How to become a part-time trader

Part-time trading holds a special allure for many individuals seeking financial independence and flexibility. It's the prospect of supplementing one's income or even achieving a career change while maintaining existing commitments that makes it so enticing. However, the path to becoming a successful part-time trader is not paved with instant riches; it demands a thorough understanding of the forex market, disciplined planning, and a steadfast commitment.

The allure of part-time trading lies in the potential for financial growth without requiring a complete career overhaul. It offers the freedom to engage with the forex market while keeping your day job, caring for your family, or pursuing other interests. For some, it's a chance to diversify their income streams, while for others, it's an exciting venture into the world of financial markets.

What is part-time trading

Part-time trading is a trading approach that allows individuals to participate in the foreign exchange (forex) market while juggling other commitments, such as a full-time job, family responsibilities, or personal interests. Unlike full-time traders who dedicate their entire workday to the markets, part-time traders adapt their trading activities to fit around their existing schedules. This flexibility is a defining feature of part-time trading, enabling people from various backgrounds and professions to access the forex market.

Benefits

Part-time trading offers several advantages. Firstly, it provides an opportunity to diversify income sources without the need to quit a current job. This can help secure financial stability and build wealth gradually. Additionally, part-time trading can be a gateway to financial independence, offering the potential to generate substantial profits over time. It also fosters discipline, time management skills, and the ability to make informed decisions, which can be beneficial in other aspects of life.

Challenges

Part-time trading, however, is not without its challenges. Balancing trading with other commitments can be demanding, and time constraints can limit the number of trading opportunities. It requires a high level of discipline and time management to ensure that trading activities do not interfere with other responsibilities. Moreover, part-time traders may experience heightened stress levels due to the need to make quick decisions within limited timeframes.

Forex market basics

To embark on a successful part-time trading journey, acquiring a solid understanding of the forex market is paramount. Start with the basics: comprehending how currency pairs work, understanding exchange rates, and learning about the factors that influence currency movements. Familiarity with key terms like pips, lots, and leverage is crucial. The more you know about the market's fundamental structure, the better equipped you'll be to make informed decisions.

Fundamental and technical analysis

Part-time traders should be well-versed in both fundamental and technical analysis. Fundamental analysis involves assessing economic indicators, geopolitical events, and central bank policies to predict currency movements. Technical analysis, on the other hand, relies on charts, patterns, and historical price data to identify potential trading opportunities. A combination of these analytical approaches can provide a more comprehensive view of the market.

Risk management

Effective risk management is the bedrock of successful trading. Part-time traders must understand the importance of preserving their capital. This includes determining their risk tolerance, setting stop-loss orders, and establishing position sizing rules. By managing risk effectively, traders can protect their investments and reduce the impact of losses.

Selecting the right broker

Choosing the right forex broker is a critical decision. Factors to consider include the broker's reputation, regulatory compliance, trading platform quality, transaction costs, and available currency pairs. It's essential to opt for a broker that aligns with your trading goals and provides reliable execution and customer support.

Creating a trading plan

A well-structured trading plan is the roadmap to success in part-time trading. Your plan should outline your trading objectives, preferred trading timeframes, risk tolerance, entry and exit strategies, and rules for managing trades. A trading plan serves as a guide to keep emotions in check and maintain discipline. By following a well-defined plan, part-time traders can navigate the complexities of the forex market with confidence and consistency.

Time management and commitment

Balancing the demands of work, personal life, and part-time trading is a crucial aspect of success in the world of forex. Part-time traders often find themselves juggling multiple responsibilities, and maintaining equilibrium is paramount. Here are some strategies to help you strike a balance:

Identify your most critical responsibilities both at work and in your personal life. This will help you allocate your time more effectively.

Clearly define your trading hours and communicate them to your employer, family, and friends. Having set boundaries ensures uninterrupted trading time.

Utilize tools such as calendars, to-do lists, and time management apps to stay organized and maximize productivity.

Choosing the right trading hours

Selecting the appropriate trading hours is essential for part-time traders. The forex market operates 24 hours a day, five days a week, offering various trading sessions, each with its unique characteristics. Here's how to choose the right trading hours:

Align your trading hours with your availability. If you have a day job, focus on trading during the overlap of your free time and major market sessions.

Familiarize yourself with the different trading sessions (Asian, European, and North American) and their market activity levels. This knowledge helps you identify when your chosen currency pairs are most active.

Tools and resources

Selecting the right trading platform and software is pivotal for part-time traders in the forex market. Here's what you need to know:

Opt for a reputable trading platform that offers a user-friendly interface, reliable execution, and the features you need for your trading style.

Since part-time traders may not always be at their computers, mobile compatibility is vital. A mobile trading app can allow you to monitor and execute trades on the go.

Explore trading software that complements your trading strategy. Some software packages provide advanced charting tools, automated trading, and in-depth market analysis.

Educational resources

Invest in forex trading books and online courses. They offer in-depth insights into various trading strategies, analysis techniques, and market dynamics.

Participate in webinars and seminars conducted by experienced traders and market analysts. These events often provide valuable tips and real-world trading scenarios.

Join online trading forums or communities. They offer a platform to discuss trading strategies, share experiences, and seek guidance from fellow traders.

Support networks

Building a support network can significantly benefit part-time traders:

Seek out a mentor or experienced trader who can offer guidance, answer questions, and provide valuable insights based on their own trading experiences.

Connect with other part-time traders. Sharing experiences, challenges, and trading strategies with peers can be motivating and provide fresh perspectives.

Engage with online trading communities and social media groups. These platforms offer opportunities to interact with a broader trading community, share knowledge, and gain support.

Part-time trading strategies

Part-time traders have the flexibility to choose from various trading strategies to suit their preferences and schedules. Here are three popular part-time trading strategies:

Scalping

Scalping is a short-term trading strategy focused on making quick, small profits from numerous trades throughout the day. Part-time traders who choose scalping often engage in rapid-fire trades, holding positions for only a few seconds to minutes. Key points to consider:

Scalping requires constant attention and quick decision-making. Traders must be available during active market hours.

Due to the high frequency of trades, risk management is critical. Scalpers typically use tight stop-loss orders to limit potential losses.

Scalping demands strong emotional control, as traders may encounter multiple small losses before securing a profitable trade.

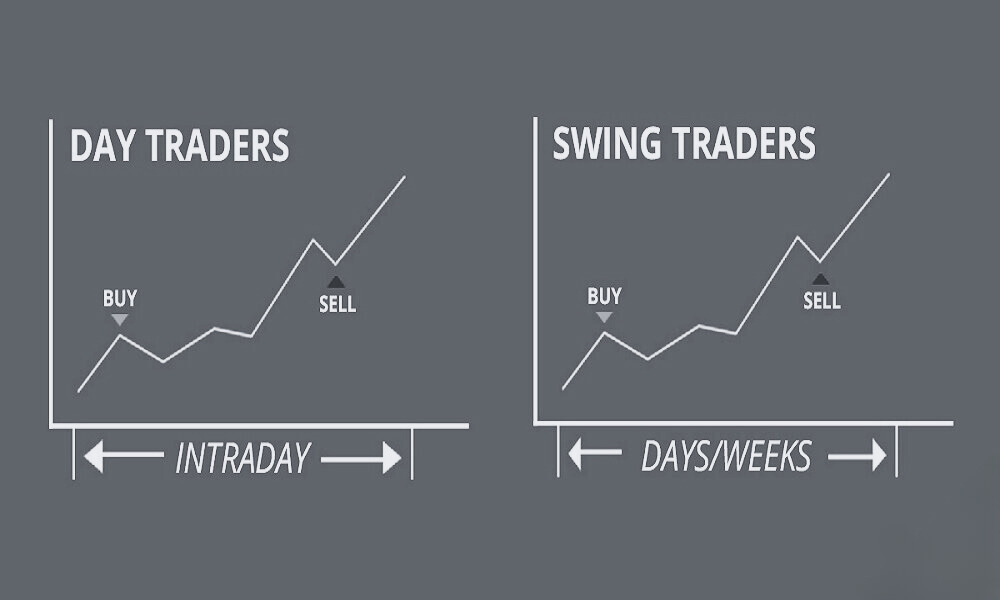

Day trading

Day trading involves opening and closing positions within the same trading day, without holding any positions overnight. It suits part-time traders who can dedicate a few hours during the day to trading. Key considerations:

Day trading typically involves shorter timeframes, like minutes to hours. Traders need to be active during the specific market hours that align with their strategy.

Day traders should implement robust risk management techniques, including stop-loss orders and proper position sizing.

Successful day traders rely on technical analysis, chart patterns, and market indicators to make quick decisions.

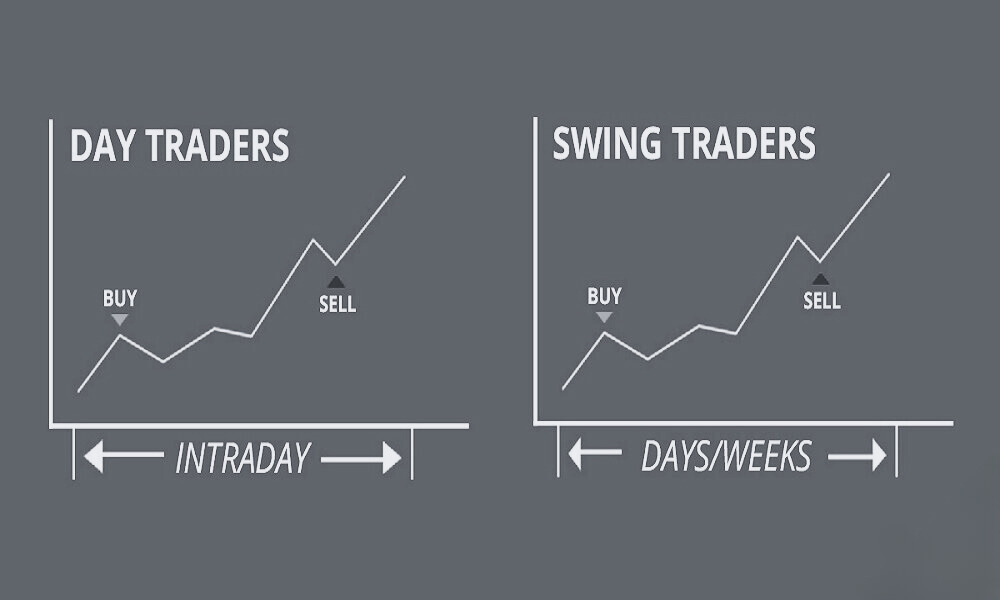

Swing trading

Swing trading is a strategy that aims to capture price swings or "swings" in the market over several days or weeks. This approach allows for more flexibility in trading hours, making it suitable for part-time traders with busy schedules. Key points to note:

Swing traders can analyze the markets and place trades during their free time, making it ideal for part-time traders.

Risk is managed through the use of stop-loss orders, and swing traders typically aim for higher reward-to-risk ratios.

Swing traders must be patient and willing to wait for their chosen currency pairs to exhibit the desired price movements.

Monitoring and evaluating progress

For part-time traders in the forex market, monitoring and evaluating your trading progress are essential to success. This ongoing assessment helps you refine your strategies, improve your decision-making, and stay on track with your goals. Here's how to effectively monitor and evaluate your progress:

Tracking key performance metrics provides valuable insights into your trading performance. These metrics include:

Win rate: Calculate the percentage of your winning trades compared to the total number of trades. A higher win rate suggests successful trading strategies.

Risk-reward ratio: Evaluate the risk-reward ratio for your trades. It's essential to ensure that potential profits outweigh potential losses.

Profit and Loss (P&L): Keep a record of your overall profits and losses. This helps you assess the overall success of your trading endeavors.

Drawdowns: Measure the maximum drawdown, or peak-to-trough decline, in your trading capital. Minimizing drawdowns is crucial for capital preservation.

Making necessary adjustments

Regularly reviewing your trading performance allows you to identify areas that need improvement. Here's how to make necessary adjustments:

Carefully analyze your losing trades to understand what went wrong. Was it a flaw in your strategy or a lapse in discipline? Use these insights to avoid repeating mistakes.

The forex market is dynamic, and what works today may not work tomorrow. Be prepared to adapt your strategies to changing market conditions.

Periodically revisit your trading plan and adjust it as needed. Your risk tolerance, goals, and trading strategies may evolve over time.

Revising goals

As you gain experience and refine your trading approach, it's essential to revisit and adjust your trading goals:

Consider whether your short-term goals align with your long-term objectives. Are you on track to achieve your ultimate financial aspirations?

Ensure that your goals remain realistic and attainable. Setting overly ambitious targets can lead to frustration and unnecessary risk-taking.

Life circumstances may change, affecting your trading goals. Be flexible in adjusting your goals to accommodate these changes.

Conclusion

Part-time trading holds the promise of financial growth, independence, and flexibility, allowing you to augment your income while maintaining other life commitments. First and foremost, understanding the forex market's fundamentals, mastering various trading strategies, and developing robust risk management skills are foundational. Equipping yourself with knowledge and discipline will empower you to navigate the complexities of the forex market successfully.

Balancing work, life, and trading is a skill that will serve you well. Effective time management, coupled with the right choice of trading hours, will ensure that your part-time trading activities complement rather than conflict with your other responsibilities.

In closing, becoming a part-time trader is not just about financial gains; it's a path to personal growth, discipline, and resilience. With dedication, knowledge, and commitment to your goals, you can embark on this journey with confidence and work towards achieving the financial independence and flexibility you desire.