Know all about Forex Trading Robot

The foreign exchange (forex) market operates on a decentralized network of banks, financial institutions, governments, corporations, and individual traders, making it a truly global marketplace. Trillions of dollars are exchanged daily in this dynamic market, with participants seeking to profit from fluctuations in currency exchange rates.

In this highly competitive forex market, traders are constantly seeking ways to gain an edge and optimize their trading strategies. Enter Forex Trading Robots, also known as forex expert advisors. These automated software programs have become increasingly popular among traders of all levels, offering the promise of executing trades with precision and speed, minimizing emotional biases, and allowing traders to capitalize on market opportunities even when they are away from their screens.

What is a Forex Trading Robot?

Forex Trading Robots, often referred to as Forex Expert Advisors (EAs), are software programs designed to automate trading activities in the forex market. These algorithms are crafted to execute buy and sell orders on behalf of traders based on predefined rules and criteria. Forex robots are essentially the digital counterparts of human traders, capable of analyzing market data, identifying trading opportunities, and executing orders with precision.

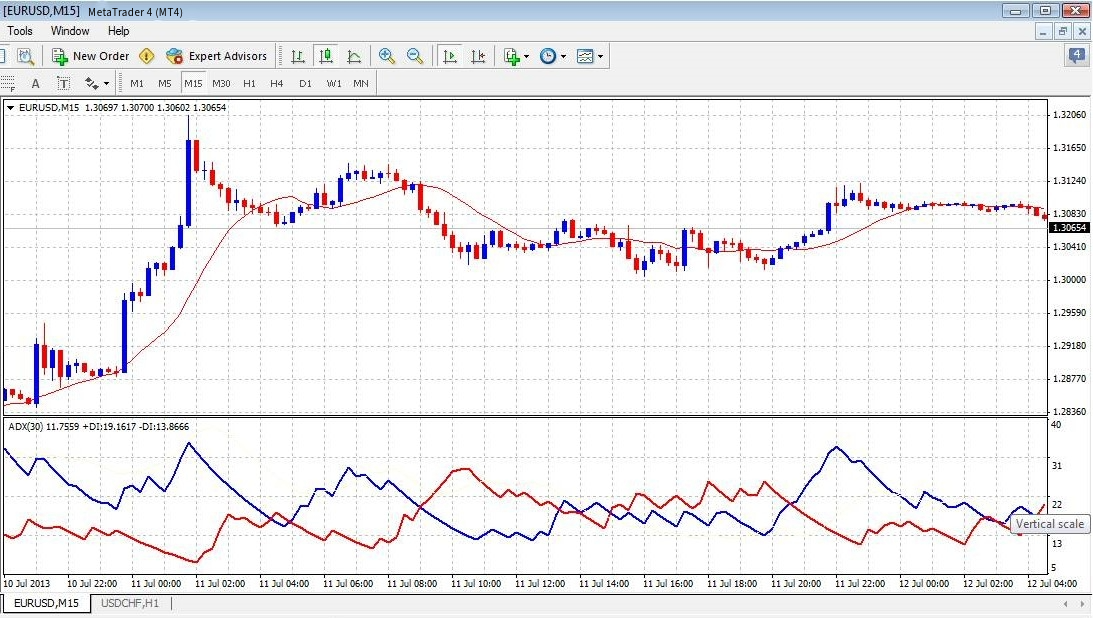

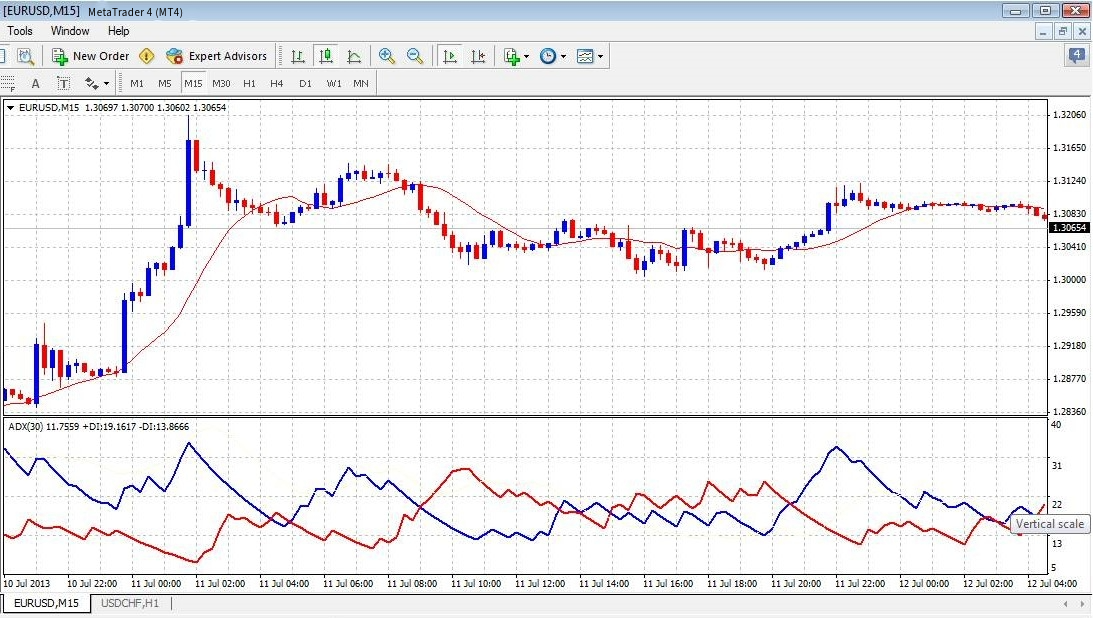

Forex robots operate by processing vast amounts of historical and real-time market data. They use various technical indicators, chart patterns, and mathematical algorithms to make trading decisions. These decisions are driven by predetermined trading strategies, risk management rules, and criteria set by the trader. Once a robot identifies a trading signal that meets the specified conditions, it swiftly executes the trade without hesitation or emotional influence, aiming to capitalize on price movements in the market.

The concept of automated trading in the forex market dates back several decades. Early versions of forex robots relied on simple scripts and basic algorithms. However, over time, advancements in technology, computational power, and data analysis have led to the development of more sophisticated and complex forex expert advisors. Today's robots can execute a wide range of trading strategies, from scalping to trend-following, catering to the diverse needs of traders.

Forex robots come in various forms, each designed to serve specific trading objectives. Some are programmed for high-frequency trading, while others focus on long-term investments. Traders can choose from grid trading robots, martingale robots, breakout bots, and many more. The choice of a forex robot type depends on a trader's risk tolerance, trading style, and market conditions.

How to use a forex robot to trade

Setting up a forex robot is the initial step in incorporating automation into your trading strategy. It typically involves installing the robot's software on your trading platform and linking it to your trading account. This process may vary depending on the specific robot and trading platform you use, but it usually includes straightforward instructions provided by the robot's developer. Once the setup is complete, the robot is ready to execute trades on your behalf.

One of the advantages of forex robots is the ability to tailor their behaviour to your specific trading preferences and risk tolerance. Most robots come with a range of customizable parameters, allowing you to define entry and exit criteria, risk management rules, and trade sizes. It's essential to carefully configure these settings according to your trading strategy and objectives. Customization ensures that the robot aligns with your trading goals and risk management principles.

While forex robots can operate autonomously, it's crucial to continuously monitor their performance. Regularly check your robot's activity to ensure it aligns with your intended strategy and goals. Additionally, stay vigilant for any technical issues or errors that may arise. Effective performance monitoring allows you to make necessary adjustments and intervene if needed, ensuring that your robot remains an asset to your trading efforts.

To assist traders in implementing automation, several popular forex robot platforms are available. These platforms provide access to a wide range of pre-built forex expert advisors, as well as tools for customizing and optimizing trading strategies. Some well-known forex robot platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), cTrader, and NinjaTrader. Each platform offers its unique features and capabilities, catering to traders with different preferences and requirements. Choosing the right platform is essential for a seamless and efficient trading experience.

Advantages of using forex robots

One of the primary advantages of utilizing forex robots is the remarkable boost in trading efficiency and speed. These automated systems can swiftly execute trades, analyze market conditions, and react to opportunities round the clock, 24 hours a day, five days a week. Unlike human traders, forex robots never tire or experience hesitation, ensuring that potential trading opportunities are not missed due to delays.

Emotions can be a significant impediment to successful trading. Greed, fear, and overconfidence can lead traders to make impulsive and irrational decisions. Forex robots, on the other hand, operate purely based on predefined algorithms and criteria, eliminating the influence of emotions. This reduction in emotional bias can lead to more disciplined and consistent trading, potentially improving overall performance.

Forex robots excel in trading continuity, as they can operate around the clock. This feature is especially advantageous in the global forex market, where currency pairs are traded in various time zones. Automated systems can take advantage of market movements during Asian, European, and North American trading sessions, allowing traders to explore opportunities regardless of their geographical location or time constraints.

Forex robots offer the invaluable ability to backtest trading strategies using historical data. Traders can assess the effectiveness of their chosen strategies over time, identify strengths and weaknesses, and make data-driven adjustments for optimization. This process provides a systematic approach to refining trading strategies, potentially enhancing profitability and risk management.

Forex robots provide traders with the flexibility to diversify their trading strategies effortlessly. Multiple robots can be employed simultaneously to execute different strategies across various currency pairs or timeframes. This diversification can help spread risk and mitigate losses in the event of adverse market conditions.

Disadvantages of using forex robots

Forex robots operate solely based on predefined algorithms and criteria. While this can eliminate emotional biases, it also means that they lack the human element of discretion. Human traders can adapt to changing market conditions, exercise judgment, and make decisions based on nuanced information. Forex robots may struggle when confronted with unique or unforeseen situations that require a more flexible approach.

As with any software, forex robots are not immune to technical failures. Internet connectivity issues, server outages, or glitches in the robot's code can disrupt automated trading. Traders relying solely on automation must be prepared to address and resolve technical problems promptly to avoid potential financial losses.

Forex robots are designed to perform optimally in specific market conditions and may struggle when faced with sudden and unexpected changes. They may not adapt well to highly volatile markets, news-driven events, or abrupt shifts in market sentiment. Traders using robots should remain vigilant and ready to intervene or adjust their strategies during such scenarios.

Forex robots lack the ability to anticipate or adapt to unforeseen events, such as geopolitical crises or major economic announcements. While humans can adjust their strategies in response to breaking news, robots may continue to execute trades based on preprogrammed parameters, potentially leading to losses in rapidly changing market conditions.

Traders may be tempted to over-optimize their forex robots by fine-tuning parameters based on historical data to achieve exceptional past performance. However, this can lead to curve-fitting, where the robot becomes overly tailored to historical data and performs poorly in live markets. It's crucial to strike a balance between optimization and robustness to ensure that the robot remains effective in real-time trading.

Analyzing the real-life examples

Real-life examples of traders who have successfully integrated forex robots into their trading strategies serve as valuable insights into the practical applications of automation. These traders have achieved notable results by harnessing the capabilities of these automated systems. Case studies may include individuals who have used forex robots for various trading styles, from scalping to long-term investing, and across diverse currency pairs.

Analyzing the experiences of successful traders who employ forex robots can provide valuable key takeaways for those considering automation. These takeaways may include the importance of careful strategy selection, diligent monitoring of robot performance, and the significance of risk management. Learning from the strategies and practices that have yielded success for others can help traders make informed decisions when implementing robots in their own trading.

While success stories offer inspiration, it's equally important to acknowledge common mistakes that traders can make when using forex robots. These mistakes may include neglecting to stay informed about market events, over-relying on automation without human oversight, or failing to diversify robot strategies. Understanding these facts can help traders navigate the challenges of automation more effectively and avoid potential setbacks.

Conclusion

One of the main themes is the importance of proper research and due diligence when considering the integration of forex robots into your trading strategy. While automation offers numerous advantages, it is not a one-size-fits-all solution. Traders must thoroughly understand their chosen robots, customize them to align with their objectives, and remain vigilant to adapt when necessary.

In conclusion, the use of forex robots can be a powerful tool to enhance trading efficiency and consistency. However, it is crucial for traders to approach automation cautiously, recognizing both its strengths and limitations. By doing so, traders can harness the potential of forex robots while maintaining the flexibility to adapt to ever-changing market conditions.