How to short forex, complete guide to short selling currency

Short selling involves a unique approach to trading where traders aim to profit from the depreciation of a currency. In essence, it's the reverse of the traditional "buy low, sell high" concept. When you short sell a currency, you're betting its value will decrease relative to another currency in a currency pair. This approach enables traders to capitalize on market downturns and potential bearish trends.

Understanding short selling is paramount for forex traders looking to diversify their strategies and optimize their potential gains. While long trades capture upward trends, short selling equips traders to navigate downward trends effectively. A comprehensive grasp of this strategy empowers traders to engage in bullish and bearish market scenarios confidently.

Concept of short selling

Short selling in the forex market is a strategic trading approach where traders aim to profit from the decline in the value of a currency pair. It involves borrowing the base currency of the pair, selling it at the current price, and then repurchasing it at a potentially lower price to return the borrowed amount. The difference between the selling and repurchasing prices constitutes the trader's profit.

While both traditional and forex short selling involve profiting from falling asset prices, there are noteworthy distinctions. In traditional markets, short selling often pertains to stocks, where traders borrow shares to sell. In the forex market, short selling focuses on currency pairs. Additionally, the forex market operates 24/5, allowing for more immediate execution of short trades compared to traditional markets with fixed trading hours.

Short selling in forex presents traders with unique risks and benefits. On one hand, the potential for profit exists even in declining markets, making short selling an attractive strategy. However, the risks include unlimited potential losses if the market moves against the trader. Effective risk management strategies, such as setting stop-loss orders, are crucial when short selling to mitigate these risks. Additionally, short selling can offer diversification to a trader's portfolio, enabling them to capitalize on various market conditions.

How to short sell currency

Choosing the right currency pair is the foundation of successful short selling. Look for pairs that exhibit signs of weakness in the base currency and strength in the quote currency. Market analysis tools, such as technical indicators and fundamental research, can help you identify candidates for short selling.

To execute a well-timed short trade, identify currency pairs that are likely to experience a downtrend. Utilize technical analysis to spot patterns like head and shoulders, bearish flags, or moving average crossovers. Confirm your analysis with fundamental factors that support the expected downward movement.

After thorough analysis, use your chosen broker's trading platform to initiate the short trade. Select the currency pair, indicate the trade size, and choose "sell" to enter the short position. Double-check your trade parameters and execute the order, ensuring accuracy in the process.

Risk management is paramount in short selling. Set a stop-loss order at a level where you're willing to exit the trade to limit potential losses if the market goes against you. Similarly, establish a take-profit order to secure profits at a level that aligns with your analysis. Balancing these orders optimizes your risk-to-reward ratio and safeguards your trading capital.

How to short currency futures

Currency futures contracts are standardized agreements to buy or sell a specified amount of a currency at a predetermined price and future date. These contracts provide traders with a way to speculate on currency price movements without owning the actual currency. Short selling currency futures involve selling contracts to profit from anticipated currency depreciation.

Steps to short currency futures

Select a currency futures contract that aligns with your trading goals and market analysis. Each contract represents a specific currency pair, and it's essential to pick pairs that exhibit signs of potential decline.

Thoroughly analyze both technical indicators and fundamental factors that influence currency price movements. Look for indications of a downtrend and gather insights from economic data, geopolitical events, and central bank decisions.

Once you've identified a promising opportunity, initiate a short position by selling the chosen currency futures contract. As the market moves in your anticipated direction, you'll profit from the price decline.

Margin requirements and maintenance in currency futures shorting

Shorting currency futures requires a margin, a deposit that ensures you can cover potential losses. Brokers set margin requirements, and it's crucial to understand the leverage and capital necessary to maintain the position. Regularly monitor the market and your account balance to avoid margin calls that can lead to forced liquidation.

How to short a currency pair

Currency pairs are the cornerstone of forex trading, representing the relative value between two currencies. Shorting a currency pair involves betting on the depreciation of the base currency against the quote currency. Understanding the interplay between these currencies is crucial for successful short selling.

Shorting a currency pair using technical analysis

Technical analysis tools like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can help identify overbought conditions. These indicate potential price reversals and signal an opportune moment to enter a short position.

Chart patterns like double tops, head and shoulders, and bearish flags offer insights into possible downward trends. Recognizing these patterns provides traders with entry and exit points for their short trades.

Shorting a currency pair using fundamental analysis

Fundamental analysis involves monitoring economic indicators such as GDP, unemployment rates, and trade balances. Additionally, geopolitical events like elections and trade negotiations can impact currency pairs. Negative developments can signal potential currency depreciation.

Central bank decisions, especially related to interest rates, have a significant impact on currency pairs. Lower interest rates can lead to currency devaluation. Traders should closely follow central bank announcements to inform their short selling strategies.

How shorting forex works: market mechanics

The forex market operates as a decentralized global network of financial centers, facilitating the exchange of currencies around the clock. This decentralization ensures continuous trading, allowing traders to engage in short selling irrespective of their time zone. The fluid nature of the market enables swift execution of short trades.

Forex brokers act as intermediaries between traders and the market. They provide platforms that allow traders to execute short trades seamlessly. Brokers offer access to various currency pairs, essential market data, and trading tools that aid in analyzing and executing short positions effectively.

Short selling in the forex market often involves using leverage, which amplifies the trader's exposure to potential profits and losses. Traders open margin accounts with brokers, depositing a fraction of the trade value as collateral. Leverage ratios determine the extent to which traders can magnify their positions. However, it's important to exercise caution, as higher leverage also increases risk.

Common mistakes to avoid in short selling forex

One of the gravest errors traders can make is diving into short selling without conducting thorough analysis. Skipping essential steps such as technical and fundamental analysis can lead to misguided decisions. It's crucial to take time to understand market trends, evaluate indicators, and assess economic factors before executing a short trade.

Effective risk management is the cornerstone of successful trading, especially in short selling. Neglecting to set appropriate stop-loss orders and failing to define an exit strategy can expose traders to significant losses. By implementing disciplined risk management, traders can limit potential downsides and protect their capital.

Emotions like greed, fear, and impatience can cloud judgment and lead to impulsive trading decisions. Traders should stick to their analysis and trading plans rather than reacting emotionally to market fluctuations. Emotional trading often results in missed opportunities and unnecessary losses.

Real-life examples of successful short selling

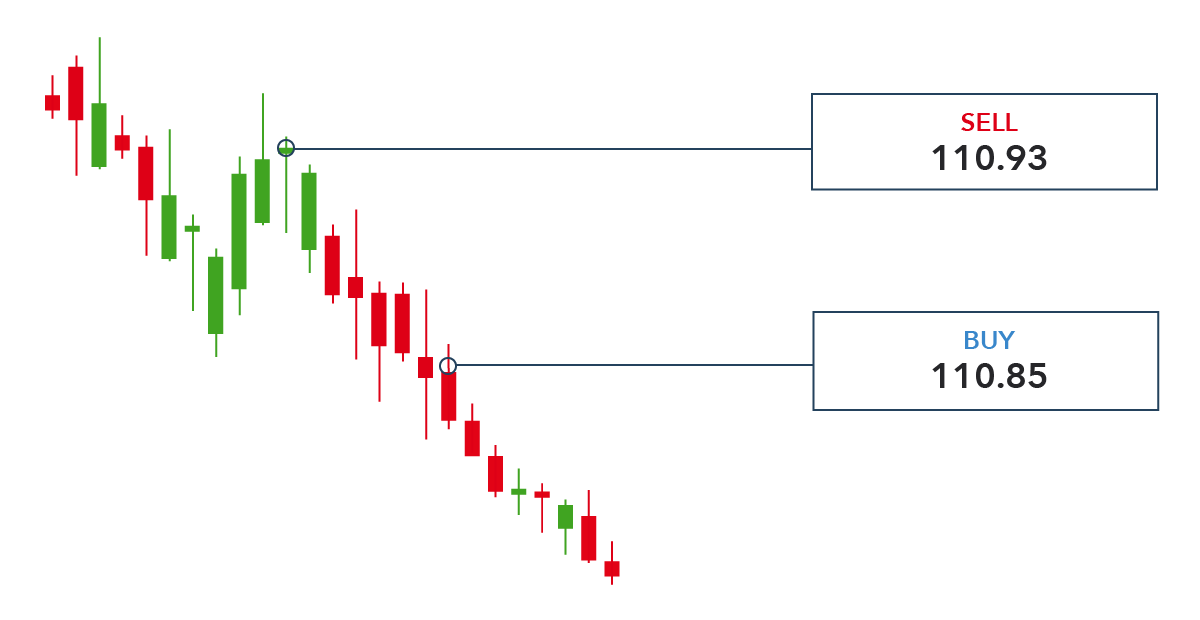

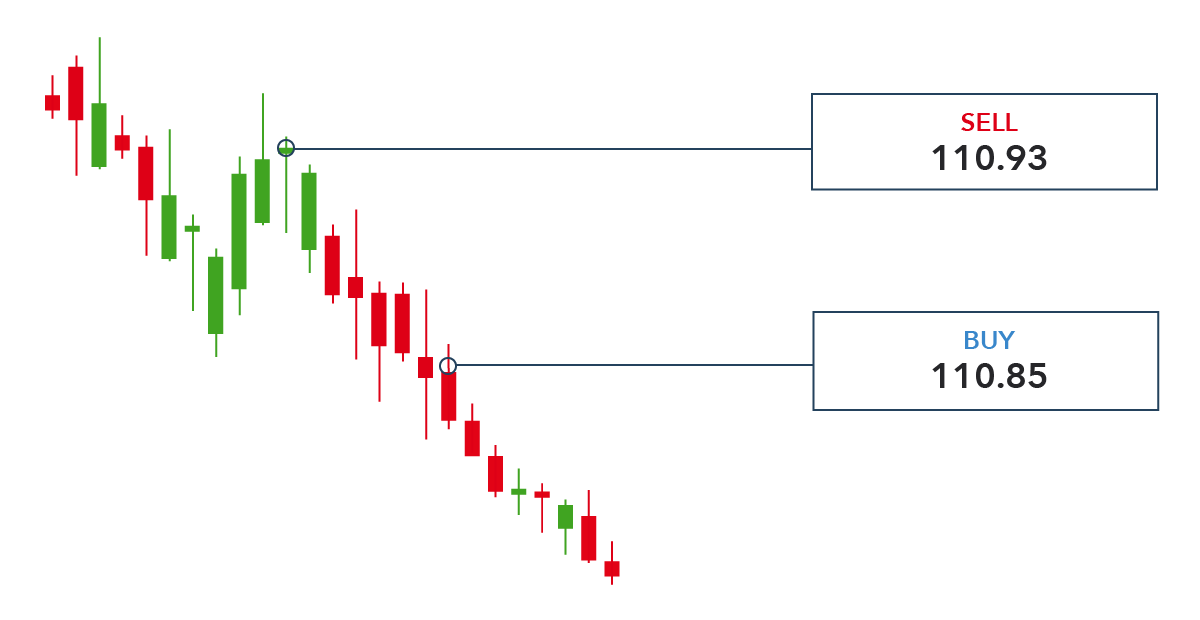

Let's delve into real-life case studies that exemplify the efficacy of short selling in the forex market. Consider the USD/JPY pair during a period of global economic uncertainty. Traders who recognized the yen's safe-haven appeal and anticipated a weaker US dollar capitalized on this trend, executing well-timed short trades.

In these instances, successful short selling was rooted in a blend of technical and fundamental analysis. Traders observed the USD/JPY's repeated failure to breach key resistance levels, signaling a potential downtrend. Simultaneously, economic indicators revealing weakening US economic conditions bolstered the case for shorting the pair.

By critically analyzing both currency-specific factors and the broader global economic landscape, traders identified opportunities to profit from currency depreciation. These case studies underscore the importance of informed decision-making, strategic analysis, and adaptability in short selling.

Conclusion

Short selling is a skill that requires dedication, practice, and continuous refinement. As you embark on your journey to master this technique, remember that success comes with patience and persistence. Utilize demo accounts to test your strategies, adapt to changing market conditions, and hone your instincts for recognizing profitable short selling opportunities.

The forex market is ever-evolving, influenced by global economic shifts, geopolitical events, and technological advancements. To thrive as a forex trader, embrace a mindset of continuous learning and adaptation. Stay updated on market trends, experiment with diverse strategies, and seek knowledge from reputable sources to stay ahead in this dynamic landscape.