What is Grid trading strategy in forex?

When it comes to forex trading, there are numerous strategies that traders can employ to maximize their profits while minimizing risk. One such approach is the Grid trading strategy, which involves placing buy and sell orders at predetermined intervals above and below the current market price. The goal is to profit from market volatility while minimizing risk, as traders are essentially creating a "grid" of orders that can generate profits in both upward and downward market movements.

At its core, the Grid trading strategy involves setting up a series of buy and sell orders at predetermined intervals, with each order having its own stop loss and take profit levels. This creates a grid of orders that can generate profits in both upward and downward market movements. The strategy is highly customizable, allowing traders to adjust the intervals, stop loss levels, and other parameters to suit their individual needs and trading styles.

While the Grid trading strategy can be a profitable approach to forex trading, it also carries certain risks. For example, incorrect setup of grids or failure to implement proper risk management techniques can lead to significant losses. As such, it's important for traders to carefully analyze market trends, set up their grids correctly, and use proper risk management techniques to minimize potential losses.

Understanding Grid trading strategy

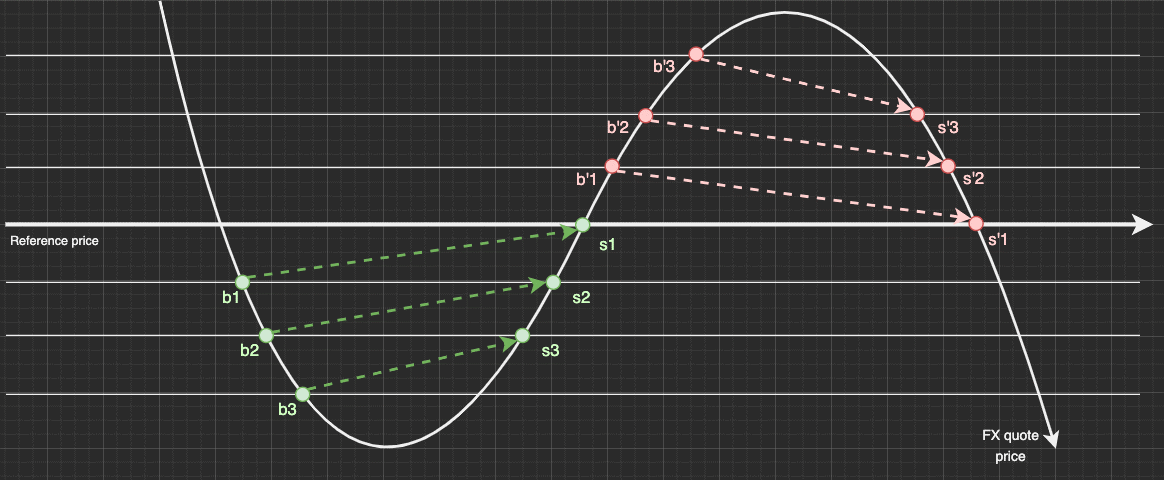

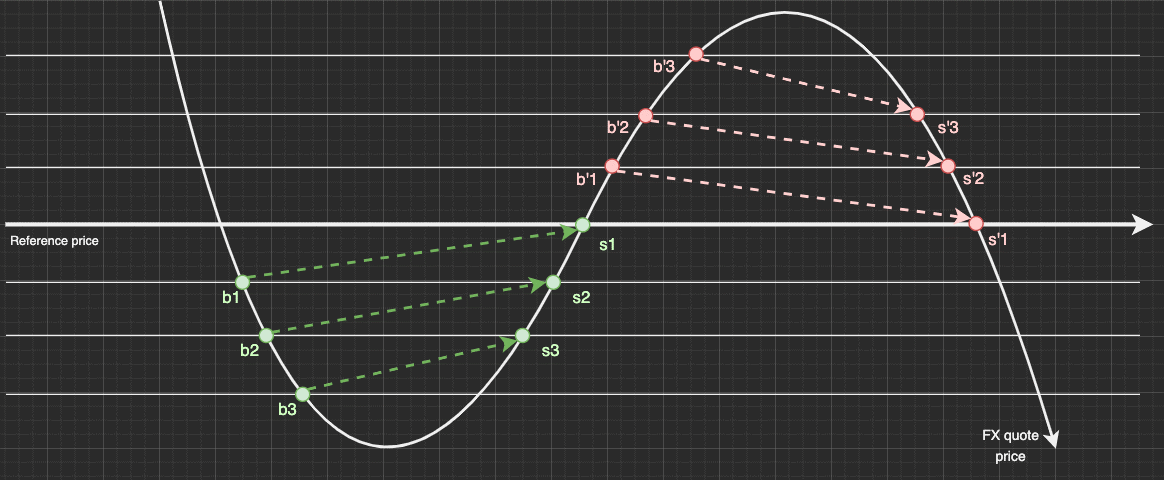

Grid trading is a forex trading strategy that involves buying and selling currencies at predetermined price levels or intervals, also known as "grid levels." The grid levels are placed above and below the current market price, creating a grid-like pattern. The primary goal of the Grid trading strategy is to profit from market volatility while minimizing the risks involved.

How Grid trading works

Grid trading works by placing a series of buy and sell orders at pre-determined price levels, creating a grid-like pattern. The trader will set a specific number of grid levels and the distance between them, which will depend on the market conditions and their trading strategy. When the market price reaches a grid level, the trader will execute a trade, either buying or selling depending on the direction of the trend.

The benefits of Grid trading strategy

One of the significant benefits of grid trading is that it is highly customizable, allowing traders to adjust the grid levels, distance between them, and other parameters to suit their individual needs and trading styles. The strategy is also suitable for different market conditions, including ranging and trending markets. In a ranging market, the Grid trading strategy can help traders capture profits in both directions, while in a trending market, traders can use grid trading to catch pullbacks and capitalize on market reversals.

Another advantage of grid trading is that it allows traders to control their risks and manage their positions effectively. Traders can set stop-loss levels at each grid level to limit their losses in case the market moves against their positions. Moreover, grid trading provides a structured approach to trading that can help traders avoid emotional decision-making and stick to their trading plans.

The components of Grid trading

Grid trading involves several key components, including setting up the grid, determining entry and exit points, using stop losses and take profits, and managing risks. Let's take a closer look at each component.

Setting up the Grid

The first step in grid trading is setting up the grid. This involves choosing the appropriate intervals between each buy and sell order. Traders must consider market volatility, as well as their own risk tolerance and trading style. Grid trading is highly customizable, which means that traders can choose to set up their grid with wide or narrow intervals, depending on their preferences.

Determining entry and exit points

Once the grid is set up, traders must determine the entry and exit points for each trade. Typically, traders will enter a long position at the lower end of the grid and a short position at the upper end of the grid. As the price fluctuates, traders will continue to enter new positions at each interval, always buying low and selling high.

Using stop losses and take profits

Grid trading also involves the use of stop losses and take profits. Stop losses are used to limit the amount of loss a trader is willing to accept on a trade, while take profits are used to lock in profits at a predetermined level. When using grid trading, it's important to set appropriate stop losses and take profits for each trade, to minimize risk and maximize profits.

Managing risks

Finally, managing risks is crucial in grid trading. Traders must always be aware of their risk tolerance and adjust their strategy accordingly. They should also be prepared for market volatility and have a plan in place for unexpected market events. Grid trading can be a profitable strategy when executed properly, but it requires discipline and careful risk management.

Types of Grid trading strategies

Grid trading is a popular forex trading approach that comes in different forms. While all types of grid trading strategies aim to take advantage of market volatility and minimize risk, each type has its unique approach and risk management style. Here are the four main types of grid trading strategies:

Basic Grid trading strategy

The basic Grid trading strategy is the simplest and most common type. It involves placing buy and sell orders at predetermined intervals above and below the current market price. Traders typically use this approach when the market is ranging, and they anticipate that price will continue to move in a sideways direction. With the basic Grid trading strategy, traders aim to profit from the market's oscillations while keeping risks low.

Advanced Grid trading strategy

The advanced Grid trading strategy is a more complex version of the basic Grid trading strategy. It involves placing multiple grids, each with different settings, in the same currency pair. Traders who use this approach usually have a more sophisticated understanding of the market and prefer to trade in more volatile market conditions.

Conservative Grid trading strategy

The conservative Grid trading strategy is designed for traders who prioritize capital preservation over higher returns. This approach involves placing a smaller number of trades than the other types of grid trading strategies. Traders who use this approach typically have a lower risk tolerance and prefer to limit their exposure to the market.

Aggressive Grid trading strategy

The aggressive Grid trading strategy is for traders who seek higher returns despite the increased risk. This approach involves placing multiple buy and sell orders at tighter intervals than the other types of grid trading strategies. Traders who use this approach typically have a higher risk tolerance and are comfortable with the potential for larger drawdowns.

Grid trading strategy is a popular forex trading technique that aims to generate profits by taking advantage of market volatility while minimizing risks. To successfully implement a Grid trading strategy, it is crucial to follow a series of steps that involve determining market conditions, setting up the grid, determining entry and exit points, using stop losses and take profits, and monitoring and managing risks.

The first step to implementing a Grid trading strategy is to determine market conditions. This involves analyzing market trends and identifying potential price movements that can be exploited through the use of a grid. Once the market conditions have been identified, the next step is to set up the grid. This involves placing buy and sell orders at predetermined intervals above and below the current market price.

The third step is to determine entry and exit points. This involves setting the levels at which the buy and sell orders will be triggered. Typically, traders will set up their grid to take advantage of price movements in both directions, which means that they will have both buy and sell orders in place.

Using stop losses and take profits is also an essential component of a Grid trading strategy. Stop losses are used to limit potential losses in the event that the market moves against the trader, while take profits are used to secure profits when the market moves in the trader's favor.

Finally, it is crucial to monitor and manage risks when implementing a Grid trading strategy. This involves regularly monitoring the market and adjusting the grid as necessary to ensure that the risk is kept within acceptable levels.

There are several types of grid trading strategies, including the basic Grid trading strategy, advanced Grid trading strategy, conservative Grid trading strategy, and aggressive Grid trading strategy. Each of these strategies has its own unique characteristics and can be tailored to suit the trader's individual needs and preferences.

Grid trading strategy is a popular trading method in Forex that has its own set of advantages and disadvantages. In this section, we will discuss the benefits and drawbacks of this strategy.

Advantages of Grid trading strategy:

- Flexibility: One of the significant benefits of grid trading is its flexibility. Traders can adjust their grid sizes, entry and exit points, and other parameters based on their trading goals and risk tolerance. This allows traders to adapt to changing market conditions and tailor their strategy to fit their individual trading style.

- Potential for profit: Grid trading strategy offers the potential for consistent profits, even in volatile markets. As the strategy involves buying and selling at different price levels, traders can benefit from market fluctuations in both directions. If executed correctly, the strategy can result in regular profits over time.

- Reduced risk: Grid trading strategy can help reduce the risk of losses by implementing stop-loss orders at key levels. This helps traders limit their losses and protect their capital. The use of take-profit orders also allows traders to secure profits and minimize the risk of losing profits due to sudden market reversals.

Disadvantages of Grid trading strategy:

- Complicated Strategy: Grid trading requires a considerable amount of planning and monitoring, making it a complicated trading strategy for novice traders. It involves setting up multiple trades at different levels, which can be time-consuming and requires a strong understanding of market trends.

- Risk of drawdowns: Grid trading strategy can result in significant drawdowns, especially if the market moves against a trader's position. As grid trading involves buying and selling at multiple price levels, it can result in multiple open positions that may become vulnerable to market fluctuations.

- Limited profit potential: While grid trading can offer consistent profits over time, the profit potential is generally limited compared to other trading strategies. Traders must aim to make small profits from each trade, which can be difficult to achieve in fast-moving markets.

Conclusion

The Grid trading strategy has its advantages and disadvantages. One of the main advantages is its ability to generate profits in both trending and ranging markets. Additionally, grid trading is a flexible strategy that can be customized to meet individual risk tolerance levels. It also helps traders to manage their emotions by removing the need for continuous market monitoring.

On the other hand, one of the main disadvantages of grid trading is that it can be complex to set up and requires a significant amount of time to monitor and manage. Additionally, if the price moves against the trader, the open positions may incur losses that could quickly add up and exceed the available margin.

Grid trading can be a useful strategy for traders looking to take advantage of market volatility while minimizing risk. However, it is important to understand the risks and potential downsides of this approach before implementing it. Traders should carefully consider their risk tolerance and ensure they have a solid understanding of the market conditions before entering any grid trading positions.

Overall, while grid trading may not be suitable for every trader, it can be a valuable tool when used in the right circumstances. It is essential to approach this strategy with a clear understanding of the risks involved and to implement appropriate risk management techniques to ensure success.