Fractals forex strategy

When looking at price chart of various forex pairs, price movement may appear random on any type of chart either line chart, bar chart or candlestick chart but when closely looked into on the candlestick chart, various repeating candlestick patterns can be clearly identified.

One of the candlestick patterns mostly used when charting and performing technical analysis of the financial markets and forex, in particular, is Fractals.

Fractal is a common term and a very significant candlestick pattern widely used by professional forex traders to have a clearer view of the fluctuations, market structure and direction bias of a forex or currency pair.

How to identify a fractal pattern

Fractals are the underlying five-bar candlestick reversal pattern that forms the underlying tops and bottoms of price movement whenever it changes direction.

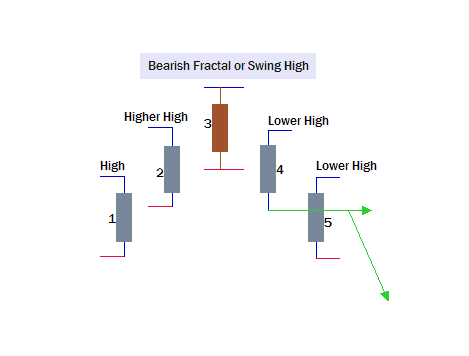

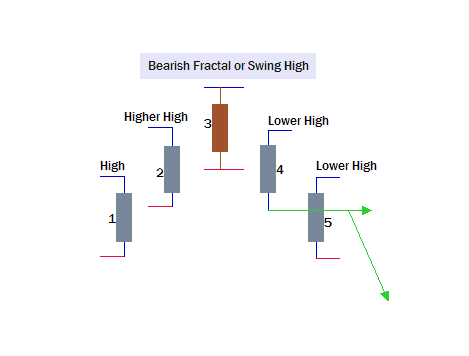

Bearish fractal can be identified by two candlesticks with a consecutive upper high from the left, one candlestick at the top and two candlesticks with a consecutive lower high at the right.

Image of a bearish fractal

A bearish fractal is confirmed valid when the 5th candlestick trades below the low of the 4th candlestick. When this happens, the momentum of price movement is expected to continue trading lower until a level of support is met.

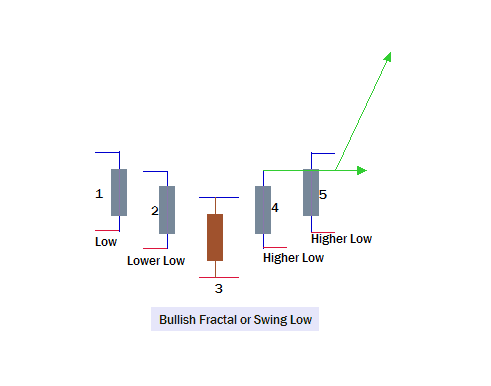

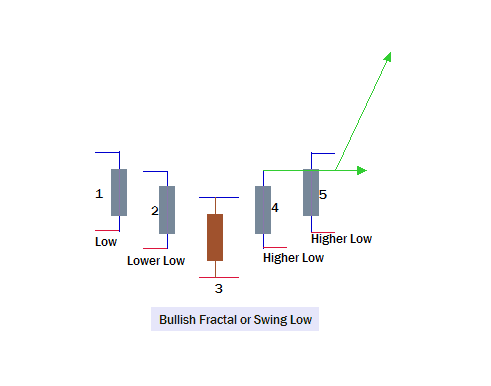

Bullish fractal can be identified by two candlesticks with a consecutive lower low from the left, one candlestick at the bottom and two candlesticks with a consecutive higher low at the right.

Image of a bullish fractal

A bullish fractal is confirmed valid when the 5th candlestick trades above the high of the 4th candlestick. When this happens, the price is expected to continue trading higher until a level of resistance is met.

This generic formation of price pattern is also known as a swing high, ring high or swing low, ring low.

Useful tips about the fractal patterns

Fractals are used to identify the current momentum or direction bias of a forex/currency pair so that traders can get in sync with the current direction of price movement and profit from the momentum in price but the flaw is that it does not predict the reversal or change in the direction of price move at the exact top of a bearish fractal or at the exact bottom for a bullish fractal.

Fractal forex trading strategy work for all trading styles such as scalping, short term trading, swing trading and position trading. The downside to swing trading and position trading on higher timeframe charts is that setups take longer time and even weeks to form but the frequency of setups for short term trading and scalping is relatively okay to practice, grow and double your account size consistently over the period of 1 year.

The fractals forex indicator

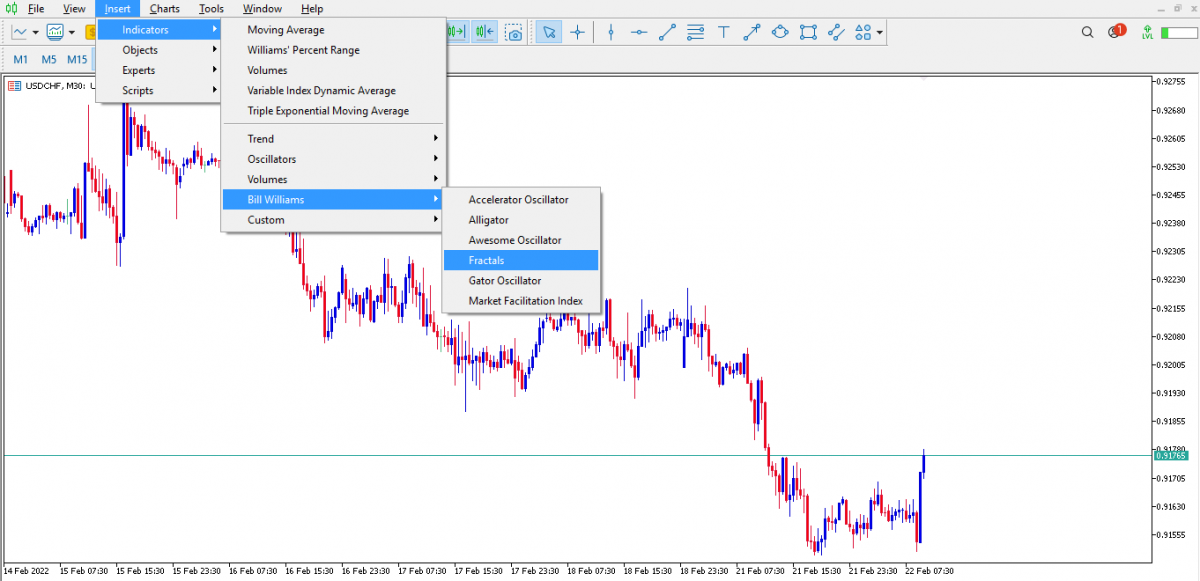

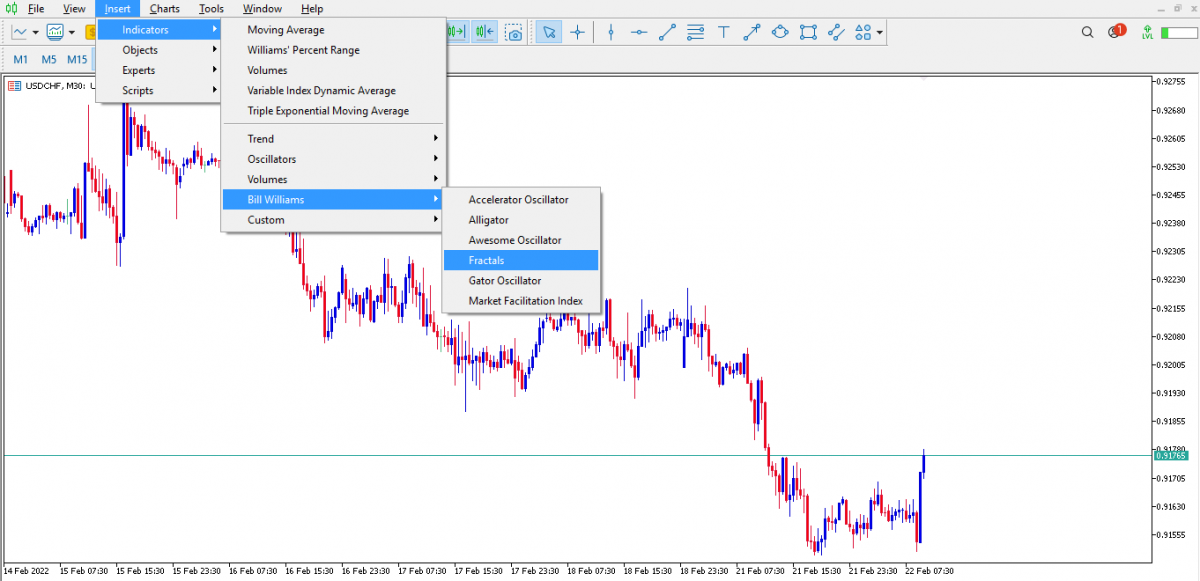

A piece of good news to charters and technical analysts that employ fractals in their analysis of the forex market is that traders don't have to identify fractals manually, rather they can automate the identification process by using the fractal forex indicator available on charting platforms like mt4 and tradingview.

The fractal indicator is among the indicators in the Bill Williams section because they were all developed by Bill Williams a well-known technical analyst and successful forex trader.

Image of Bill Williams Indicators and the fractal indicator.

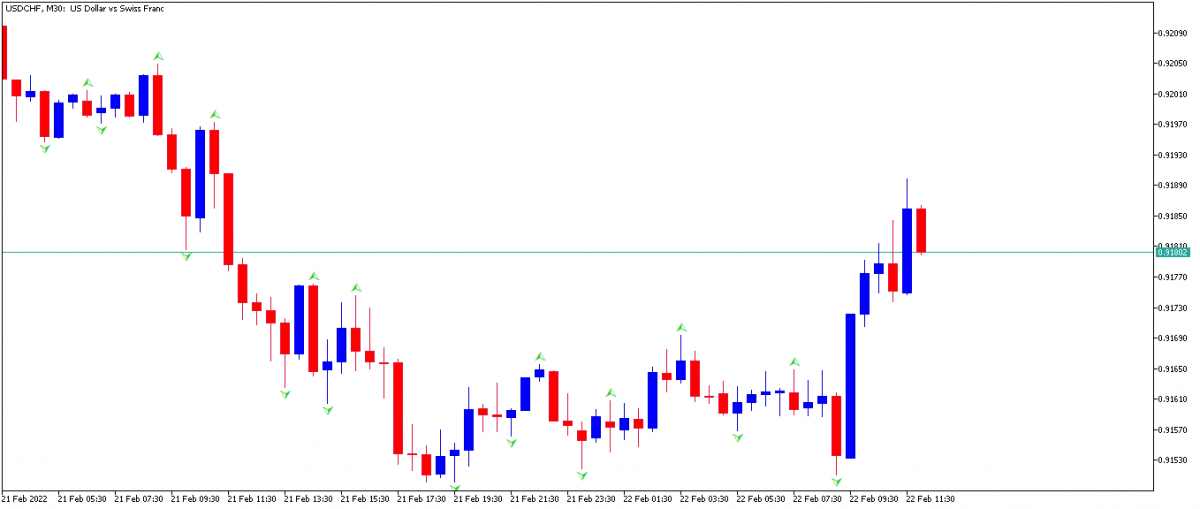

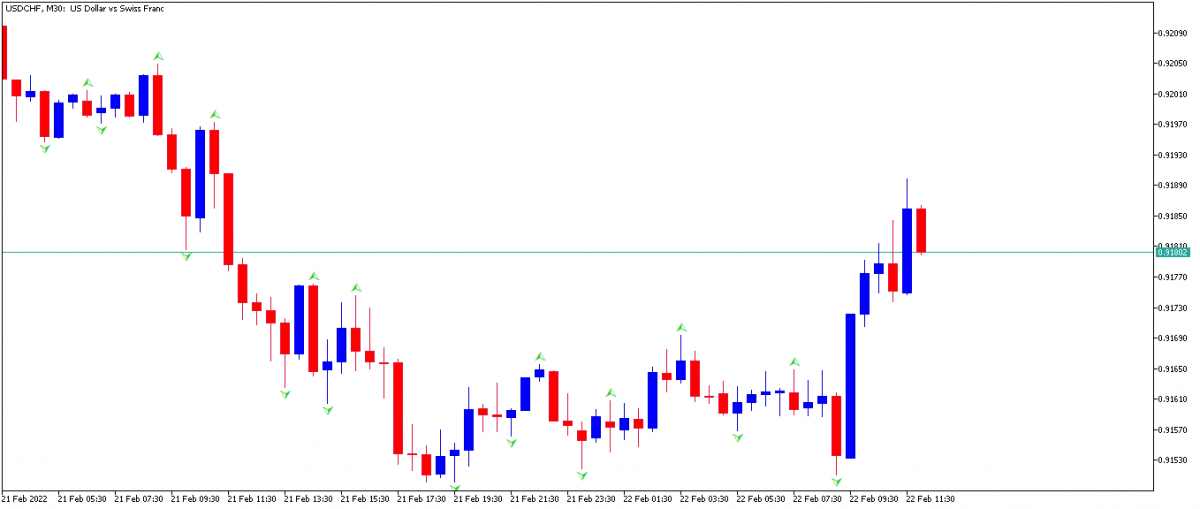

The indicator helps to identify previously formed, valid fractals with an arrow sign thereby providing traders with insights about the historical and structural behaviour of price movement and also the indicator identifies fractal signals that form in real-time for traders to profit from the current momentum or direction of price movements.

Guide to trading the forex fractals effectively

Trading the fractal signals can be very effective and highly profitable when the trade setups are based on market structure analysis, trend and combination of other indicators but here we will go through a simple forex fractal trading strategy that implements only the Fibonacci tool for confluence setups.

The Fibonacci retracement levels are used to pick optimal entries and the Fibonacci extension levels are used for profit target objectives in short term trading and scalping.

You might have to read through the following steps of the trading plan over again to gain proper understanding of this fractal forex trading strategy.

Trading plan for short term and scalping buy trade setups

Step 1: Identify a bullish daily bias by a bullish market structure break on the daily chart;

How?

Wait for a fractal high or a swing high on the daily chart to be broken through by a bullish price move: this will indicate a bullish stage or bullish bias.

It doesn't mean to buy right there, instead, it means to be on alert for a specific criteria to scout for a high probable buy setup.

Step 2: Wait for a retracement, followed by a fractal low (swing low) to form.

Note that this swing low should not take out any recent swing low.

In summary, we have a bullish market structure break and then a higher low in the form of a retracement after the break of a short term high.

This means waiting for the major market participants to get back in line with the momentum on the upside.

Step 3: At the formation of the swing low, anticipate the high of the 4th daily candle to be traded through the next day. If this happens, the momentum on the daily chart will most likely remain in motion for a few days.

Therefore we will look for reasons to go bullish with the Fibonacci retracement levels either short-term or scalping.

For short term trade setups using the fibonacci retracement levels.

- After a swing low have formed on the daily chart

- Drop down to the 4hr or 1hr timeframe.

- Undo the Fractal indicator on the chart

- Use the Fibonacci tool to scout for optimal trade entry long setup at the Fibonacci retracement levels (50%, 61.8% or 78.6%) of a significant price move.

- 50 - 200 pips profit objective is possible

For scalp or intraday trade setups using the fibonacci retracement levels.

- When the Daily bias is already confirmed bullish.

- We will drop down to the lower timeframe between (1hr - 5min) to target raids on liquidity above Previous Day lows on lower timeframe (1hr - 5min).

- There will be a retracement on or before 7 am New York time

- Between 7-9 am New York time, we'll employ the Fibonacci tool to scout for optimal trade entry long setup at the Fibonacci retracement levels either 50%, 61.8% or 78.6%.

- For profit targets, expect price to reach for target 1, 2 or symmetrical price swing on the Fibonacci extension level.

- Aim for a minimum of 20 - 25 pips profit objective

Classic example of a scalp buy trade setup on EURUSD

Trading plan for short term and scalping sell trade setups

Step 1. The First step is to identify a bearish daily bias by a market structure break;

How?

On the daily chart, wait for a fractal low or a swing low to form and be broken through by a bearish price move: this will indicate a bearish stage or bearish bias.

It doesn't mean to sell right there, instead, it means to be on alert for a specific framework to scout for a high probable sell setup.

Step 2. Wait for a retracement, followed by a fractal high (swing high) to form.

This means waiting for the major market participants to get back in line with the bearish momentum after the retracement.

Note that this swing high should not take out any recent swing high.

To summarize we have a bearish market structure break, a lower high in the form of a retracement after the break of a short term low and then waiting for the major market participants to get back in line with the bearish momentum to the downside.

Step 3: At the formation of the swing high, anticipate the low of the 4th daily candle to be traded through the next day. If this happens, the momentum on the daily chart will most likely remain in a decline for a few days.

Therefore we will look for reasons to go bearish with the Fibonacci retracement levels either short-term or scalping.

For short term sell trade setups with the fibonacci retracement levels.

- After a swing high has formed on the daily chart

- Drop down to the 4hr or 1hr timeframe.

- Undo the Fractal indicator on the chart

- Use the Fibonacci tool to scout for optimal trade entry sell setup at the Fibonacci retracement levels (50%, 61.8% or 78.6%) of a significant bearish price move.

- 50 - 200 pips profit objective is possible.

Classic example of a short term sell trade setup on EURUSD

For scalping or intraday sell trade setups with the fibonacci retracement levels.

- When the Daily bias is already confirmed bearish.

- We will drop down to the lower timeframe between (1hr - 5min) to target raids on liquidity above Previous Day lows on lower timeframe (1hr - 5min)

- There will be a retracement on or before 7 am New York time

- Between 7-9 am New York time, we'll employ the Fibonacci tool to scout for optimal trade entry sell setup at the Fibonacci retracement levels (50%, 61.8% or 78.6%) of a significant price move.

- For profit target objective, expect price to reach for target 1, 2 or symmetrical price swing on the Fibonacci extension level or rather, aim for a minimum of 20 - 25 pips profit objective

Important risk management advice

This setup will not form every single day, but if you look at a few majors paired against the dollar. About 3 - 4 solid setups will form in a week.

While you practice this trading strategy on a demo account it is important to also practise discipline and risk management because this is the only protection to keep you in the trading business.

Over leveraging your trades will impede your development as a trader and drastically decrease your chances of seeing responsible equity growth.

With this strategy, you only need about 50 pips per week, risking only 2% of your account per trade setup. It will take nothing less than 25 pips to make 8% on your account monthly and double your equity by compounding over the course of a 12 month period.

Note that The Highest probable time of the day to trade this setup is either the London or New York trading session.

Click on the button below to Download our "Fractals forex strategy" Guide in PDF