Know all about margin call in forex trading

The foreign exchange (forex) market, often referred to as the largest and most liquid financial market globally plays a pivotal role in the world of international finance. It is where currencies are bought and sold, making it an essential component of global trade and investment. However, the forex market's immense potential for profit comes hand in hand with a substantial degree of risk. This is where the importance of risk management in forex trading becomes evident.

Risk management is one of the key elements of a successful forex trading strategy. Without it, even the most experienced traders can find themselves vulnerable to significant financial losses. One of the critical risk management concepts in forex trading is the "margin call." A margin call serves as a safeguard, a last line of defence, against excessive trading losses. It's a mechanism that ensures traders maintain adequate funds in their trading accounts to cover their positions and potential losses.

What is a margin call in forex trading?

In the world of forex trading, a margin call is a risk management tool used by brokers to protect both traders and the brokerage itself. It occurs when a trader's account balance falls below the required minimum margin level, which is the amount of capital needed to maintain open positions. When this happens, the broker will issue a margin call, prompting the trader to either deposit additional funds or close out some of their positions to bring the account back to a safe margin level.

Leverage is a double-edged sword in forex trading. While it allows traders to control larger positions with a relatively small amount of capital, it also increases the risk of substantial losses. The use of leverage can amplify gains, but it can also lead to rapid account depletion if not managed prudently. Margin calls often come into play when traders overleverage their positions, as it magnifies the impact of adverse price movements.

Margin calls occur when the market moves against a trader's position, and their account balance cannot cover the losses or meet the required margin level. This can happen due to unfavourable market fluctuations, unexpected news events, or poor risk management practices such as excessive leverage.

Ignoring or mishandling a margin call can have serious consequences. Traders risk having their positions forcibly closed by the broker, often at unfavourable prices, leading to realized losses. Moreover, a margin call can damage a trader's confidence and overall trading strategy.

Margin call meaning in forex

In forex trading, the term "margin" refers to the collateral or deposit required by a broker to open and maintain a trading position. It is not a fee or a transaction cost but rather a portion of your account equity that is set aside as security. Margin is expressed as a percentage, indicating the portion of the total position size that must be provided as collateral. For instance, if your broker requires a 2% margin, you would need to have 2% of the total position size in your account to open the trade.

Margin is a powerful tool that allows traders to control positions much larger than their account balance. This is known as leverage. Leverage magnifies both potential profits and losses. While it can amplify gains when markets move in your favour, it also heightens the risk of significant losses if the market goes against your position.

A margin call in forex occurs when a trader's account balance falls below the required margin level due to trading losses. When this happens, the broker requests the trader to deposit additional funds or close out some positions to restore the account's margin level to a safe threshold. Failure to meet a margin call may lead to forced position closures by the broker, resulting in realized losses.

Maintaining a sufficient margin level is crucial for traders to avoid margin calls and manage risk effectively. Adequate margin acts as a buffer against adverse price movements, allowing traders to weather short-term market volatility without risking a margin call. Traders should always be vigilant about their margin levels and use risk management strategies to ensure their trading accounts remain healthy and resilient in the face of market fluctuations.

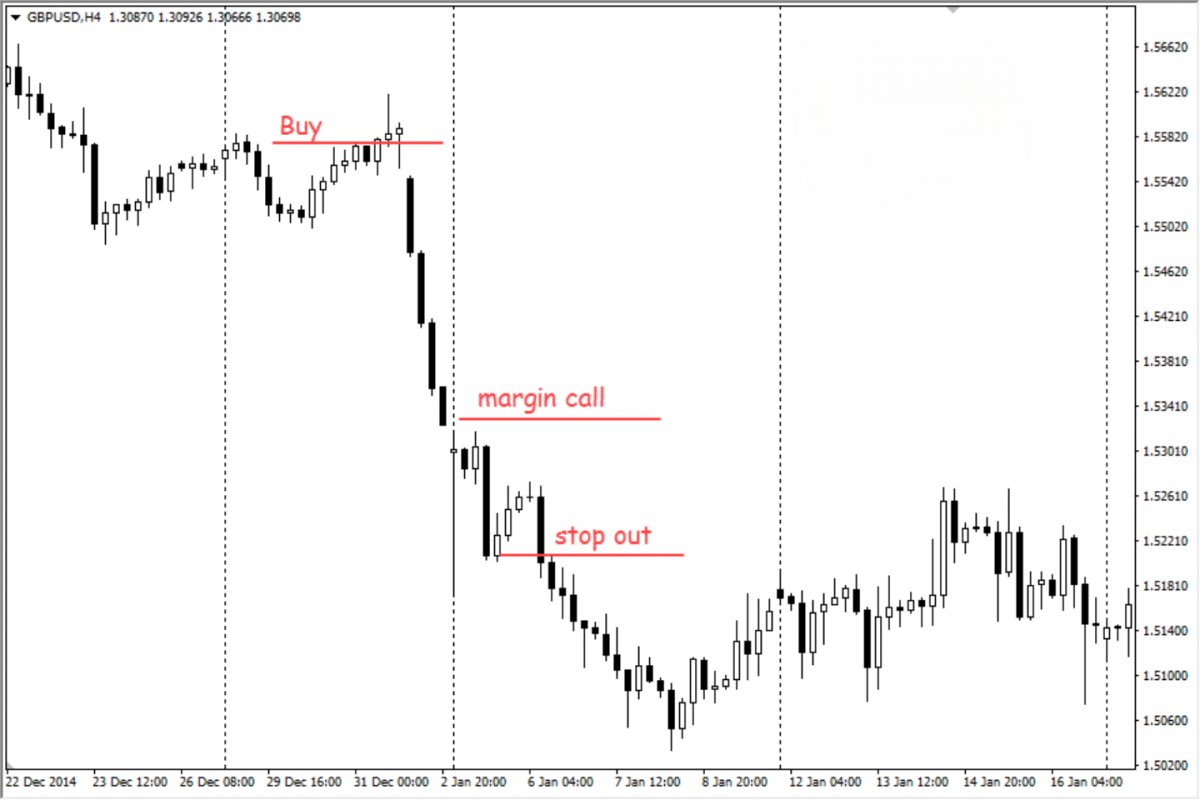

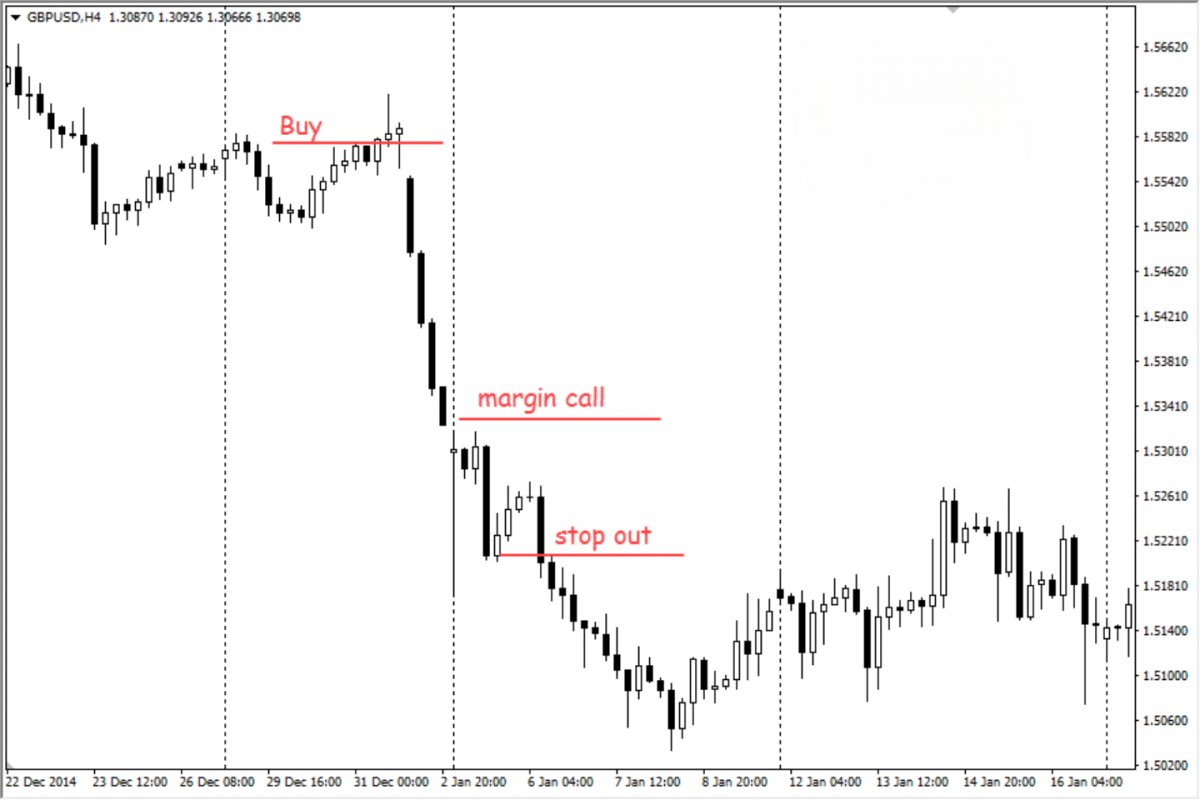

Margin call forex example

Let's delve into a practical scenario to illustrate the concept of a margin call in forex trading. Imagine a trader who opens a leveraged position on a major currency pair, EUR/USD, with a trading account balance of $5,000. The broker requires a 2% margin for this trade, which means the trader can control a position size of $250,000. However, due to adverse market movements, the trade starts incurring losses.

As the EUR/USD exchange rate moves against the trader's position, the unrealized losses begin to eat into the account balance. When the account balance falls to $2,500, half of the initial deposit, the margin level drops below the required 2%. This triggers a margin call from the broker.

This example underscores the importance of monitoring your account's margin level closely. When a margin call occurs, the trader faces a critical decision: either inject additional funds into the account to meet the margin requirement or close out the losing position. It also emphasizes the risks associated with leverage, as it can amplify both gains and losses.

To avoid margin calls, traders should:

Use leverage cautiously and in proportion to their risk tolerance.

Set appropriate stop-loss orders to limit potential losses.

Diversify their trading portfolio to spread risk.

Regularly review and adjust their trading strategy as market conditions change.

Managing margin calls effectively

Setting appropriate stop-loss orders:

Utilizing stop-loss orders is a fundamental risk management technique. These orders allow traders to define the maximum amount of loss they are willing to tolerate on a trade. By setting stop-loss levels strategically, traders can limit potential losses and reduce the likelihood of a margin call. It's essential to base stop-loss levels on technical analysis, market conditions, and your risk tolerance.

Diversifying your trading portfolio:

Diversification involves spreading your investments across various currency pairs or asset classes. This strategy can help reduce the overall risk of your portfolio because different assets may move independently of each other. A well-diversified portfolio is less susceptible to substantial losses in a single trade, which can contribute to a more stable margin level.

Using risk-reward ratios:

Calculating and adhering to risk-reward ratios is another crucial aspect of risk management. A common rule of thumb is to aim for a risk-reward ratio of at least 1:2, meaning you target a profit that is at least twice the size of your potential loss. By consistently applying this ratio to your trades, you can improve the odds of profitable outcomes and reduce the impact of losses on your margin.

How to handle a margin call if it occurs:

Notifying your broker:

When faced with a margin call, it's essential to communicate promptly with your broker. Inform them of your intention to either deposit additional funds or close out positions to meet the margin requirement. Effective communication can lead to a smoother resolution of the situation.

Liquidating positions strategically:

If you decide to close out positions to meet the margin call, do so strategically. Prioritize closing positions with the most significant losses or those that are least aligned with your trading strategy. This approach can help mitigate further damage to your account balance.

Reevaluating your trading strategy:

A margin call should serve as a wake-up call to reevaluate your trading strategy. Analyze what led to the margin call and consider adjustments, such as reducing leverage, refining your risk management techniques, or reviewing your overall trading plan. Learning from the experience can help you become a more resilient and informed trader.

Conclusion

In this comprehensive exploration of margin calls in forex trading, we've uncovered vital insights into this critical risk management aspect. Here are the key takeaways:

Margin calls occur when your account balance falls below the required margin level due to trading losses.

Understanding margin, leverage, and how margin calls work is essential for responsible trading.

Effective risk management strategies, such as setting stop-loss orders, diversifying your portfolio, and using risk-reward ratios, can help prevent margin calls.

If a margin call does occur, timely communication with your broker and strategic position liquidation are crucial.

Use margin calls as an opportunity to reevaluate and refine your trading strategy for long-term success.

Margin calls are not to be taken lightly; they represent a warning sign in your trading journey. Ignoring or mishandling them can lead to substantial financial losses and erode your confidence as a trader. It's paramount to grasp the concept of margin calls thoroughly and incorporate responsible risk management into your trading practices.

In closing, Forex trading is not a sprint but a marathon. It's essential to maintain a long-term perspective and not be discouraged by occasional margin calls or losses. Even the most experienced traders face challenges. The key is to learn from these experiences, adapt, and continue refining your skills.