Moving average envelopes

The Moving Average Envelope consists of a simple or exponential moving average, with the envelope bands set at a fixed percentage above and below this average. These bands act as dynamic support and resistance levels, guiding traders in making decisions based on price behaviour near these boundaries. Unlike some technical indicators that lag significantly, MA Envelopes provide real-time feedback on price trends, making them valuable for both trend-following and mean-reversion strategies.

Forex traders often rely on MA Envelopes to identify trend strength, detect breakout opportunities, and anticipate potential reversals. The indicator’s adaptability allows it to be customized across different timeframes and currency pairs, enhancing its effectiveness in various market conditions. Whether trading major pairs like EUR/USD, GBP/USD, or more volatile crosses, Moving Average Envelopes offer a structured approach to navigating price action.

Understanding the mechanics of moving average envelopes

The Moving Average Envelope (MA Envelope) is a technical analysis tool designed to highlight price deviations from a central moving average. It consists of three key components: the central moving average line and two envelope bands—one plotted above and one below the moving average. These bands are set at a fixed percentage distance from the moving average, creating a “channel” that helps traders assess price volatility, trend strength, and potential reversal points.

At the heart of the MA Envelope is the moving average, which can be either a Simple Moving Average (SMA) or an Exponential Moving Average (EMA). The SMA calculates the average closing price over a specified period, offering a smooth line that reacts steadily to price changes. In contrast, the EMA places more weight on recent price data, making it more responsive to short-term price movements. Traders choose between SMA and EMA based on their trading style—whether they prefer a lagging, smoother indicator (SMA) or a more sensitive, real-time measure (EMA).

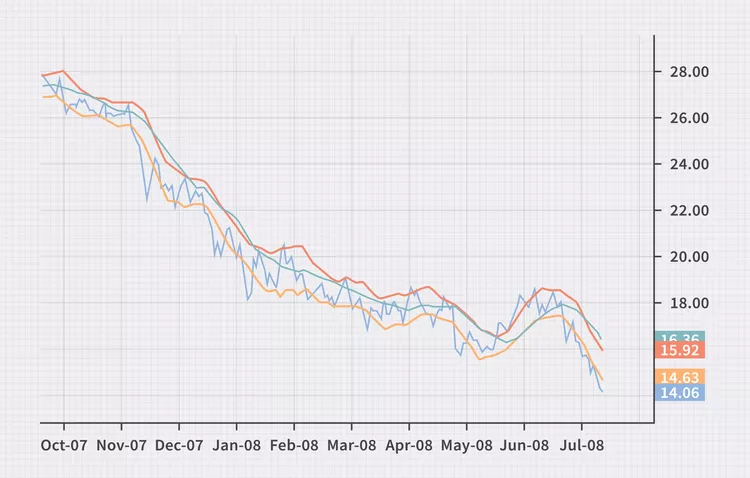

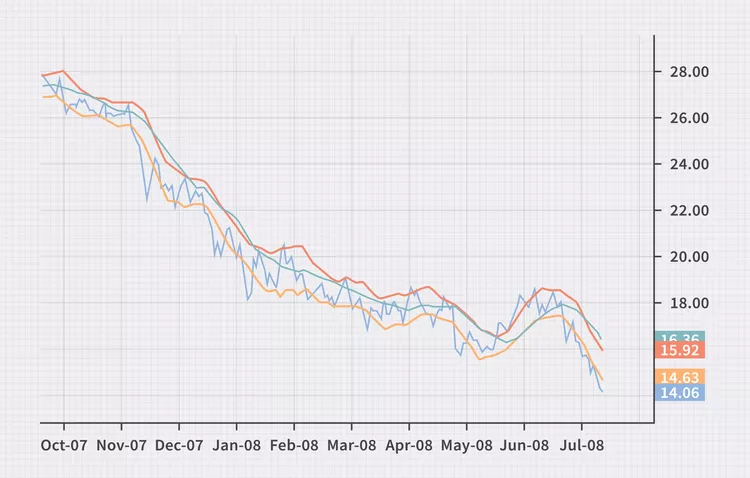

The envelope bands are typically set at a deviation of 1-3% from the moving average, though this can be adjusted depending on market volatility and the trader’s strategy. When prices approach or breach these bands, it can signal potential overbought or oversold conditions. Unlike Bollinger Bands, which adjust dynamically based on standard deviation, MA Envelopes maintain a consistent distance from the moving average, offering a more stable framework for identifying price extremes.

Types of moving average envelopes

Moving Average Envelopes can be tailored to fit different trading strategies, primarily based on the type of moving average used to calculate the central line. The two most common types are Simple Moving Average (SMA) Envelopes and Exponential Moving Average (EMA) Envelopes, each offering unique advantages depending on market conditions and trading goals.

Simple moving average (SMA) envelopes

SMA Envelopes use a simple moving average as the central reference point. The SMA calculates the average price over a specific number of periods, providing a smooth line that filters out short-term fluctuations. This type of envelope is popular among long-term traders because it responds slowly to price changes, helping identify broader market trends. SMA Envelopes are particularly effective in trending markets, where price movements are more stable and less prone to sudden reversals.

Exponential moving average (EMA) envelopes

EMA Envelopes are based on the exponential moving average, which assigns greater weight to recent price data. This makes EMA Envelopes more responsive to short-term price movements, making them a preferred choice for day traders and scalpers who need quicker signals. EMA Envelopes are effective in volatile markets where rapid price shifts require timely reactions.

Customizable MA envelope indicators

Modern trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView offer customizable MA Envelope indicators. Traders can adjust the moving average type, period length, and deviation percentage to suit their trading style. Whether analyzing major currency pairs like USD/JPY or more volatile crosses, these flexible settings allow traders to adapt the indicator to different market conditions.

How to set up the moving average envelope indicator

Setting up the Moving Average Envelope (MA Envelope) indicator is straightforward, especially with the user-friendly interfaces of popular trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView. Proper configuration is key to optimizing its effectiveness in identifying trends, breakouts, and potential reversal points in the forex market.

On MetaTrader 4 (MT4) & MetaTrader 5 (MT5):

- Open the trading platform and select the desired currency pair chart.

- Click on “Insert” > “Indicators” > “Trend” > “Envelopes.”

- In the settings window, configure the following parameters:

- Period: Defines the number of periods used to calculate the moving average. A common setting is 20, but traders may adjust based on their strategy.

- MA method: Choose between Simple Moving Average (SMA) or Exponential Moving Average (EMA).

- Deviation: Set the percentage distance for the envelope bands from the moving average. Typical values range from 1% to 3%.

- Shift: Optional, used to move the envelope forward or backward on the chart.

- Customize the color and thickness of the envelope bands for better visibility, then click “OK.”

On TradingView:

- Open your chart and click on “Indicators.”

- Search for “Moving Average Envelope” or create a custom script using Pine Script for more advanced settings.

- Adjust parameters like the moving average type, period, and deviation directly in the indicator’s settings panel.

Moving average envelope trading strategies

The Moving Average Enelope (MA Envelope) is a multipurpose tool that can be applied across various trading strategies, helping forex traders identify trends, potential reversals, and breakout opportunities.

Trend-following strategy

One of the most common uses of MA Envelopes is in trend-following strategies. When the price consistently trades near or above the upper envelope band, it indicates a strong bullish trend. On the contrary, when the price stays near or below the lower envelope band, it signals a bearish trend. Traders often enter long positions during sustained upward trends and short positions during downward trends, confirming signals with additional indicators like the Relative Strength Index (RSI) or MACD.

Reversal strategy

MA Envelopes can also help identify potential reversal points. When the price touches or breaches the upper or lower band significantly, it may indicate overbought or oversold conditions. Traders watch for signs of price exhaustion, such as candlestick reversal patterns (e.g., doji, engulfing patterns), to anticipate a reversal and enter trades in the opposite direction.

Breakout strategy

In periods of consolidation, price movements tend to narrow within the envelope bands. A sharp breakout above the upper band or below the lower band, accompanied by high trading volume, often signals the start of a new trend. Traders can capitalize on these breakouts by entering trades in the direction of the breakout.

Mean reversion strategy

Since prices tend to revert to the mean over time, MA Envelopes are useful for mean reversion strategies. Traders look for price deviations from the central moving average, entering trades when the price is expected to return toward the middle band.

Advantages and limitations of using moving average envelopes

The Moving Average Envelope (MA Envelope) is a popular technical analysis tool among forex traders due to its simplicity and effectiveness.

Advantages:

- MA Envelopes are easy to understand and interpret, making them accessible for both beginner and experienced traders. The clear visualization of price movement relative to the envelope bands helps in quickly identifying trends and potential entry or exit points.

- The indicator works well in various market conditions. In trending markets, it helps confirm the strength and direction of a trend, while in ranging markets, it can identify overbought and oversold conditions.

- Traders can adjust the moving average type, period length, and envelope deviation to suit different trading styles and currency pairs. This flexibility allows for tailored strategies that align with specific market conditions.

- MA Envelopes can be applied to both short-term and long-term charts, making them suitable for day traders, swing traders, and position traders.

Limitations:

- As a trend-following indicator, MA Envelopes are based on historical price data, which can result in delayed signals, especially during sudden market reversals.

- In highly volatile or choppy market conditions, the indicator may generate false breakouts or misleading signals, leading to potential losses.

- Relying solely on MA Envelopes can be risky. It’s most effective when used in combination with other technical indicators like the Relative Strength Index (RSI), MACD, or volume analysis for more reliable signals.

Conclusion

The Moving Average Envelope (MA Envelope) is a versatile and valuable tool in the arsenal of forex traders. Its ability to highlight trends, identify overbought or oversold conditions, and signal potential breakouts makes it suitable for a wide range of trading strategies. Whether used in trend-following, mean-reversion, or breakout approaches, MA Envelopes offer clear, visual cues that help traders make more informed decisions.

At its core, the MA Envelope consists of a central moving average—either a Simple Moving Average (SMA) or an Exponential Moving Average (EMA)—flanked by upper and lower bands set at a fixed percentage deviation. This structure allows traders to gauge price volatility and trend strength with ease. When combined with other technical indicators like the Relative Strength Index (RSI), MACD, or volume analysis, MA Envelopes can significantly boost the accuracy of trading signals.