How does leverage affect pip value

Forex trading, also known as foreign exchange trading, involves purchasing and selling currency pairs in order to make a profit from changes in exchange rates. Leverage is a key concept in forex trading, enabling traders to manage significant positions with only a small capital investment. In essence, leverage amplifies potential gains and losses, making it a potent yet risky instrument.

The value of a pip is another important idea in forex trading. A "pip" is short for "percentage in point" and signifies the smallest price change a currency pair can experience. The worth of a pip changes based on the currency pair and the volume of money being exchanged. Having a grasp on pip value is essential for effectively managing risk and customizing trading tactics based on one's financial limitations and market anticipations.

Comprehending important ideas

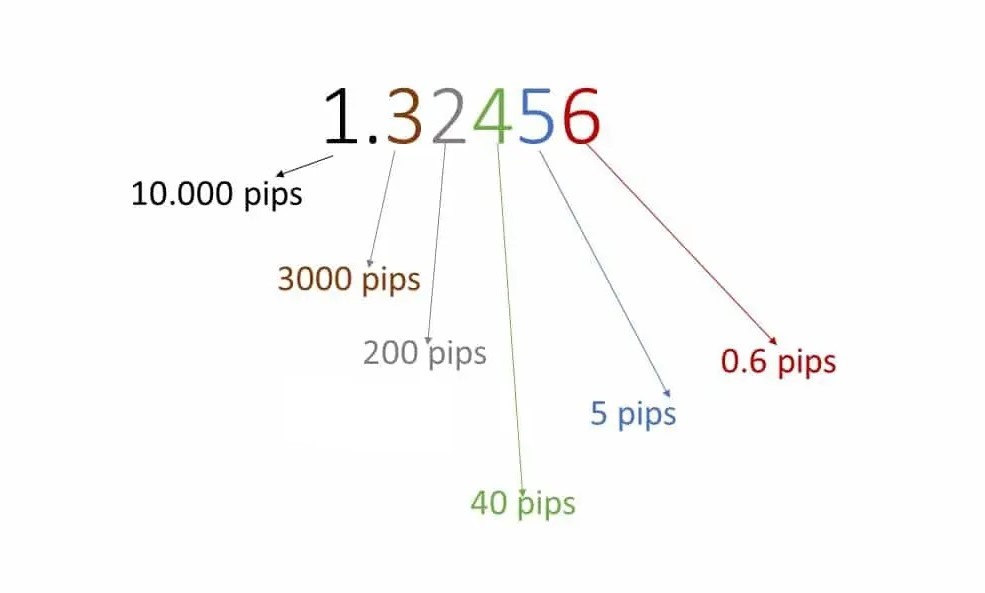

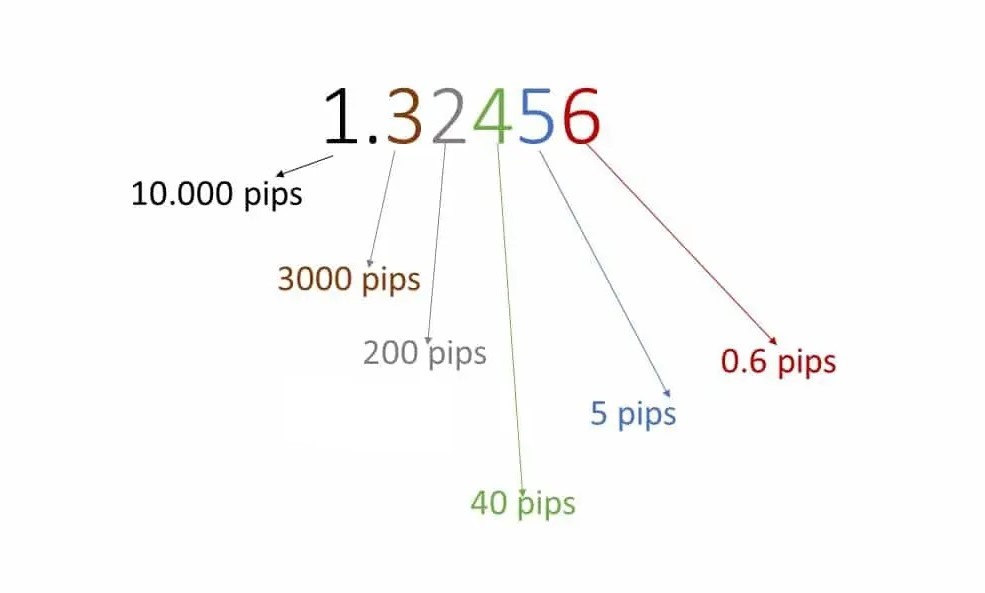

Meaning of pips: In the world of forex trading, a pip represents the minimum price fluctuation that a currency pair can experience in line with market standards. In general, a pip represents a single-unit change in the fourth decimal point of a currency pair, for example, 0.0001 of the specified price. For the majority of couples, this is equivalent to 0.01 percent, or one basis point. Pips are the unit of measurement commonly utilized to gauge fluctuations in the value of an exchange rate. For example, if the EUR/USD pair changes from 1.1050 to 1.1051, it has experienced a one pip movement.

Comprehending leverage: Utilizing leverage in forex trading allows traders to access significant amounts of currency without needing to pay the entire trade amount initially. Rather than, a trader is only required to invest a portion of the capital, while the broker covers the remainder. Typical forex leverage ratios such as 50:1, 100:1, or higher, enable traders to increase their potential profits on investments but also raise the risk level.

The correlation between pips and leverage: The merging of leverage and pip value can greatly influence the profitability of transactions. Increased leverage amplifies the impact of each pip movement due to the larger total value of the position compared to the initial investment. Therefore, minor adjustments in pip value could lead to significant percentage fluctuations in account equity, magnifying both profits and losses. Grasping this connection is essential for successful risk management in forex trading.

The impact of leverage on pip value

To determine the pip value in forex trading, you need to multiply the trade size by one pip. If you traded 100,000 units of EUR/USD with one pip equaling 0.0001, the value of one pip would be $10 after calculating 100,000 x 0.0001. This indicates that with each one pip movement, the trade's financial worth changes by $10. This calculation is based on the assumption that no leverage is used.

When leverage is utilized, the pip value rises as the position size expands compared to the trader's initial investment. If a trader utilizes a 100:1 leverage with 100,000 units of EUR/USD, they would only require $1,000 of their own capital. Even with a reduced capital requirement, the pip value stays at $10 due to the consistent volume of currency being traded. Nevertheless, the effect on the trader's profit compared to their initial investment is greatly increased.

Examples: Take two traders who both enter a trade in EUR/USD with leverage of 100:1, but with varying account balances. Trader A leverages $1,000 of their own money to command $100,000 in currency, whereas Trader B utilizes $500 to oversee $50,000. A one pip movement will have a proportional effect on both traders according to the amount they control, but the impact on their return depends on the capital they have invested. A loss of 10 pips would decrease Trader A's capital by 10%, while Trader B's capital would decrease by 20%, showing how leverage magnifies both profits and losses in comparison to the actual investment amount.

Pros and cons of utilizing leverage in forex trading

Possible benefits: Utilizing leverage in forex trading has the potential to greatly increase earnings through small changes in currency values. Through the use of leverage, traders are able to enhance their purchasing ability, enabling them to initiate larger trades than they could with just their available cash balance. For instance, by using a leverage ratio of 100:1, a trader can manage a significant position with just 1% of its value required as margin. This configuration has the potential to result in significant profits if the currency shifts in a positive direction, even by a slight amount, since the return is based on the overall value of the investment.

Possible risks: Although leverage can boost potential gains, it also heightens the risk of losses. If the trader's position is impacted by the currency moving in the opposite direction, losses may rapidly increase, possibly surpassing the initial investment. Excessive leverage may result in margin calls, requiring the broker to ask for more funds to uphold current positions. If funding is not provided, positions could be closed forcibly, or the account could be liquidated.

Risk management strategies: In order to reduce the risks linked with leverage, traders need to utilize risk management strategies. This involves placing stop-loss orders that will close positions at a specific price to control losses. Moreover, it is essential to comprehend and comply with margin requirements. Traders should consider using more cautious leverage ratios to help manage their exposure and minimize the risk of significant losses during periods of market volatility.

Comprehending the dangers: losses, margin calls, and liquidation

Using leverage can amplify profits, but it also significantly raises the chances of experiencing significant losses. The main danger is that losses can be amplified as well, so a slight drop in market price could result in a much bigger loss compared to the trader's original investment. If a trader employs 100:1 leverage and the market shifts 1% opposite the position, it might lead to a loss equivalent to 100% of the trader's initial margin, potentially erasing the entire account without a stop-loss in position.

Using high leverage increases the risk of margin calls significantly. These happen when the account's value drops below the broker's necessary margin level. In these situations, the trader has to either deposit additional funds into the account to satisfy the margin criteria or risk having their positions forcibly sold to make up for the deficit. This may occur rapidly in unstable markets, giving the trader little opportunity to respond.

Liquidation of an account is the most serious outcome of an unsuccessful margin call. If a trader is unable to meet the margin requirement, the broker will liquidate all active positions at the prevailing market rates. This measure is typically implemented in order to avoid additional losses that may jeopardize the broker. Comprehending these dangers and handling leverage smartly is crucial for long-term success in forex trading.

Useful advice for traders

Selecting the correct leverage is essential and should be customized to suit each trader's individual style and risk tolerance. Conservative traders, or beginners in forex trading, may choose to use lower leverage like 10:1 or 20:1 in order to decrease their level of risk. Seasoned traders may be more at ease with increased leverage, however, it is crucial to take into account the volatility of the market and the particular currency pair being traded. When determining leverage levels, it is important to take into account factors such as economic announcements and market liquidity.

Instruments and materials: Different resources are available to help traders accurately calculate pip value and handle leverage efficiently. Forex calculators found on various trading platforms enable traders to enter their currency pair, trade size, and leverage for automated pip value calculation. Furthermore, tools for managing risk such as margin calculators assist traders in determining the necessary capital to hold their positions and prevent margin calls.

Top methods: Utilizing responsibly requires continuous oversight of available positions and market circumstances. Traders need to modify their leverage according to shifts in market volatility and individual performance measures. During periods of high volatility or when facing losses, it is recommended to reduce the amount of leverage in order to protect capital. Utilizing stop-loss orders and frequently evaluating position sizes in relation to account equity are also recommended strategies for effectively managing risks caused by leverage.

Conclusion

Important aspects like the possible benefits of utilizing high leverage highlight its attraction as a potent trading instrument that can amplify earnings from small price fluctuations. Nevertheless, we also pointed out the dangers linked to its improper use, such as higher chances of notable losses, margin calls, and even account liquidation. It is crucial to implement effective risk management strategies, which include using stop-loss orders, following appropriate margin requirements, and choosing suitable leverage ratios according to individual risk tolerance and market conditions.

Ultimately, utilizing leverage strategically is crucial to harness its advantages in forex trading. Traders should carefully consider their personal trading style and the current market conditions when dealing with leverage. By taking advantage of this opportunity, they can use their resources wisely, improving their trading results while reducing the chance of negative financial consequences.