What is an Entry Order in Forex Trading

Opening trade positions in the forex market requires the use of entry orders provided by forex trading platforms. It is possible for traders to perform technical and fundamental analysis on price movement and deduce many trading strategies, but without an entry order to trade potential price movements, all that work becomes unprofitable. The foreign exchange market is open 24 hours a day, typically from Monday through Friday, but can also be open all through the week depending on the asset class. Is it good for a trader to sit through and watch all the price movement for a whole 24hrs? Of course, no!

In this regard, entry orders play a key role in forex trading. They allow traders to set in advance buy or sell trades on any currency at predetermined price levels, which can only become effective when the predetermined price is met. Trading forex with entry orders offers several benefits, which we will explore in the following section but before then, a comprehensive understanding of entry orders is necessary.

What is an entry order in forex trading

A forex entry order is a pending order to buy or sell any financial asset at a desired price provided the conditions for the order are met.

Assume that the price movement of a currency pair is poised to move in a particular direction. It could be a breakout that is forecasted from a flag pattern where the price movement has consistently bounced back and forth around the perimeters of the pattern. An entry limit order can be set up so that, at any given time, when price movement breaks out of the pattern, the order automatically takes effect. However, if price movement falls short of the desired price level, the order will remain pending. It is important to take into consideration the types of entry orders.

There are four basic types of entry orders:

- Buy Entry Limit Order: This type of entry order can be set below the current market price

- Sell Entry Limit Order: This type of entry order can be set above the current market price

- Buy Entry Stop Order: This type of entry order can be set above the current market price

- Sell Entry Stop Order: This type of entry order can be set below the current market price

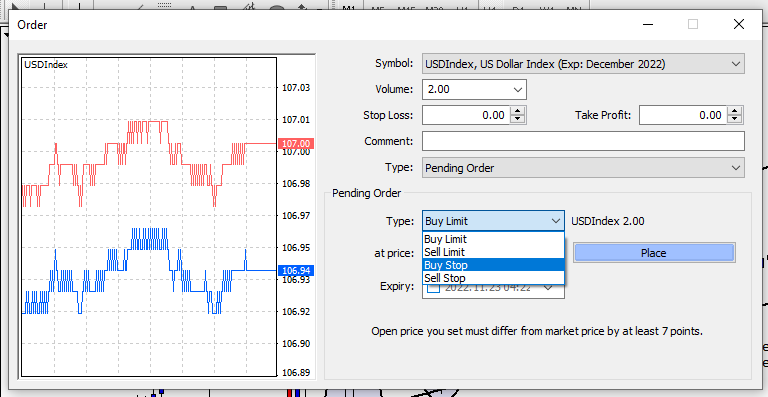

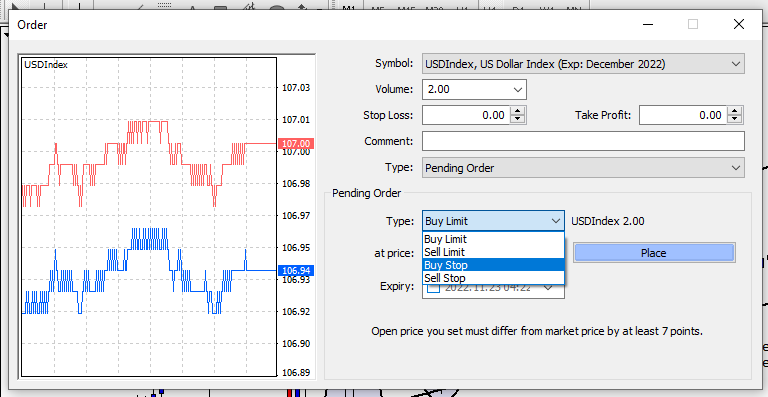

Image(I) US Dollar Index Deal Ticket to setup an entry order

Entry orders can be of great advantage. Why? Because your trade can get automatically activated while you are productive at some other task instead of staring at charts all day. However, it can be frustrating when price movement almost fills and triggers your entry order with just a few pip distance but later moves in the actual predetermined direction without activating your order. It is also important to know that entry orders do not protect trades from poor risk management practices or a lack of stop loss.

Guidelines to setup a conditional forex entry order

The following guidelines are simple to adhere to and they apply to almost all major trading platforms:

- To place an entry order, firstly, you must have been convinced by both technical and fundamental factors that the price movement of the currency pair you are about to buy or sell will move accordingly.

- Next, open a deal ticket by left clicking on the 'New Order' tab at the top of the trading platform

III. On the deal ticket, change the order type from market execution to pending order

- The next step is to choose from the four order types that correspond with your prediction of price movement direction.

- Ensure to input the price level that aligns with the selected order type. Also ensure that a logical stop loss and take profit value are inputted as part of good risk management practice.

- You may also choose to set an expiry time/date for the trade setup.

VII. Following the completion of all of these steps, the entry can be submitted.

Prior to engaging in any real money trading activities, it is imperative to be accustomed to the platform you are using. This can help to ensure that your trades are executed or managed more efficiently, thus minimizing impractical errors.

Here are some proven trading strategies that works best with forex entry orders.

- Trend channels entry order strategy

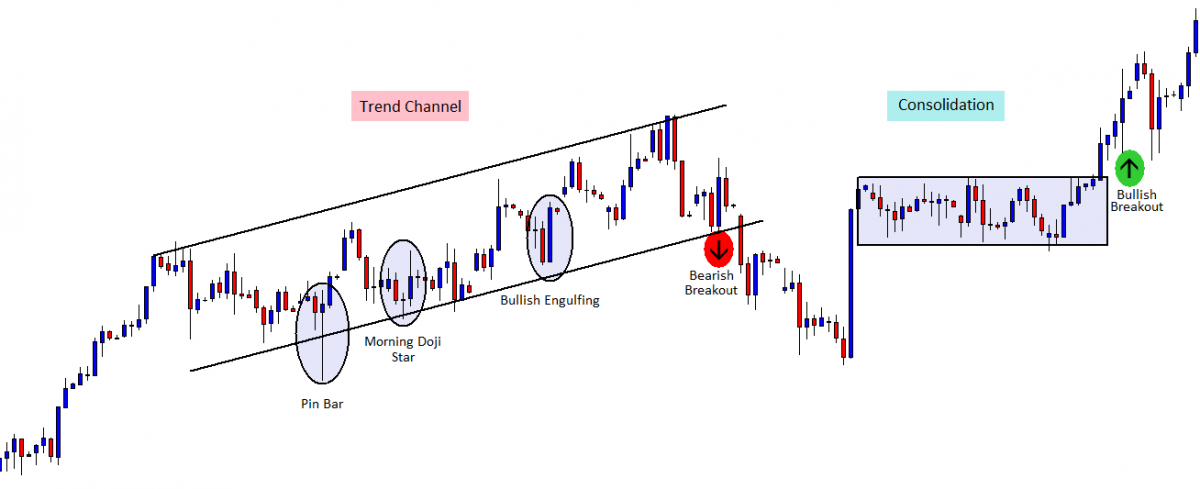

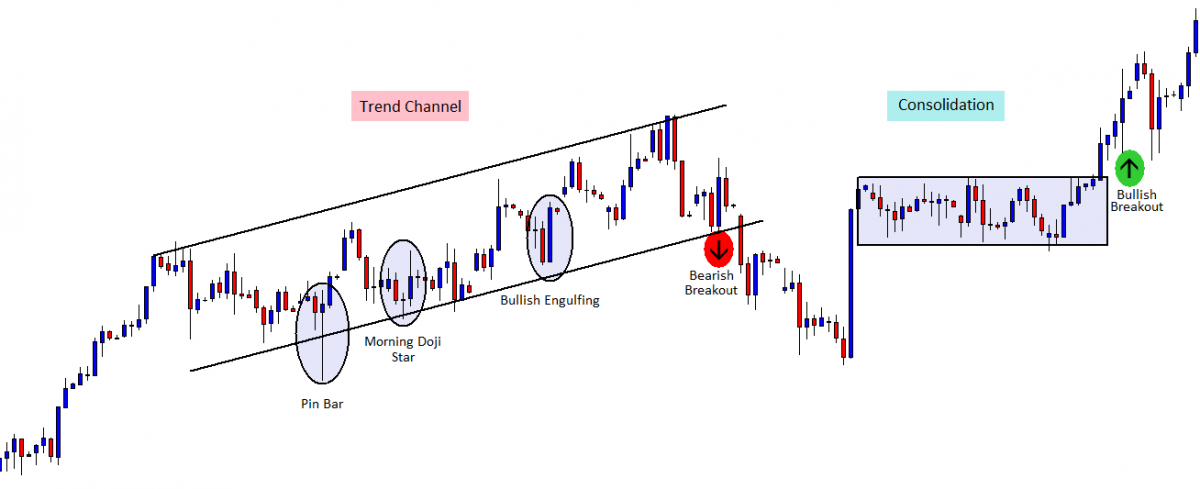

Trendlines are basic tools used by technical analysts to identify dynamic levels of support and resistance as price movement trend higher or lower. As shown in the trend channel below, price movement is indicative of an uptrend with consequent higher highs and higher lows. This helps to determine the most ideal level of support to set up a buy entry order and the most significant level of resistance at the top of the channel to set a take profit.

Image illustrates the three proven entry order strategies discussed in this section.

- Breakout entry order strategy

Breakout of price movement from market consolidations is a common phenomenon. Market consolidations may be in the form of ranges, pennants, wedges, flag patterns and triangle patterns. The image above shows two examples of breakout entry strategy. The first is the bearish breakout from a bullish trend channel and the second is a bullish breakout from consolidating price movement. Entry orders placed at such key price levels of anticipated breakouts use to be highly effective.

- Candlestick patterns entry order strategy

Candlestick patterns are one of the most powerful tools traders use to confirm highly probable entry orders. Engulfing candlestick patterns, pin bars and the doji star are the most commonly used by experienced traders.

In the example above, the blue circle on the price chart designates the pin bar, the doji star and the bullish engulfing candlestick pattern on the price chart and they can be seen on high probable price levels suggesting potential price movement reversal. Candlestick patterns alone are not a confirmation for entry orders and they are of no significance without strong technical and fundamental factors but they help to validate highly probable price levels where entry orders at placed.

The pin bar, the doji star and the bullish engulfing candlestick pattern on the price chart would have been of no significance if not for the technical analysis of trend channels, consolidation, and dynamic support and resistance. It is important that traders combine confluences of indicators, institutional big figures, pivot points and news releases with the candlestick pattern strategy.

Top 4 advantage of using forex entry orders

- Control over entry price

Entry orders allows traders to indicate an exact price level where they wish to buy or sell any financial asset thus eliminating the possibility of slippages. The ability to set an entry order at a future price level simplifies trading and eliminates the need to constantly monitor the market.

- Freedom to be productive at other endeavors

By using entry orders, traders are not compelled to be in front of their trading platform all day in anticipation that price may bounce off a trendline or break out of a consolidation or price channel. While some may be analyzing other forex pairs, the others may be busy with other daily tasks. Entry orders make it easier to participate and profit from price movement that is predicted beforehand. It is also possible to set and adjust conditional stop orders before and after an entry order gets triggered. This is an example of effective risk management for safety and peace of mind when away from the trading platform.

- Better Time Management

Taking into account how much time traders dedicate to trading each day can help you grasp the whole of this concept. How much time is 12 hours, 5 hours, 1 hour or 10 minutes? Those that have a day job, a family and other obligations to fulfill usually spends an average of 30 minutes to an hour each day to trade. When compared to the 24-hour trading period of the forex market. A trader that spends 10 minutes a day placing trades devotes at least 1% of the day watching the market. If a trader spends an hour a day placing trades, he/she may have devoted about 4% of the day watching the market. Being mindful of the amount of time devoted to trading, what are the chances of a trader observing the market at the most advantageous time to place a trade? It is unlikely that the odds will be very high.

The most optimal entry time for a trader is likely to be within the time he or she is away from the trading platform. Therefore, to avoid forcing trades at times where the odds of being profitable is risky, the best risk management practice is to use entry orders to set up buy or sell pending trades at a later time and at the most ideal price.

- Accountability

Traders should have in place strategies with rules that allow them to take the right actions at any given market event before they happen. Forex entry orders help to keep traders on the right track. They also eliminate the possibility of emotions and bad decisions that can interfere with reliable and profitable trades.