What is news trading in forex?

The foreign exchange market, commonly known as Forex, is the largest and most liquid financial market in the world. It operates 24 hours a day, five days a week, allowing participants to buy, sell, and exchange currencies. Forex plays a crucial role in facilitating international trade and investment, as well as providing opportunities for speculative trading.

Within the Forex market, news trading has emerged as a significant strategy employed by traders to capitalize on market movements triggered by news events. News trading involves making trading decisions based on the release of economic indicators, central bank announcements, geopolitical developments, and other news that can impact currency values. By reacting swiftly to news releases, traders aim to profit from rapid price fluctuations and take advantage of market sentiment shifts.

In the fast-paced world of Forex trading, staying informed about news events and their potential impact is vital. News releases can significantly influence market sentiment, trigger sharp price movements, and create both opportunities and risks for traders. Failing to recognize the importance of news and its impact on Forex market movements can lead to missed trading opportunities or unexpected losses.

By understanding the relationship between news and currency price movements, traders can make more informed decisions and develop effective trading strategies. Analyzing news releases, studying historical trends, and keeping abreast of economic and geopolitical developments are crucial for those seeking success in news trading.

Definition and scope of news in forex

In the context of Forex trading, news refers to any significant information or events that can influence currency values and subsequently impact the Forex market. News releases can encompass a wide range of economic, financial, political, and social developments, and they provide traders with valuable insights into market trends and potential trading opportunities.

News in Forex can include official economic indicators, central bank announcements, geopolitical events, natural disasters, and emergencies. Understanding the scope of news in Forex is crucial for traders, as it helps them navigate the complex dynamics of the market and make informed trading decisions.

Types of news events that impact the forex market

Economic indicators (NFP, CPI, GDP, etc.)

Economic indicators play a significant role in shaping Forex market movements. Key indicators such as the Non-Farm Payrolls (NFP), Consumer Price Index (CPI), Gross Domestic Product (GDP), and retail sales figures provide insights into the health of an economy and its potential impact on currency values.

Central bank announcements

Decisions and statements made by central banks, such as interest rate changes, monetary policy decisions, and forward guidance, can have a profound effect on currency markets. Central bank announcements often provide signals about the future direction of monetary policy, which can lead to significant market volatility.

Geopolitical events

Political developments, international conflicts, elections, trade agreements, and policy changes can greatly influence Forex markets. Geopolitical events can create uncertainty, impact investor sentiment, and cause currency values to fluctuate.

Natural disasters and emergencies

Unforeseen events such as natural disasters, pandemics, or other emergencies can disrupt economies, affect global supply chains, and trigger currency movements. These events can have both short-term and long-term effects on Forex markets.

By staying informed about different types of news events and their potential impact on Forex, traders can position themselves to take advantage of market opportunities and mitigate risks.

NFP news: a game changer in forex

The Non-Farm Payrolls (NFP) report is a highly anticipated economic indicator released by the U.S. Bureau of Labor Statistics on a monthly basis. It provides crucial information about the number of jobs added or lost in non-farm sectors of the U.S. economy, excluding agricultural and government employment.

The NFP news has a profound impact on Forex markets due to its role in reflecting the overall health of the U.S. economy. Positive NFP figures suggest a robust labor market and often lead to increased confidence in the U.S. dollar, while negative or weaker-than-expected NFP data can trigger selling pressure on the currency.

Historically, NFP news releases have resulted in significant volatility in currency pairs, creating both opportunities and risks for Forex traders. Sudden market movements during NFP announcements can lead to rapid price fluctuations, increased trading volumes, and heightened market sentiment.

Trading NFP news requires careful analysis and the implementation of suitable strategies. Traders often prepare by studying consensus forecasts, historical data, and related indicators such as wage growth and unemployment rates. Some common strategies include:

Pre-news positioning: Traders may establish positions before the release based on market expectations and technical analysis.

Reaction-based trading: Traders react quickly to the actual NFP figures, aiming to take advantage of immediate market movements.

Fading the news: This strategy involves trading against the initial market reaction, assuming that the initial move may be overdone or exaggerated.

Post-news momentum: Traders may enter trades after the initial volatility subsides, seeking to profit from sustained trends that develop following the NFP release.

Successful NFP trading requires a combination of thorough research, risk management, and disciplined execution. Traders should consider employing appropriate risk control measures such as stop-loss orders and avoiding excessive leverage.

High-impact news events and their influence on forex

High-impact news events refer to significant economic, financial, political, or social developments that have the potential to cause substantial volatility in Forex markets. These events often generate heightened market interest and can result in rapid price movements, presenting both opportunities and risks for traders.

Key economic indicators that have a strong impact on forex market

Several key economic indicators are closely monitored by Forex traders due to their substantial influence on market sentiment and currency values. These indicators include:

Gross Domestic Product (GDP): GDP measures the economic output of a country and serves as a barometer of its overall economic health.

Consumer Price Index (CPI): The CPI measures changes in the prices of a basket of goods and services, providing insights into inflation levels.

Interest Rate Decisions: Central banks' decisions on interest rates have a significant impact on currency values as they influence borrowing costs and capital flows.

Employment Data: Employment figures, such as the Non-Farm Payrolls (NFP) report, reveal the state of the labor market and can affect currency values.

Role of central bank announcements in shaping market sentiment

Central banks play a crucial role in Forex markets through their monetary policy decisions and announcements. Central bank statements regarding interest rates, quantitative easing programs, or forward guidance can shape market sentiment and influence currency values.

Traders carefully analyze central bank communications, paying attention to the wording, tone, and signals provided, as they can offer insights into future policy directions and impact market expectations.

Identifying geopolitical events and their impact on forex

Geopolitical events encompass political developments, international conflicts, elections, trade negotiations, and policy changes. These events can significantly affect Forex markets as they introduce uncertainties and impact investor sentiment.

Traders closely monitor geopolitical developments to assess their potential impact on currencies. Changes in diplomatic relations, trade agreements, or geopolitical tensions can lead to currency fluctuations as market participants adjust their positions based on perceived risks and opportunities.

Understanding the influence of high-impact news events, economic indicators, central bank announcements, and geopolitical events is essential for Forex traders. By staying informed and analyzing the potential implications of these factors, traders can make more informed decisions and adapt their strategies accordingly.

Factors that determine news impact on forex market

The impact of news on the Forex market depends on the differential between expected and actual outcomes. When news aligns with market expectations, the market response may be muted. However, when news deviates significantly from expectations, it can lead to heightened market volatility and substantial price movements.

Market sentiment and investor reactions to news releases

News releases can influence market sentiment, which, in turn, affects investor reactions. Positive news can create a bullish sentiment, leading to increased buying activity, while negative news can generate a bearish sentiment, resulting in selling pressure. Investor sentiment plays a crucial role in determining the market's immediate response to news.

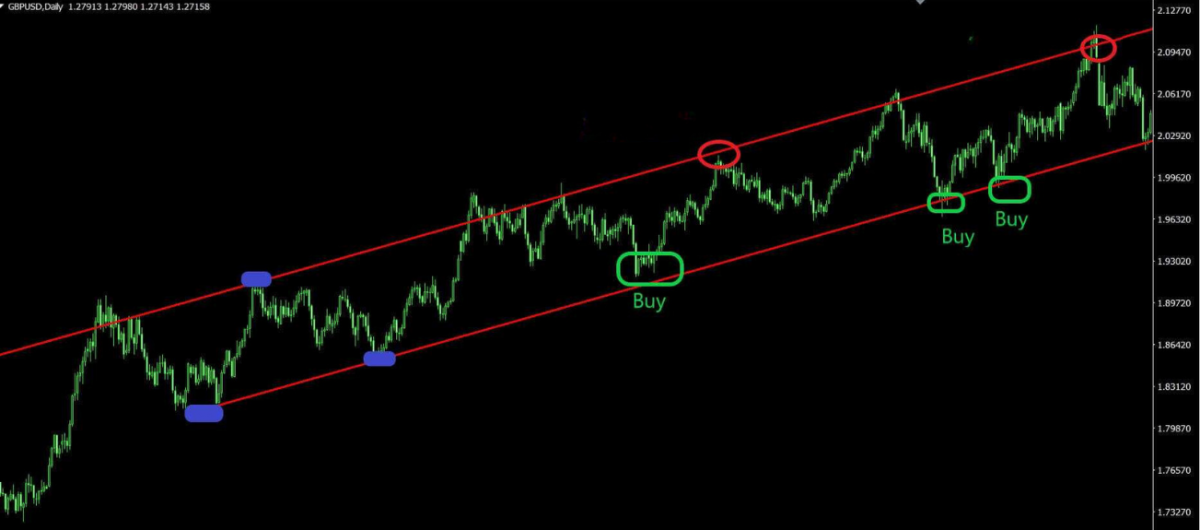

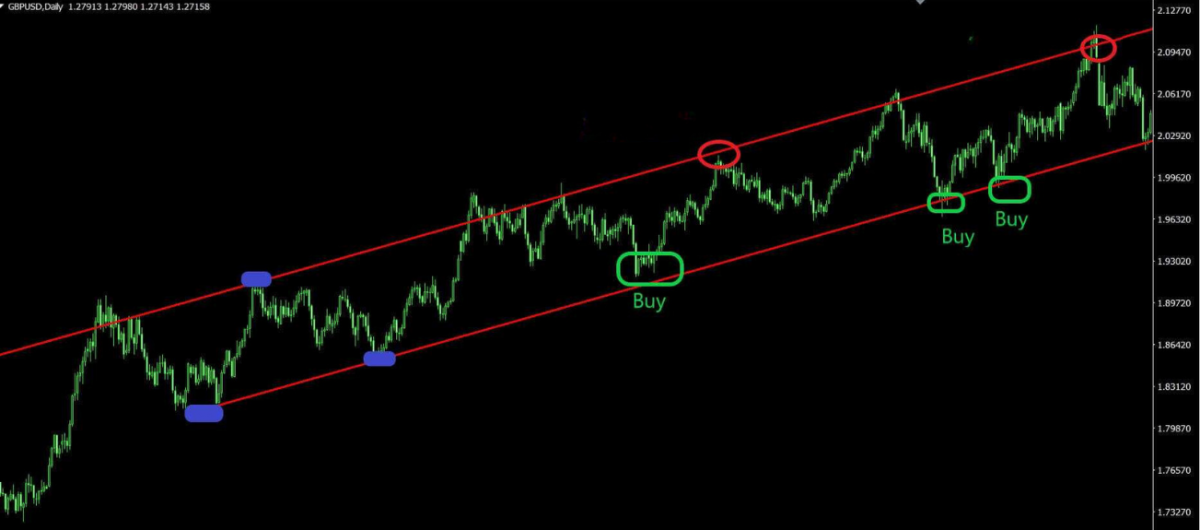

Relationship between news and technical analysis

News and technical analysis are intertwined in Forex trading. Technical analysis focuses on price patterns, trends, and historical data, while news provides fundamental insights. Traders often incorporate both approaches to gain a comprehensive understanding of market dynamics and make informed trading decisions.

News releases can act as catalysts for technical patterns, triggering breakouts, or invalidating existing patterns. Similarly, technical levels can influence how news is interpreted and traded. The relationship between news and technical analysis is dynamic and requires a nuanced approach.

News trading pitfalls and challenges

News trading poses certain pitfalls and challenges for traders. Volatility during news releases can lead to slippage, wider spreads, and increased market noise, making it challenging to execute trades at desired prices. Additionally, rapid price movements can result in false signals or whipsaws, causing losses for traders.

Another challenge is the ability to process and interpret news accurately and efficiently. Traders need to analyze multiple news sources, assess the credibility and reliability of information, and make quick decisions based on the available data.

Risk management is paramount in news trading, as unexpected outcomes can lead to significant losses. Traders must establish appropriate risk control measures, including the use of stop-loss orders and position sizing techniques.

News trading strategies and techniques

Preparing for news releases: research and analysis

Successful news trading begins with thorough research and analysis. Traders need to identify key news events, understand their significance, and analyze their potential impact on the Forex market. This involves staying updated with economic calendars, studying historical price reactions to similar news events, and considering market expectations.

Fundamental analysis is crucial in preparing for news releases. Traders assess economic indicators, central bank policies, geopolitical developments, and other relevant factors to gauge potential outcomes and market reactions.

Trading during news releases: techniques and approaches

Trading during news releases requires a proactive approach and the ability to act swiftly. Some popular techniques include:

Straddle Strategy: Traders open both a buy and a sell position before the news release to take advantage of potential market volatility regardless of the news outcome.

News Fading: Traders take contrarian positions, assuming that market reactions to news releases are overblown or short-lived.

Breakout Trading: Traders anticipate significant price movements following news releases and enter trades based on breakouts of key technical levels.

Post-news trading: managing risks and capitalizing on opportunities

After a news release, managing risks and capitalizing on opportunities become crucial. Traders should closely monitor market reactions and adjust their positions accordingly. Implementing proper risk management techniques, such as setting stop-loss orders and trailing stops, is essential to limit potential losses.

Identifying potential post-news trading opportunities involves assessing the initial market reaction, looking for follow-through movements, and analyzing price patterns and technical indicators to determine favorable entry and exit points.

Using technology and automation in news trading

Advancements in technology have revolutionized news trading. Traders now have access to advanced trading platforms, news aggregation tools, and algorithmic trading systems that enable faster information processing and automated execution.

Automated news trading systems can be programmed to execute trades based on predefined rules and parameters, allowing traders to capitalize on market movements with speed and precision.

However, it is important to note that technology-based trading should be accompanied by thorough testing, risk management protocols, and ongoing monitoring to ensure the effectiveness and reliability of automated strategies.

Conclusion

By staying updated with news events and their potential impact on currency pairs, traders can anticipate market reactions, adjust their strategies, and take advantage of price movements generated by news releases.

The future of news trading in Forex is likely to be shaped by advancements in technology and data analysis. With the increasing availability of real-time news feeds, advanced trading algorithms, and artificial intelligence tools, traders can expect faster and more efficient news processing and trade execution.

Moreover, the integration of machine learning and natural language processing techniques can help traders extract relevant information from vast amounts of news data, enabling them to make quicker and more accurate trading decisions.

Furthermore, as market participants continue to seek an edge in news trading, the development of sophisticated sentiment analysis tools and predictive analytics models may become more prevalent, providing deeper insights into market reactions to news events.

In conclusion, news trading plays a vital role in Forex trading, offering opportunities for profit by capitalizing on market volatility driven by news releases. By staying informed, combining fundamental and technical analysis, implementing risk management, and adapting to market conditions, traders can navigate the complexities of news trading and enhance their trading strategies.