How to open a forex trading account

The potential for huge financial gains and the excitement of whooping profits have made forex trading a very popular profession. Opening a forex account today is a privilege and an opportunity for anyone with access to the internet, small-capped (retail) traders and investors willing to participate in foreign exchange transactions amongst institutional banks, hedge funds and other big players doing millions of dollars transactions daily in the financial markets

Prior to the development of electronic forex trading in the late 90s. It has been impossible for small investors and retail traders to take part in foreign exchange transactions alongside the big players on the interbank level because of the financial barriers that restrict trading to only financial institutions and deep-pocket investors.

The development of the internet, trading softwares, and 'forex brokers allowing trading on margin', began the rise of retail trading. Today, anyone with internet access can become a forex trader and investor, with the opportunity to access the global financial markets and trade spot currencies with market makers on margin. This means they can buy and sell financial instruments through forex brokers using only a small percentage of their account size.

Today, retail forex trading makes up about 6% of the entire foreign exchange market.

You need to open a forex trading account, a platform that grants you access to trade financial instruments in the financial market.

The exact steps involved in opening a trading account may vary from brokerage to brokerage, but the procedure commonly involves the following:

Step 1: Register/Sign up for an account with a forex broker

Prior to opening a forex trading account to buy and sell financial instruments. The first step is to sign up with a reputable forex broker.

Visit the broker’s website and click ‘Sign up’ or ‘Register an account.

You will be required to fill out the following personal information in an online application form.

- Name

- Email

- Phone number

- Address

- Choose account currency

- Date of birth

- Country of citizenship

- Social Security Number or Tax ID

- Employment status

- A password for your trading account

You might be prompted to answer a few financial questions, such as:

- Annual income

- Source of deposit

- Net worth

- Trading experience

- Trading purpose

Fill out all the important information and click on ‘Register’ or ‘Create account’.

You will be allocated a personal portal on the broker's website.

Upon registration, some important documents like government ID and driver's license will take up to a day or two to get verified.

Note: Forex Trading Risk Disclosure

During the final steps of registering an account with a broker. You will be prompted to read the risk disclosure. This is a very important read, especially for beginner traders who are excited about the potential of huge profit in forex trading. On average, it is recorded that 78% of retail forex traders lose money every year.

Step 2: Select from the different types of trading account

Login to your personal portal on the broker’s website to open a trading account.

There are different types of accounts available to choose from. Each account has different benefits and limitations.

Your choice of account type depends on the following

- Your experience in forex trading

- Your skill, knowledge and trading competency

- Your financial capacity

- Your risk tolerance

Different types of trading accounts are as follows;

- Demo account:

This is a risk-free trading account with virtual funds; an opportunity for beginners and novice traders to practice, trade and experience the financial markets in real-time without any financial risk.

It is also of use to professional traders for study, backtesting and forward testing of trading strategies.

Keep in mind that with a demo trading account, you can do everything that can be done with a real account but the only difference is the emotional attachment to trading real money as opposed to virtual funds.

- Real trading account:

A real trading account allows you to trade the Forex market using real money.

Real accounts of different types are offered by forex brokers to provide varying services that best suit retail traders and investors of different financial capabilities.

Different types of real trading accounts:

This type of forex trading account is designed for traders with small capital for funding.

Deposit limit varies across different forex brokers from $5 - $20. This account type also has restrictions on the sizes of trade that can be executed. It does allow 10,000 units of a currency pair to be bought or sold.

A standard account is a regular account reserved for experienced traders with large capital. The account may be presented as classic, premium or gold account.

The minimum deposit on a standard account is between $100 - $500 allowing users the access to trade $100,000 worth or more of a currency pair.

A ‘swap’ is the commission or interest a broker charges for trades that are held overnight or rolled to the next day. Such accounts offer interest-free forex trading with no rollover or any premiums.

Step 4: Determine your size of margin and leverage

Once you’ve come to a conclusion on the type of account that is suitable for you, the next step might be to choose leverage or margin size for your account.

The majority of retail forex traders do not have the financial capacity to participate in foreign exchange transactions on the interbank level. Forex brokers understand this and so in order to present retail traders the opportunity to trade the financial markets and boost their financial trading capacity.

Margin is offered to forex traders by brokers thus acting as an intermediary between forex traders and the interbank market, providing liquidity and taking counter trades to their customers.

Margin can be considered a loan of funds from the brokerage to a trader so that the trader can "leverage," or effectively multiply, the amount of capital they have available to make a trade. Margin requirements are usually determined by regulatory bodies and the broker itself.

It is up to the retail forex trader (or traders) to make wise use of the leverage made available by their preferred broker with effective risk management.

The use of margin increases the potential profits of trading, but it can also multiply risks, and individual traders will be responsible for covering the losses that are incurred in trading activities, even those beyond their initial account balance.

Step 5: Funding a Real Account.

After setting up your real forex trading account. You have a zero balance and must fund the account so as to buy and sell financial instruments.

Brokers do provide a variety of means for traders to fund their account either by bank transfer, USSD code, credit or debit card, cryptocurrencies, e-wallets and so on.

Select any option you're more comfortable with. Fund your account and start trading.

A piece of advice especially for beginner and novice forex traders is, no matter your level of trading confidence. Do not put any money into trading that you cannot afford to lose. Be highly disciplined and follow strict risk management principles.

Many people start off with overconfidence and excitement, taking unnecessary risks with the hope of getting rich overnight. This dopamine excitement have always been hit with the reality of forex trading

Start with a fair amount of money, do not risk more than 5% on any trade setup so as not to trade with emotions which of course will stunt your growth as a forex trader.

Alternative to open a forex trading account; using the Mt4/MT5 trading terminal

After the completion of your registration on a forex broker website.

Download and install the broker's trading platform either the Metatrader 4 or the MetaTrader 5 onto your computer, laptop, smartphone, tablet or any other device.

On successful installation, open the app and do the following.

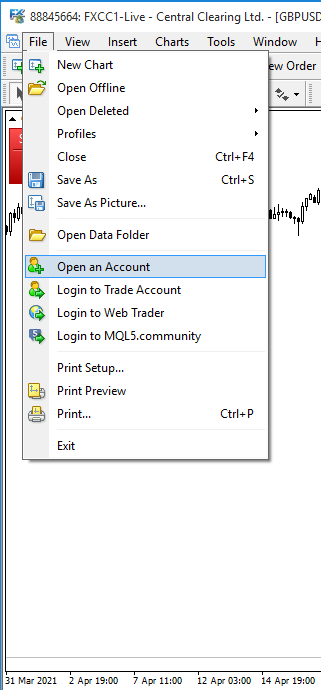

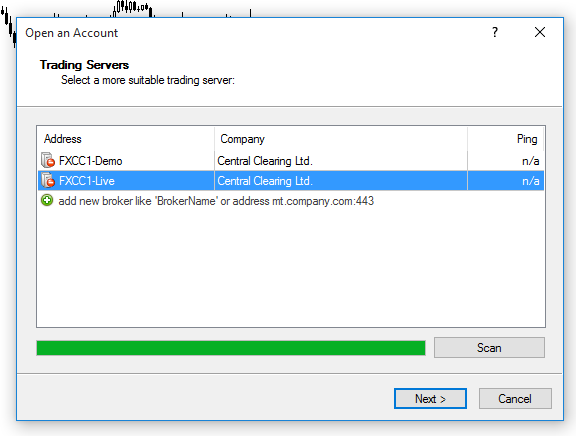

On PC:

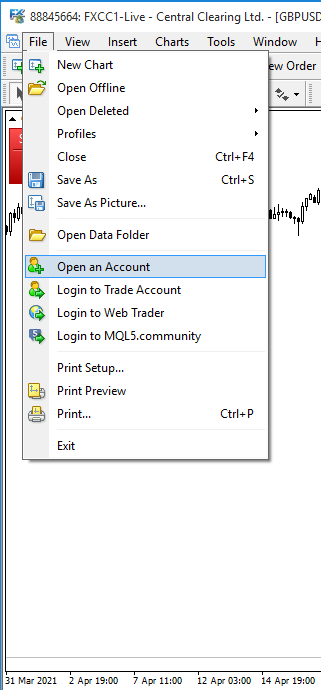

I) Click on file at the top left corner of the trading terminal and scroll down to open account

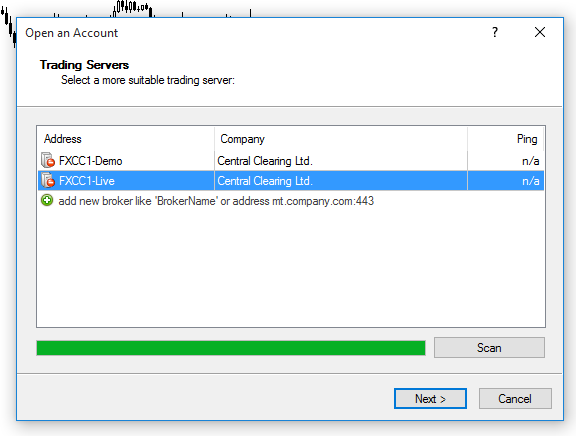

II) select the trading server of the type of account that you want to open

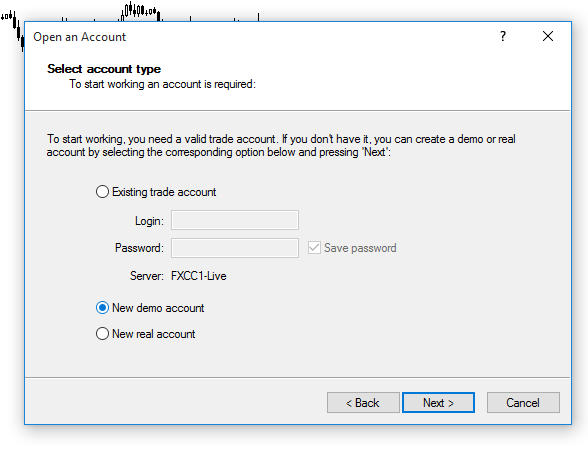

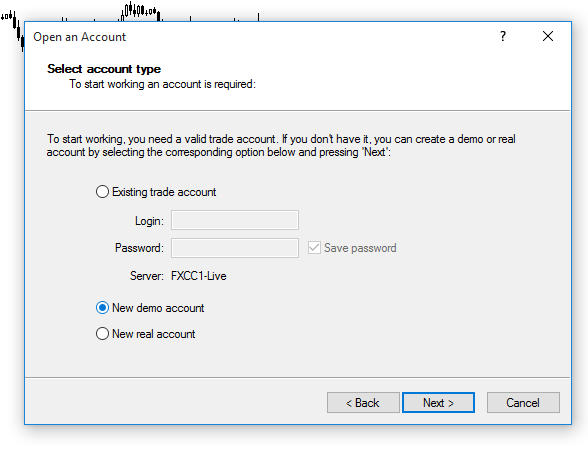

III) On the next display, select either ‘new or real account’ and click on Next

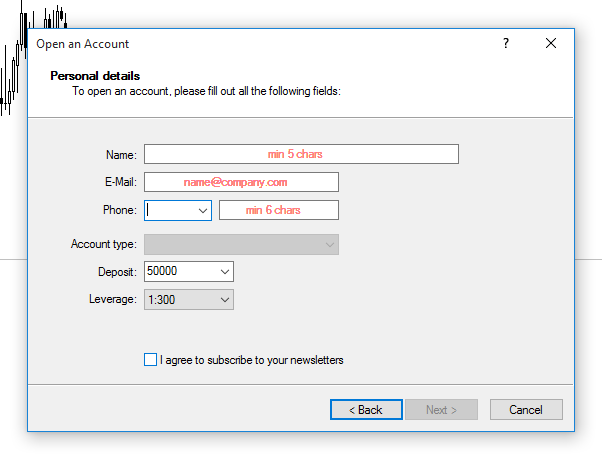

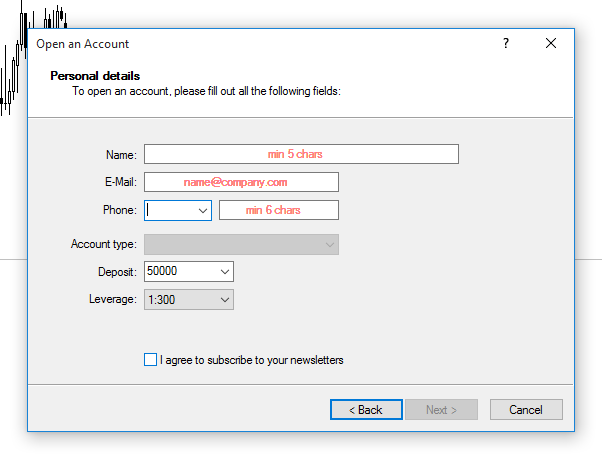

IV) Fill out all the fields of personal and important information, then click Next.

IV) A unique ID and password will be assigned to your new account.

The disadvantage of opening a real account from the trading terminal is that you must login to your client portal on the broker's website to transfer funds into the newly created account.

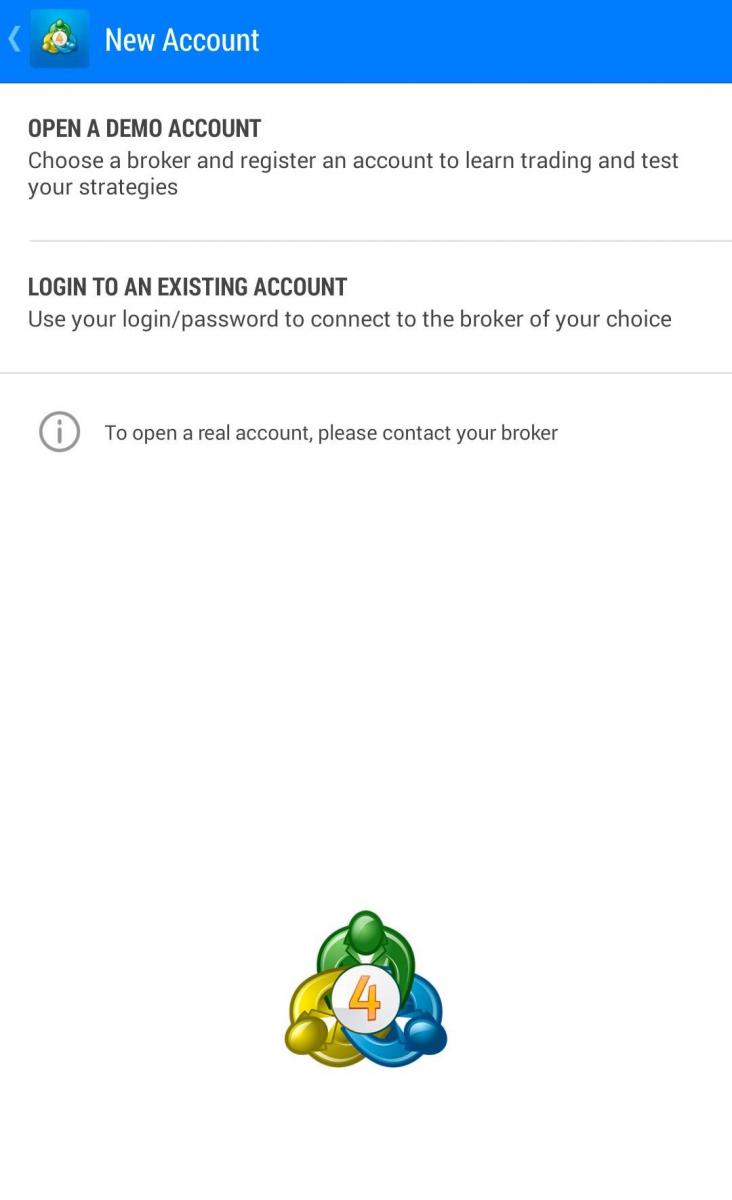

On Smartphone/Tablet:

You can only open a demo trading account using the Mt4 or Mt5 terminal on smartphone devices. To open a real trading account, you must either use the PC trading terminal or the broker's website itself.

Follow the steps to open an account using the Mt4 and Mt5 on smartphone devices.

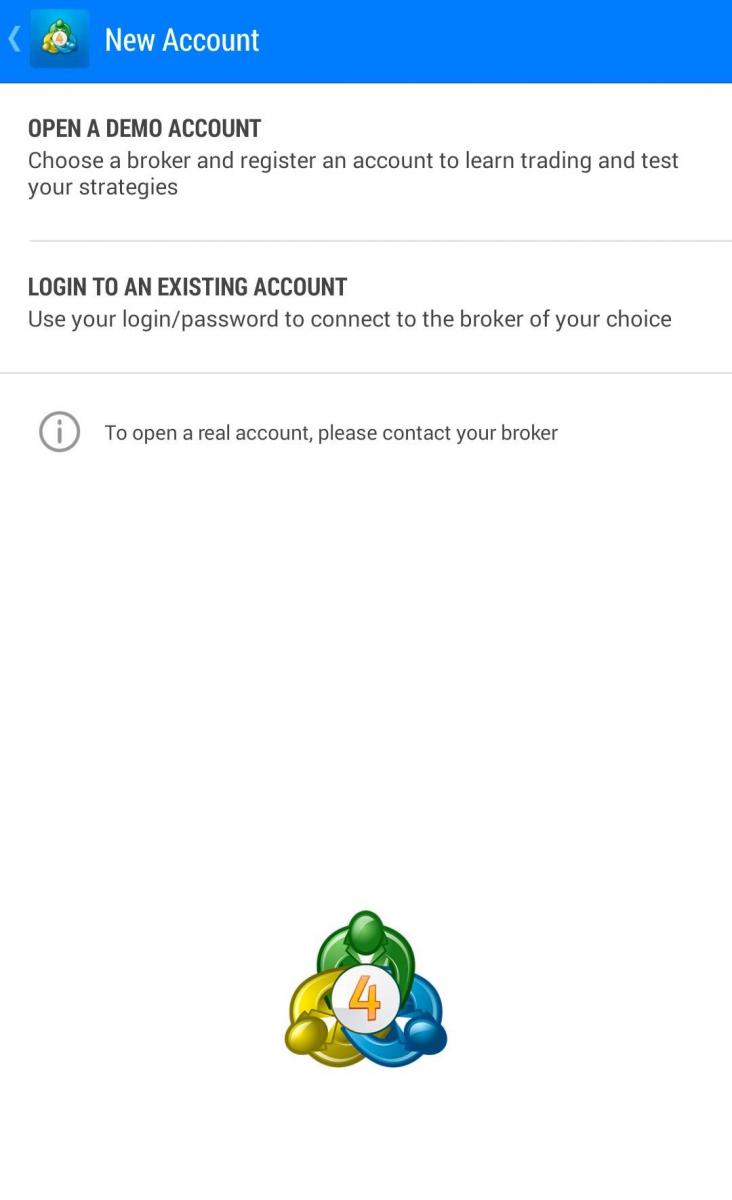

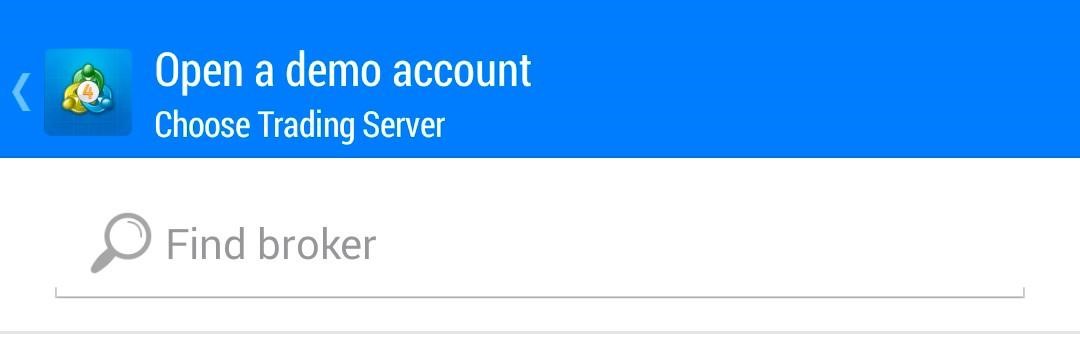

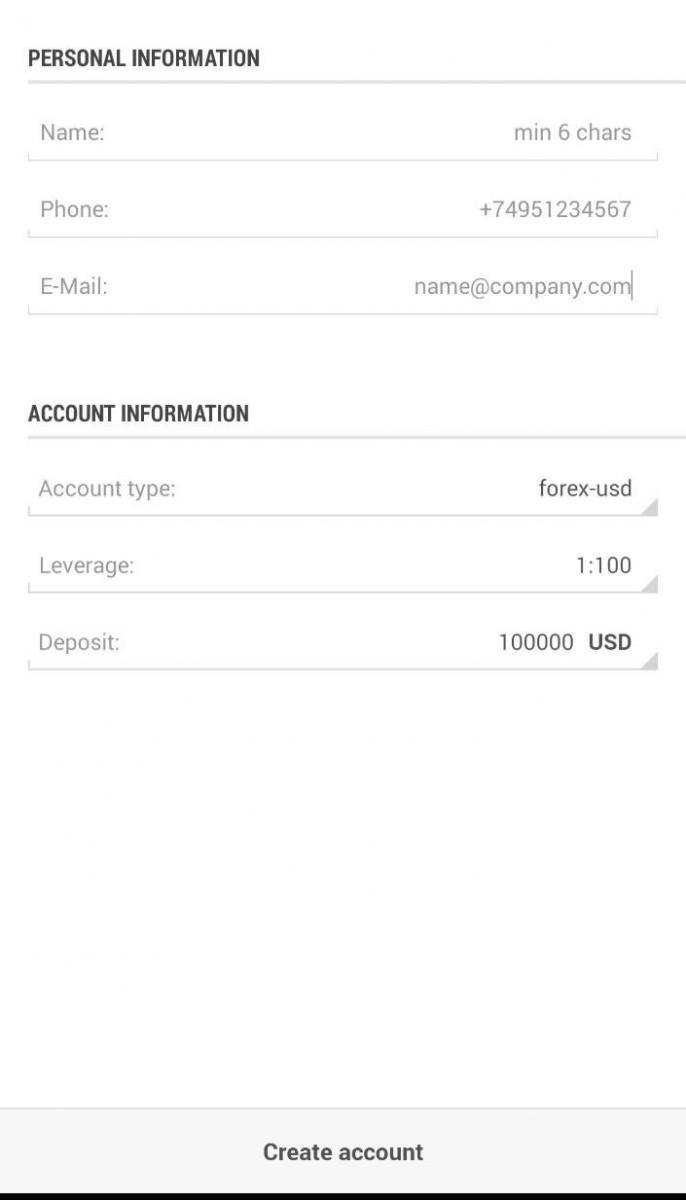

I) On the side menu of the trading app, click on manage account.

II) Tap on the ‘+’ sign at the top right corner of the screen.

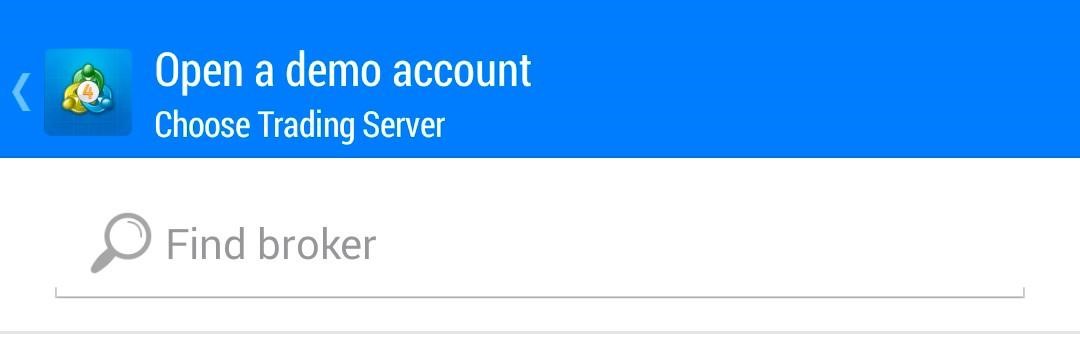

III) Click on ‘open a demo account’

IV) Find and click on your broker in the search bar

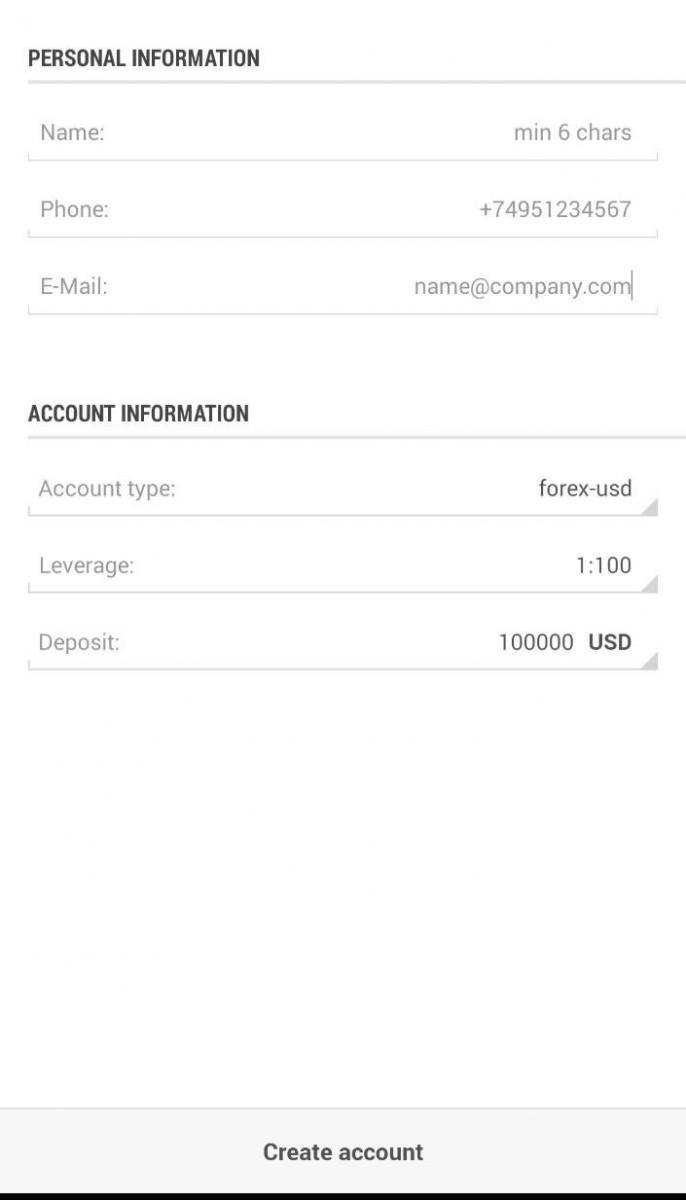

V) Fill out all the fields of personal details and click ‘Create an account

Your demo account will be created and you can start trading right away.

Good luck and good trading!

Click on the button below to Download our "How to open a forex trading account" Guide in PDF