What is tick scalping in forex

Tick scalping is a specialized trading strategy in forex that focuses on capitalizing on tiny price movements, known as "ticks." A tick represents the smallest possible price fluctuation in a currency pair. Unlike traditional scalping, where trades may be held for several minutes or hours, tick scalping involves executing multiple trades in seconds or milliseconds, with the goal of gaining profit from these minimal market changes.

This technique has grown in popularity among forex traders due to its potential for generating quick profits, especially in highly liquid markets such as the EUR/USD or GBP/USD. Traders are drawn to tick scalping because it can be highly profitable if executed correctly, though it requires significant skill and access to high-speed trading platforms.

Speed and precision are essential in tick scalping, as even a delay of milliseconds can impact profitability. Traders must act quickly to enter and exit positions before market conditions shift.

In the broader context of forex strategies, tick scalping is considered a high-frequency method that contrasts with longer-term approaches like swing trading or position trading. It appeals to traders who prefer short-term, fast-paced trading environments and have the necessary resources to manage the demands of real-time execution.

Understanding tick movements in forex

In forex trading, a “tick” represents the smallest possible change in the price of a currency pair, typically measured in fractions of a pip (percentage in point). For example, if the price of the EUR/USD pair moves from 1.2051 to 1.2052, that one-point shift represents a tick. These minimal price changes occur rapidly in highly liquid markets, making them key targets for scalpers aiming to profit from micro price fluctuations.

Tick scalping differs from other scalping techniques, such as time-based scalping, where traders hold positions for minutes or even hours, waiting for slightly larger price movements. In tick scalping, the focus is on immediate, ultra-short-term trades, often completed within seconds. The rapid pace means traders may place dozens or even hundreds of trades in a single session.

Micro price movements are crucial for tick scalping because they provide opportunities for frequent, small profits. Traders often rely on highly liquid currency pairs and market conditions that produce consistent tick activity.

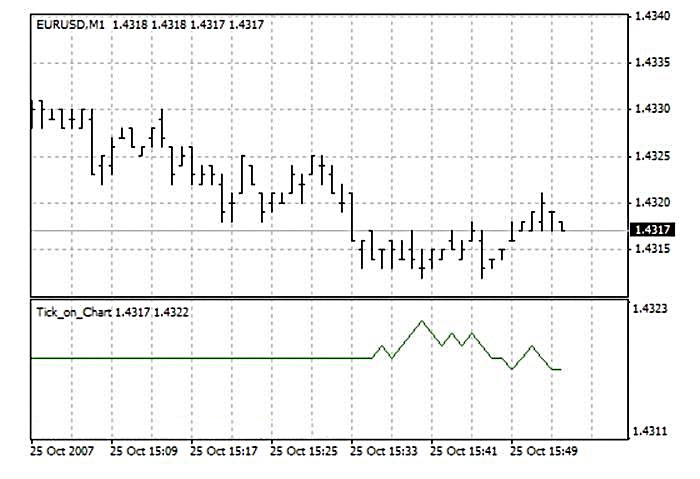

Brokers play a critical role in providing access to tick data, which updates in real-time. Advanced platforms display this data through tick charts, enabling traders to make split-second decisions.

Tick scalping techniques in forex

Tick scalping in forex involves various strategies aimed at profiting from rapid, small price movements. One of the most common methods is high-frequency trading (HFT), where traders use powerful algorithms to place numerous trades within milliseconds. HFT is highly effective for tick scalping, as it relies on advanced technology to capitalize on even the tiniest price fluctuations.

Algorithmic trading plays a significant role in tick scalping, allowing traders to automate their strategies. Algorithms can be programmed to trigger trades when certain market conditions are met, such as a specific price movement or volume change, reducing the need for manual intervention. These systems are designed for speed and accuracy, making them well-suited to tick scalping.

Traders may choose between manual and automated tick scalping, each with its pros and cons. Manual trading allows for greater control and flexibility, but it demands constant focus and fast decision-making. Automated trading, on the other hand, eliminates emotional bias and can execute trades more quickly, but it requires robust systems and can be expensive to implement.

To identify entry and exit points, traders often use tools like tick charts, which display each individual price change, and volume analysis, which highlights market activity. Price action strategies are also essential, as they help traders react to immediate market conditions based on real-time data.

Advantages and challenges of tick scalping in forex

Tick scalping in forex presents several advantages, making it attractive to traders who thrive in fast-paced environments. One key benefit is the potential for quick profits. Since tick scalping focuses on exploiting small price movements, traders can generate numerous gains in a short time, especially in highly liquid markets like the EUR/USD or USD/JPY pairs. The strategy also offers flexibility, as trades are held for mere seconds or minutes, reducing the risk of exposure to sudden market reversals or major economic news events. Additionally, because positions are held for such brief periods, traders face lower exposure to large market swings or extreme volatility.

However, tick scalping is not without its challenges. High transaction costs can accumulate quickly, as the frequent trades result in paying spreads or commissions repeatedly, which can erode profits. Successful tick scalping also requires advanced technical knowledge and the ability to execute trades almost instantly, often relying on sophisticated tools and platforms. Another critical challenge is the impact of broker spreads and latency—even a small delay or unfavorable spread can diminish profitability.

Tick scalping tools and platforms

Successful tick scalping in forex relies on access to advanced trading platforms that support the rapid execution of trades and real-time market data. Several popular platforms offer robust features tailored to tick scalping. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely used due to their customizable interface, support for algorithmic trading, and access to numerous technical indicators. Both platforms provide real-time tick charts, which are essential for scalpers who rely on precise price movements to execute trades.

Another popular platform for tick scalping is cTrader, which is known for its fast order execution and clean, user-friendly design. cTrader is ideal for high-frequency traders who require low latency and advanced charting tools. NinjaTrader is also favored by scalpers due to its sophisticated analysis tools, including tick charts and market depth indicators, which give traders a detailed view of market liquidity.

For tick scalping, specialized tools are crucial. Tick charts display each individual price movement, helping traders spot entry and exit points with precision. Market depth indicators provide insights into the order book, showing available buy and sell orders, which can help traders anticipate short-term price shifts. Latency-sensitive order execution tools minimize delays, ensuring that orders are filled quickly and at the desired price.

Risk management in tick scalping

Effective risk management is essential for traders engaged in tick scalping, given the fast pace and frequent trades that define this strategy. Since tick scalping targets small price movements, even minor market fluctuations can result in significant losses if not properly controlled. Therefore, implementing risk control measures is critical to ensure consistent profitability and avoid excessive losses.

One key approach in risk management is the use of stop-loss and take-profit techniques. For tick scalpers, these tools help automate exits when the market moves unfavorably. A tight stop-loss ensures that losses are kept minimal by closing positions swiftly when the market moves against the trade. Similarly, predefined take-profit levels allow scalpers to secure gains from small price movements without needing to manually monitor each trade.

Managing leverage and margin is another crucial component in risk management. While high leverage can amplify profits, it also increases exposure to potential losses. Tick scalpers must carefully manage their margin to prevent large losses, particularly when trading with high leverage.

Several risk management tools can enhance safety, such as trailing stops, which adjust dynamically as a trade becomes profitable, locking in gains while limiting downside risk. Additionally, automated risk controls built into trading platforms help scalpers set limits on their trades, minimizing the chance of significant losses in volatile market conditions.

Is tick scalping suitable for all forex traders?

Tick scalping is a highly specialized trading strategy, and it may not be suitable for all forex traders. This approach is best suited for traders who thrive in fast-paced environments, possess a high tolerance for risk, and have the ability to make split-second decisions. The ideal tick scalper must exhibit certain skill sets, including exceptional speed in executing trades, focus during intense trading sessions, and proficiency in technical analysis, as this strategy heavily relies on interpreting short-term price movements.

Compared to other strategies, such as swing trading or day trading, tick scalping requires a more aggressive mindset. Swing traders, for example, hold positions for days or weeks, focusing on medium-term trends, while day traders generally complete all trades within a single session. In contrast, tick scalpers execute numerous trades within seconds or minutes, focusing on tiny price fluctuations. This difference in approach makes tick scalping less suitable for traders who prefer a more measured, long-term strategy.

Market conditions also influence the effectiveness of tick scalping. It works best in highly liquid markets, where price movements are frequent, providing more opportunities for profit. However, in volatile markets, where prices can move erratically and spreads widen, tick scalping becomes riskier, as slippage and unexpected movements can negatively affect profitability.

Conclusion

Tick scalping is a forex trading strategy that focuses on profiting from the smallest price movements, or "ticks," within currency pairs. It involves executing numerous trades in a short amount of time, with the aim of capturing small gains repeatedly throughout a trading session. Tick scalping is fast-paced and relies on precision, making it popular among traders who thrive in a high-frequency trading environment.

The strategy offers several key benefits, including the potential for quick profits and reduced exposure to large market swings, given the short holding periods. However, tick scalping comes with significant challenges, such as high transaction costs from frequent trading and the need for advanced technical skills to navigate rapid market fluctuations effectively. The profitability of this strategy can also be impacted by broker spreads, latency, and the risk of emotional burnout from the intense focus required.

Overall, tick scalping is a viable strategy for traders who have the technical know-how, discipline, and access to fast execution platforms. While it is not suited for every type of trader, it can be highly profitable for those who can master the nuances of this approach.