Forex GBP USD trading strategy

One of the largest economies in the world is the UK. Its currency, the Great British Pound (GBP), a very popular currency, makes the list of the major currencies in the world and furthermore one of the most traded forex instruments due to its sufficient liquidity and volatility.

In the forex trading market, every forex pair has its own characteristics. GBPUSD is well known among Forex traders to be the most volatile major currency as well as other GBP pairs.

Until the early 1970s, The Pound and USD had been previously pegged to the gold standard but began to be traded as a pair after the UK and the United States decided to shift to free-floating exchange rates.

Overview of GBPUSD forex pair

Another popular name for the GBPUSD forex pair is ‘The Cable’. The pair represents the price of the British pound's exchange rate against the US dollar (two of the world's largest economies), thus making it one of the most liquid and most traded forex pairs in the world.

Basic parameters of the GBPUSD forex pair

- Quote and base currency

The base currency of the GBPUSD forex pair is the British pound while the quote currency is the US dollar. The quote 'GBPUSD' simply indicates the exchange rate of how much USD is needed to purchase one unit of GBP, the base currency.

Take, for instance, the price of GBPUSD is quoted at 2.100.

To buy GBPUSD, you need to have 2.100 USD to purchase one unit of GBP and to sell the GBPUSD, you will receive 2.100 USD for one unit of GBP.

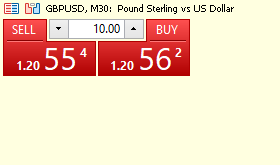

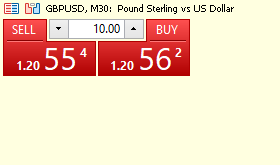

- Bid and ask price

Forex pairs are always quoted with two prices, the bid and ask price which is constantly changing relative to price movement. The difference between the bid and ask price is the cost of trading called ‘spread’.

In the example above, the spread is less than 1 pip

1.20554 - 1.20562 = 0.00008

By using the 0.0001 Forex pip measurement, the 0.00008 spread would mean a spread value of 0.8 pips).

If you buy at the ask price and close the trade sooner or later at that same ask price you would lose 0.8 pips because your long trade position will be closed at the bid price of 1.20554. Therefore, a long trade position at the ask price of 1.20562 must move 0.8 pips and higher in order to profit from the trade.

For long trade setup

Assume a long trade, opened at the ask price of 1.20562 and price movement rally high to Bid/Ask price of 1.2076/1.2077.

The trader can exit at the bid price of 1.2076 with 20 pips in profit i.e (1.2076 - 1.2056).

Howbeit, if price movement had declined from 1.2056 down to Bid/Ask price of 1.2036/1.2037. The trader will incur some loss of 20 pips at the exit price.

For short trade setup

Assume a short trade, with entry at the ask price of 1.20562 and price movement declines to Bid /Ask price of 1.2026/1.2027.

The trader may exit at the bid price of 1.2026 with 30 pips in profit i.e (1.2056 - 1.2026).

Howbeit, if the price movement had moved otherwise and rallied up from 1.2056 up to Bid/Ask price of 1.2096/1.2097. The trader will incur a loss of 40 pips at the exit price

Using fundamental analysis to trade GBPUSD

Many beginner traders get stuck in curiousity about the factors that impact the GBPUSD exchange rate because if they can monitor the fundamental factors that influence the GBPUSD exchange rate they will be able to have a good forecast and an precise predictions of the direction of price movement.

There are plenty of economic reports and news announcements that traders should focus on for this particular pair.

- Interest rates:

In the forex market, central banks' activities are the major driver of price movement and volatility. The Bank of England and the Feds’ decisions on interest rates have a major impact on the GBPUSD currency pair.

Key members of the bank of England meet once every month to review their Monetary Policy Summary Report so as to come to conclusions on whether to cut interest rates, increase interest rates or maintain the interest rate. Key members of the fed are also tasked with making interest rate decisions and the reports are usually released as FOMC.

If there is optimism about rising interest rates from the Bank of England, the price movement of GBPUSD will rally higher but on the contrary, it price movement will decline on threats of interest rate cuts.

- Political events

Political events such as government elections, change in political parties and Brexit is among the key drivers of the GBPUSD forex price movement.

Brexit is a major threat to the British Pound as it previously collapsed the British pound exchange rate to the Dollar and other foreign currencies.

- Economic data

There are other economic data reports with short-term influence on the GBPUSD pair. They include the gross domestic product report (GDP), retail sales, employment figures, inflation e.t.c.

- The Pound and Dollar have respective GDP reports of their countries. GDP is a quarterly report that measures the level of economic activity or in other words, measures the monetary value of all finished goods and services made within the perimeters of a country over a specified period of time. This report, being the earliest to be released, does provide traders early assessment of a country’s economy.

- NFP, a short acronym for the Non-Farm Payroll of the United States, is the most watched employment figure that strongly affects the volatility of the GBPUSD forex pair. The monthly report is the statistic of the number of jobs gained or lost in the United States over the previous month. Any significant and unexpected report from analyst expectations have always driven the volatility of GBPUSD wild in both directionsdirections within seconds and moments after the release. It is very important to stay hands off the charts and close all running trades before the release of the NFP report because of the enormous volatility that will potentially be impacted on the GBPUSD price movement. Only professional traders with a certain level of experience are expected to trade the NFP news.

- It is also important that traders pay very close attention to inflation figures in the United States and in the UK. These figures are greatly affected by the interest rate of both countries.

- Other news reports include the consumer price index (CPI), the producer price index (PPI), trade balance, ISM e.t.c.

Using technical analysis to trade the GBPUSD forex pair

There are a lot of forex trading strategies that can be used to trade the GBPUSD forex pair but there are a few with consistent profitable results that makes the best of GBPUSD trading strategies because they apply to all timeframes and they can also be combined with other forex trading strategies and indicators. These strategies are also universal because they can be used for scalping, day trading, short-term and long-term trading.

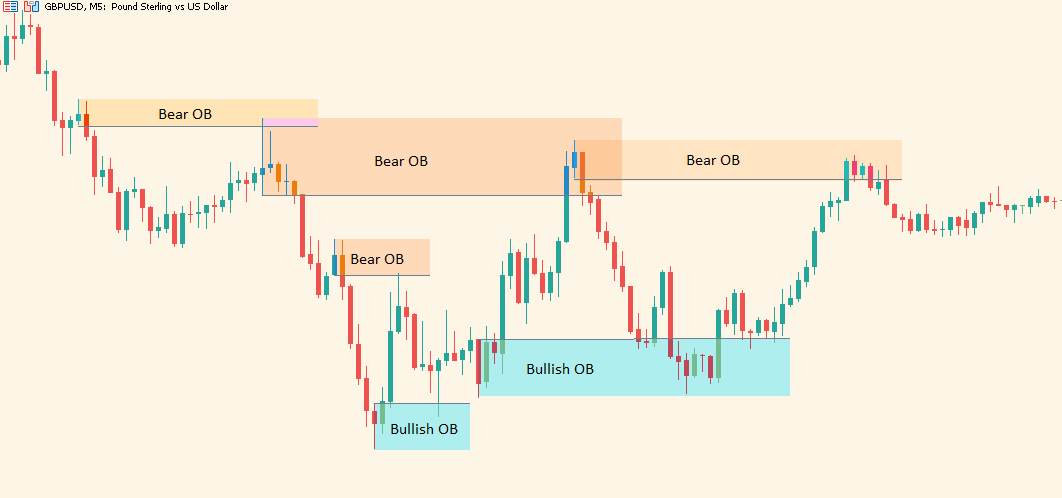

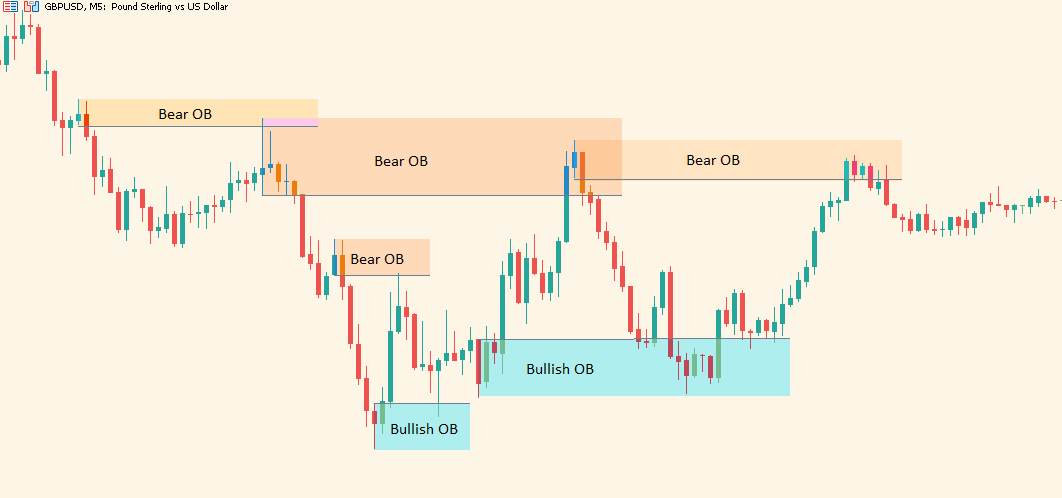

- Orderblock trading strategy: Order Blocks (OBs) unveil levels of high probability institutional supply and demand on any timeframe. They are represented by the last up candle and the last down candle at the extreme and origin of price movement.

5-Minute GBPUSD scalping strategy using Orderblocks

- Exponential Moving averages (EMAs): Moving averages is the most ideal technical indicator for identifying trends of the GBPUSD price movement because

- It displays the slope (average calculation) of the candlesticks opening and closing prices for a certain period of time.

- And it identifies trend support and resistance levels.

GBPUSD Ema trading strategy

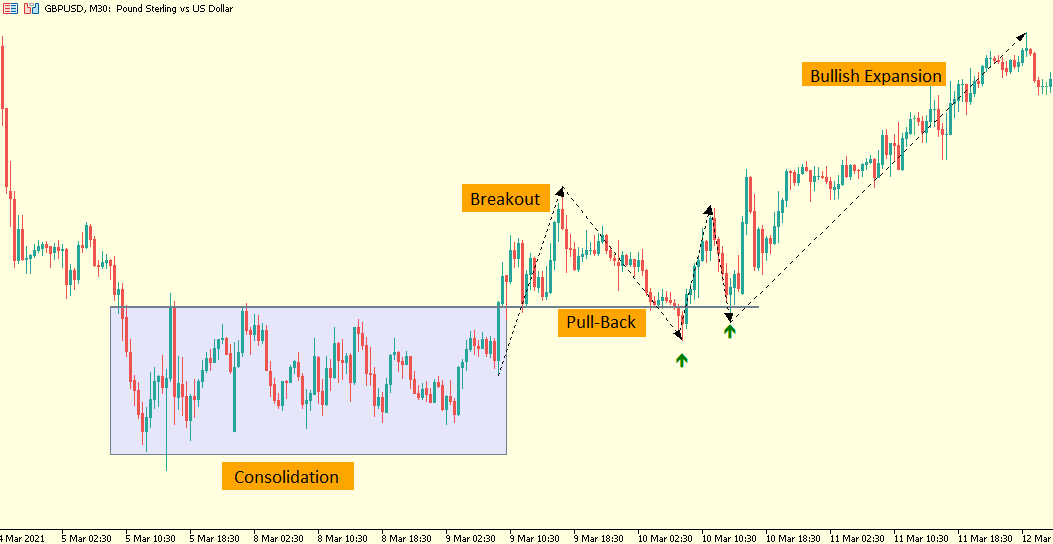

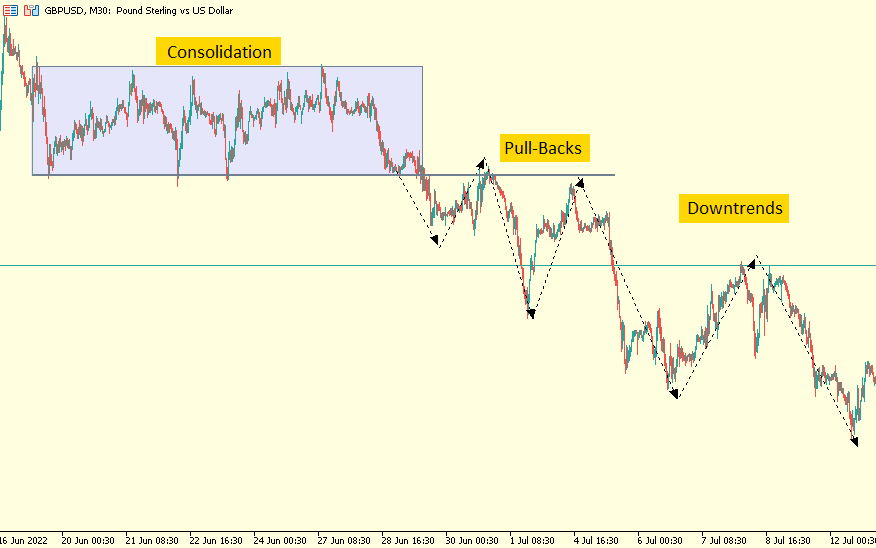

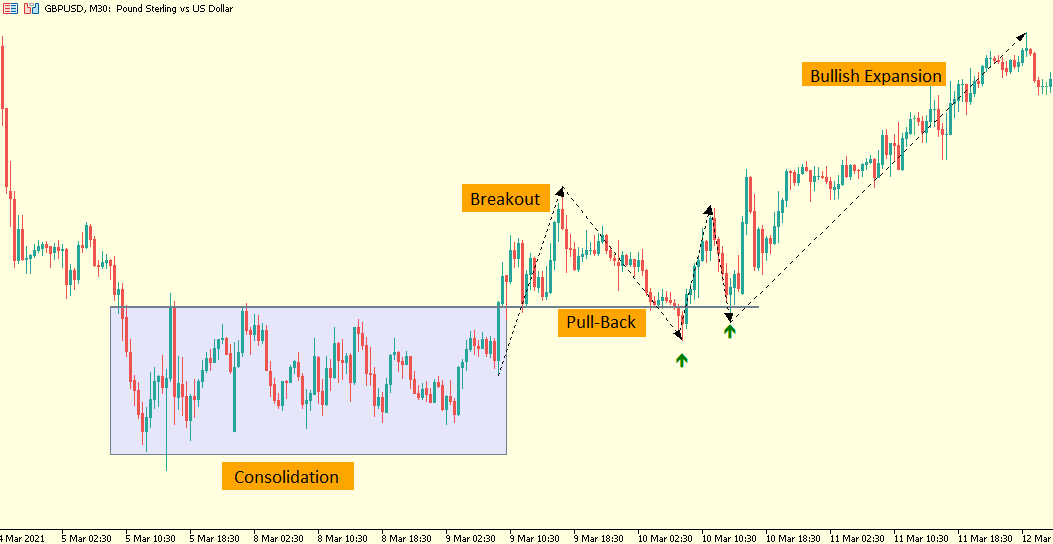

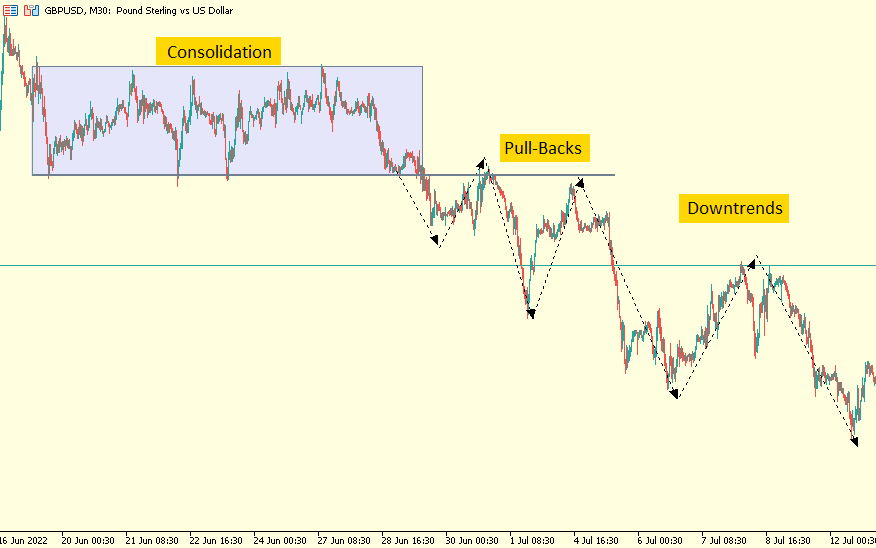

- GBPUSD Breakout trading strategy: This strategy looks for areas of consolidation in the price movement of the GBPUSD forex pair. Whenever price movement breaks out of this consolidation, oftentimes there is usually a pullback and then an aggressive expansion in the direction of the consolidation breakout.

Bullish GBPUSD breakout strategy

Bearish GBPUSD breakout strategy

What is the best time to trade the GBPUSD

Short-term traders must be cognizant of the trading sessions that offer the best opportunities to take advantage of the GBPUSD intraday price swings within the 24-hours of a day. This is to ensure that potential profits made from the intraday price movement outweigh the associated transaction costs therefore short-term traders and scalpers must focus on sessions where the liquidity is highest. In essence, traders benefit from a tight bid-ask spread and reduced slippage costs. Moreso, trading GBPUSD during the most liquid period of the day presents great opportunities to capture the most explosive’s price swings for the session.

The best and most ideal time for trading the GBPUSD forex pair (long or short) is at the opening hours of the London session between 7 AM to 9 AM (GMT). During this period, most of the European financial institutions are trading hence there is a lot of trading volume and liquidity during the period.

Another ideal time for trading the GBP USD forex pair is the period of the London and New York session overlap. At this time, there is usually high liquidity in the GBPUSD because this is the period of time when both the London financial institutions and the United States financial institutions are very active. You can expect tighter spreads and minimal slippages when trading within this period. The time window of this session overlap is 12 PM to 4 PM (GMT).

Click on the button below to Download our "Forex GBP USD trading strategy" Guide in PDF