Technical vs fundamental analysis in forex

One of the critical aspects of successful forex trading is analysis. Traders rely on analysis to make informed decisions about when to enter and exit trades. Effective analysis helps traders predict future price movements, manage risks, and develop strategies tailored to their trading goals. Without proper analysis, trading decisions would be based on guesswork, significantly increasing the likelihood of losses.

There are two primary types of analysis used in forex trading: technical analysis and fundamental analysis. Technical analysis focuses on historical price data and market trends to forecast future movements. It involves the use of charts, patterns, and technical indicators. On the other hand, fundamental analysis examines economic indicators, news events, and financial reports to assess a currency's intrinsic value. Both methods offer unique insights and can be used independently or in conjunction to enhance trading strategies. Understanding these analyses is crucial for any trader aiming to succeed in the forex market.

Understanding technical analysis

Technical analysis is a method used by traders to evaluate and forecast future price movements in the forex market by analyzing past market data, primarily price and volume. It operates on the premise that historical price movements are likely to repeat themselves due to market psychology.

Key concepts:

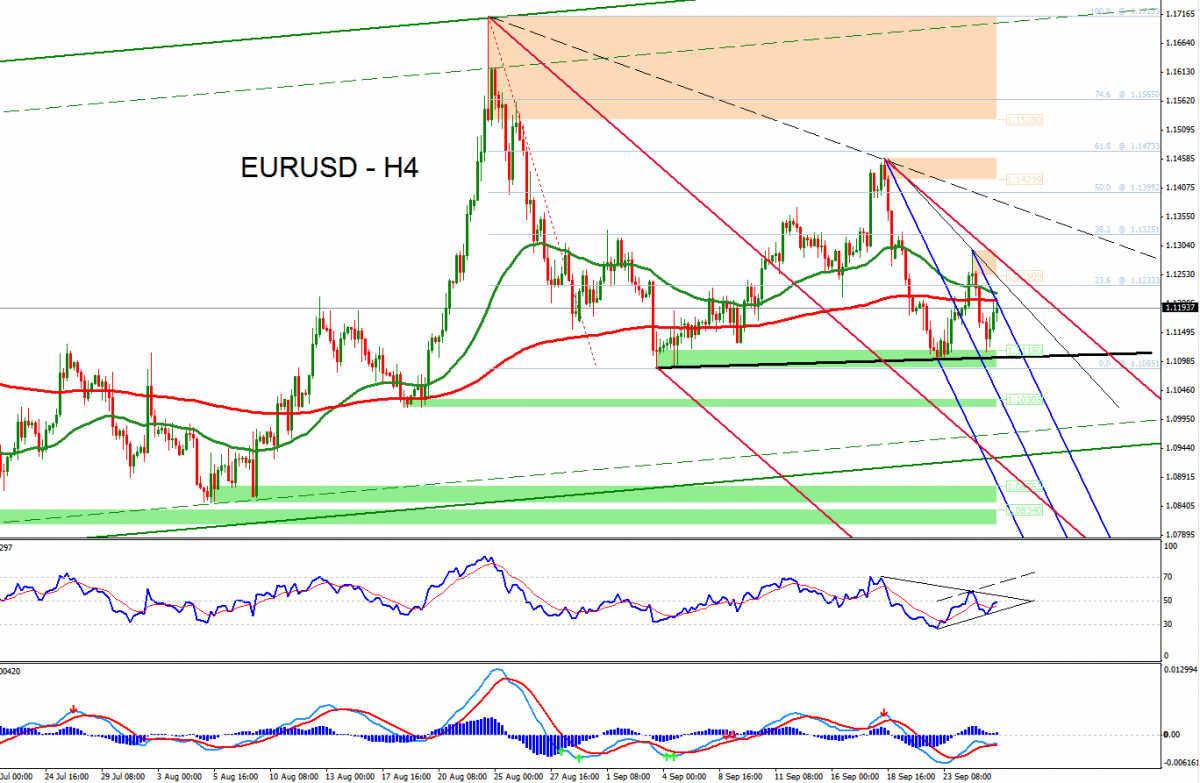

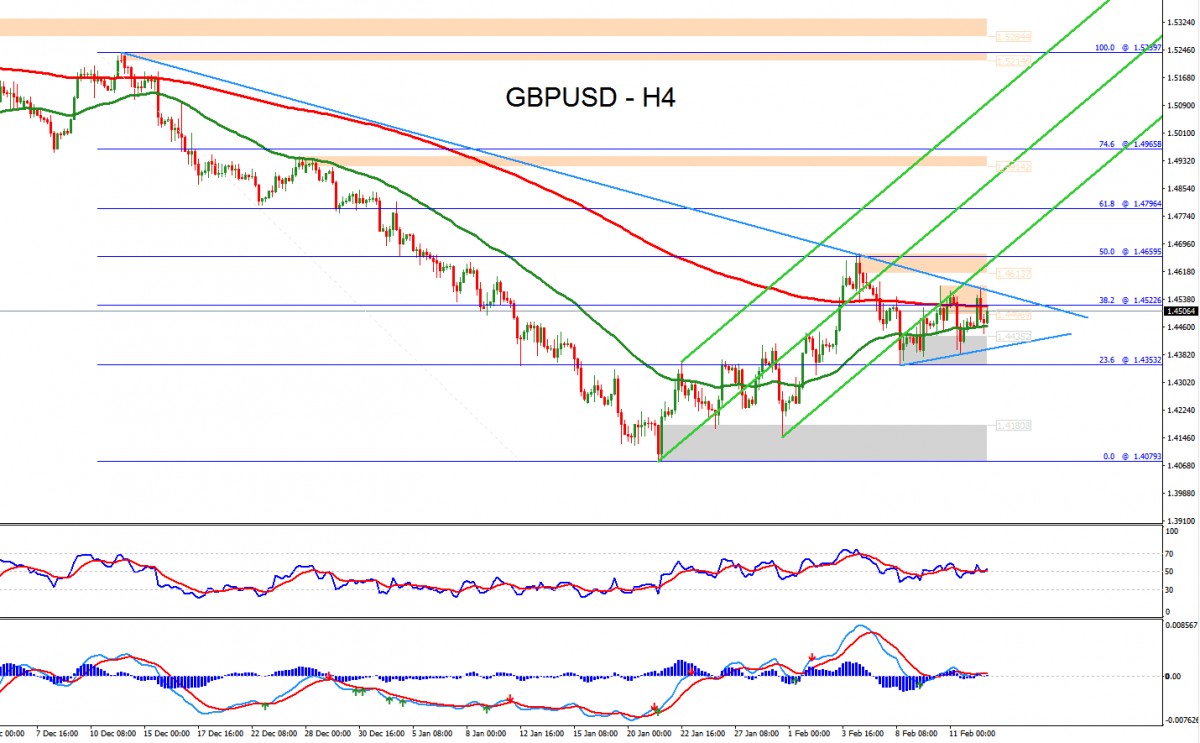

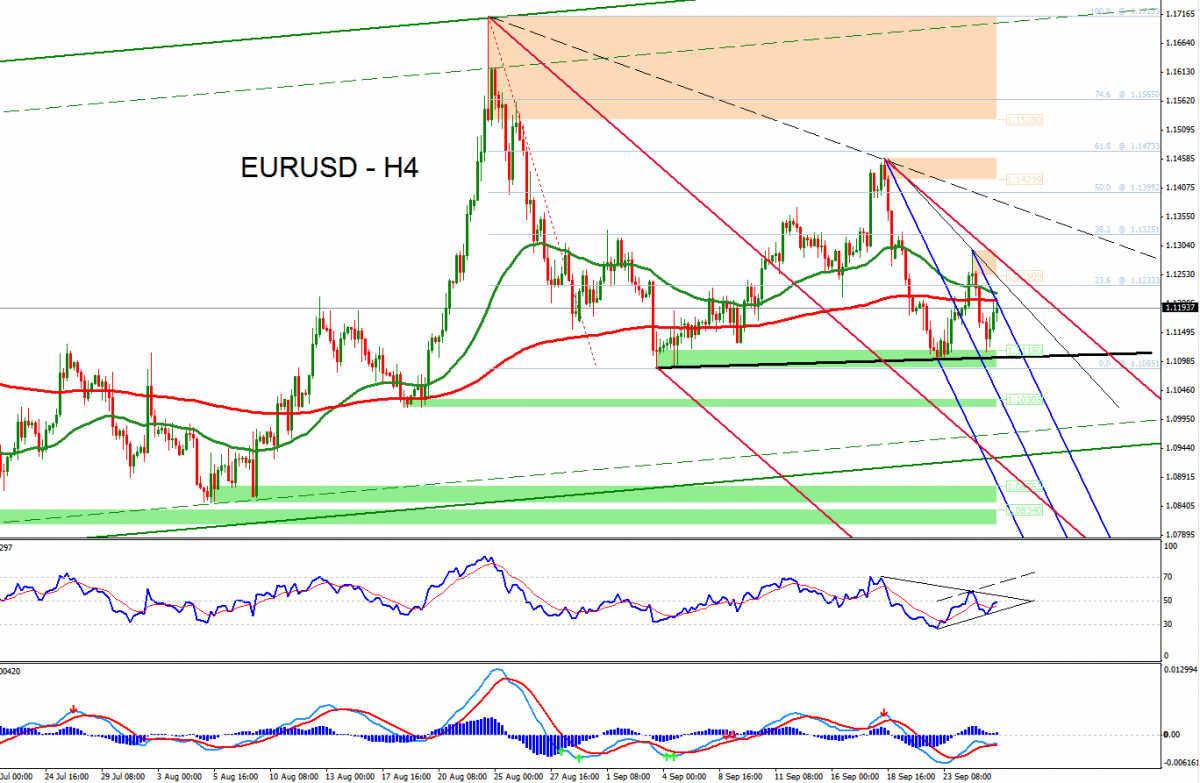

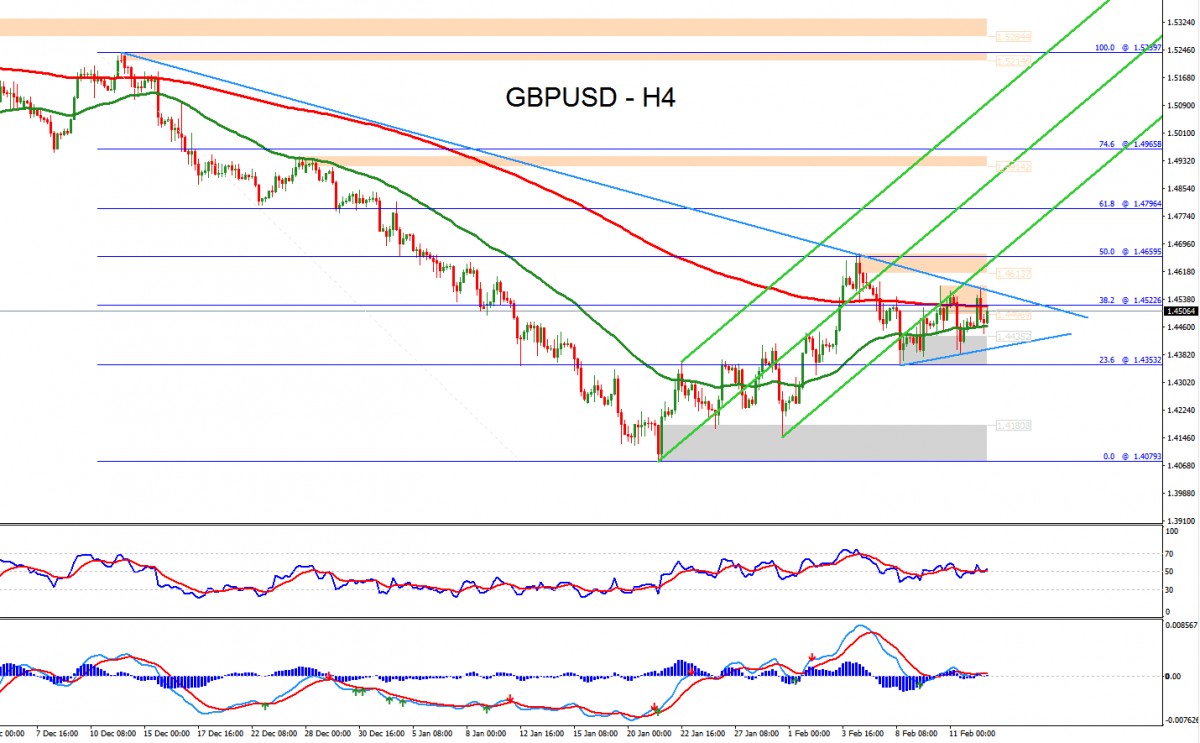

- Price charts and patterns: Technical analysis heavily relies on price charts, which graphically represent historical price movements over different time frames. Common chart patterns such as head and shoulders, double tops, and flags are used to predict future price actions.

- Technical indicators: These are mathematical calculations based on historical price data. Popular indicators include Moving Averages, which smooth out price data to identify trends; the Relative Strength Index (RSI), which measures the speed and change of price movements; and the Moving Average Convergence Divergence (MACD), which helps identify changes in momentum, direction, and strength of a price trend.

- Trend analysis: Identifying trends is a cornerstone of technical analysis. Traders look for upward, downward, or sideways trends to make informed decisions. Trend lines, channels, and other graphical tools help in visualizing these trends.

Tools and software commonly used:

Technical analysts use a variety of tools and software to assist in their analysis. Charting platforms like MetaTrader, TradingView, and various broker-provided tools offer comprehensive features for drawing charts, applying indicators, and backtesting strategies.

Benefits of technical analysis in forex trading:

Technical analysis is beneficial because it provides a systematic approach to trading, allowing traders to make decisions based on objective data rather than emotions. It is particularly useful for short-term trading, where rapid decision-making is essential.

Limitations of technical analysis:

Despite its advantages, technical analysis has limitations. It relies solely on historical data, which may not always predict future movements accurately, especially in volatile or unprecedented market conditions. Additionally, technical analysis does not consider underlying economic factors that might influence currency prices, which is where fundamental analysis becomes essential.

Understanding fundamental analysis

Fundamental analysis is a method used by traders to evaluate the intrinsic value of a currency by examining economic, financial, and other qualitative and quantitative factors. Unlike technical analysis, which focuses on historical price patterns, fundamental analysis assesses factors that can influence currency prices over the long term.

Key concepts:

- Economic indicators: These are statistical measures that reflect the economic performance of a country. Key indicators include Gross Domestic Product (GDP), which measures the total economic output; inflation rates, which indicate the rate at which prices for goods and services rise; and employment data, which shows the health of the labor market. Strong economic indicators typically strengthen a currency, while weak indicators can weaken it.

- Central bank policies: Central banks, such as the Federal Reserve or the European Central Bank, influence currency values through monetary policies, including interest rate decisions and quantitative easing measures. Higher interest rates can attract foreign investment, increasing demand for a currency.

- Political events: Political stability and government policies significantly impact forex markets. Elections, geopolitical tensions, and policy changes can lead to volatility. Traders monitor these events to anticipate market movements.

- News and financial reports: Regularly released news and financial reports provide insights into economic conditions and market sentiment. Important news releases, such as employment reports or inflation data, can cause significant market reactions.

Tools and resources for fundamental analysis:

Traders use various tools and resources, such as economic calendars, financial news websites, central bank reports, and government publications, to gather and analyze information. Platforms like Bloomberg, Reuters, and Forex Factory are popular sources for up-to-date economic data and news.

Benefits of fundamental analysis in forex trading:

Fundamental analysis assists traders in grasping the core aspects influencing currency values, offering a thorough perspective of the market. It is especially beneficial for developing long-term trading tactics and for making well-informed choices regarding currency valuations, taking into account economic health and geopolitical developments.

Limitations of fundamental analysis:

The primary drawback of fundamental analysis is its complexity and the extensive data needed. Understanding how various factors interact and impact the market can prove difficult. Moreover, fundamental analysis might not be as useful for short-term trading, as quick price changes are largely influenced by technical factors.

The difference between technical and fundamental analysis

Comparison of the focus areas:

Technical analysis: This method focuses on past price movements, patterns, and indicators to predict future price behavior. It involves analyzing price charts and utilizing various technical indicators such as Moving Averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD). The primary assumption is that historical price patterns tend to repeat themselves due to market psychology.

Fundamental analysis: In contrast, fundamental analysis examines economic data, news, and events to assess a currency’s intrinsic value. It includes analyzing economic indicators like GDP, inflation rates, employment data, central bank policies, and political events. The goal is to understand the underlying factors that drive currency value changes.

Timeframes:

Technical analysis: Generally used for short-term trading strategies. Traders may use intraday, daily, or weekly charts to identify trading opportunities based on quick price movements and trends.

Fundamental analysis: More suited for long-term trading. Investors might hold positions for weeks, months, or even years, basing their decisions on broader economic trends and long-term economic indicators.

Analytical approaches:

Technical analysis: Predominantly quantitative. It relies on numerical data, charts, and statistical indicators. Traders use mathematical models and historical data to identify patterns and trends.

Fundamental analysis: Qualitative and quantitative. It involves interpreting economic reports, financial statements, news events, and political developments. The analysis requires a deep understanding of economics and geopolitics.

Practical application:

Technical analysis: Useful for identifying entry and exit points in the market. Traders use technical indicators to set stop-loss and take-profit levels, aiming to capitalize on short-term price movements.

Fundamental analysis: Helps in making informed decisions about the overall direction of a currency pair over a longer period. Traders might use fundamental analysis to justify holding a position during periods of market volatility, based on strong underlying economic data.

Integrating technical and fundamental analysis

Combining technical and fundamental analysis can provide traders with a comprehensive view of the forex market. While technical analysis offers insights into short-term price movements through historical data and patterns, fundamental analysis provides an understanding of long-term trends based on economic indicators and news events. The synergy between these two methods allows traders to make more informed and balanced trading decisions.

Integrating both analyses can enhance trading decisions by providing a fuller picture of market conditions. For instance, a trader might use fundamental analysis to identify a currency pair with strong long-term potential due to favorable economic indicators. They could then use technical analysis to determine the best entry and exit points based on price patterns and technical indicators. This combination helps in managing risks and maximizing returns.

Examples of strategies that use both types of analysis:

- News-based strategy with technical confirmation: A trader might analyze an upcoming economic report, such as a central bank interest rate decision, using fundamental analysis. If the report suggests a potential increase in currency value, the trader could then use technical analysis to identify an optimal entry point by examining chart patterns and technical indicators.

- Long-term investment with short-term technical adjustments: An investor might hold a currency pair based on strong economic fundamentals but use technical analysis to fine-tune their positions. For example, they might add to their position during technical dips or take partial profits during technical peaks, aligning short-term market movements with long-term trends.

Case studies of successful integration:

One notable example is the trading strategy used by hedge funds. Many hedge funds employ both technical and fundamental analysis to achieve consistent returns. For instance, they might identify a currency pair with strong economic growth potential and use technical indicators to time their trades, minimizing risks and capturing short-term gains.

Another example is the approach taken by professional forex traders who follow major economic events, such as non-farm payroll reports or central bank meetings, to gauge market sentiment. They combine this with technical analysis to pinpoint precise trading opportunities, ensuring they are entering and exiting trades at optimal times based on both economic data and market trends.

Conclusion

In summary, understanding both technical and fundamental analysis is crucial for any trader aiming to succeed in the forex market. Each method offers unique insights that, when combined, can provide a more comprehensive view of market conditions and enhance trading decisions. This integrated approach helps in identifying optimal entry and exit points, managing risks, and capitalizing on both short-term and long-term opportunities.

For those new to technical analysis, start by learning basic chart patterns and indicators. Use demo accounts to practice identifying trends and making trades without risking real money. Resources like online courses, trading books, and webinars can provide valuable knowledge.

Beginners interested in fundamental analysis should start by understanding key economic indicators and how they impact currency values. Following financial news, reading economic reports, and studying central bank policies can provide a solid foundation. Combining both methods gradually can also be beneficial, as it allows traders to develop a well-rounded approach to forex trading.