What is order block in forex trading

Technical analysis plays a crucial role in forex trading, helping traders make informed decisions based on historical price data. This approach involves studying patterns, trends, and price movements on charts to predict future market behavior. One of the advanced concepts within technical analysis is the order block, which has gained popularity among traders looking to align with institutional trading strategies.

An order block refers to a significant price level where large financial institutions, such as banks and hedge funds, place substantial buy or sell orders. These blocks often cause price consolidation before a significant market move. Understanding order blocks allows retail traders to gain insight into institutional trading behavior, giving them a strategic advantage in identifying key market zones where price action is likely to reverse or continue.

What is an order block in forex trading?

An order block in forex trading refers to a price zone where institutional traders, such as banks and hedge funds, place large buy or sell orders. These institutions have the financial power to influence market prices due to the sheer volume of their trades. As a result, their actions often lead to the creation of order blocks, which are areas on the chart where price consolidates before a significant market move occurs. Retail traders who can identify these zones gain valuable insights into potential future price movements.

Order blocks generally form when institutions accumulate or distribute their positions over time. During this process, price remains in a narrow range, creating an area of consolidation that reflects either buying (accumulation) or selling (distribution). Once the institutional orders are fully placed, the market often experiences a strong move in the direction of the prevailing order flow. These areas are viewed as critical supply and demand zones.

There are two main types of order blocks: bullish and bearish. A bullish order block occurs when large buy orders are placed, signaling upward momentum. Conversely, a bearish order block forms when sell orders dominate, indicating potential downward movement. Identifying these blocks helps traders align their strategies with the market’s institutional flow.

How to identify order blocks in forex

Identifying order blocks in forex trading requires understanding specific characteristics such as size, volume, and price movement. Order blocks are usually formed when large institutional trades are placed, causing noticeable consolidation in the market. The size of an order block often reflects the magnitude of institutional involvement, while higher trading volume within these zones signals the accumulation or distribution of significant orders. Once the market absorbs these orders, a breakout in price movement typically follows.

The best timeframes for spotting order blocks are higher timeframes, such as the daily or H4 (4-hour) charts. These larger timeframes offer a clearer picture of institutional activity, reducing the noise often seen in smaller timeframes. Traders focusing on lower timeframes, such as the M15 (15-minute) chart, may struggle to see reliable order block formations due to market volatility.

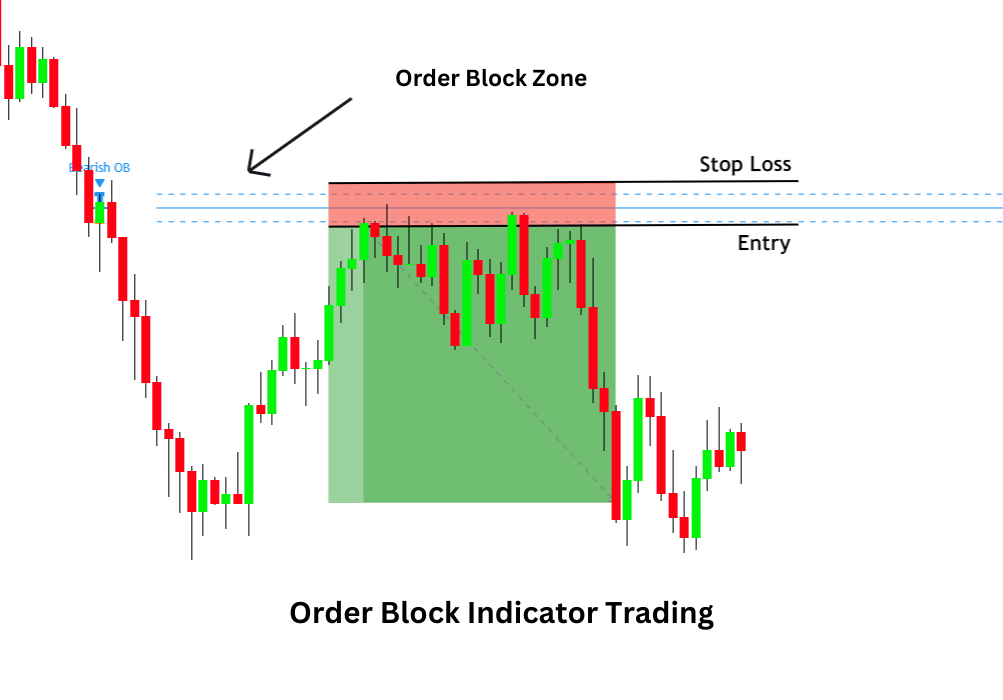

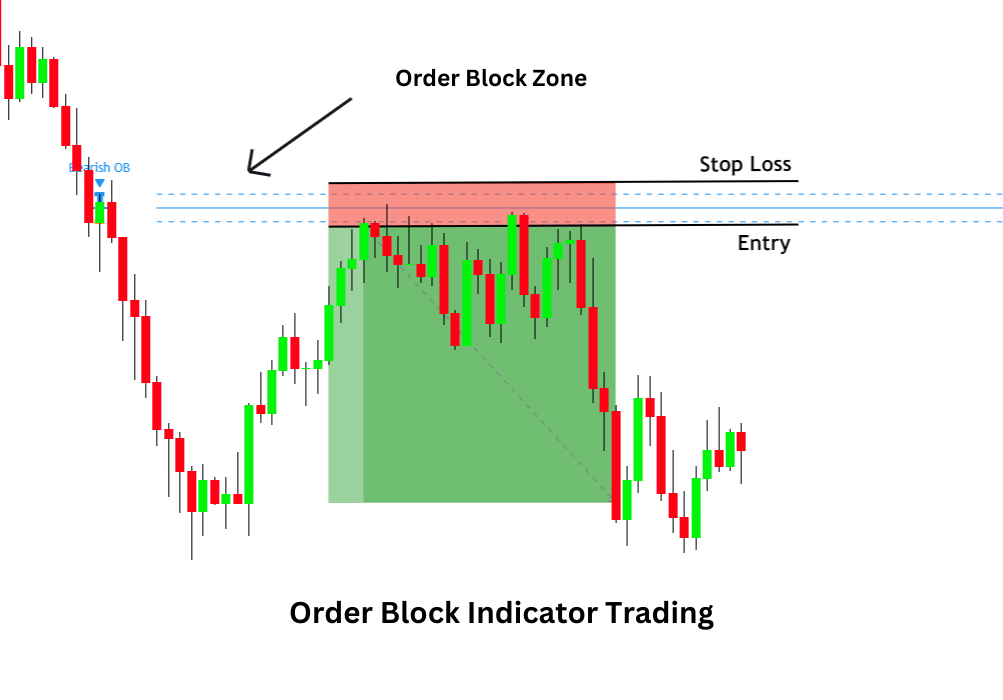

To aid in identifying order blocks, traders can use tools like the order block indicator for MT4. This indicator highlights potential order blocks on the chart, simplifying the process of spotting institutional trading zones. For example, a significant bullish order block might form after a period of consolidation followed by a sharp upward move, indicating institutional buying. Likewise, a bearish order block could precede a strong downward trend after large-scale selling.

The importance of order blocks in forex trading

Order blocks play a pivotal role in shaping price action and determining the trend direction in forex markets. These zones, created by large institutional traders, often signal significant areas of supply and demand. When price approaches an order block, it frequently reacts with either a reversal or continuation, depending on the underlying institutional activity. This ability to influence the market makes order blocks critical in understanding future price movements.

For retail traders, using order blocks offers several advantages. One of the key benefits is risk management. By identifying potential order blocks, traders can set more precise entry and exit points, reducing the chances of entering trades at inefficient prices. This also helps in placing stop-loss orders just outside these zones to minimize potential losses.

Order blocks also offer improved market structure analysis. They help traders identify major price zones, giving insights into where institutional players are likely to buy or sell. This perspective allows traders to filter out market noise and focus on high-probability trading areas.

Additionally, order blocks enhance trade decision-making by allowing retail traders to follow the institutional footprints in the market. By understanding where large players are positioning themselves, retail traders can adjust their strategies to align with the “smart money,” increasing the likelihood of more successful trades.

How to use order block indicator in MT4 for trading

The order block indicator for MT4 (MetaTrader 4) is a powerful tool that helps traders identify key areas where large institutional orders have been placed. This indicator automatically highlights potential order blocks on the chart, eliminating the guesswork involved in manually spotting these zones. By using this indicator, retail traders can align their trades with institutional activity, improving their ability to anticipate price movements.

Step-by-step guide to setting up the order block indicator on MT4:

Download the indicator: Obtain the order block indicator from a reputable source or trading community.

Install the indicator: Place the downloaded indicator file in the "Indicators" folder within the MT4 directory on your computer.

Apply the indicator: Open MT4, go to the "Navigator" panel, find the order block indicator, and drag it onto your chart.

Customize settings: Adjust the indicator's settings based on your preferred timeframes and visual preferences.

The order block indicator simplifies trading by automatically identifying significant order blocks, making it easier to spot areas of accumulation or distribution. For instance, if the indicator highlights a bullish order block, a trader may consider entering a buy position when price retests this zone. Conversely, when a bearish order block is detected, a sell opportunity may arise as the price approaches the area.

Order block strategies in forex

Order block strategies offer traders several ways to take advantage of institutional price levels in the forex market. These strategies are designed to identify key zones where the market is likely to react, helping traders make more informed decisions. Below are some common trading strategies based on order blocks.

Breakout and retest strategy

One of the most popular strategies involves waiting for a breakout from an order block, followed by a retest of that same zone. For example, after price breaks out of a bullish order block, traders can look for a retest of this area before entering a long position, anticipating continued upward momentum.

Trend continuation strategy

Order blocks are also useful for identifying trend continuation opportunities. When the market is trending, order blocks help to confirm the trend by marking areas where institutions may place additional buy or sell orders. Traders can enter positions in the direction of the trend after identifying a relevant order block.

Scalping and day trading strategies

For short-term traders, order blocks can be used in scalping or day trading strategies. These traders rely on smaller timeframes, such as the M15 or H1 charts, to spot short-term order blocks, capitalizing on brief market moves within these zones.

Combining order blocks with other tools

Order blocks can be combined with other technical tools such as Fibonacci retracements, moving averages, and support/resistance levels. This combination provides a more holistic view of the market, increasing the accuracy of trade setups.

Pros and cons of using order block strategies

The main advantage of order block strategies is their alignment with institutional trading behavior, offering retail traders insights into market direction. However, they can be complex to master, and traders may experience false signals if not combined with proper risk management and confirmation tools.

Final thoughts on order blocks in forex trading

Understanding and utilizing order blocks in forex trading provides a significant advantage, especially for traders seeking to align their strategies with institutional-level trading. Order blocks reveal critical areas where large financial institutions are likely to place buy or sell orders, offering traders a clearer view of potential price movements. By identifying these zones, traders can enhance their overall strategy and improve entry and exit points, aligning with the “smart money” that drives the market.

For those new to the concept, it is crucial to backtest strategies involving order blocks before applying them in live trading. Backtesting allows traders to analyze how well these setups perform across various market conditions and timeframes, helping them refine their approach and increase their confidence in the strategy. Using tools like the order block indicator for MT4 can further assist in accurately identifying these zones and enhancing the backtesting process.

In addition to providing valuable insights into price movements, order blocks can also help traders avoid common pitfalls, such as false breakouts or poor entry points. By focusing on areas where institutional traders are most active, retail traders can better filter market noise and reduce emotional decision-making. This focus on market structure and order flow leads to more strategic trading, allowing individuals to trade with the confidence that they are moving in sync with the broader market forces. Over time, consistently incorporating order block analysis into one’s trading plan can enhance both short-term and long-term performance, offering a more methodical approach to navigating the complexities of the forex market.