What is the best Forex Trading Strategy?

Making pips, keeping them, and repeating the process is the key to being reliably profitable in forex trading.

Unfortunately, it isn't as simple as it looks.

You must develop a trading strategy that gives you a competitive advantage in the markets, solid risk management, and a firm grasp of your trading psychology.

But what in God's name is a forex trading strategy, and why are we talking about it?

Well, let's find out!

What is a forex trading strategy?

A forex trading strategy is a systematic approach to decide whether to buy or sell a currency pair at any given time based on certain rules.

Forex trading strategies comprise fundamental or technical analysis. These approaches to trading signals can be manual or automated.

Manual systems assume that a trader undertake trading decisions and press buy, sell buttons on his own.

On the other hand, a trader creates an algo, robot or expert advisor that detects trading signals and conducts trades in automated systems.

In the automated systems, human emotion is removed from the equation, which can boost efficiency.

How to choose the best forex strategy?

Before we discuss the best forex trading strategies, it's important to understand the best methods of choosing a trading strategy.

Here's how you can choose the best forex strategy:

Time frame

It is critical to choose a time frame that is appropriate for your trading style. There is a significant difference between trading on a 15-minute chart and trading on a weekly chart for a trader. If you want to become a scalper, a trader who seeks to profit from smaller market movements (we'll go over that later, don't worry), you can work on lower time frames, such as 1-minute to 15-minute charts.

Swing traders, on the other hand (we'll talk about this later too), are more likely to use a 4-hour chart and a regular chart to create lucrative trading opportunities. As a result, before deciding on your preferred trading strategy, consider answering the question,

"How long do I want to stay in a trade?"

Number of trading opportunities

When deciding on a strategy, you should consider the following question: "How frequently do I want to open positions?"

If you want to open a larger number of positions, you can use a scalping trading strategy.

Traders who devote more time and money studying macroeconomic reports and fundamental factors, on the other hand, are likely to spend less time in front of charts.

As a result, their chosen trading approach focuses on longer time frames and larger positions.

Trade size

The value of determining the correct trade size cannot be overstated. Effective trading strategies necessitate an understanding of risk tolerance. Risking more than you can afford is dangerous because it can lead to larger losses.

Setting a risk limit at each trade is a common piece of advice in this regard. For example, traders often set a 1% limit on their trades, which means they would not lose more than 1% of their account on a single trade.

Ok, now let's move to the juicy part:

Here are some of the best trading strategies:

1. Trend-following

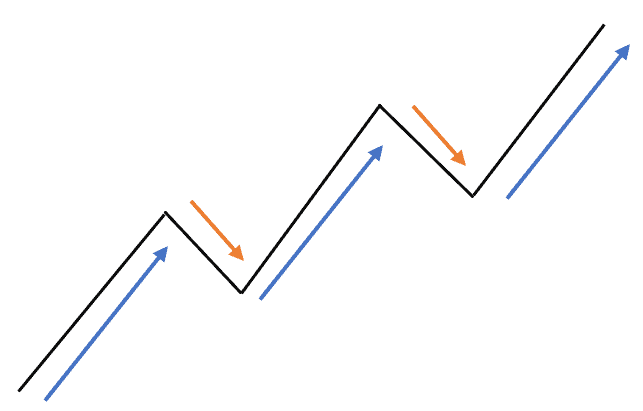

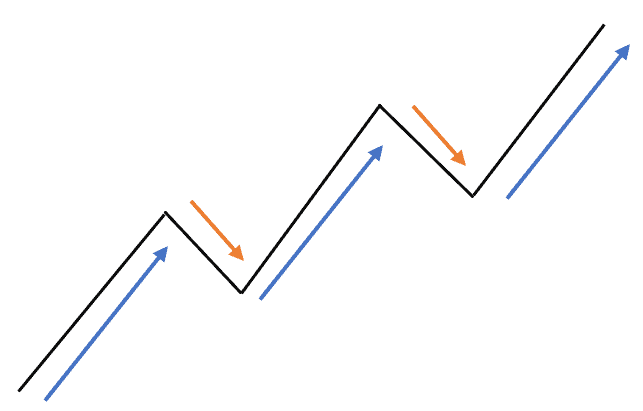

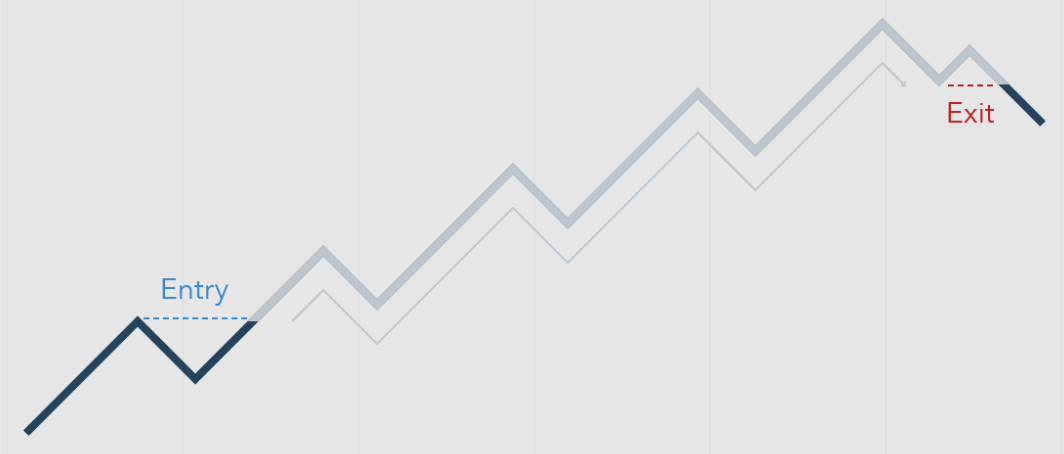

Trend-following is one of the simplest strategies for a beginner to learn. It requires trading in the trend's direction. If a trader has identified the trend's direction, he or she must open positions in that direction.

It's important to note that market patterns can be short, medium, or long. Traders must focus their trading strategies on the duration of the trend. A scalper, for example, can follow the trend's course for shorter periods of time.

Since so many factors influence the market, a pattern may shift in an instant. To prevent losses in these cases, traders must employ various types of technical analysis. You can optimize your trading ability by looking for chart trends or using indicators.

Pros:

- Ample trading opportunities

- Favorable risk/reward ratio

Cons:

- Requires extended time investment

- Involves strong appreciation of technical analysis

2. Scalping

Scalping sounds like a thriller movie, but it is more than that. Forex scalping is a common trading strategy that focuses on small market fluctuations. This approach requires opening a large number of trades in the hopes of making small gains from each one.

As a result, scalpers strive to maximize profits by making a large number of smaller gains. This strategy is the opposite of remaining in a position for hours, days, or even weeks.

Because of the liquidity and volatility of the forex market, scalping is quite common. Traders search for markets where the pricing behavior is continuously changing to profit from minor fluctuations.

This form of trader is interested in profits of about five pips per trade. However, scalpers are hoping that many trades are successful as profits are consistent and easy to achieve.

Pros:

- Plenty of trading opportunities

- Quick profits

Cons:

- Requires a lot of invested time

- Lowest risk/reward ratio

3. Day trading

Day trading is a traditional trading strategy in which you buy and sell a financial instrument over a single trading day to benefit from small price movements.

Unlike scalpers, who just want to remain in markets for a few minutes, day traders usually track and manage open trades during the day. Day traders develop trading ideas primarily using 30-minute and 1-hour time frames.

Many day traders base their trading strategies on important news. Scheduled activities, such as economic data, interest rates, GDPs, elections, and so on, have a significant impact on the market.

Day traders usually set a regular risk target in addition to the limit set on each position. Setting a daily risk limit of 3% is a popular decision among traders. This safeguards your account and capital.

Day trading is appropriate for forex traders who have enough time during the day to research, conduct, and monitor a trade.

If you think scalping is too quick for you, but swing trading is too slow, day trading might be for you.

Pros:

- Plenty of trading opportunities

- Median risk/reward ratio

Cons:

- Requires lengthy periods of time investment

- Requires strong technical analysis

4. Position trading

Position trading is a long-term investment strategy. This trading strategy, unlike scalping and day trading, is mainly concerned with fundamental factors.

Minor market fluctuations are not taken into account in this strategy because they have no impact on the overall market picture.

To identify market patterns, position traders are likely to observe central bank monetary policies, political developments, and other fundamental factors. Over the course of a year, successful position traders can only open a few trades. However, profit expectations in these trades are likely to be in the hundreds of pips range.

This trading strategy is for patient traders, as their position can take weeks, months, or even years to complete.

Pros:

- Requires minimal time investment

- Great risk/reward ratio

Cons:

- Few trading opportunities

- Requires strong fundamental analysis

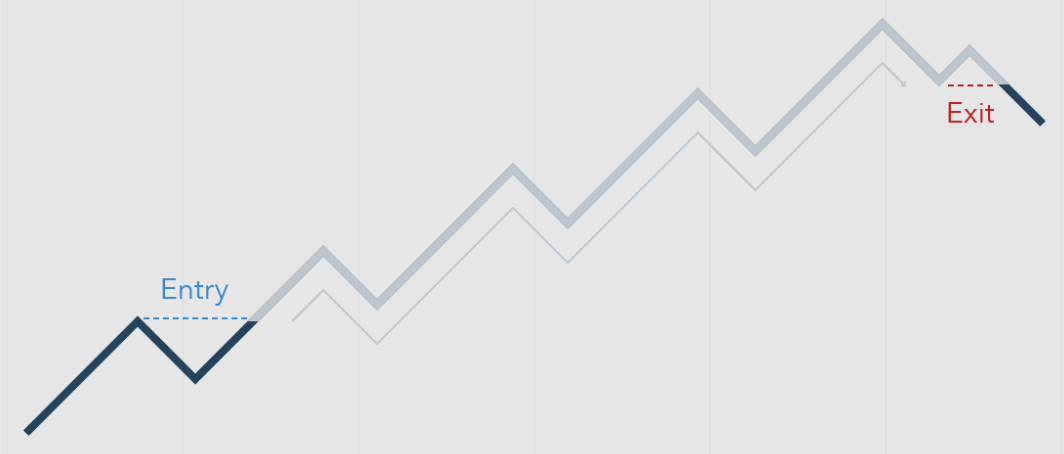

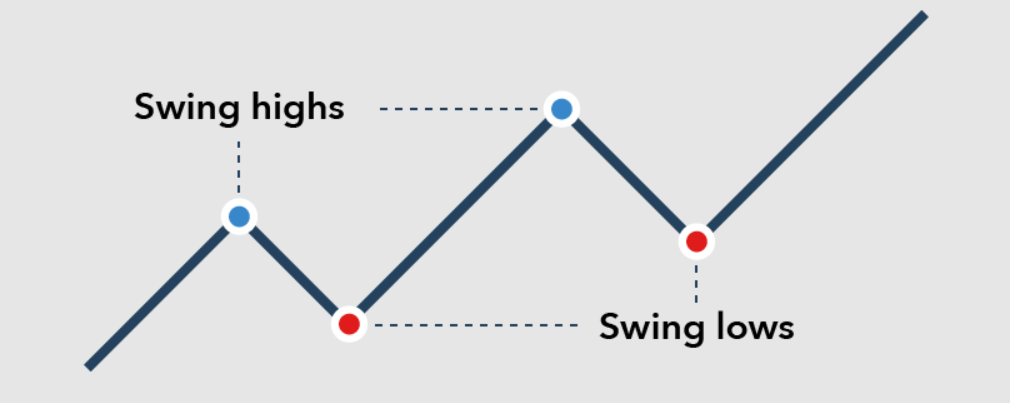

5. Swing trading

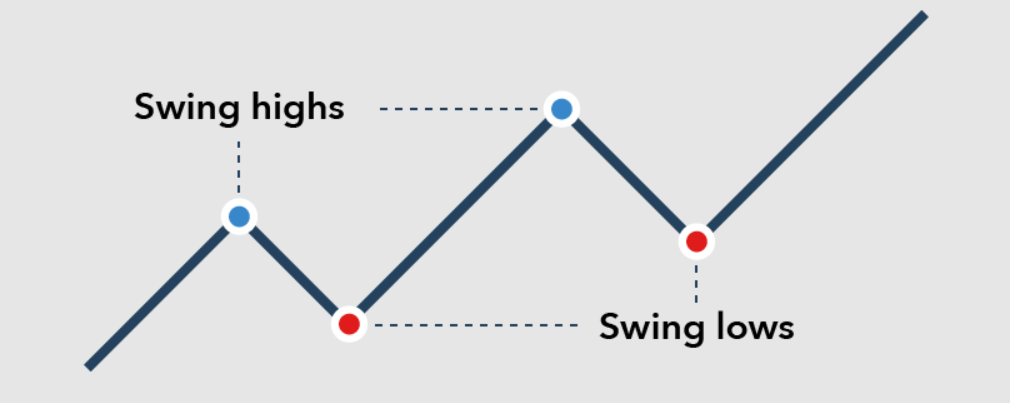

Swing trading is a strategy for traders who prefer a mid-term trading style where positions can be kept for several days and seeks to benefit from price fluctuations by finding the 'swing highs' or 'swing lows' in a pattern.

To determine where to enter or leave the trade, you must analyze price movements. You should also look at a country's economic stability or political situation to see where the price is likely to go next.

A currency pair with a wider spread and lower liquidity is preferable when using a swing trading strategy, like EUR/USD or GBP/USD.

While this strategy typically requires less time focussing on the market than day trading, it does put you at risk of any overnight volatility or gapping.

Pros:

- Substantial number of trading opportunities

- Median risk/reward ratio

Cons:

- Requires strong technical analysis

- Requires extensive time investment

6. Range trading

Range trading includes identifying support and resistance points, so you can place trades around these key levels.

If the price is near the resistance levels, it's a sign that a downtrend will follow. So, you need to take sell positions. On the other hand, if the price is near the support level, it's a signal that an uptrend will follow. So, you should take buy positions.

Pros:

- Substantial number of trading opportunities

- Favorable risk/reward ratio

Cons:

- Requires lengthy periods of time investment

- Entails strong technical analysis

7. Trend Lines

Drawing trend lines on the chart is one of the stress-free trading strategies. Draw a straight line connecting two points to use this method. Link two low points if there is an uptrend and two high points if there is a downtrend. When the price breaks through these trend lines, it indicates a shift in the trend.

Pros:

- Little time investment needed

- Median risk/reward ratio

Cons:

- Requires strong analysis of forex market

- Infrequent trading opportunities

Bottom line

If you want to succeed in the forex world, you have to come up with a proper strategy. If you don't have any strategy, you can see your dollar bills saying "bye-bye" to you.

Also, before choosing any strategy, define your risk tolerance. So, you don’t end up blowing your account.

Click on the button below to Download our "What is the best Forex Trading Strategy?" Guide in PDF