Volatility expansion strategy

Volatility, in simple terms, refers to the degree of variation in the price of a financial instrument over a specific time period. It plays a key role in Forex markets, influencing how currency pairs behave and the risks and opportunities they present. High volatility often accompanies major economic events, geopolitical developments, or significant shifts in market sentiment, making it both a challenge and an opportunity for traders.

The volatility expansion strategy in Forex allows traders to identify and act on periods of heightened price activity, aiming to ride the momentum created by expanding volatility. By focusing on these high-energy moments, the strategy helps traders avoid stagnant markets and instead engage during periods of heightened potential for profit.

Volatility in forex

Volatility in Forex refers to the degree of price fluctuations within a specific time frame. In simple terms, it measures how much a currency pair's value changes over time. For traders, understanding volatility is critical as it directly impacts their ability to profit from price movements and influences their risk exposure. Unlike stable or low-volatility conditions, periods of high volatility present both opportunities and challenges, as price movements can be sudden, significant, and unpredictable.

To measure volatility, traders rely on various tools and indicators. The Average True Range (ATR) is a popular choice, providing insights into the average price movement over a given period. Bollinger Bands, another common tool, help identify periods of low volatility (when bands contract) and high volatility (when bands expand). These indicators allow traders to spot potential breakout opportunities where volatility begins to surge.

Volatility in Forex is driven by several key factors. Macroeconomic events, such as central bank interest rate decisions, GDP data releases, or unemployment reports, can trigger significant price movements. For example, the U.S. Federal Reserve's monetary policy announcements often impact the USD and related currency pairs. Geopolitical developments, such as elections or conflicts, can also create market uncertainty, leading to increased volatility. Additionally, shifts in market sentiment, such as a transition from "risk-on" to "risk-off" behavior, can amplify price swings.

Core principles of the volatility expansion strategy

The volatility expansion strategy is designed to help traders identify and capitalize on sudden increases in market volatility. By focusing on key technical and price action signals, this approach allows traders to enter the market at opportune moments, often just before a breakout occurs. To effectively apply this strategy, traders must understand its core principles and utilize the right tools to confirm their analysis.

The first step is identifying market conditions that indicate an impending increase in volatility. Tools like Bollinger Bands are particularly useful, as their contraction (a "squeeze") signals low-volatility periods that often precede significant price movements. Similarly, the Average True Range (ATR) can help measure changes in volatility, allowing traders to spot the early stages of expansion. Combining these tools with trend analysis helps ensure that the breakout aligns with the broader market direction, increasing the chances of success.

Technical indicators are essential for confirming entry points. For instance, the Moving Average Convergence Divergence (MACD) can help identify momentum shifts, while the Relative Strength Index (RSI) highlights overbought or oversold conditions that may signal a breakout. Keltner Channels can also be compared with Bollinger Bands to provide additional confirmation of price movements.

How to implement a volatility expansion strategy in forex

Implementing the volatility expansion strategy requires a structured approach to maximize the potential of breakout trades while minimizing risk.

Choosing the right currency pair

The first step involves selecting currency pairs that are prone to high volatility. Major pairs, such as GBP/USD or EUR/USD, often experience significant price fluctuations during major economic events. Cross pairs like GBP/JPY or AUD/NZD are also known for their heightened volatility, offering prime opportunities for breakout strategies. Traders should prioritize pairs with sufficient liquidity to ensure smooth trade execution.

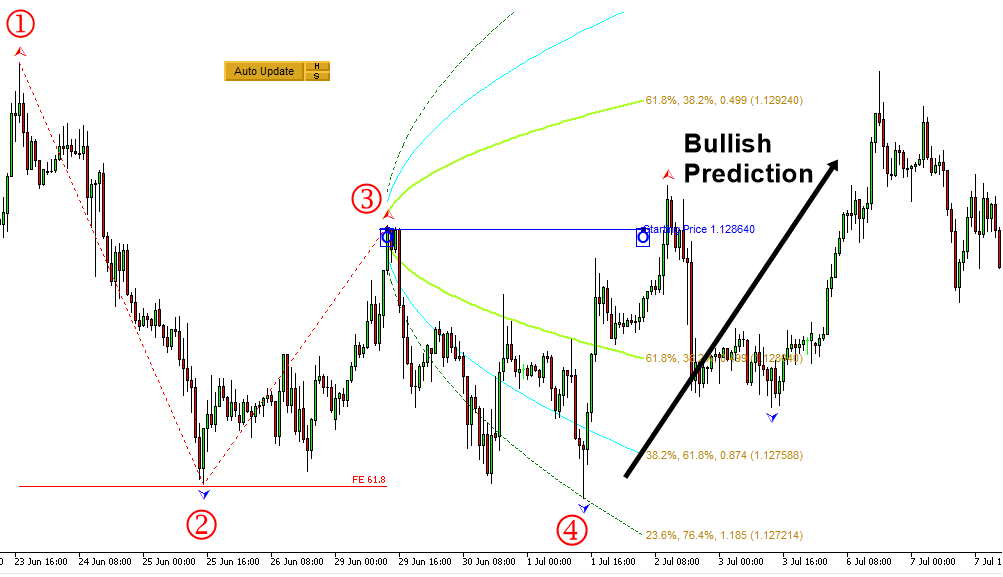

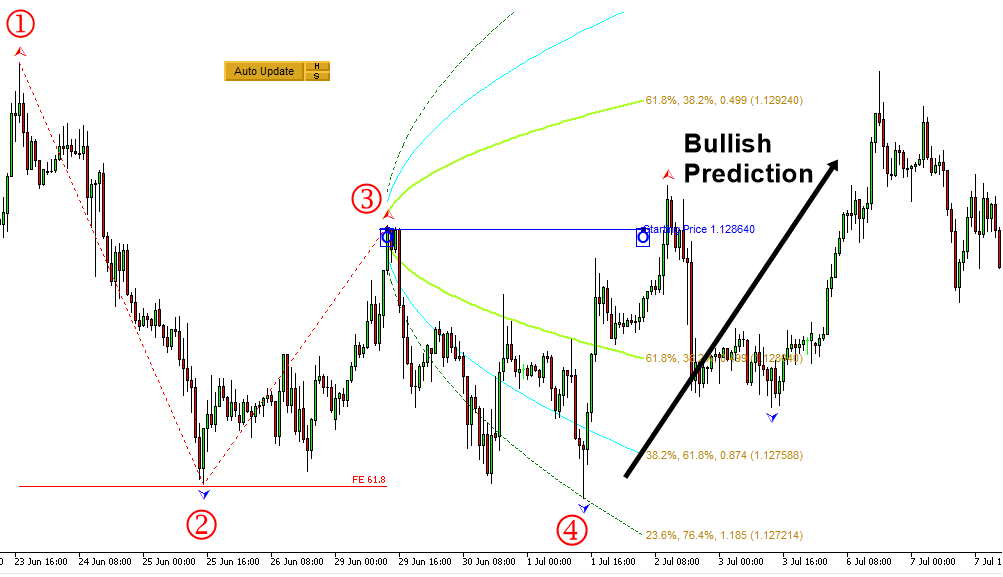

Identifying potential breakout zones

Spotting support and resistance levels is crucial for identifying potential breakout areas. These levels can be derived using tools like horizontal trendlines, Fibonacci retracement levels, or pivot points. When price approaches these zones during periods of low volatility, traders can anticipate potential expansion as the market breaks through these barriers.

Selecting the right indicators

Combining volatility and momentum indicators strengthens trade setups. Tools like Bollinger Bands (to identify squeezes) and ATR (to measure price movement) can signal expanding volatility. Adding momentum indicators, such as the MACD or RSI, helps confirm the direction of the breakout and filters out false signals.

Setting entry and exit rules

Precise entry and exit rules are essential. Traders can set entries just above resistance or below support levels. Exits should be based on clear profit targets or trailing stop-loss orders, helping lock in gains while protecting against sudden reversals.

Risk management in volatility expansion strategy

Volatile market conditions can lead to rapid price swings, presenting both opportunities and risks. Traders must implement measures to safeguard their capital while maximizing profit potential.

Position sizing for volatile markets

In highly volatile environments, the risk per trade increases. To mitigate this, traders should adjust their position sizes to account for larger price movements. For instance, instead of risking a fixed number of pips, traders can calculate position sizes based on the Average True Range (ATR) or current market volatility. This ensures that they do not overexpose their capital.

Stop-loss placement

Proper stop-loss placement is crucial to protect against unexpected price reversals. In the context of volatility expansion, stop-loss orders should be placed beyond significant support or resistance levels. For example, if a trader is entering a long trade on a breakout above a resistance level, the stop-loss might be placed just below that level to account for potential false breakouts. Using tools like ATR can help determine an optimal stop-loss distance.

Managing false breakouts

False breakouts are a common risk in volatility trading. To reduce their impact, traders should look for confirmation signals before entering a trade. These signals might include momentum indicators like the MACD or candlestick patterns such as bullish or bearish engulfing. Additionally, avoiding trades during highly unpredictable market conditions, such as during major news releases, can reduce the likelihood of being caught in false moves.

Advantages and challenges of the volatility expansion strategy

The volatility expansion strategy offers traders unique opportunities to capitalize on rapid price movements, but it also comes with inherent challenges.

Advantages

One of the primary benefits of the volatility expansion strategy is its potential for significant profits within short timeframes. When volatility increases, breakouts often lead to strong directional trends, providing traders with high reward-to-risk opportunities. For instance, during a central bank interest rate announcement, price movements can exceed normal ranges, creating lucrative trading setups for those prepared.

Another advantage is the strategy’s flexibility across different timeframes and trading styles. Scalpers can utilize it on shorter timeframes, like 5-minute or 15-minute charts, while swing traders can apply it to daily or weekly charts to capture longer-term trends. Additionally, the strategy helps traders avoid range-bound or stagnant markets, focusing instead on high-energy conditions where opportunities are abundant.

Challenges

Despite its benefits, the volatility expansion strategy poses challenges. One of the most significant is the risk of false breakouts, where price briefly moves beyond support or resistance levels before reversing. This can lead to losses if trades are entered prematurely or without proper confirmation.

Tools and resources to master volatility expansion strategy

Mastering the volatility expansion strategy in Forex trading requires the right combination of tools, platforms, and educational resources.

Top trading platforms for strategy execution

Platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are widely used by Forex traders for their advanced charting tools and customizable indicators. With features like Bollinger Bands, Average True Range (ATR), and customizable alerts, these platforms are ideal for monitoring volatility conditions.

Educational resources and market analysis

Websites like DailyFX, Forex Factory, and Investing.com provide real-time news, economic calendars, and technical analysis tailored to Forex traders. For beginners, platforms like Babypips offer in-depth tutorials on understanding volatility, technical indicators, and risk management, making it a great starting point for traders new to this strategy.

Using economic calendars for timing volatility

Economic calendars are vital for pinpointing high-volatility periods. Events like central bank meetings, nonfarm payroll (NFP) reports, or gross domestic product (GDP) data releases are often accompanied by sharp price movements. Resources like the Forex.com Economic Calendar and OANDA’s market insights help traders prepare for these events, aligning their strategy with expected volatility.

Conclusion

Risk management is integral to the success of any trading strategy, and the volatility expansion approach is no exception. Proper position sizing, disciplined stop-loss placement, and patience in waiting for confirmation signals are essential to avoid common errors, such as false breakouts or overexposure to risk.

While the strategy offers numerous advantages, including scalability across different timeframes and the potential for significant short-term profits, it also presents challenges. Traders must prepare for the psychological and technical demands of trading in volatile environments.

By leveraging reputable tools and resources like MetaTrader platforms, DailyFX, and TradingView, and by staying informed about macroeconomic events through economic calendars, traders can refine their implementation of the volatility expansion strategy.