Forex weekly trading strategy

In the fast-paced world of forex trading, traders face numerous challenges, including market volatility, rapid price fluctuations, and the constant pressure to make quick decisions. To navigate these obstacles successfully, adopting a well-thought-out trading strategy becomes essential.

Understanding forex weekly chart strategy

Embracing the weekly time frame in forex trading unveils a dynamic approach that yields valuable insights into market trends and price movements. With each candlestick representing a week's worth of price action, the weekly time frame allows traders to grasp the broader market context. By stepping back from the noise of lower time frames, traders can better identify long-term trends and significant price levels, providing a solid foundation for strategic decision-making.

When comparing different time frames in forex trading, the weekly chart stands out as a powerful tool for trend analysis and risk management. While shorter time frames may offer more frequent trading opportunities, they often generate increased market noise and false signals. On the other hand, higher time frames, such as monthly or quarterly, may need more granularity for timely entries and exits. The weekly time frame strikes a balance between capturing substantial price moves and avoiding the distractions of intraday fluctuations.

Focusing on weekly charts presents traders with several advantages. Firstly, it allows for a more relaxed and less time-consuming trading approach, suitable for those with busy schedules or seeking a less emotionally charged trading experience. Secondly, weekly charts provide reliable trend signals, reducing the risk of making impulsive decisions based on short-term market fluctuations. Lastly, weekly charts enhance the clarity of support and resistance levels, facilitating accurate identification of potential entry and exit points.

Key elements of a successful weekly time frame strategy

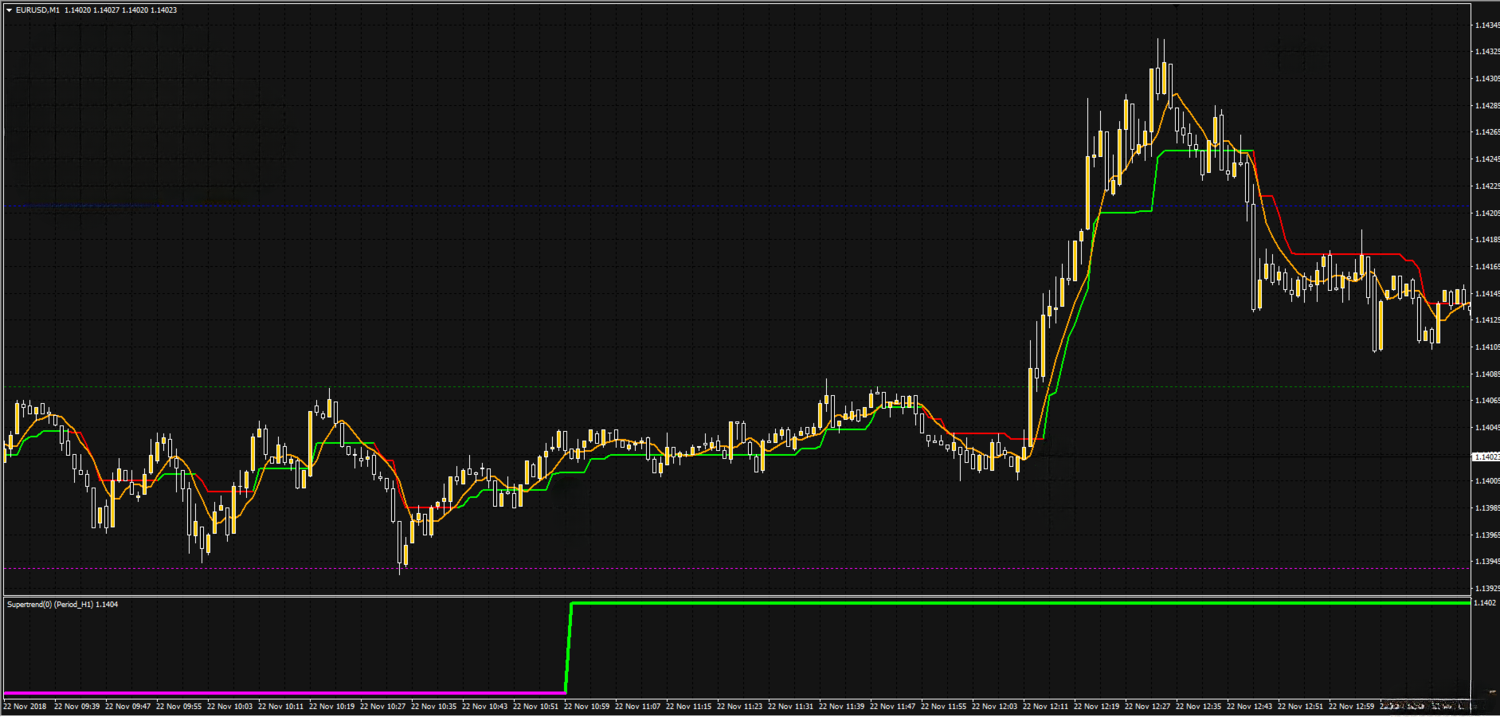

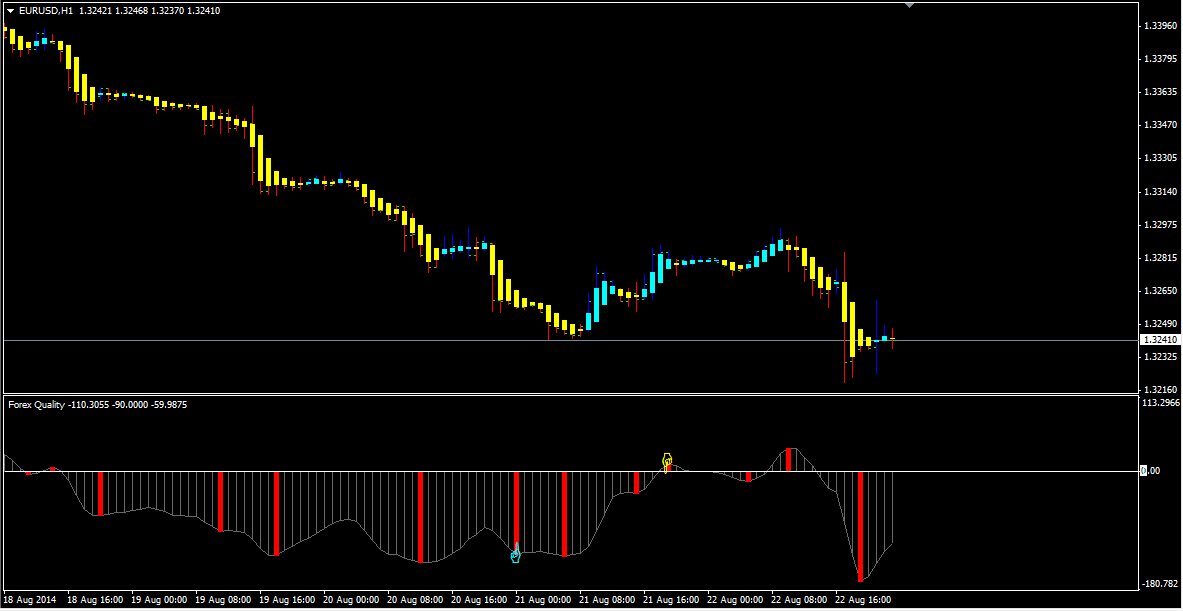

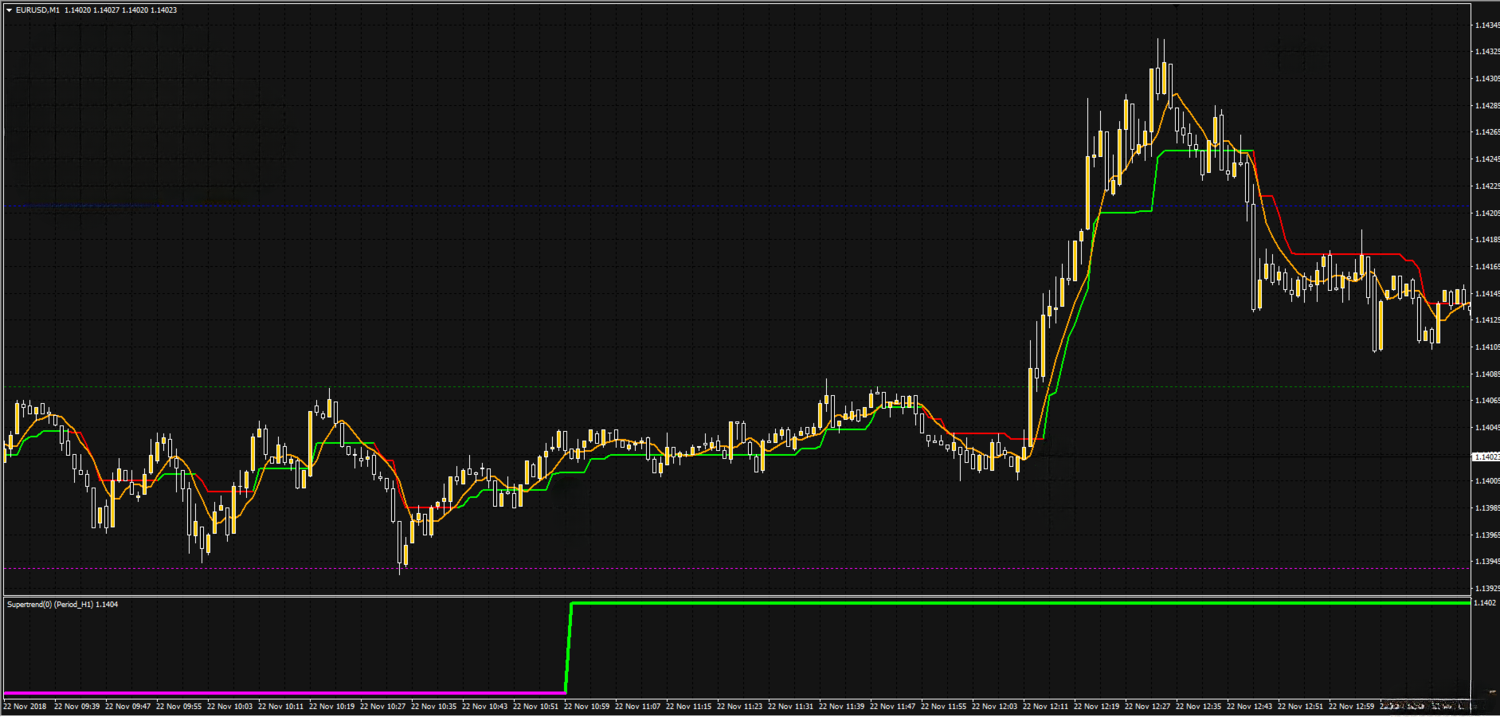

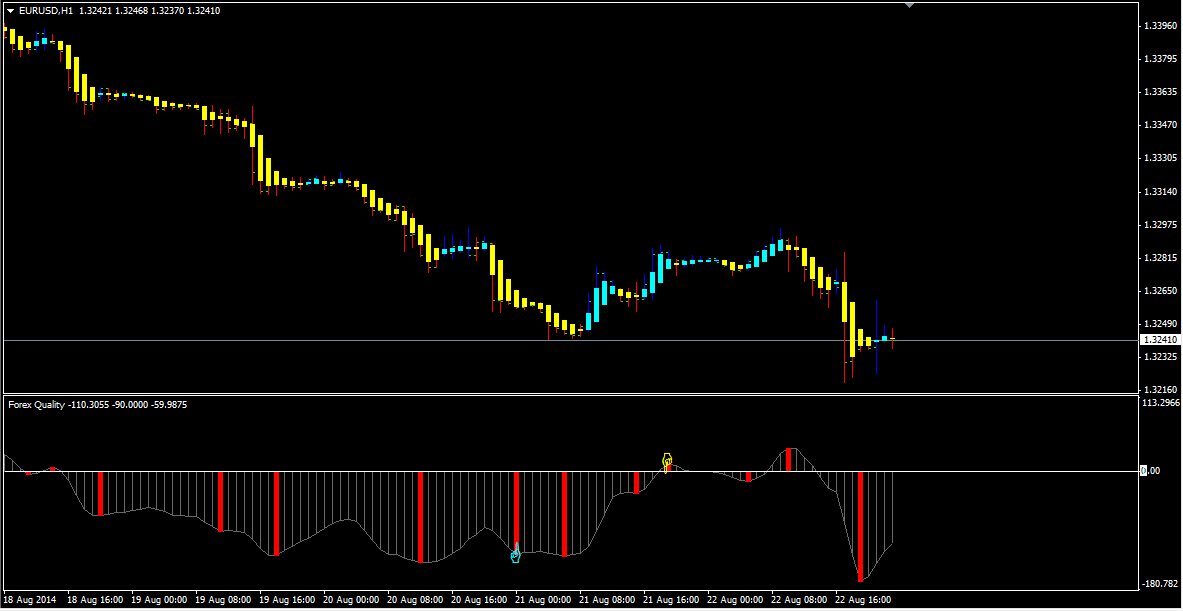

Incorporating a forex weekly chart strategy necessitates focusing on identifying the prevailing trend. Technical indicators, such as Moving Averages, MACD, and RSI, serve as valuable tools for trend analysis on the weekly time frame. By examining price movements over an extended period, traders can gain a clearer perspective on the market's direction and potential reversals. Additionally, plotting support and resistance levels on the weekly chart aids in recognizing crucial price zones, and guiding traders in making well-timed entry and exit decisions.

Weekly candlestick patterns carry significant weight in weekly trading strategies. Recognizing popular candlestick patterns, such as Doji, Hammer, and Engulfing patterns, can offer valuable insights into potential trend reversals and continuations. The weekly chart's larger time frame enhances the reliability of these patterns, making them more robust signals for traders. Interpreting these patterns effectively helps traders gauge market sentiment and confidently make informed trading choices.

While technical analysis is crucial in weekly trading, integrating fundamental analysis complements the overall strategy. Economic events can significantly impact currency pairs on the weekly time frame, leading to substantial price movements. Traders should stay informed about scheduled economic releases, central bank decisions, and geopolitical developments to understand the fundamental forces shaping the market. By considering fundamental factors alongside technical analysis, traders can fine-tune their weekly trading strategy for more accurate and rewarding outcomes.

The forex weekly open strategy

The forex weekly open strategy revolves around understanding and leveraging the concept of weekly opening prices. As the forex market operates 24/5, each trading week commences with the opening price of the first trading session. Traders closely monitor this price level as it provides a crucial reference point for the week ahead. By paying attention to how price reacts to the weekly open, traders can gain insights into market sentiment and potential price directions.

Executing trades based on the weekly open involves employing different trading approaches. One such method is the "breakout strategy," where traders enter positions when price breaches the weekly open level. This signifies a potential shift in market sentiment and can lead to significant price movements. Another approach is to use the weekly open as a reference point to confirm existing trade signals from other technical or fundamental analysis methods, strengthening the overall trading decision.

Effective risk management is paramount when implementing the forex weekly open strategy. Traders must consider stop-loss and take-profit levels based on the weekly open price and the overall market conditions. Position sizing should align with risk tolerance and account size to ensure prudent capital preservation. Moreover, traders should be mindful of potential gaps in price during the market open, which can impact stop-loss orders. By integrating risk management practices, traders can safeguard their capital while maximizing the strategy's profit potential.

Weekly candle close strategy

The weekly candle close holds significant importance in the forex market, serving as a key reference point for traders. As the trading week concludes, the closing price of the weekly candle reflects the market's sentiment over the entire week. This price level encapsulates market participants' collective actions and decisions, providing valuable insights into the market's strength and direction.

Traders often use the weekly candle close for trade confirmation. When a particular trading signal or pattern emerges during the week, waiting for the weekly candle to close before executing a trade adds an extra layer of validation. Confirming the signal based on the weekly candle close reduces the risk of false breakouts or premature entries, ensuring that traders enter positions with higher conviction.

While the weekly candle close strategy offers advantages, traders must be cautious of potential pitfalls. One common mistake is basing trade decisions solely on the weekly candle without considering other relevant factors, such as trendlines, support and resistance levels, or fundamental analysis. Additionally, traders should be mindful of market gaps that may occur over the weekend, potentially impacting their positions when the market reopens. By incorporating the weekly candle close strategy as part of a comprehensive trading approach, traders can optimize its benefits while mitigating its limitations.

Backtesting and optimizing the weekly time frame strategy

Backtesting stands as a vital step in validating the effectiveness of a forex weekly time frame strategy. By using historical price data, traders can simulate their chosen strategy and assess its performance over past market conditions. Through backtesting, traders can gain valuable insights into the strategy's strengths and weaknesses, identifying potential areas for improvement. It also helps in understanding the strategy's historical win rate, risk-reward ratio, and drawdowns, providing a more realistic expectation of its future performance.

Choosing suitable parameters is crucial for optimizing the weekly time frame strategy. Traders should carefully adjust and fine-tune indicators, entry/exit rules, and risk management settings to achieve optimal results. This process involves striking a balance between simplicity and complexity, ensuring the strategy remains practical and robust. By systematically optimizing the strategy, traders can adapt it to various currency pairs and market conditions, enhancing its versatility and potential profitability.

The journey to success with the weekly time frame strategy does not end with backtesting and optimization. Markets continuously evolve, and strategies that once thrived may require adjustments to remain effective. Traders should continually refine and adapt their strategies based on changing market dynamics, integrating new insights and lessons from real trading experiences. This iterative process ensures the strategy remains relevant and resilient, allowing traders to stay ahead in the ever-changing forex landscape.

Risk management and position sizing

Implementing robust risk management practices is paramount for traders adopting the forex weekly time frame strategy. This approach involves setting clear guidelines for risk exposure on each trade to protect capital from significant losses. Traders can employ risk management techniques, such as setting a fixed percentage of their trading capital as the maximum risk per trade or using a fixed dollar amount. Additionally, implementing stop-loss orders based on key support, resistance levels, or technical indicators helps limit potential losses and preserve capital.

Determining appropriate position sizes is an integral part of risk management in weekly trading. Traders must strike a balance between maximizing profit potential and managing risk. Position sizing should consider the specific currency pair's volatility, the distance to the stop-loss level, and the trader's risk tolerance. Properly sized positions allow traders to withstand market fluctuations without jeopardizing their trading capital, fostering consistency and longevity in their trading journey.

Combining risk management with the weekly strategy ensures that traders execute their trades disciplined. The weekly time frame offers more significant price swings, and holding positions for an extended period can be emotionally challenging. Staying true to the risk management plan and position sizing rules helps traders maintain a rational mindset, reducing the emotional impact of individual trades and preventing impulsive decisions that can lead to losses.

Psychological considerations in weekly trading

Trading on a longer time frame, such as the weekly chart, poses unique psychological challenges for traders. Unlike shorter time frames where trades unfold rapidly, the weekly strategy demands a heightened level of patience and emotional composure. Enduring prolonged periods between trade setups and waiting for the weekly candle to close can test a trader's discipline and confidence in their chosen approach. Moreover, the slow pace of weekly trading can lead to feelings of anxiety or restlessness, prompting traders to overtrade or abandon their strategy prematurely.

Developing discipline and patience is crucial for traders adopting the weekly time frame strategy. This involves adhering strictly to the trading plan, avoiding impulsive decisions, and resisting the urge to chase trades outside the set criteria. Traders must recognize that not every week will present a suitable trading opportunity and learn to embrace patience as a virtue. By maintaining a consistent and disciplined approach, traders can stay focused on the bigger picture and resist emotional reactions to short-term market fluctuations.

Coping with drawdowns and losing streaks is an inevitable aspect of trading. With its longer holding periods, the weekly time frame strategy may expose traders to more extended drawdowns compared to shorter time frames. It is crucial to maintain a positive mindset during challenging times, refraining from making revenge trades or deviating from the established risk management plan. Successful traders view drawdowns as part of the learning process and use them as opportunities to refine their strategy and enhance their skills.

Conclusion

The forex weekly time frame strategy offers a compelling approach to navigating the complexities of the forex market. By focusing on broader market trends and employing robust technical and fundamental analysis, traders can gain valuable insights that lead to well-informed trading decisions. The significance of the weekly candle close and the strategic use of the weekly opening price add further depth to this approach, enhancing the trader's ability to identify potential entry and exit points more precisely.

Encouragement for traders to explore and test the forex weekly chart strategy lies in its potential to unlock long-term profitability. As traders embrace the discipline and patience required, they can harness the power of this strategy and capitalize on the substantial price moves that unfold on the weekly time frame. Through rigorous backtesting and optimization, traders can refine their approach, adapt to changing market conditions, and build a resilient strategy that withstands the test of time.

In the quest for long-term success in forex trading, traders must not underestimate the psychological aspect of the journey. Developing mental fortitude, practising risk management, and maintaining discipline are crucial to achieving consistent results. By combining sound strategy with a positive mindset, traders can overcome challenges, cope with drawdowns, and ultimately thrive in the forex market.