What is Average Directional Index in Forex

By examining historical price data and market trends, traders utilize various tools and indicators to predict future price movements. Among these tools, the Average Directional Index (ADX) stands out as a key instrument designed to measure the strength of a trend.

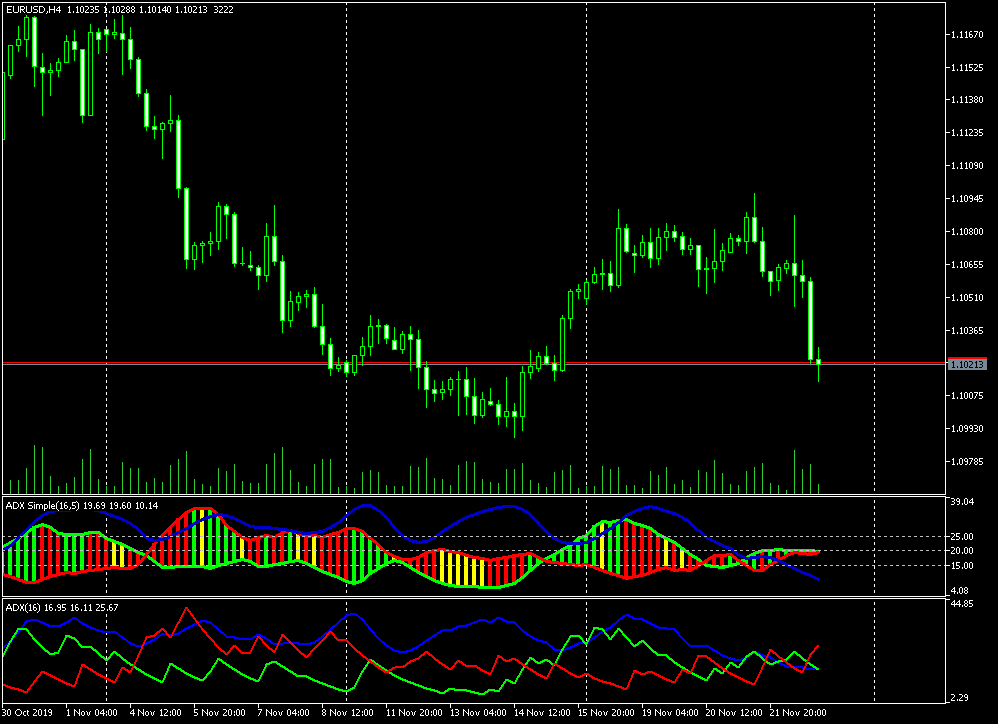

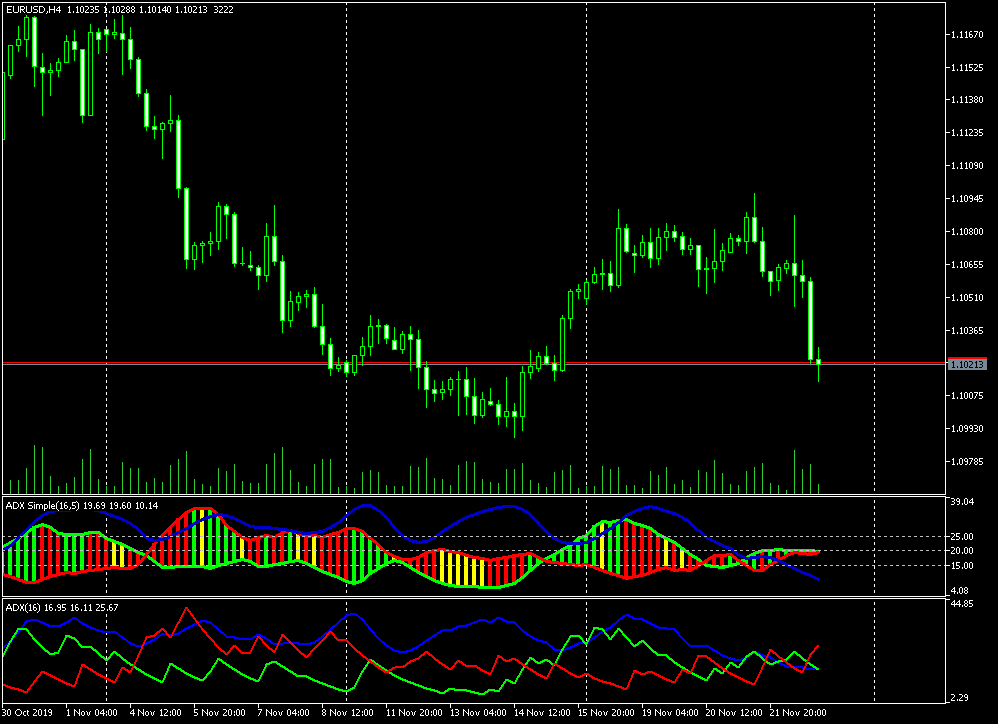

The ADX is an indicator used extensively in technical analysis that helps traders determine the robustness of a trend, regardless of whether the market is moving up or down. Developed by Welles Wilder in the late 1970s, the ADX is part of a system that includes other directional movement indicators. It quantifies the strength of a trend by producing a line that fluctuates between values of 0 to 100. Values above 25 typically suggest a strong trend, offering traders valuable insights into potential opportunities for entering or exiting trades based on the clarity of the trend's direction. This introduction to the ADX paves the way for a deeper exploration of its calculation, interpretation, and practical application in the volatile Forex market.

Understanding the Average Directional Index (ADX)

The Average Directional Index (ADX) is a technical analysis indicator designed to measure the strength of a trend in the forex market. It does not indicate the direction of the trend, but rather gauges the momentum and strength behind price movements, aiding traders in distinguishing between trending and range-bound conditions. This is crucial in forex trading as it helps traders optimize their strategy based on the trend's strength.

Developed by Welles Wilder in 1978, the ADX is part of the Directional Movement System, which includes the Positive Directional Indicator (+DI) and Negative Directional Indicator (-DI). These accompanying indicators help determine the direction of the trend while the ADX itself assesses its strength. Wilder introduced the ADX with the intent to help traders make profits by catching strong trends, hence, it is especially valued in markets like forex, where identifying trends can be highly profitable.

Historically, the ADX was created during a period when traders were seeking ways to objectively quantify trend strength without the subjective bias of visual chart analysis. Its mathematical approach provided a new perspective in technical analysis, offering a systematic way to assess whether to enter or exit a position based on the prevailing trend strength.

Components of the ADX

The Average Directional Index (ADX) consists of two key components: the Positive Directional Indicator (+DI) and the Negative Directional Indicator (-DI). These components work together to provide insights into the strength and direction of a trend in the forex market.

The Positive Directional Indicator (+DI) measures the strength of upward price movements, indicating the bullish momentum in the market. Conversely, the Negative Directional Indicator (-DI) assesses the strength of downward price movements, reflecting bearish momentum. Traders often use these indicators in conjunction to gauge the overall direction of price movement.

The ADX itself is derived from these directional indicators. It calculates the difference between the +DI and -DI, normalizes the values, and smoothens them to provide a single line that represents the strength of the trend. This line oscillates between 0 and 100, with higher values indicating a stronger trend and lower values suggesting a weaker trend or a range-bound market.

Understanding the interplay between the +DI, -DI, and ADX is crucial for traders looking to effectively utilize the ADX indicator in their forex trading strategies. By comprehending how these components interact, traders can better interpret market trends and make informed decisions about when to enter or exit positions.

Calculating the ADX

The calculation of the Average Directional Index (ADX) involves several steps, culminating in a single numerical value that indicates the strength of a trend in the forex market. Here is a step-by-step guide on how to calculate the ADX:

Calculate the True Range (TR): The True Range is the greatest of the following:

The difference between the current high and low.

The absolute value of the difference between the current high and the previous close.

The absolute value of the difference between the current low and the previous close.

Calculate the Directional Movement (DM):

Positive Directional Movement (+DM) is the current high minus the previous high if it is greater than the previous low minus the current low, otherwise it is zero.

Negative Directional Movement (-DM) is the previous low minus the current low if it is greater than the current high minus the previous high, otherwise it is zero.

Smooth the Directional Movement: Calculate the 14-period exponential moving average (EMA) of both the +DM and -DM values.

Calculate the Directional Index (DI):

Calculate the +DI and -DI by dividing the smoothed +DM and -DM values by the 14-period True Range.

Calculate the Average Directional Index (ADX):

Calculate the Directional Movement Index (DX) as the absolute difference between the +DI and -DI, divided by their sum, multiplied by 100.

Calculate the 14-period EMA of the DX values to obtain the ADX.

The 14-day period used in ADX calculations is considered standard practice due to its balance between responsiveness and smoothing. This timeframe allows the indicator to capture significant price movements while filtering out short-term fluctuations, providing traders with a reliable measure of trend strength over a reasonable time horizon.

Interpreting ADX values

Interpreting Average Directional Index (ADX) values is essential for traders to assess market conditions and make informed trading decisions. ADX values typically range from 0 to 100, with specific thresholds indicating different market scenarios.

Low ADX (under 25): ADX values below 25 suggest a weak trend or a range-bound market. In such conditions, traders may encounter choppy price movements with no clear trend direction. It is often prudent to exercise caution and avoid entering trades solely based on trend-following strategies.

Medium ADX (25-50): ADX values between 25 and 50 indicate a moderate to strong trend. During this phase, traders may observe more consistent price movements in a particular direction. Trend-following strategies may be more effective in capturing profits, but traders should remain vigilant for signs of potential trend reversals.

High ADX (above 50): ADX values exceeding 50 signify a very strong trend. In such robust trends, price movements tend to be more decisive and sustained. Traders can have greater confidence in trend-following strategies and may consider adding to or holding onto existing positions to maximize profits.

For instance, a low ADX reading during a range-bound market might prompt traders to employ range-trading strategies, such as buying near support levels and selling near resistance levels. Conversely, a high ADX reading during a strong uptrend could encourage traders to ride the trend by entering long positions or adding to existing ones, anticipating further price appreciation.

Using the ADX in forex trading strategies

Incorporating the Average Directional Index (ADX) into forex trading strategies can significantly enhance traders' ability to identify and capitalize on trends in the market. Here's how traders can utilize ADX effectively:

Trend-following strategies: Traders often use ADX to confirm the presence of a trend before entering a trade. When ADX rises above 25, indicating a strengthening trend, traders may look for opportunities to enter positions in the direction of the trend. They might wait for pullbacks or retracements within the trend to enter trades with favorable risk-reward ratios.

Combining with other indicators: ADX is commonly used in conjunction with other technical indicators to validate trading signals and improve overall market analysis. For example, traders may combine ADX with moving averages to confirm trend direction or with oscillators like the Relative Strength Index (RSI) to identify overbought or oversold conditions within a trend.

Advantages and limitations of the ADX

The Average Directional Index (ADX) offers several benefits for traders seeking to make informed decisions in the forex market, but it also has its limitations.

Advantages:

Objective Trend Strength Measurement: ADX provides traders with a straightforward and objective measure of trend strength, helping them identify strong trends and potential trading opportunities with greater confidence.

Versatility: ADX can be used in various trading strategies, including trend-following, range-bound, and breakout strategies. Its flexibility makes it a valuable tool for traders across different market conditions.

Clear signals: ADX readings above 25 typically indicate the presence of a trend, while readings above 50 suggest a strong trend. This clarity of signals enables traders to make timely decisions about entering or exiting trades.

Limitations:

Lagging indicator: ADX is a lagging indicator, meaning it may not provide signals in real-time. Traders may experience delayed responses to changes in market conditions, potentially resulting in missed opportunities or late exits from trades.

Whipsawing in choppy markets: In choppy or range-bound markets, ADX readings may fluctuate around the 25 threshold, leading to false signals and whipsawing. Traders need to exercise caution and consider additional confirmation before acting on ADX signals in such conditions.

Lack of directional bias: While ADX measures trend strength, it does not indicate the direction of the trend. Traders must use other tools or analysis techniques to determine the direction of the trend before relying on ADX for entry or exit signals.

Conclusion

In conclusion, the Average Directional Index (ADX) serves as a valuable tool for traders in the forex market, providing insights into trend strength and aiding in decision-making processes.

Key takeaways include understanding how ADX measures trend strength objectively, using it in conjunction with other indicators to validate trading signals, and recognizing its versatility across different market conditions. Traders can benefit from incorporating ADX into their trading arsenal to enhance their ability to identify and capitalize on trends effectively.

However, it's essential to recognize that ADX is not infallible and may have limitations, such as lagging behind real-time market movements and providing false signals in choppy markets. Therefore, traders are encouraged to practice using ADX in a demo account before applying it in live trading scenarios. This allows traders to familiarize themselves with the indicator's behavior, refine their trading strategies, and gain confidence in its application without risking real capital.