What is forex swap

A very uncommon topic in finance and the foreign exchange (forex) market is the notion of Swap. What does swap mean in forex?

Swap is a type of agreement typically between two foreign entities designed to obtain loans using the currency of the other party's country and then swapping the interest cost on the loan between both parties.

This process involves the buying and selling of an equal volume of two different foreign currencies simultaneously with an initial swap at an entry or spot price and then a final (exit swap) at a forward price.

What is the importance of forex swap?

Foreign exchange swap is an important concept in cross-border investment. There are a lot of financial and economical benefits associated with Swaps and we will go through a few.

- Forex swaps ensure circulation of capital were mostly needed to benefit economic activities.

- With forex swaps, government and business loans are procured at more favorable interest rates than might be available in the foreign exchange market.

Take, for instance, a Chinese firm A borrows 150 million Dollars from a US company B and simultaneously, a US company X borrows 200 million Dollars from a Chinese firm Y.

The initial swap is based on the entry or spot price of the loan which could be a 2.5 dollar entry spot price. The swap agreement is made by both companies because it allows both companies to borrow foreign currencies at cheaper interest costs then at maturity, the principal will be exchanged with a forward price.

- Forex swaps help to insure foreign investment from exchange rate risk. It also reduces the exposure of investments to undesirable unforeseen fluctuations in exchange rates. What this means is that two foreign entities can take a position simultaneously on each other's currency via a forex swap in order to hedge their investments.

Any loss incurred at the forward price can be offset by the profit on the swap

How did forex swap come about?

The history of forex swap began in 1981. An investment banking firm 'Solomon Brothers' coordinated the first currency swap of German Dutch and Swiss francs in exchange for the US dollar. The swap transaction was between IBM and the World Bank.

In 2008, developing countries that faced liquidity challenges were allowed by the Fed Reserve to take advantage of currency swaps for loan purposes. These events led to the awareness of forex swap.

How does forex swap work?

Foreign entities (governments, businesses e.t.c.) agree to swap equal volumes of their respective currencies at a spot rate and then pay interest on the loan principal of the other party and vice versa throughout the term of the agreement. The rate of the swap is usually indexed to LIBOR, an acronym for London InterBank Offered Rate.

This is the average interest cost used by international lenders dealing with foreign currency loans. At the end of a certain loan term, the principals are exchanged at a forward price.

Forex swaps in Metatrader 4 (Mt 4)

How do forex swaps apply to retail forex and CFD traders?

In forex and CFD trading, the concept of forex swaps is quite similar but with a unique approach.

The cost of forex swap in Mt 4 is charged as Swap fee or rollover fee. It is the interest cost charged on leveraged open positions that are held overnight in the Forex market.

Swap fee is calculated using the interest rate differential of the two currencies of a forex pair, and the fee is usually the same for positions either long or short.

Forex trades usually involve the simultaneous buying and selling of equal volume of two currencies in a forex pair

How? A long or short position of a forex pair involves one currency of the forex Pair being bought while the other is simultaneously sold at the same time and equal volume.

We can as well assume that one of the currencies in a forex pair is borrowed in order to purchase the other currency. Hence an interest cost must be charged on the borrowed currency.

Swap fees are also charged because trade positions on forex brokers' platforms are always leveraged with the broker's fund in order to maximize potential gain.

Swap fees can be positive or negative depending on the swap rate and the volume of the open trade positions.

If the underlying swap rate of the pair is higher for the purchased currency versus the currency that is being sold, interest might be earned if the position is held overnight.

However, due to other considerations, such as brokers’ data feed and commissions, interest cost will be charged on open trade positions (long or short).

It is important to note that swap fees do vary for trading instruments i.e the swap fee for an instrument like the GBP/USD will not be the same for other currencies.

Other factors that affect the swap fees include

- The type of position: purchase or sale

- The difference between the interest rates of currencies in a forex pair

- The number of nights the position is open

- The volume or leverage of the position

- And lastly, the broker commissions, terms and policies

When are Swaps Charged on Mt4?

The time when open trade positions are charged depends on the broker. In most cases, it is charged around midnight, usually between 23:00 and 00:00 server time.

Sometimes the swap for maintaining a position over the weekend gets charged even before the weekend.

Depending on the instrument you are trading, you may need to look at contract specifications or ask your broker directly to confirm when exactly swap fees are charged on your account.

How to Calculate the Swap fees?

Calculating forex swap fees can sometimes be fairly complicated, depending on the broker you use.

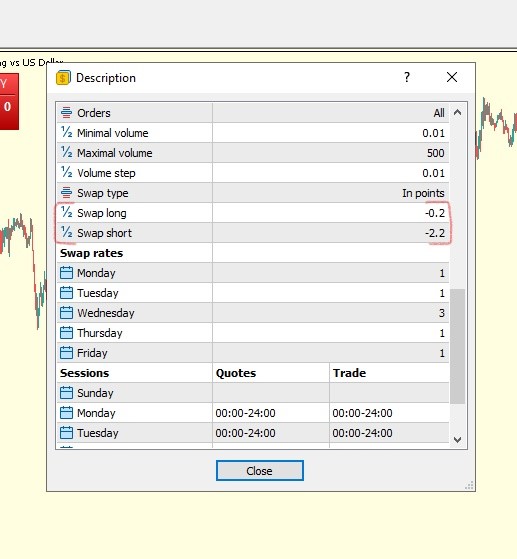

You can find out how much it is on the contract specification page for the instrument you are trading. The fee that is displayed on the specification page is relative to the pip value of your open trade position.

The forex swap fee can be calculated by the following:

Swap Fee = (Swap Rate * Pip Value * No. of Night) / 10

- Pip Value: This is often used to reference the losses or gains of a trade position. Pip Value is the price attributed to a one-pip move of a forex pair.

- Swap Rate: A swap or rollover rate is the difference in interest rates between both currencies of a forex pair. For example, if you are trading the British Pound Sterling against the United States dollar (GBP/USD), the rollover rate calculation would be based on the interest rates between British Pounds and the United States.

Whether a trade position is long or short, a swap rate is applied and each forex pair has its own unique swap rate.

Example: Trading 1 lot of GBP/USD (long) with an account denominated in USD.

Pip value: $8

No of Night: 2

Swap rate: 0.44

Swap Fee = (Pip Value * Swap Rate * No. of Night) / 10

Swap fee: (8 * 0.44 * 2) / 10 = $0.704

It is possible that a broker may show you their swap rate as a daily or annual percentage which can be used to calculate the swap fee for the duration of your trade.

As we have already noted, the amount of the swap fee depends on which financial instrument you are trading. It can be a positive or negative rate depending on the position you take but regardless of the position you take, you would always be charged for holding the position overnight.

A Forex swap rate depends largely on the underlying interest rates of the currencies in the pair that is being traded. There is also a custody fee incorporated into the swap rates.

With assets such as commodities, the costs of holding such assets overnight or through the weekend is high hence negative swaps will usually be observed on both long and short positions.

How to check swap rates in MetaTrader platforms

You can check the swap fee on either of the MetaTrader 4 (MT 4) or MetaTrader 5 (MT 5) trading platforms by following the simple step

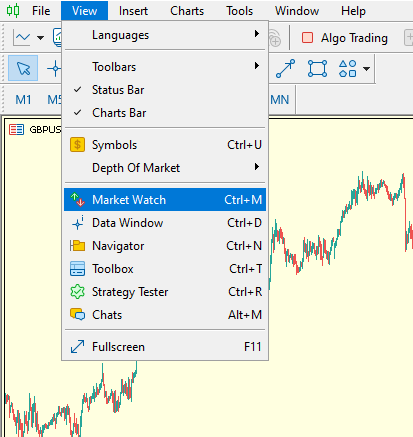

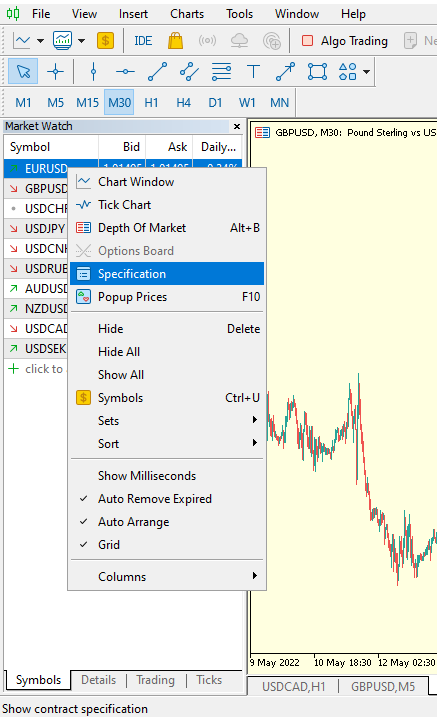

- Click on the “view” tab, scroll down to “Market Watch” and click on it.

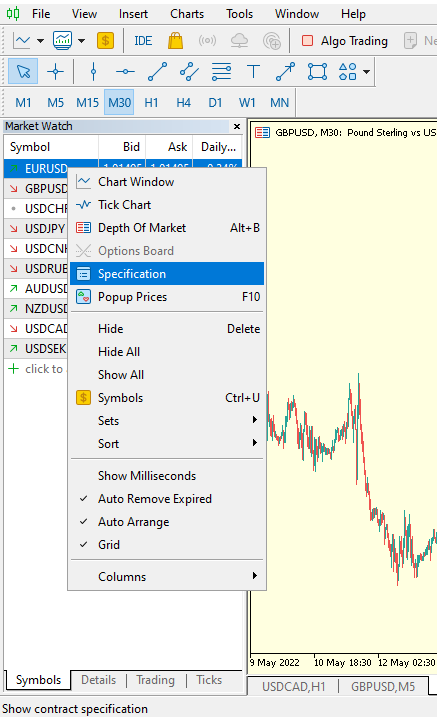

2. Right-click on the trading forex pair or asset of your choice in the "Market Watch" window and from the subsequent drop-down, click on "Specification"

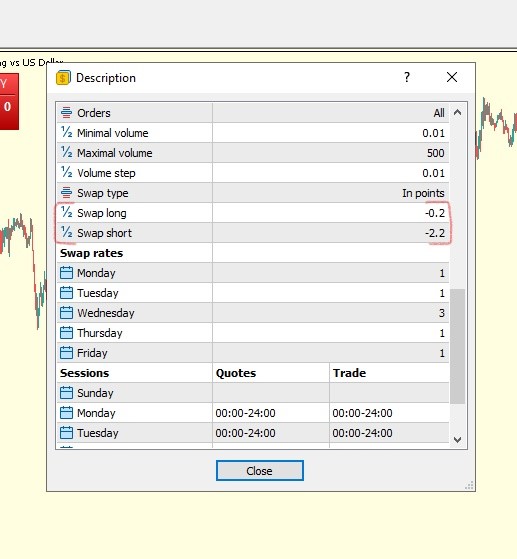

What will be displayed to you is a dialogue box that contains information regarding the forex pair, including the swap values.

What is the impact of swap fees on Long Term and Short Term Trading?

For short-term traders and day traders, swap fees may have a very little or insignificant impact on the trading account balance.

For long-term trades. swap fees will have more impact on the balance of the trading account because the fees will accumulate daily. long-term traders handling high-volume orders, it might be of interest to avoid forex swaps by either trading with a swap-free Forex trading account or trading directly without leverage.

Click on the button below to Download our "What is forex swap " Guide in PDF