Pin bar strategy in forex

The Forex market, with its dynamic nature and vast opportunities, has captivated traders around the world. To navigate this complex financial arena successfully, traders must equip themselves with effective strategies that can decipher market movements and uncover profitable opportunities. Among the various strategies employed by traders, the pin bar strategy stands out as a powerful tool that unveils the hidden potential within the Forex market.

Implementing the pin bar strategy requires careful consideration of various factors. Traders must evaluate the location of the pin bar within the broader market trend, identify key support or resistance levels, and seek confirmation through additional technical indicators. By adhering to these principles, traders can effectively time their entry and exit points, maximizing profits and minimizing risks.

Real-life examples and case studies further highlight the effectiveness of pin bars in Forex trading. By analyzing historical Forex charts, traders can witness the successful implementation of this strategy in different market conditions. However, it is crucial to remain cautious of potential challenges and pitfalls that may arise when trading pin bars. Adequate risk management, including position sizing and risk-to-reward ratios, plays a crucial role in ensuring long-term success.

Understanding pin bars: definition and characteristics

A pin bar, also known as a Pinocchio bar, is a candlestick pattern that provides valuable insights into market sentiment and potential reversals. It is characterized by a distinct shape, comprising a long tail or "wick" and a small body. The wick represents the range between the high and low price levels reached during a specific time period, while the body signifies the opening and closing prices.

Pin bars possess unique characteristics that make them stand out amidst the vast array of candlestick patterns. One key characteristic is the elongated tail, which indicates a sharp rejection of price at a specific level. This rejection signifies a battle between buyers and sellers, with one side overpowering the other and driving the price in a particular direction.

Furthermore, the body of a pin bar is small relative to its tail, emphasizing the significance of the rejection and the subsequent potential reversal. The colour of the pin bar's body, whether bullish or bearish, provides additional insights into market sentiment and can influence trading decisions.

While there are numerous candlestick patterns in Forex, pin bars possess unique attributes that differentiate them from the rest. Unlike other patterns that focus solely on price reversals, pin bars also provide valuable information about key levels of support and resistance in the market.

Pin bars can be easily identified by their distinctive shape, which sets them apart from patterns such as doji, engulfing, or hammer candles. Their elongated wicks and small bodies create a visual representation of market dynamics, showcasing the battle between buyers and sellers at specific price levels.

The psychology behind pin bars

Forex trading is not merely a battle of numbers and charts; it is deeply intertwined with the psychology of market participants. Understanding the intricate web of emotions and behaviours that drive buying and selling decisions is essential for successful trading. Pin bars, with their distinct shape and characteristics, offer valuable insights into market psychology and play a significant role in decision-making.

Pin bars serve as a window into the psychology of market participants, revealing their sentiments and intentions. When a pin bar forms, it represents a significant rejection of price at a particular level, indicating a shift in market dynamics. This rejection is a reflection of the battle between buyers and sellers, as they strive to exert dominance over price direction.

Traders who understand the psychology behind pin bars can gain a competitive edge in their decision-making process. The elongated wick of a pin bar signifies a strong rejection, suggesting that the opposing party has overwhelmed the market sentiment. It serves as a visual representation of the imbalance between buyers and sellers and can foreshadow a potential reversal in price.

Understanding the buyer-seller dynamic within a pin bar formation

Within the formation of a pin bar, the buyer-seller dynamic is brought into sharp focus. As price approaches a key level of support or resistance, buyers and sellers enter into a psychological tug-of-war. The rejection represented by the pin bar illustrates the shift in power and the dominance of one group over the other.

The appearance of a pin bar at a support level, for example, indicates that buyers have stepped in forcefully, rejecting lower prices and driving the market higher. Conversely, a pin bar at a resistance level signifies a strong rejection by sellers, hinting at a potential decline in price.

By understanding the psychology of pin bars and the dynamics between buyers and sellers, traders can make informed decisions.

Pin bar trading strategies

When employing the pin bar strategy in Forex trading, traders must consider various factors to identify optimal setups.

Pin bar location within a trend

Pin bars are most effective when they occur at key turning points within a trend. If a pin bar forms at the end of a prolonged uptrend or downtrend, it signifies a potential reversal in price direction.

Pin bar formation at key support or resistance levels

Pin bars that form at significant support or resistance levels carry greater weight. These levels represent zones where buyers and sellers have exhibited strong interest in the past, increasing the likelihood of a price reversal.

Pin bar confirmation through additional technical indicators

While pin bars alone can provide valuable insights, confirmation from additional technical indicators strengthens the trading signal. Traders may use tools such as moving averages, trend lines, or oscillators to validate the strength of the pin bar setup.

Entry and exit strategies when trading pin bars

Successful execution of pin bar trading strategies involves precise entry and exit strategies.

Traders enter a trade when the price breaks the high or low of the pin bar, depending on the direction of the anticipated reversal. This breakout confirms the strength of the pin bar signal and provides a clear entry point.

To manage risk, traders must establish appropriate stop-loss levels beyond the pin bar's high or low. The distance between the entry point and the stop-loss should consider the pin bar's volatility and the trader's risk tolerance. Take-profit levels can be set based on key support or resistance levels or by employing a risk-to-reward ratio.

As the price moves in favour of the trade, traders can adjust their stop-loss levels to protect profits. This trailing stop technique allows traders to capture additional gains if the price continues to move in their favour.

By incorporating these strategies into their trading approach, traders can effectively capitalize on pin bar setups in Forex, maximizing their profitability while managing risk.

Pin bars: real-life examples and case studies

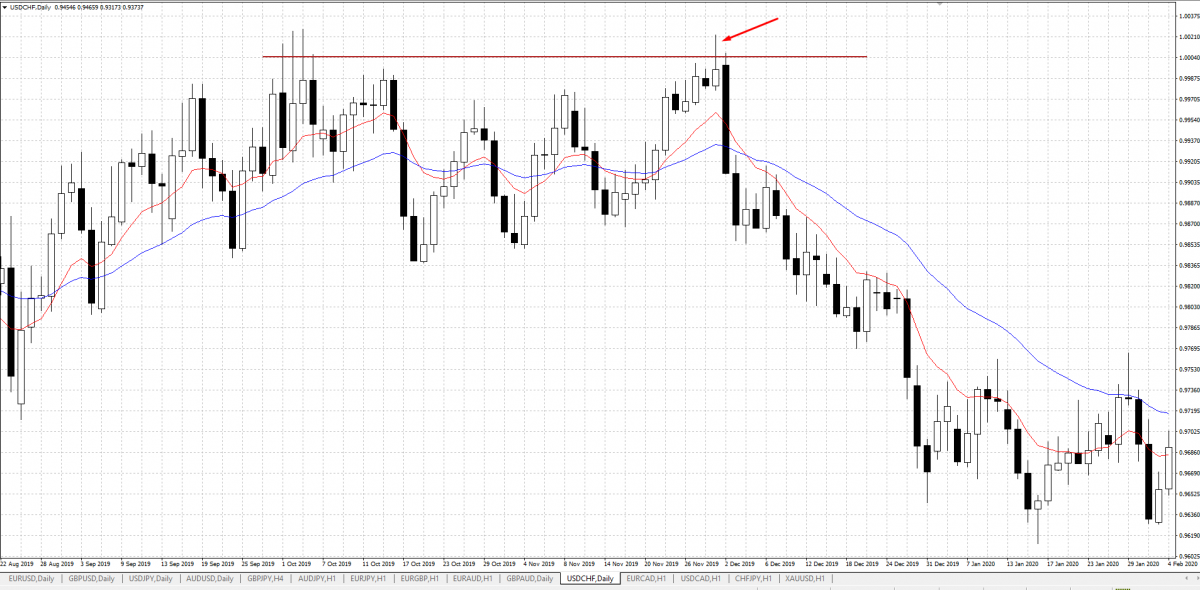

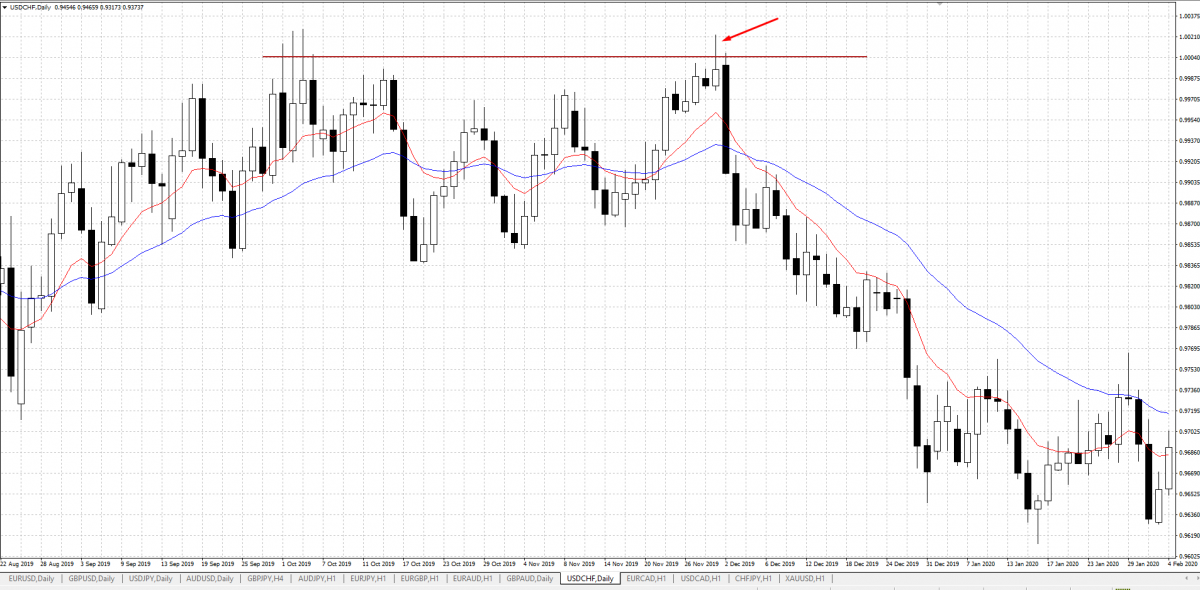

To demonstrate the effectiveness of the pin bar strategy in Forex, we turn to historical charts and analyze real-life examples. By examining past price action, we can uncover instances where pin bars provided valuable trading opportunities.

For instance, in a bullish market, a pin bar forming at a key support level could signal a potential upward reversal. By identifying such setups on historical charts and examining subsequent price movements, we can observe the profitable opportunities presented by pin bars.

Pin bars have proven their worth across various market conditions, and case studies help us understand their effectiveness in different scenarios. By examining case studies from trending markets, ranging markets, and volatile markets, we gain insights into the versatility of the pin bar strategy.

In a trending market, pin bars can signal continuation or reversal points, allowing traders to ride the trend or capitalize on potential reversals. In ranging markets, pin bars near support or resistance levels can identify range boundaries and potential breakouts. Even in volatile markets, pin bars can provide valuable insights into market sentiment and help traders navigate price fluctuations.

Addressing common challenges and potential pitfalls when trading pin bars

While the pin bar strategy can be highly effective, traders must also be aware of the challenges and pitfalls that come with it. Pin bars, like any other trading signal, are not foolproof and require proper analysis and risk management.

Some challenges include false pin bar signals, where the setup appears valid but fails to result in a substantial price reversal. Traders must exercise caution and use additional technical analysis to confirm the strength of the signal.

Another pitfall is overtrading, where traders may become too eager to trade every pin bar they encounter, leading to suboptimal results. Selectivity and patience are key when trading pin bars, ensuring that only high-quality setups are pursued.

By addressing these challenges and understanding potential pitfalls, traders can refine their pin bar strategy and increase their chances of success.

Pin bars in conjunction with risk management

Successful trading in the Forex market goes beyond strategy selection; it requires effective risk management. Risk management is the cornerstone of long-term profitability and capital preservation. Traders must prioritize the protection of their capital by implementing prudent risk management principles.

When incorporating the pin bar strategy into Forex trading, it is essential to integrate risk management principles. Pin bars provide valuable trading signals, but managing risk is crucial to ensure sustainable success.

Traders should define their risk tolerance and set appropriate stop-loss levels when trading pin bars. Stop-loss orders help limit potential losses and protect against adverse market movements. By carefully determining the distance between the entry point and the stop-loss level, traders can effectively manage risk while allowing room for price fluctuations.

Position sizing and risk-to-reward ratios when trading pin bars

Position sizing is another critical aspect of risk management when trading pin bars. Traders should allocate an appropriate portion of their capital to each trade, considering their risk tolerance and the specific characteristics of the pin bar setup. Position sizes should be adjusted based on the potential risk and reward of each trade.

Additionally, evaluating risk-to-reward ratios is essential in pin bar trading. By analyzing the potential reward in relation to the risk taken, traders can make informed decisions and identify trades with favourable risk-to-reward profiles. A positive risk-to-reward ratio ensures that potential profits outweigh potential losses, enhancing the overall profitability of the trading strategy.

By integrating risk management principles, such as setting appropriate stop-loss levels, determining optimal position sizes, and evaluating risk-to-reward ratios, traders can effectively mitigate risks associated with pin bar trading. This approach safeguards capital and promotes consistent, long-term profitability.

Conclusion

Pin bars offer traders a powerful tool for identifying potential price reversals, continuation patterns, and significant market turning points. The simplicity and versatility of the pin bar strategy make it a valuable addition to any Forex trader's arsenal. By mastering the art of reading pin bars and effectively integrating them into trading strategies, traders can enhance their decision-making process and improve overall trading performance.

As traders, it is essential to continuously explore new strategies and techniques to improve our trading performance. The pin bar strategy presents a compelling opportunity to enhance our understanding of market dynamics and capitalize on profitable trading setups. We encourage traders to delve deeper into the pin bar strategy, conduct further research, and practice its application in simulated and live trading environments. With dedication, discipline, and proper risk management, the pin bar strategy can contribute to consistent profitability and success in the challenging world of Forex trading.

In conclusion, the pin bar strategy offers traders a powerful and reliable tool to navigate the complexities of the Forex market. By understanding its characteristics, integrating it with effective risk management, and honing our skills through practice, we can unlock the true potential of pin bars and elevate our trading endeavours to new heights.