What is bullish and bearish in forex?

The foreign exchange market, or forex, is one of the world's largest and most active financial markets, with over $6 trillion traded daily. With so much money at stake, it's no wonder that traders are always looking for trends and indicators that can help them make informed trading decisions. One of the critical concepts in forex trading is bullish and bearish trends.

At its core, bullish and bearish trends refer to the market sentiment or how traders feel about the direction of a currency pair. A bullish trend means that traders are optimistic about the currency pair’s future and are buying more of it hoping to profit from a price increase. Conversely, a bearish trend means that traders are pessimistic about the currency pair's future and are selling it hoping to profit from a price decrease.

Understanding bullish and bearish trends are critical for forex traders, as it can help them make informed trading decisions and minimize risk. By analyzing market sentiment and observing economic and political factors that may affect a currency pair, traders can make informed decisions about when to enter and exit the market. In this article, we'll dive deeper into the world of bullish and bearish trends, exploring what they mean, how they work, and how traders can use them to inform their trading strategies.

Bullish and bearish trends in forex trading

Forex trading is marked by bullish and bearish trends, which signal traders' general sentiment regarding a currency pair's future prospects. In a bullish trend, traders are optimistic and buying the currency, hoping to profit from a price increase. Positive economic news, political stability, and other factors boost confidence in the currency's prospects. Traders take long positions and may use technical analysis to identify entry and exit points. Examples of bullish trends include interest rate hikes, GDP growth, and low unemployment, but these trends can be short-lived and may turn bearish if economic or political conditions change.

In contrast, a bearish trend reflects pessimism about the future of a currency pair, with traders selling the currency to profit from a price decrease. Negative economic news, political instability, and other factors erode confidence in the currency's prospects. Traders take short positions and may use technical analysis to identify entry and exit points. Examples of bearish trends include interest rate cuts, high inflation, and low consumer confidence. Still, these trends can also be short-lived and may turn bullish if economic or political conditions change. It's important to monitor market conditions and adjust trading strategies accordingly.

Last, understanding bearish trends are critical for forex traders, as it can help them identify potential risks and make informed trading decisions. By analyzing market sentiment and monitoring key economic indicators, traders can take advantage of bearish trends to profit from a falling currency pair. By understanding bullish and bearish trends, traders can make informed decisions and potentially profit from the dynamic world of forex trading.

How to identify bullish and bearish trends in forex trading

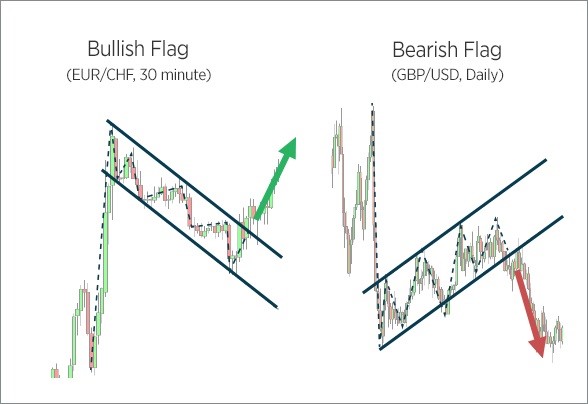

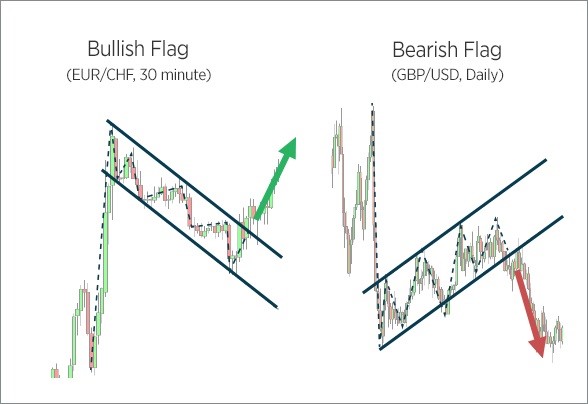

Traders use various technical analysis tools to identify bullish and bearish trends in forex trading, such as charts and indicators. A simple way to determine the trend is to look at the direction of the price movement of a currency pair. If the price is upward, the trend is bullish, and if it is moving downwards, the trend is bearish.

Traders also use moving averages, which are calculated by averaging out the price of a currency pair over a certain period. If the current price is above the moving average, it can indicate a bullish trend, and if it is below, it can indicate a bearish trend. Traders may also use trend lines to help identify potential entry and exit points.

Another popular technical analysis tool is the Relative Strength Index (RSI), which measures the strength of a currency pair's price action. If the RSI is above 50, it can indicate a bullish trend, and if it is below 50, it can indicate a bearish trend.

It's important to note that no single technical analysis tool can accurately predict the future direction of a currency pair's price movement. Traders should use a combination of tools and consider fundamental factors, such as economic and political news, to make informed trading decisions.

Using bullish and bearish trends to inform trading strategy

Once traders have identified bullish and bearish trends, they can use this information to inform their trading strategy. A preferred trading method refers to the choices that dictate the frequency and duration of your trades. Your trading style is influenced by factors such as the size of your account, the amount of time you have available for trading, your personality traits, and your willingness to take risks. A bullish trend suggests that the price of a currency pair is likely to increase, and traders can use this information to open long positions. In contrast, a bearish trend suggests that the price of a currency pair is likely to decrease, and traders can use this information to open short positions.

Traders can also use bullish and bearish trends to identify potential entry and exit points. For example, if a trader identifies a bullish trend in a currency pair, they may wait for a dip in price before opening a long position. Similarly, if a trader identifies a bearish trend, they may wait for a bounce in price before opening a short position.

It's important to note that trading based on trends alone can be risky. Traders should always consider fundamental factors, such as economic and political news, as well as risk management strategies, such as stopping loss orders, to minimize their losses.

In addition, traders should avoid trading based on emotions, such as fear or greed. Maintaining discipline and sticking to the trading plan are important, even when the market is volatile.

In summary, identifying bullish and bearish trends is an essential part of forex trading. Traders can use this information to inform their trading strategy and potentially profit from the dynamic world of forex trading. However, traders should always consider fundamental factors and risk management strategies to minimize losses and avoid emotional trading.

Common misconceptions about bullish and bearish trends

Several common misconceptions about bullish and bearish trends in forex trading can lead to poor trading decisions. It's important to understand these misconceptions to avoid falling into these traps.

One common misconception is that a bullish trend always leads to a profitable trade. While a bullish trend suggests that the price of a currency pair is likely to increase, this is not always the case. The market is unpredictable, and traders must always consider the risks involved in any trade.

Another misconception is that bearish trends always lead to a loss. While bearish trends suggest that the price of a currency pair is likely to decrease, this is not always the case. Traders can still profit from short positions during a bearish trend but must manage their risks carefully.

A third misconception is that trends always continue. While trends can be useful for identifying potential trading opportunities, traders should not assume that a trend will continue indefinitely. The market is unpredictable, and traders must always be prepared to adjust their trading strategy as market conditions change.

Finally, some traders believe that technical analysis tools, such as charts and indicators, can predict the future direction of the market with 100% accuracy. While these tools can be useful for identifying trends and potential trading opportunities, they could be more foolproof. Traders must always consider fundamental factors, such as economic and political news, and manage their risks carefully.

Conclusion

In conclusion, understanding bullish and bearish trends in forex trading are essential for any trader who hopes to be successful in the market. Knowing when a trend is likely to emerge, identifying the signals that suggest a trend is changing and using these insights to inform your trading strategy can make all the difference between a profitable trade and a loss.

Bullish trends suggest that the price of a currency pair is likely to increase, while bearish trends suggest that the price is likely to decrease. By analyzing market data, traders can identify when a trend is emerging and use this information to make informed decisions about when to buy or sell a particular currency pair.

There are several tools that traders can use to identify bullish and bearish trends, including technical analysis tools like charts and indicators, as well as fundamental analysis tools like economic and political news. It's important to consider both data types when making trading decisions, as they can provide different insights into the market.

Using bullish and bearish trends to inform your trading strategy requires careful risk management and an understanding of the market's unpredictability. It's important to avoid common misconceptions about bullish and bearish trends, such as assuming that trends always continue or that technical analysis tools can predict the future direction of the market with 100% accuracy.

Ultimately, successful trading in the forex market requires a balance of knowledge, discipline, and risk management. By understanding bullish and bearish trends and using this information to inform your trading strategy, you can increase your chances of making profitable trades and achieving success in the market.