offers to buy the currency pair from a client. It is the price the client will be quoted when wanting to sell (go short) a position.

- Ask price

It is the price at which the currency, or instrument is offered for sale by FXCC (or another counter party). The ask or offer price is effectively the price a client will be quoted when wanting to buy (go long) a position..

- Currency pair

Currencies are always traded in pairs, e.g., EUR/USD. The first currency is the base currency, and second is the quote currency. This shows how much of quote currency is required to buy the base currency.

- Spread

The difference between bid and ask price is called spread.

- Forecast

The process of evaluating current charts to predict which way the market will move next.

- Commission/fees

It is the fee that a broker such as FXCC may charge per trade.

- Market order

The market order is based on the current price set by the market. If you give such a buy or sell order, you will be able to get to the trade as quickly as possible.

- Limit order

The limit order enables the trader to set a price limit up to which currency pairs are bought or sold. This allows planning to trade certain price levels and avoid overpriced buying prices or selling prices that are too cheap.

- Stop-loss order

With the stop-loss order, the trader can minimize the loss in a trade if the price goes in opposite direction. The order is activated when the price of a currency pair reaches a certain price level. The trader can place a stop-loss while opening a trade or it can be placed even after opening the trade. The stop-loss order is one of the basic tools to manage the risk.

- Leverage

Leverage allows the traders to trade bigger volumes than what the principle capital allows. Potential profits multiply, but the risks also increase significantly.

- Margin

While trading forex, traders are only required a small portion of the capital to open and maintain a trading position. This portion of capital is called margin.

- Pip

Pip is a basic unit in forex trading. It indicates the change in the price of a currency pair. A pip corresponds to a course change of 0.0001.

- Lot

A lot means 100,000 units of the base currency in forex trading. Modern brokers offer mini lots with 10,000 units and micro lots with 1,000 units to traders with lower capital.

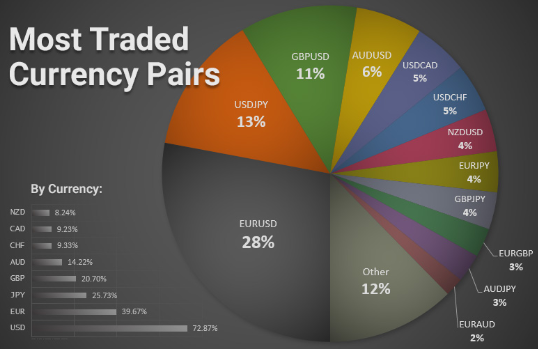

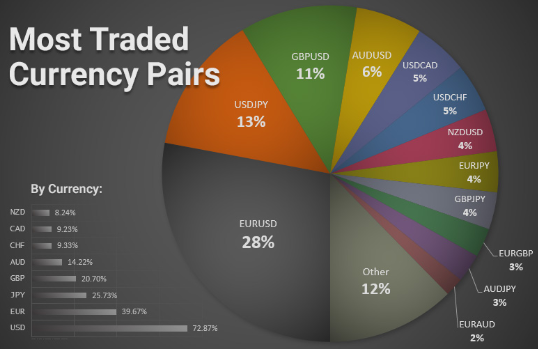

- Exotic pairs

Exotic pairs are not traded as often as the "majors". Instead, they are weaker currencies, but they can be combined with EUR, USD, or JPY. Due to more unstable financial systems, such exotic currency pairs are often significantly more volatile than the majors that are mostly stable.

- Volume

Volume is the total amount of trading activity of a particular currency pair. Sometimes it's also considered as the total number of contracts traded during the day..

- Go long

“Going long” means buying a currency pair with expectation of a rise in price of that currency pair. The order becomes profitable when the price rises above the entry price.

- Go short

Short a currency pair means that you expect the price of currency pair will fall. The order becomes profitable when the price falls below the entry price.

- No swap accounts

With a no swap account, the broker does not charge rollover fee for holding any trading position overnight.

- Standard account

The online forex brokers now offer all kinds of accounts. If you have no special requirements or wishes, keep the standard account.

- Mini account

A mini account allows forex traders to trade mini-lots.

- Micro account

A micro account allows forex traders to trade micro-lots.

- Mirror trading

Mirror trading allows traders to automatically copy the trades of other successful traders against a certain fee.

- Slippage

The difference between actual fill price and expected fill price is called slippage. The slippage usually occurs when market is highly volatile.

- Scalping

Scalping is a short-term trading style. The time period between opening and closing of a trade can vary from few seconds to few minutes.

3. Open a demo account

We recommend a demo account with which you can try out forex trading without any risk. So, you can get your first FX experience without risk.

A demo account works like a real account with limited functionalities. Here you have virtual money that you can use for trading.

4. Pick a trading software

Some brokers offer their exclusive web trading portal while other FX brokers provide you with particular software or app. Most brokers support the popular MetaTrader trading plaform.

If you use the internet through a less common browser, you must assume that your FX broker does not support it. To still be able to trade with Forex broker, you will have to use an app in this case - or install one of the common browsers on your computer.

5. Choose a currency pair

Forex trades are made in currency pairs only. You, therefore, have to decide which currency pair to invest in. As a rule, majors and minors are available. The most popular currency pairs are probably EURUSD, USDJPY, and EURGBP.

6. Try some trading strategies

A coherent forex strategy necessarily includes four points:

- defined entry signals

- position sizes

- risk management

- the exit from a trade.

Select a trading strategy that suits you best.

Here are some of the common trading strategies:

- Scalping

In so-called "scalping," the positions run particularly for a very short span of time. As a rule, they close the trade within a few minutes of their opening. Traders are satisfied with low income per trade when scalping. The constant repetition can lead to high returns in the long term.

- Day trading

In day trading, trades are opened and closed within one day. The day trader tries to gain from short-term fluctuations in a highly volatile forex market.

- Swing trading

Swing trading is medium-term trading mode where traders hold their positions from two days to several weeks and they try to get maximum profit from a trend.

- Position Trading

In position trading, traders follow long-term trends to realize the maximum potential from a price movement.

Forex Trading FAQs

Is it worth investing in Forex?

As with any venture, there is always a risk of loss when trading Forex. You must set up a suitable forex trading strategy that corresponds to your trading personality. Those who invest wisely can achieve high returns from forex trading.

What is the best platform for forex trading?

The selection of platform is very subjective and it depends on one’s trading requirements. Some of the well known Forex Trading platforms include MetaTrader 4 and MetaTrader 5. Not all trading platforms are free though. Apart from a monthly recurring fee, some platforms may have wider spread as well.

How difficult is it to be successful in trading forex?

There is no doubt that it takes a lot of practice to make money with forex trading. In addition to choosing the right currency pair, constant training is essential in becoming a successful forex trader.

Conclusion

Online forex trading promises high returns for investors but demands a lot from them. Only those who are ready to prepare for online forex trading properly and to deal extensively with forex trading strategies should venture into the forex market.

With the tips discussed above, you are well prepared to have your first forex experience and can finally start learning forex trading.

Click on the button below to Download our "Learn Forex Trading step by step" Guide in PDF