What is a margin call, and how to avoid it?

A margin call is what happens when a trader runs out of free margin. If there is less amount deposited than required under the terms of leverage, open trades in Forex are automatically closed. This is a mechanism that limits the loss and traders do not lose more than their deposited amount. Traders can avoid margin call if they use the margin wisely. They should limit their position size according to their account size.

How to find the margin in MT4 terminal?

You can see the margin, free margin and margin level in the account terminal window. This is the same window where your balance and equity are shown.

Calculating the maximum lot for margin trading

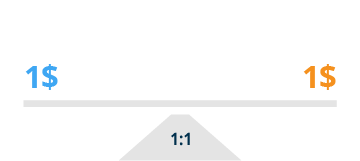

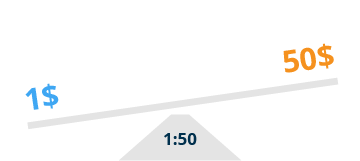

The standard Forex lot size is 100,000 currency units. With a 100: 1 leverage, every $1000 deposit in a trading account gives you buying power of $100,000. The broker allows the traders to dispose of this hundred thousand, while there is a real thousand on the deposit.

For example, if we will buy 10,000 currency units at 1.26484 with a leverage of 400: 1, we will get a little more than $ 31 of the required margin. This is the very minimum "collateral" for opening a trade in Forex.

Example of margin trading

Let's say a trader opens an account with a broker with a leverage of 1: 100. He decides to trade the EUR / USD currency pair; that is, he buys in euros for the US dollar. The price is 1.1000, and the standard lot is € 100,000. In normal trading, he would have to deposit 100,000 into his account to open a trade. But trading with a leverage of 1: 100, he only deposits $ 1000 into his account.

Forecasting the rise or fall of the price, he opens a long or short trade. If the price goes right, the trader will make a profit. If not, the drawdown may exceed your deposit. The deal will close, the trader will lose money.

Conclusion

Of course, margin trading is a useful tool for those looking to trade Forex with limited start-up capital. When used correctly, leveraged trading promotes rapid profit growth and provides more room for portfolio diversification.

This trading method can also exacerbate losses and involve additional risks. Thus, we conclude that it is quite hard to enter the real market without knowing the features of Forex.

The risk of losing all the money is too high. As for cryptocurrencies and other volatile instruments, such as metals, only experienced traders who generally have a good level and successful statistics can go in here.

By the way, it will be interesting to know if you like Forex, if you like to trade with leveraged funds, and what is your favorite leverage.