What is pin bar trading strategy in forex

The most compelling candlestick reversal pattern with the highest probable triggers in price action is the pin bar candlestick. In this article, we will go step by step through the entire theory of a pin bar.

Firstly the name “Pin bar” was coined by Martin Print from the word, Pinocchio bar, referring to Pinocchio nose because whenever Pinocchio tells a lie, his nose grows longer, hence the term “pin bar” because it told a lie about the direction of price on a candlestick.

The pin bar is one of the most significant candlestick patterns in forex because it is the only singular candlestick in a forex chart that can reveal a certain price level that has been rejected or overturned by an influx of opposing buyers or sellers in a market. Another major reason is that it often causes the major turning point at the extreme high and low of price movement in either a consolidation (sideway) or a trending market environment.

It is very essential to develop a consistent and profitable trading plan that implements the pin bar reversal signals. Therefore, proper understanding of everything about the pin bar such as its identification, how it is formed, how it can be traded in various market environments and its risk management practices are all crucial for consistency, accuracy and profitability in forex trading.

WHAT ARE THE STRUCTURAL CHARACTERISTICS OF PIN BARS?

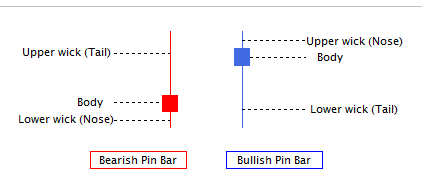

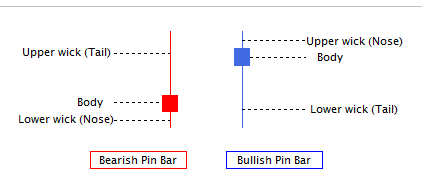

Pin bars can be clearly seen and identified only on candlestick charts. By looking at the structure below, a pin bar primarily has three major parts; the tail, the body and the nose. The structure of a pin bar can be seen as having an extended, elongated tail (upper tail for a bearish pin bar and lower tail for a bullish pin bar), a much smaller body which is the area between the open and the close of the body and lastly a nose (usually the smaller wick).

The pin needle-like (elongated tail) part of the candlestick tells that the price at that level has been tested and rejected by an opposing dominant force.

The area between the open and the close of the pin bar is the body which is relatively small compared to the height of the pin bar and the body of other candlesticks. The body of pin bars always form at the opposing end of the elongated tail (very close to the nose) thereby forming an arrow-like (pin) structure.

The arrow-like structure of the pin bar candlestick conveys the idea that price is expected to expand further in the direction of the nose.

FORMATION OF A PIN BAR

To trade the pin bar strategy with the right approach and the right mindset, it is very important that traders understand the idea behind the price movement that makes up a pin bar and why the pin bar is distinct from every other candlestick in forex.

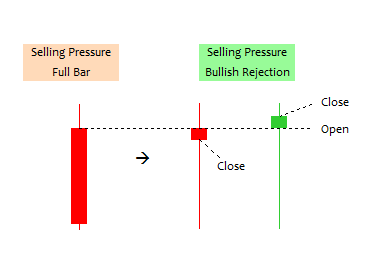

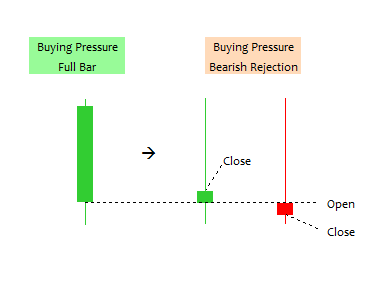

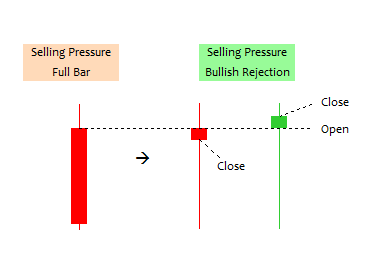

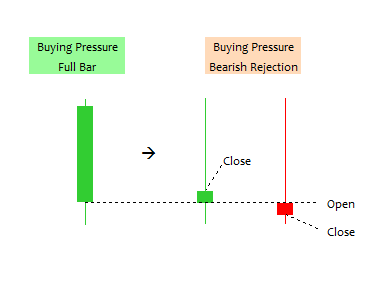

A pin bar usually begins with an enticing impulsive price move towards a particular direction. This initial impulsive price move of buying or selling pressure creates a false impression of strength that lure traders to participate and jump in on the impulsive price move with the aim to profit from it.

However, an opposing influx of buying or selling pressure overturns the initial impulsive price move causing a reversal that leads price to close near (above or below) the open of the candlestick and then ultimately appears as a candle with a long tail.

A bullish pin bar is then seen as a small body (very close to the nose) with an elongated lower tail that represents the bullish rejection of a certain price or support level with an impression that price should expand further in the bullish direction.

Also, a bearish pin bar is seen as a small body (very close to the nose) with an elongated upper tail that represents the bearish rejection of a certain price or resistance level with an impression that price should expand further in the bearish direction.

An ideal pin bar has a tail (wick) that is ⅔ or more the height of the pin bar and the remaining ⅓ makes up the rest of the pin bar including the body and the nose.

The area between the open and the close that makes up the body must be relatively small compared to the total height of the pin bar, hence the longer the tail, the smaller the body, the closer the body to the nose, the better the pin bar.

MARKET CONTEXT FOR PIN BAR TRADING

Pin bars can be identified almost everywhere on a forex chart. How then do we identify and select the right profitable pin bar signals to trade?

The best pin bars often converge with various confluences such as support and resistance, trend, moving averages, RSI and other confirming factors. Pin bar trading strategy with support and resistance make up one of the most effective strategies in forex trading. Other confluences and confirmation signals can also be incorporated into the pin bar trading strategy for high precision trade setups and long-term profitability in forex trading.

These highly probable pin bars are often seen starting off major price moves in trending and consolidating market environment. They also have the potential for explosive price movement and large profits.

The pin bar strategy can be applied on all time frames but is most meaningful and effective on the daily, 4hr and 1hr time frame.

It applies to various market environments and also adapts to the ever-changing conditions of the market. Below are some examples of the different market conditions and how the pin bar reversal pattern applies to each of them.

TRADING PIN BARS IN A CONSOLIDATION (SIDEWAYS) MARKET ENVIRONMENT

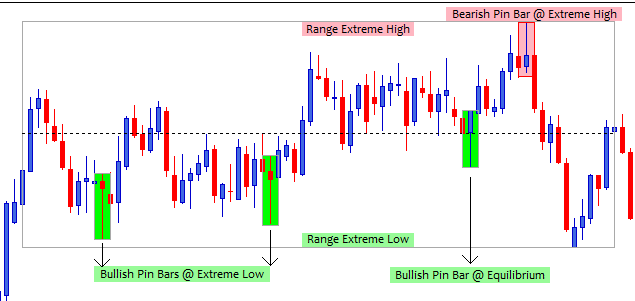

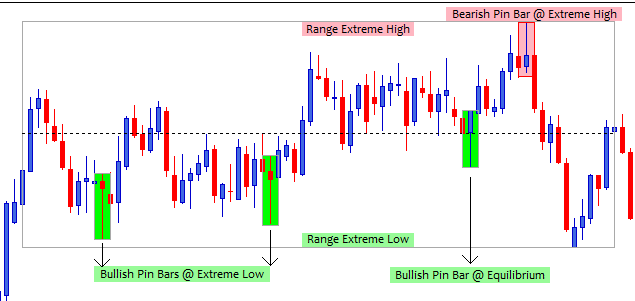

In a consolidation or ranging market, high probability pin bar signals do form at the equilibrium (midpoint) and at the upper or lower extreme of the consolidation.

A trade can be taken if a pin bar is very obvious, clear and backed by other confluences at the consolidation equilibrium (mid-point) and at the extreme high and low. Pin bar signals at these market extremes are often seen with impulsive price movement towards the equilibrium and the opposite end of the consolidation.

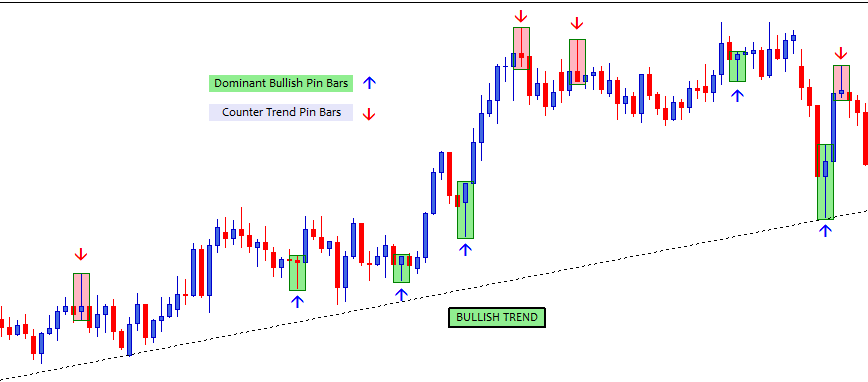

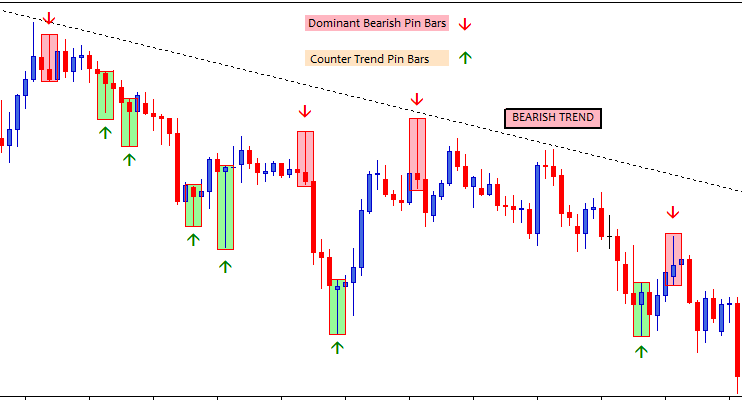

TRADING PIN BARS IN A TRENDING MARKET ENVIRONMENT

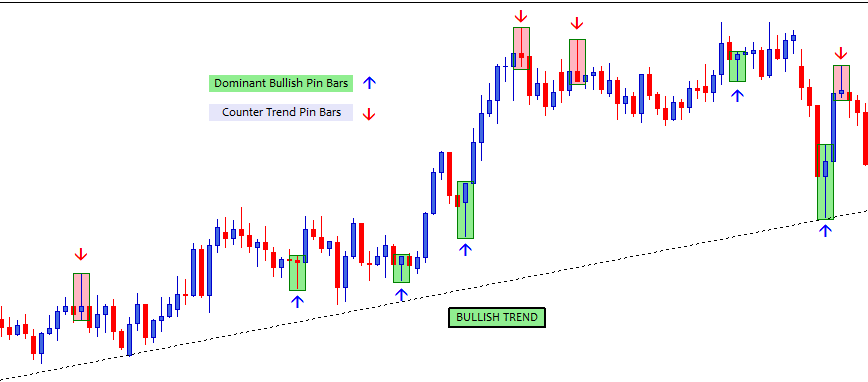

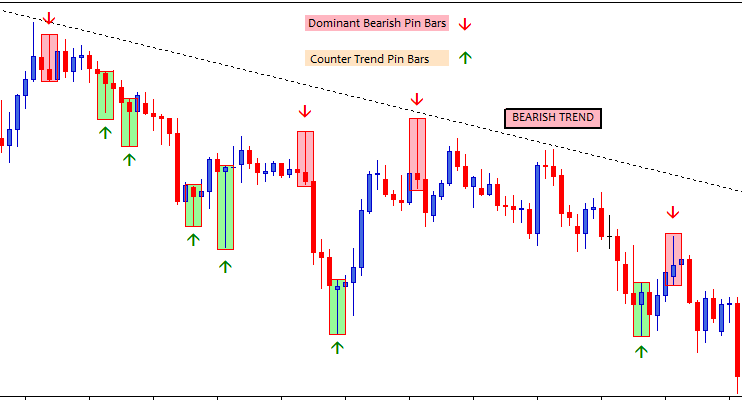

Trend trading is the most reliable, predictable and safest method of trading forex.

Pin bar signals in the direction or trend of the market (basically trend continuations) are safer and more highly probable than the counter-trend (contrarian) signals although counter-trend pin bars can also set off long-term reversals, with large profit potential.

Oftentimes there is a rapid change in the current direction of price or trend by a bullish pin bar that forms a “v” shape reversal pattern at the bottom of a price swing or a bearish pin bar that forms a “^” shape reversal pattern at the top of a price swing. Pin bar signals either in the direction of a trend or counter-trend can lead to explosive, long-term price movement and, ultimately, significant gains.

CRITERIA FOR TRADING PIN BAR SIGNALS

A solid trading plan that implements the pin bar candlestick reversal strategy and aims at profit consistency and long term portfolio growth must be based on the following criteria.

HIGHER TIMEFRAME (HTF) DIRECTIONAL BIAS: Trade ideas executed in sync with the monthly and weekly directional bias will always triumph and be favored in terms of explosive price moves and the amount of pips covered. Another important criterion to HTF directional bias is that long term trends tend to remain in place.

The weekly chart is the most important HTF chart for long term analysis and directional bias. Trade ideas and setups on the daily, 4hr and 1hr chart are highly probable when supported by the weekly HTF bias.

MARKET STRUCTURE: Proper understanding and implementation of the pin bar strategy in varying market conditions (uptrend, downtrend, retracement, reversal, consolidation) is a prerequisite to highly probable setups in the FX market.

TIMEFRAMES: It is important that emphasis is placed on the daily and 4hr time frame because they provide valuable insight about the entire condition of the market environment on an intermediate and short term basis. The daily, 4hr and 1hr timeframes are the proper time frames to trade pin bar signals but lower timeframes (4hr and 1hr) present more efficient trade entry and minimal risks.

TRADE MANAGEMENT:

Before opening a trade position, proper and ideal lot size must be carefully calculated and allocated to the trade based on the maximum risk, entry price and profit objective.

- TRADE ENTRY:

Enter long after the close of a valid bullish pin bar at 2-3 pips above the nose of the candlestick or place a buy limit at 50% the height of the bullish pin bar.

Enter short after the close of a valid bearish pin bar at 2-3 pips below the nose of the candlestick or place a sell limit at 50% the height of the bearish pin bar.

- STOP LOSS:

The distance between the entry price and the end of the elongated (rejection) wick is the approximate stop-loss that should be assigned to any trade.

The stop loss should not be tight at the end of the wick but some space (some amount of pips depending on the timeframe) should be tolerated at the end of the wick.

- PROFIT OBJECTIVE:

The most ideal risk to reward for any trade setup in forex 1:3. Trading the pin bar strategy, the risk is measured by the size (height) of the pin bar and it is used as a multiplier to project profit targets in multiples of 1, 2, 3 or more.

It is important to build a trading plan with a defined and permanent risk to reward (profit objective) for long term consistency. Aiming for larger gains without locking in partial profits at certain price levels can be attributed to greed which is ultimately detrimental to the long term stability of a trader.

Click on the button below to Download our "What is pin bar trading strategy in forex" Guide in PDF