What is an ECN account?

ECN trading gets classed as the gold standard for retail forex traders. Here we’ll describe the ECN process, which brokers offer ECN trading accounts, and how to get the best out of the opportunity.

We’ll also discuss the specific features and benefits of an ECN account, the differences between versions of ECN and standard trading accounts, and how to search for reputable ECN brokers.

What is an ECN forex account?

An ECN forex account is a specialised trading account that allows you to trade through an ECN broker.

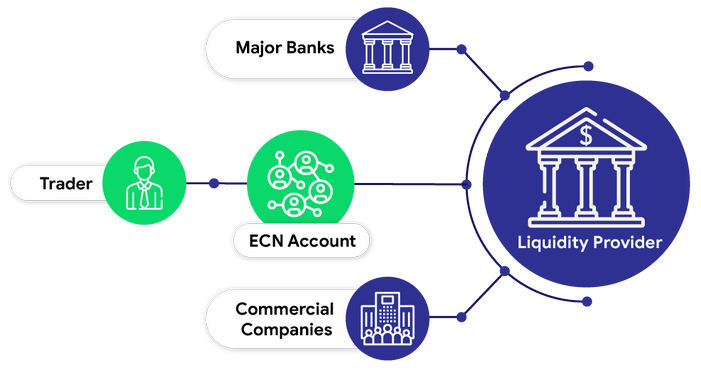

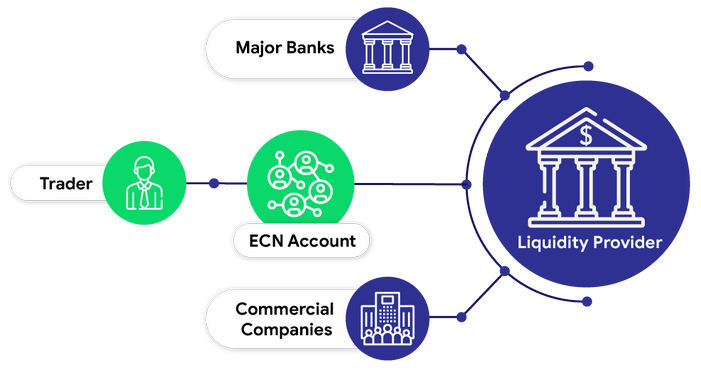

The ECN abbreviation stands for Electronic Communication Network. The communication network is a virtual digital pool of bids and offers orders from various industry sources, creating a massive liquid digital pool where your order gets matched.

The liquidity pool consists of institutional banks, hedge funds, and other liquidity sources (like tier-one brokers) who route your orders to the ECN.

When your FX orders go into the ECN, you’re in excellent company. Your order ranks equal to that of any other anonymous participant. There is no priority given to other parties; whatever your transaction sizes, it will be matched asap and at the best or next best price available.

How an ECN account works

ECN accounts allow you to trade FX through ECN brokers. They’ll match and execute orders in a seamless simultaneous action.

ECN forex account holders are usually charged a commission on the raw spread for the execution of the order, which could be in the form of a quoted spread.

The ECN (Electronic Communications Network) account is an order-matching execution system. The broker charges a premium as commission per trade instead of inflating the cost of the raw spread.

NDD, STP and ECN

It’s worth focusing on specific forex trading and industry terminology to explain how your market orders get routed to market.

It would be best to look for a broker who satisfies the following three criteria: NDD, STP and ECN.

NDD stands for no dealing desk. Your NDD broker doesn’t interfere with your order through their dealing desk operation. They don’t group your orders, delay them, or otherwise try to game the system to increase their bottom-line profitability.

When your order comes in, the NDD broker routes it to market asap and at whatever represents the best price, the millisecond the order gets matched.

STP stands for straight-through processing. STP compliments the NDD protocol, and your orders are routed straight through to the forex market through to a liquidity supplier. STP is a highly transparent process, and as with NDD, the purpose is to get you the best price available.

ECN is the electronic computer network where your order gets matched. Imagine the ECN is a liquid pool of buy-and-sell orders that get matched with a partner. Your order goes into the vast collection and finds a match in milliseconds.

As you can see, combinations of NDD, STP and ECN supply the ideal basis for transparent and fair trading. It’s advisable to consider your options and choose a broker with these three standards in mind but avoid using dealing desk brokers where possible. The primary motivation of dealing desk brokers is their profitability ahead of their clients’ welfare.

What is the difference between an ECN and a standard account?

An ECN account matches orders, and a commission gets charged for the execution without placing any premium on the raw spread. In contrast, a market-making broker usually offers standard trading accounts, where they apply premiums on top of raw spreads to profit from the trade execution.

When you trade a standard trading account, you typically get a fixed spread. For instance, you might get quoted a 2-pip spread on EUR/USD, whatever the price or volatility of the currency pair.

You’ve no idea what price you’ll be filled at when you place your order on a standard account, but the broker will try to guarantee the 2-pip spread. The spread is your version of commission or charge to handle the transaction. In this situation, the broker acts as the counterparty to any position you have live.

The fixed spread/counterparty situation doesn’t always work against the trader. In times of increased volatility, that 2 pip spread could be an attractive choice and, at times, more competitive.

If you’re a swing or position trader, you might prefer this choice. If you pay 2 pips per trade when you’re aiming for 150 pips plus, then the transaction cost isn’t as significant compared to being a scalper.

The downside of fixed spreads is that you might be paying something like 1.5 pips extra per trade compared to the ECN trading model, and if you are a frequent trader, the extra costs soon add up and eat into your bottom-line profits.

The ECN broker charges a commission as a varying spread which could be as low as 0.5 on EUR/USD at times, so paying two pips on each trade if you scalp or day-trade can be expensive. The ECN model is regarded as fairer and transparent because you pay the live market rate at the time of execution.

What are the benefits of trading through an ECN account?

Trading through an ECN broker is advantageous for many reasons, some of which we’ve already covered above. Transparency, fairness, speed of execution, and the lower cost of each trade are just some advantages.

You’re also trading how professionals trade. Although you’re not dealing with an interbank only network, ECN trading provides a close replica of the institutional-level trading model traders at banks and hedge funds will use.

It’s also worth noting that an ECN broker’s fundamental function is to deliver a cost-effective solution for their clients. ECN brokers thrive on turnover, and they need you to be successful and profitable.

If you prosper, then you’re more likely to stay in the forex trading industry and remain loyal to the broker who helped launch your success. Therefore, you’ll trade more and provide the broker with more revenue.

How to find an ECN broker

A simple search through a search engine will reveal which brokers offer ECN trading accounts. You can then work your way through these brokers and perhaps engage in an online conversation with them to decide where to open your trading account.

You could also search for reviews on the broker and check their typical spreads and commissions while subjecting them to other tests, like reading their analysis articles before committing to open an account.

Conclusion

The ECN trading account is the choice of many retail traders who take a professional attitude to forex trading. If you trade into an ECN on a platform such as MetaTrader’s MT4 through a reputable broker, then you’ve given yourself the best foundation to underpin your progress.

You’ll be trading in a transparent, fair and anonymous environment, getting equal treatment whatever the size of your account and order, and be dealing in live prices matched in milliseconds.

Click on the button below to Download our "What is an ECN account?" Guide in PDF