What is Forex Spot rate and how does it work

The Forex spot rate is a fundamental concept in the world of currency trading, holding significant importance for traders and investors alike. At its core, the Forex spot rate, often referred to simply as the "spot rate," represents the current exchange rate between two currencies for immediate delivery or settlement. It is the rate at which one currency can be exchanged for another at the present moment, and it forms the foundation upon which the entire Forex market operates.

For traders, understanding and closely monitoring the Forex spot rate is crucial for making informed decisions. Changes in spot rates can have a profound impact on the profitability of currency trades, making it essential for traders to grasp the factors influencing these rates and how they can be leveraged to their advantage.

Understanding Forex Spot Rate

The Forex spot rate, often referred to simply as the "spot rate," is the prevailing exchange rate at a particular moment in time for the immediate exchange or delivery of one currency for another. It's the rate at which currencies are traded on the spot market, which means transactions are settled within two business days. The Forex spot rate is in sharp contrast to the forward rate, where currencies are exchanged at a specified future date, usually with a predetermined exchange rate.

The concept of the Forex spot rate has a rich history dating back centuries. In the past, it was primarily determined by physical exchanges of currencies at specific locations, often near financial centers. However, the modern Forex market has evolved significantly with technological advancements. Electronic trading platforms have become the norm, facilitating instantaneous currency exchange on a global scale. This evolution has led to increased accessibility and liquidity, making it possible for individuals and institutions of all sizes to participate in the Forex market.

Factors influencing Forex Spot Rates

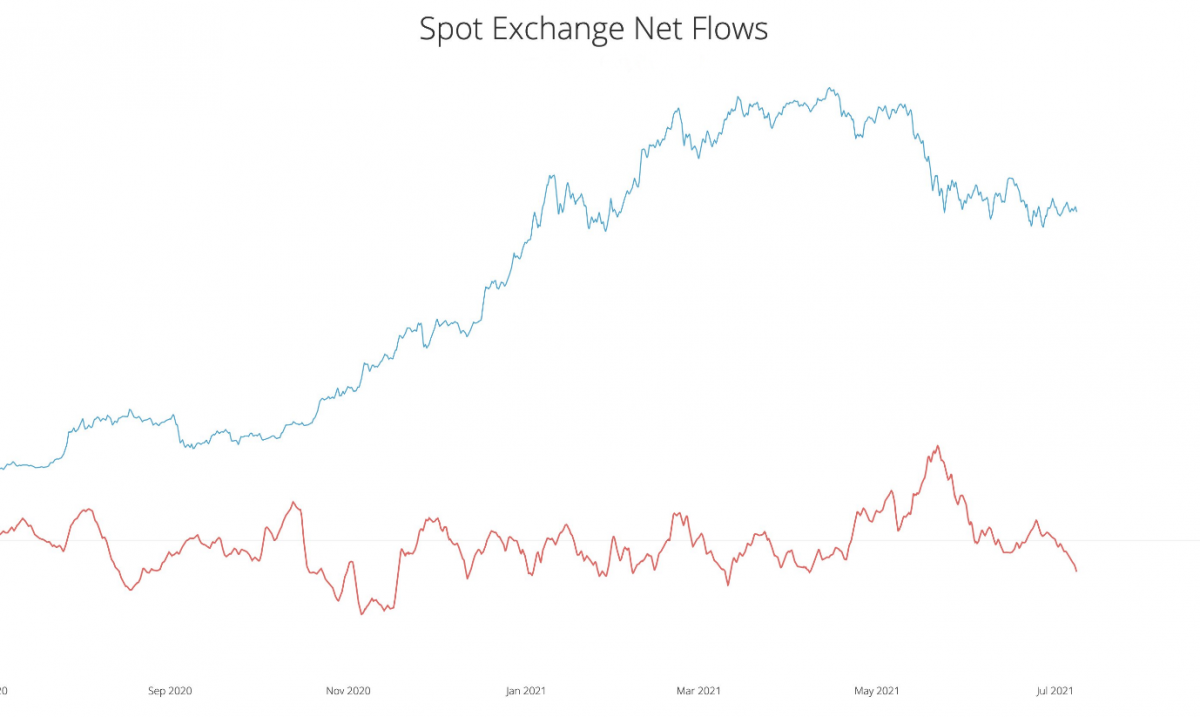

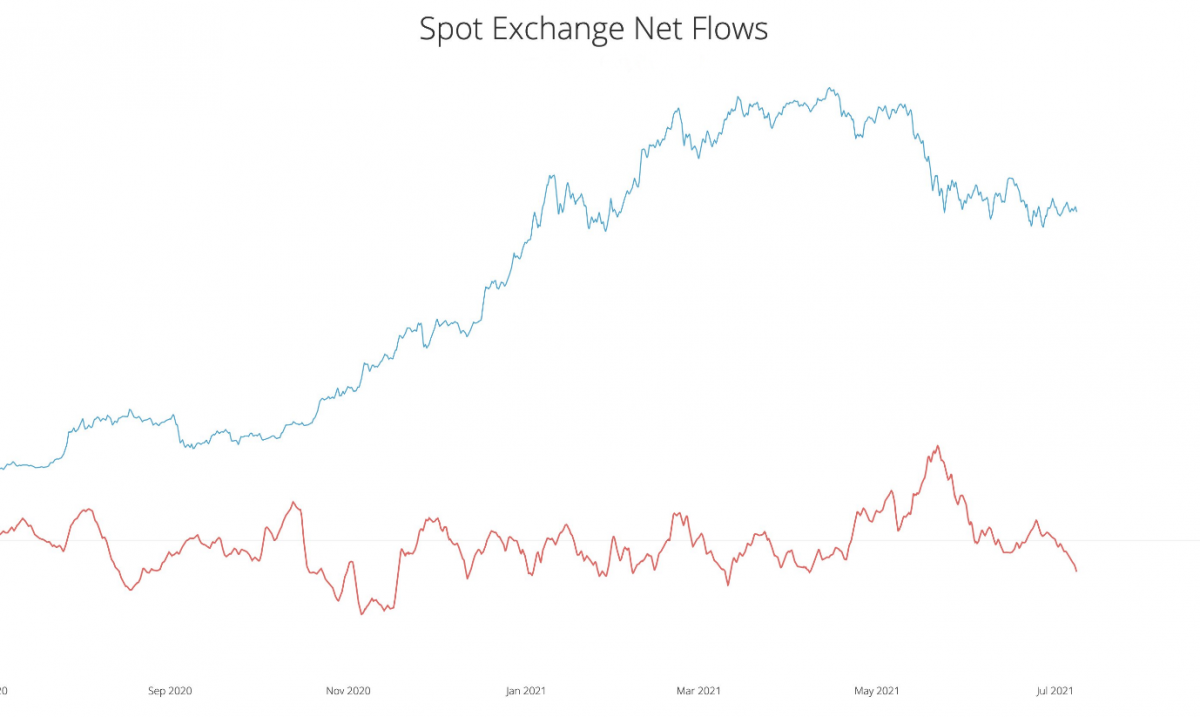

Forex spot rates are predominantly shaped by the forces of supply and demand. The principle is straightforward: when demand for a currency exceeds its supply, its value typically appreciates, causing an increase in the spot rate. Conversely, if the supply of a currency surpasses demand, its value tends to depreciate, leading to a lower spot rate. These dynamics are influenced by a myriad of factors, including trade balances, capital flows, geopolitical events, and market sentiment.

Economic indicators and news events play a pivotal role in influencing Forex spot rates. Announcements such as GDP figures, employment reports, inflation data, and interest rate changes can have an immediate and substantial impact on currency valuations. Traders closely monitor economic calendars to anticipate how such releases might affect the spot rates of the currencies they trade. Unexpected or significant news events, including geopolitical developments or natural disasters, can also trigger rapid and substantial movements in spot rates.

Central banks wield considerable influence over their respective currencies' spot rates through their monetary policies. Decisions on interest rates, money supply, and intervention in the foreign exchange market can all impact a currency's value. For instance, a central bank raising interest rates may attract foreign capital inflows, increasing demand for the currency and boosting its spot rate. Conversely, central bank interventions can be used to stabilize or manipulate a currency's value in response to economic conditions or to achieve specific policy objectives.

How Forex Spot Rates are quoted

Forex spot rates are always quoted in pairs, reflecting the relative value of one currency compared to another. These pairs consist of a base currency and a quote currency. The base currency is the first currency listed in the pair, while the quote currency is the second. For instance, in the EUR/USD pair, the euro (EUR) is the base currency, and the U.S. dollar (USD) is the quote currency. The spot rate, in this case, tells us how many U.S. dollars one euro can purchase at that specific moment.

Currency pairs are categorized into major, minor, and exotic pairs based on their liquidity and trading volume. Major pairs involve the world's most traded currencies, while minor pairs involve smaller economies' currencies. Exotic pairs include one major currency and one from a smaller economy. Understanding currency pairs is fundamental for traders, as it forms the basis for all Forex spot rate quotes.

The Forex spot rate is quoted with a bid-ask spread. The bid price represents the maximum price that a buyer is willing to pay for a currency pair, while the ask price is the minimum price at which a seller is willing to sell. The difference between the bid and ask prices is the spread, and it represents the transaction cost for traders. Brokers profit from this spread, which can vary in size depending on market conditions and the currency pair being traded.

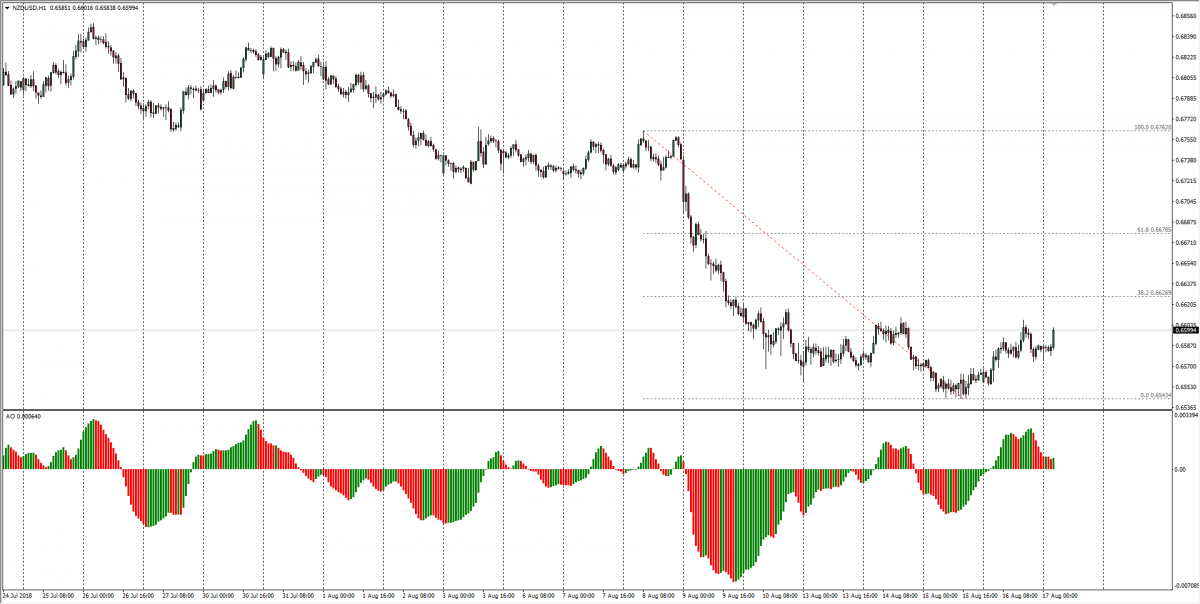

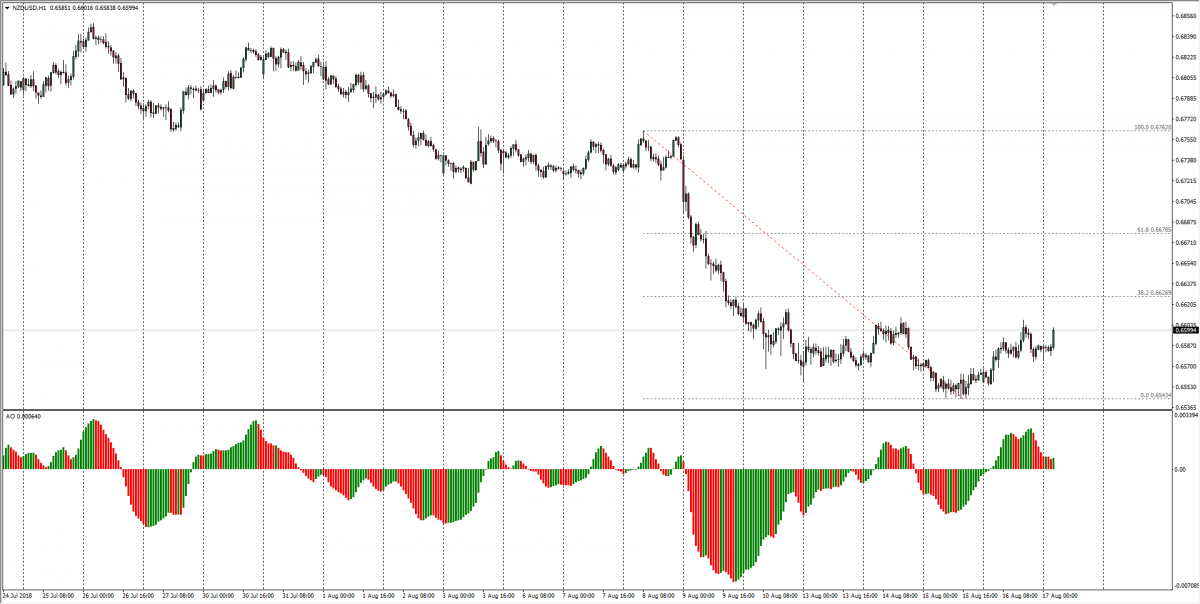

Forex spot rates are continuously changing in real-time as the market operates 24 hours a day during the trading week. Traders can access these rates through trading platforms, which provide live price feeds and charts. Real-time pricing is crucial for traders to make informed decisions and execute trades swiftly when market conditions align with their strategies. It allows traders to react to the dynamic nature of the Forex market, capturing opportunities as they arise.

Role of market makers and liquidity providers

Market makers are financial institutions or entities that facilitate trading in the Forex market by providing liquidity. They act as intermediaries between buyers and sellers, ensuring that there is a continuous flow of trades, even in highly liquid or fast-moving markets. Market makers often quote both bid and ask prices for a currency pair, allowing traders to buy or sell at these prices. These market participants play a vital role in maintaining a smoothly functioning Forex market.

Market makers can influence spot rates through their pricing strategies. They typically adjust their bid-ask spreads based on market conditions, supply and demand, and their own inventory of currencies. In times of high volatility, market makers may widen spreads to protect themselves from potential losses. This can impact traders, as wider spreads mean higher transaction costs. However, market makers also help stabilize the market by providing liquidity during turbulent periods, preventing extreme price fluctuations.

Liquidity is the lifeblood of the Forex market, ensuring that traders can easily buy or sell currencies without significant price slippage. Market makers play a crucial role in maintaining this liquidity by continuously offering to buy and sell currency pairs. Their presence ensures that traders can execute orders promptly at prevailing spot rates, regardless of market conditions. Without market makers and liquidity providers, the Forex market would be far less accessible and efficient for all participants.

The mechanics of Forex Spot transactions

Forex spot transactions involve the buying or selling of currencies at the current spot rate. Traders can initiate these transactions using two primary types of orders: market orders and limit orders.

Market orders: A market order is an instruction to buy or sell a currency pair at the prevailing market price. Market orders are executed immediately at the best available rate in the market. They are typically used when traders want to enter or exit a position quickly without specifying a specific price.

Limit orders: A limit order, on the other hand, is an order to buy or sell a currency pair at a specific price or better. These orders are not executed until the market reaches the specified price. Limit orders are useful for traders who want to enter a position at a specific price level or for those looking to secure a certain profit level when closing a trade.

Once a market or limit order is placed, it undergoes the execution process. For market orders, execution occurs instantly at the best available price in the market. Limit orders are executed when the market price reaches the specified level. The execution process is facilitated by market makers and liquidity providers, who match buy and sell orders from traders.

Forex spot transactions are settled within two business days (T+2). This means that the actual exchange of currencies takes place on the second business day after the trade is initiated. However, most Forex brokers offer traders the option to roll over their positions to the next business day, allowing them to hold positions indefinitely if desired.

Settlement is electronic and does not involve physical delivery of currencies. The net difference in the exchange rates between the two currencies is credited or debited to the trader's account, depending on whether they bought or sold the currency pair.

Conclusion

Forex spot rates play a central role in shaping trading strategies. Traders analyze these rates to make informed decisions on when to buy or sell currency pairs. Spot rates influence the timing of trades, helping traders identify favourable entry and exit points whether a trader is employing technical analysis, fundamental analysis, or a combination of both. Understanding how spot rates are trending and why is essential for crafting effective trading strategies.

Traders use spot rates to determine stop-loss and take-profit levels, limiting potential losses and locking in profits. Additionally, spot rates are crucial for hedging strategies, where traders open positions to offset potential losses in existing ones. By strategically using spot rates, traders can protect their capital and manage risk effectively. By comprehending the multifaceted role of spot rates, you empower yourself with the knowledge and tools needed to navigate the dynamic world of Forex trading effectively.