The best method of analysis for forex trading

Foreign exchange trading, or forex trading, consists of the purchase and sale of currencies on a worldwide market. Being the biggest financial market globally, it works around the clock to support global trade and investments through currency exchange. Achieving success in forex trading is greatly dependent on thorough market analysis, allowing traders to make educated decisions and maneuver through the frequently unpredictable currency markets.

Market analysis is essential in forex trading. It provides traders with knowledge on currency value patterns, economic stability, and possible financial changes. By comprehending these elements, traders can plan their trades to take advantage of market changes and reduce risks.

Traders have different opinions on the "best method of analysis" which depend on individual trading styles, risk tolerance, and market conditions. Nevertheless, it primarily centers on three primary categories: fundamental analysis, technical analysis, and sentiment analysis. Each approach has unique benefits and can be customized to fit various trading strategies.

Understanding the basics of forex market analysis

In forex trading, market analysis is a structured method for traders to assess different factors affecting currency values and forecast their future trends. This analysis is essential in order to create strategies that aim to capitalize on fluctuations in the forex market. Market analysis techniques are divided into three main types: fundamental analysis, technical analysis, and sentiment analysis.

Fundamental analysis examines the factors of economics, society, and politics that influence the fluctuation of currency supply and demand. Traders who utilize this technique analyze macroeconomic indicators like GDP growth rates, employment data, and decisions on interest rates to forecast currency fluctuations.

Technical analysis utilizes statistical patterns from market behavior, such as price changes and trading volume. Traders analyze past data, charts, and mathematical tools to recognize patterns and trends that may indicate upcoming activity.

Sentiment analysis evaluates how market participants feel about a specific currency and is commonly combined with other forms of analysis. This method consists of examining the positive or negative trends by utilizing indicators of market sentiment and positioning information.

Fundamental analysis

In forex trading, fundamental analysis involves assessing economic, social, and political factors to determine the true value of a currency based on its supply and demand. This method considers that the currency might be incorrectly valued by the market temporarily, but will eventually adjust to accurately represent the economic conditions below.

Important economic indicators essential for this analysis consist of Gross Domestic Product (GDP), job rates, inflation, trade balances, and central bank activities, specifically interest rate choices. For instance, an increase in GDP or a decrease in unemployment could indicate an improving economy and potentially result in the country's currency gaining value. On the other hand, if inflation is high, a central bank may decide to increase interest rates, leading to an increase in foreign investment and a stronger currency.

The benefits of fundamental analysis include its capacity to offer an in-depth insight into the prolonged market trends and the macroeconomic factors influencing currency fluctuations. Yet, its drawbacks stem from the difficulty of connecting economic indicators to real market fluctuations. Additionally, this technique may not be as successful in forecasting immediate price changes, which are subject to market sentiment and speculation.

Technical analysis

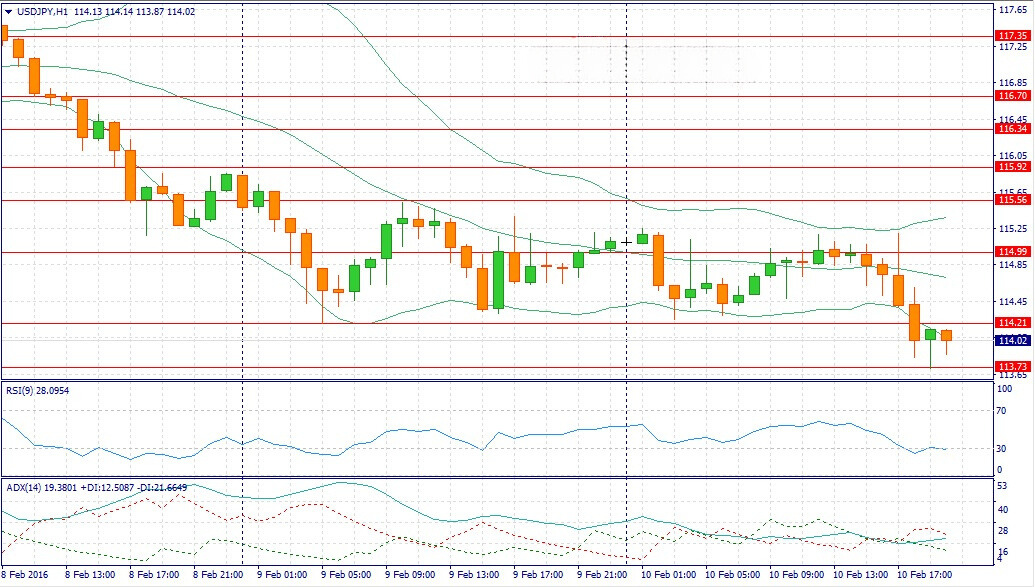

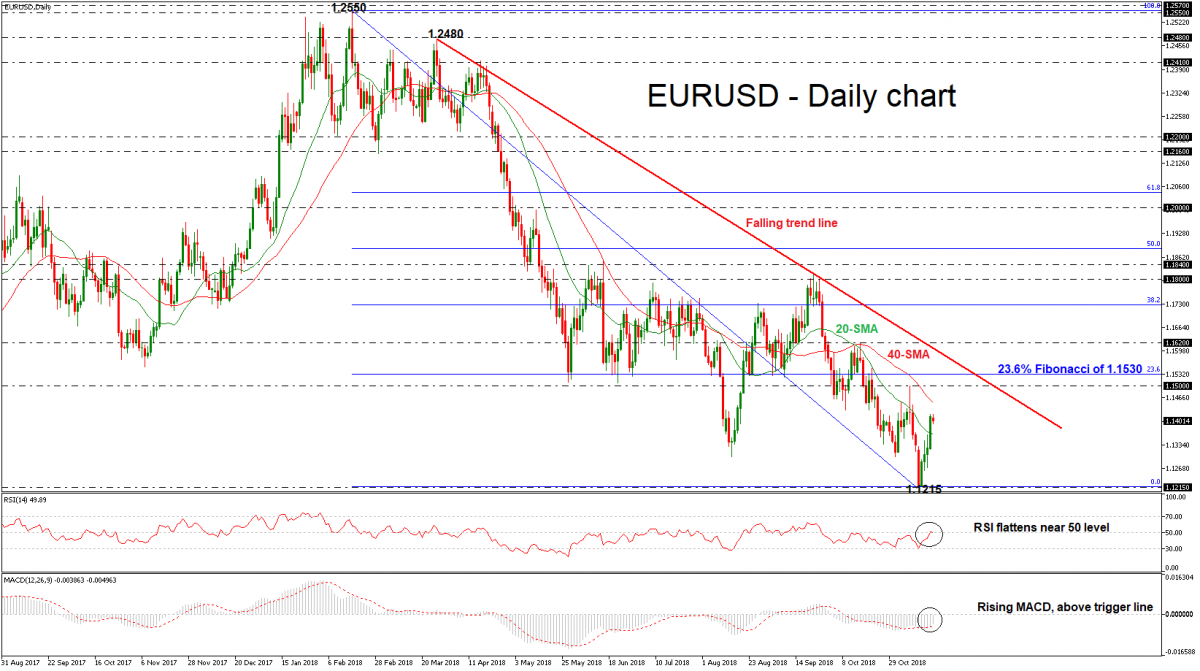

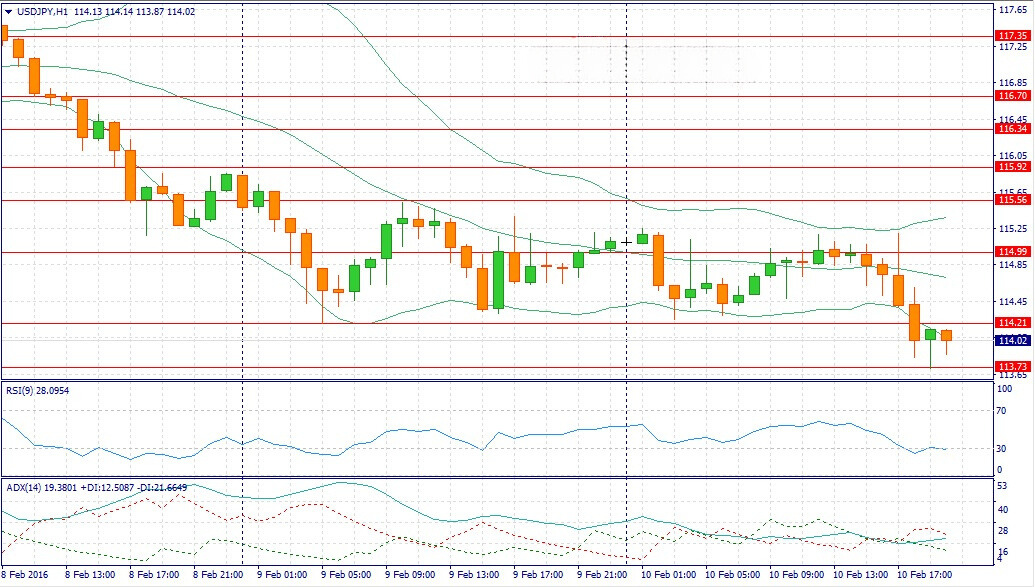

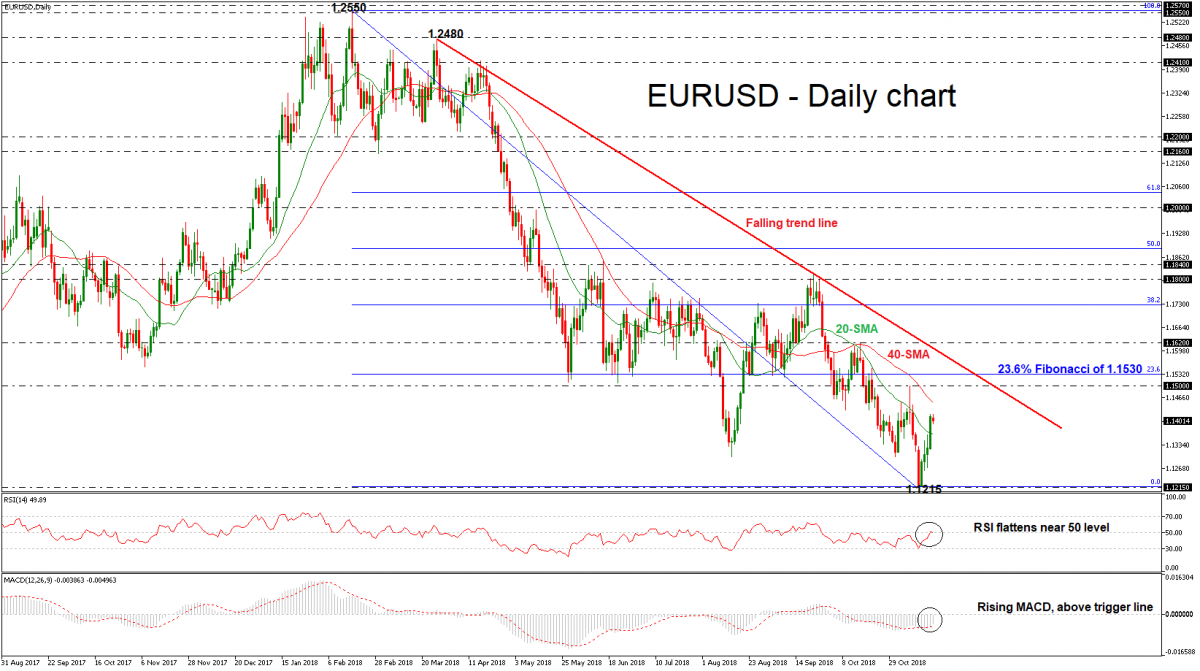

Technical analysis, commonly used in forex trading, analyzes previous market data such as price and volume to predict future price changes. This method operates under the assumption that prices already incorporate all market information, and that trends in price changes are expected to recur.

Some of the technical indicators commonly utilized in this analysis are:

Moving Averages (MA): These signals blend price information to generate one continuous line, enabling better recognition of trend direction. For example, when a moving average crossover occurs, it often indicates a possible change in market direction.

The RSI is a momentum indicator that gauges the velocity and magnitude of price changes within a range of zero to 100. Typically, an RSI higher than 70 signals overbought circumstances, whereas a level below 30 indicates oversold conditions.

The MACD indicator calculates the connection between two currency price moving averages, aiding in pinpointing potential trading opportunities.

Patterns on charts, such as head and shoulders, triangles, and flags, are important indicators as they signal potential market continuations or reversals.

Technical analysis is beneficial because it can be used for short-term trading and to produce unambiguous signals for buying and selling. Nonetheless, its shortcomings are significant, as it may generate inaccurate signals at times and is frequently censured for depending too heavily on past price changes, which might not always forecast future changes precisely.

Sentiment analysis

The assessment of investors' general feelings towards a specific currency or currency pair is called sentiment analysis in forex trading. This technique evaluates if traders are mostly positive (anticipating prices to increase) or negative (anticipating prices to decrease). Gaining insight into market sentiment is important as it can reveal valuable information on price changes that may not be apparent with traditional fundamental or technical analysis.

Traders frequently examine multiple indicators to assess market sentiment:

Information on positions, like the Commitment of Traders (COT) reports, show the overall net long or short positions of various trader categories.

Market data from options can signal what the market anticipates for upcoming volatility and price movements.

Market commentary and news analysis have the potential to mirror market participants' sentiment and impact trading choices.

Tools made specifically for sentiment analysis include sentiment indexes and exclusive algorithms that analyze news headlines and social media to generate sentiment scores. These tools gather the combined perspectives of traders and investors, offering a glimpse of market sentiment at any moment.

Sentiment analysis is beneficial because it can serve as a contrarian indicator; when sentiment readings are extreme, they can indicate possible market reversals. Nevertheless, subjectivity and the possibility of sudden shifts in sentiment not obvious in conventional data sources are among its constraints.

Comparative analysis

Evaluating the efficiency of different analysis techniques in forex trading requires evaluating their compatibility with specific market conditions, trading styles, and trader objectives. Fundamental analysis is very useful for long-term investments, as it is influenced by economic trends and policy changes that determine market movements. On the flip side, technical analysis is favored for short-term trading because it can rapidly decipher market movements using charts and historical data patterns. Sentiment analysis is beneficial for grasping the market's sentiment, especially in times of volatility or uncertainty.

In a scenario where a trader profited from a significant economic announcement, fundamental analysis revealed how these announcements could influence currency strength. On the other hand, a technical trader may use chart patterns to make rapid trades based on expected short-term movements after such news.

Traders select the most suitable approach by matching it to their trading strategies and objectives. A trader who is cautious about risks and seeks consistent returns may lean towards using fundamental analysis, whereas a day trader who is focused on making fast profits may opt for technical analysis. Certain seasoned traders blend the three approaches to develop a comprehensive trading strategy that adapts to market conditions and individual risk tolerance.

This method of comparison emphasizes the significance of an adaptable trading plan, customized to personal preferences and market conditions, improving decision-making and potential profits in the unpredictable forex market.

Combining several analytical approaches

The integration of basic, technical, and sentiment analysis can greatly improve forex trading strategies, providing a more thorough outlook of the market. This combined method capitalizes on the strengths of each while reducing their respective limitations, resulting in better informed and well-rounded trading choices.

Advantages of integrating analysis techniques consist of:

Improved precision: Combining fundamental analysis for long-term trends and technical analysis for entry and exit points can enhance traders' prediction accuracy. Including sentiment analysis can enhance these tactics by exposing the emotional tendencies of the market, which may anticipate changes that traditional data cannot foresee.

Risk mitigation is achieved through a variety of analytical methods that offer different views on potential market shifts, aiding traders in spotting false signals or missed opportunities, ultimately lowering risks.

Flexibility: Traders can adjust their trading strategies quickly in response to sudden economic changes or news events that could impact the market, thanks to a multi-faceted approach.

Selecting the most suitable technique for your needs

Choosing the optimal analysis technique for forex trading is highly reliant on the individual trader's preferences, goals, and external conditions. Comprehending these factors can assist in customizing an analysis method that aligns well with individual requirements, increasing the chances of achieving successful trading results.

Things to keep in mind are:

Trading strategy: Are you a short-term day trader aiming for speedy gains, or a long-haul investor concentrating on broader economic patterns? Short-term traders often prefer technical analysis for its quick insights from price actions, while fundamental analysis is favored by longer-term traders.

Time frame: Your analysis choice is influenced by the time frame you intend to trade within. Short-term traders could see more advantages in technical analysis, while individuals with a longer time frame could lean towards fundamental analysis to assess future movements.

Market dynamics: Unstable markets could be advantageous for utilizing sentiment analysis and technical indicators to detect abrupt fluctuations, whereas steady markets may be more compatible with fundamental analysis.

Conclusion

Different analysis techniques exist in forex trading, each providing distinct perspectives on market dynamics and trader actions. Fundamental analysis involves a thorough examination of economic indicators and their impact on currency values in the long run. Technical analysis uses patterns in price movements to predict future trends, making it well-suited for short-term trading plans. Sentiment analysis provides insight into the market's sentiment, giving an important understanding layer that can predict changes driven by trader emotions.

Trying out various techniques is strongly recommended. The success of every trader in the forex market often depends on identifying the perfect combination of these strategies that align with their trading preferences and objectives. Utilizing a combination of techniques can result in stronger and more durable trading tactics, better prepared to navigate the intricacies and uncertainties of the forex market.