EMA forex strategy

Moving average, also known as Moving mean, is a technical analysis tool that statistically measures the average change in price movement over a certain period of time.

Moving averages are the most simple and easy to use forex trading indicator because of its visual simplicity and the insights it provide about price movement when performing technical analysis. For this reason, the moving average is arguably the most common, popular and most used indicator among forex traders.

There are 4 variations of moving averages, they are simple, exponential, linear and weighted moving average. In this article, our focus will be based on the Exponential Moving Average and the EMA forex strategy.

EMA is the acronym for the Exponential Moving Average and they are often used interchangeably. The exponential moving average is the most preferred variation of moving average among traders and technical analysts because the formula of the exponential moving average puts more weight on the most recent price (high, low, open and close) data and it also reacts faster to recent price changes thus it becomes more useful as an indicator and as a trading strategy to predict precise levels of support and resistance, to provide a clearer picture of the present condition of the market (either trending or consolidating), to generate trading signals and many more.

Setting up the exponential moving average indicators for the EMA trading strategy

The basic EMA trading strategy setup implements the use of two exponential moving averages but the EMA trading strategy discussed in this article implement 3 different exponential moving averages (in terms of the input values);

A short term, an intermediate-term and longer-term exponential moving averages.

The best option of input values for a short term EMA should be within the range of 15 - 20.

The best option of input values for a medium-term EMA should be within the range of 30 - 100.

The best option of input values for a longer-term EMA should be within the range of 100 - 200.

If we choose an input value of 20 for a short term EMA, it means that the EMA is a calculated exponential average of the previous 20 bars or candlesticks on any timeframe.

If we choose an input value of 60 for a medium-term EMA, it means that the EMA is a calculated exponential average of the previous 60 bars or candlesticks on any timeframe.

And if we choose an input value of 120 for a long-term EMA, it means that the EMA is a calculated exponential average of the previous 120 bars or candlesticks on any timeframe.

These 3 distinct EMAs (short term, intermediate-term and long-term exponential moving averages) are then used to find crossover signals that tell the direction of price movement by providing a framework for traders to find opportunities and trade setups in the direction of the crossover.

What is the interpretation of this exponential moving average crossovers

This interpretation applies to all timeframes and all variety of trading styles like scalping, day trading, swing trading and long term position trading.

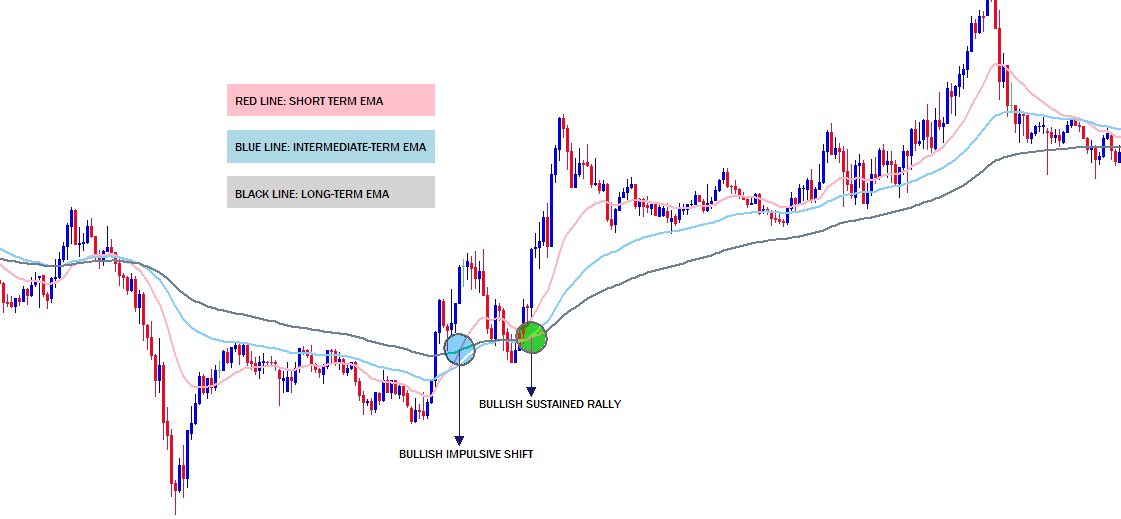

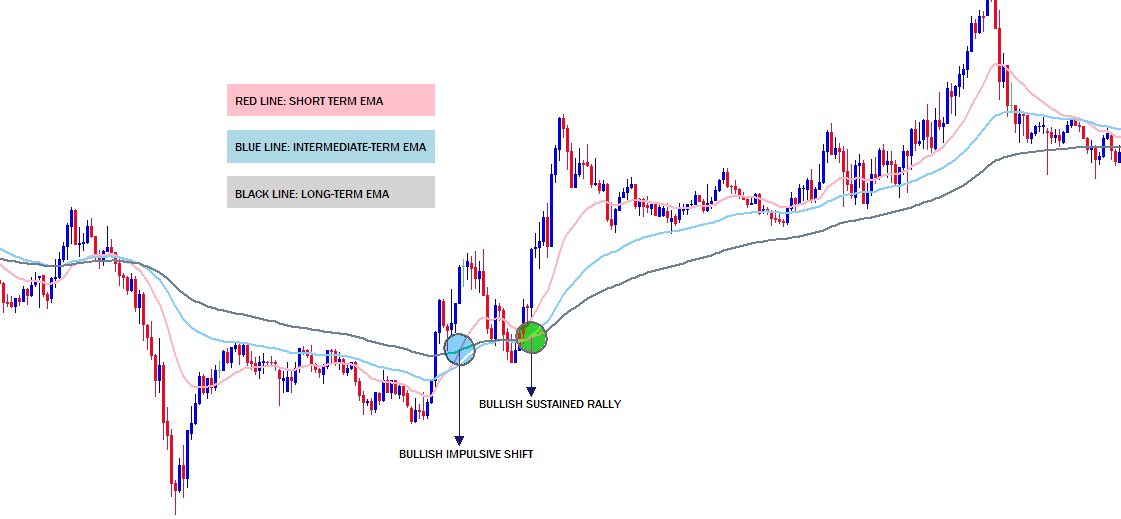

Whenever the short term exponential moving average crosses above the medium and long term exponential moving average, it signifies an impulsive shift in the direction of price movement to the upside on a short term basis.

If the medium-term exponential moving average follow suit by crossing above the long term exponential moving average, this indicates a sustained upward price movement or bullish trend

Therefore, in a confirmed uptrend by a bullish crossover, traders' bias and expectations of trade setups become bullish and so any pullback or retracement of the bullish trend can then find support on either of the 3 EMAs.

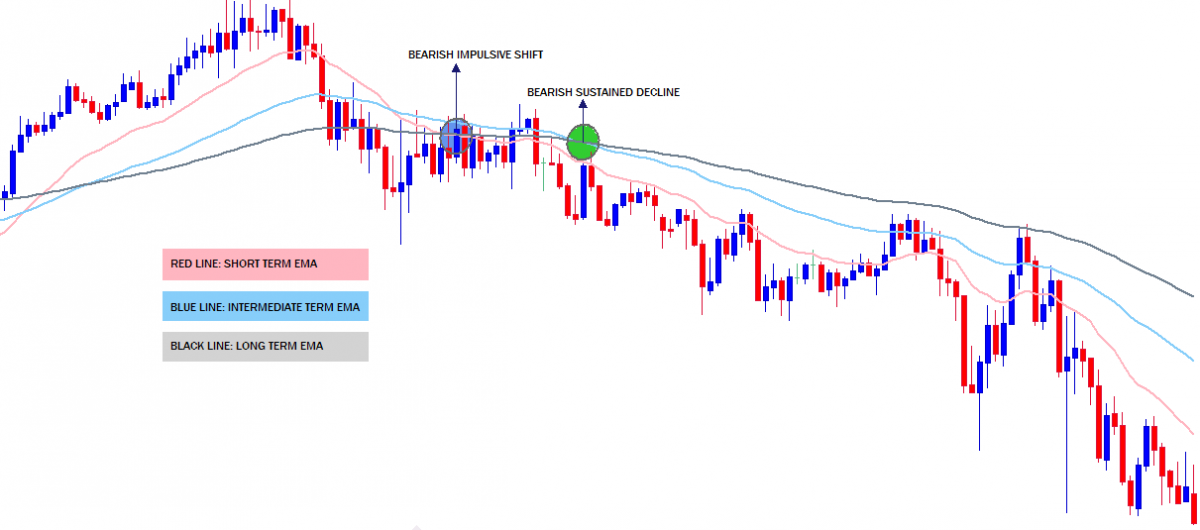

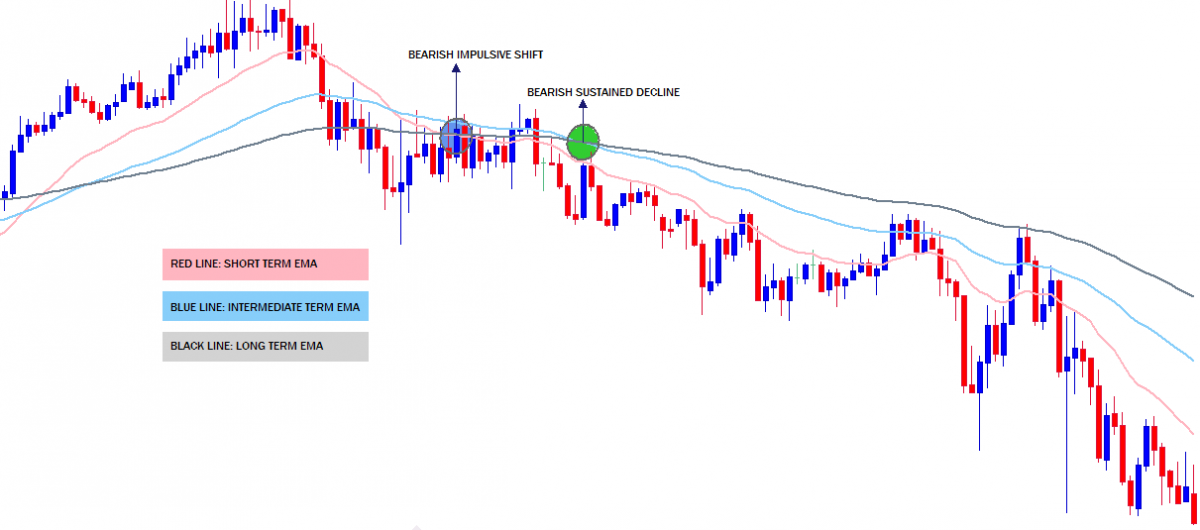

Conversely, whenever the short term exponential moving average crosses below the medium and long term exponential moving average, it signifies an impulsive shift or decline in the direction of price movement to the downside on a short term basis.

If the medium-term exponential moving average accompanies the impulsive bearish shift by crossing below the long term exponential moving average, this indicates a sustained downward price movement or bearish trend.

Therefore a confirmed downtrend by a bearish crossover sets a traders' bias and anticipations of trade setups to become bearish and so any pullback or retracement of the bearish trend can then find resistance on either of the 3 EMAs.

Guidelines to trade the EMA forex strategy

The first step is to determine the style of trading you're competent with as a trader. It could be swing trading, position trading, scalping, day trading or intraday trading. The EMA forex strategy discussed in this article is focused on scalping i.e. Scalping EMA forex strategy.- The next step is to determine the right input values for the short term, medium-term and long term exponential moving averages to implement in your EMA forex strategy.

- Plot the right Exponential Moving Averages on whatever timeframe depending on your trading style.

For scalping, plot the 3 EMA between the 1 to 30 minutes chart.

For day trading or short term trading, plot the 3 EMA on either the 1hr or 4hr chart.

For swing or position trading, plot the 3 EMA on either the daily, weekly or monthly chart.

Use the visual information from the 3 EMA to determine the market conditions

If the 3 EMAs are tangled together this means the market is in a trading range or sideways consolidation.

If the 3 EMAs are separated and moving further apart (either bullish or bearish) in order according to their weight, this indicates a strong and sustained trend.

Trading plan for 3 EMA scalping strategy

Timeframe for the EMA scalping strategy must be between the 1 to 30 minute chart.

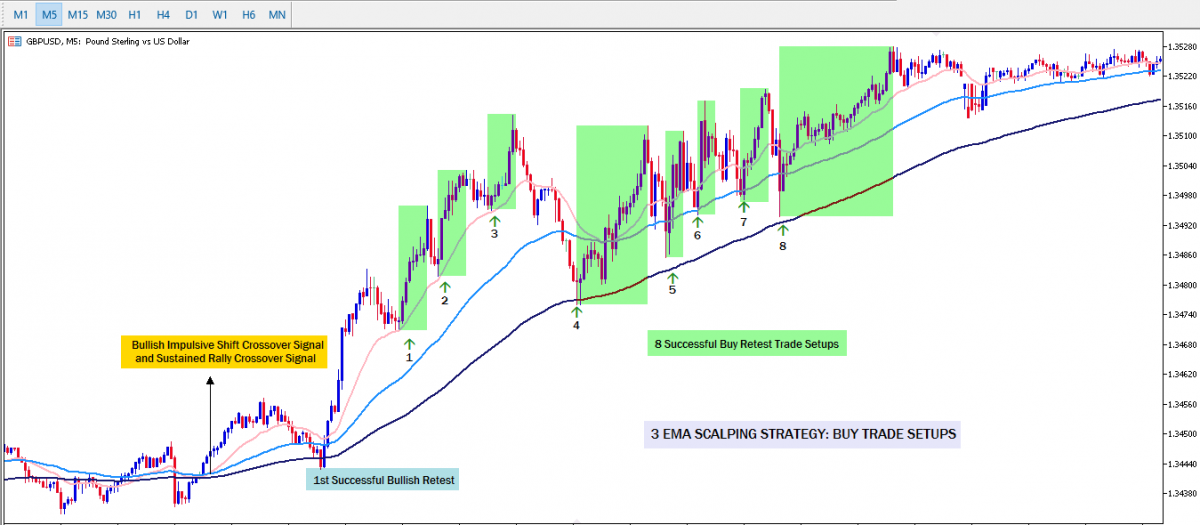

Input the best values for the short term, intermediate-term and long term EMAs which are 20, 55 and 120.

Then wait to confirm certain criteria of price movement in accordance to the exponential moving averages.

For bullish trade setup

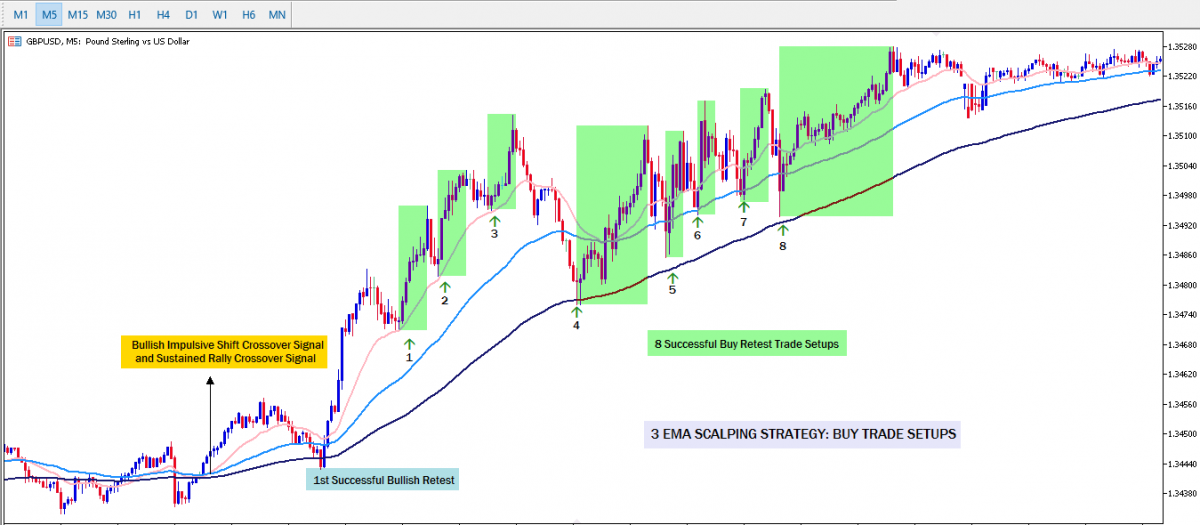

- The first step is to confirm a bullish market condition in price movement relative to the 3 EMAs.

How?

- Wait for a bullish EMA crossover and wait for price to trade above the 20, 55 and 120 exponential moving averages

- When the 20 period EMA crosses above the 55 and 120 EMAs. It indicates an impulsive shift in the direction of price movement to the upside on a short term basis and oftentimes, just the 20 period EMA bullish crossover is not usually strong enough to assume a sustained bullish price move.

- The market is usually prone to false signals and so more evidence from the other exponential moving averages is needed to support the idea of a valid buy setup in an uptrend.

For this reason, wait for the 55 period EMA to also cross above the 120 period EMA while it is below the 20 period EMA in a rising slope. This indicates a sustained bullish uptrend.

- To pick the highest probable buy setups, it is important to be patient and watch for further confirmations before executing a buy market order.

Further confirmation like

- A successful bullish retest of price movement on either of the exponential moving averages as valid dynamic support.

- A break of a previous swing high that indicates a market structure shift to the upside

- Confluences with other indicators or bullish candlestick entry patterns such as bullish doji, bullish pin bar e.t.c.

- Lastly, open a long market order at the retest of the 20, 55 and 120 period EMA.

For bearish trade setup

- The first step is to confirm a bearish market condition in price movement relative to the 3 EMAs.

How?

- Wait for a bearish EMA crossover and wait for price to trade below the 20, 55 and 120 exponential moving averages

- When the 20 period EMA crosses below the 55 and 120 EMAs. It indicates an impulsive shift in the direction of price movement to the downside on a short term basis and oftentimes, just the 20 period EMA crossover is usually not strong enough to assume a sustained bearish price move.

- The market is usually prone to false signals and so more evidence from the other exponential moving averages is needed to support the idea of a valid sell setup in a downtrend.

For this reason, wait for the 55 period EMA to also cross below the 120 period EMA while it is above the 20 period EMA in a downward slope. This indicates a sustained bearish downtrend.

- To pick the highest probable sell setups, it is important to be patient and watch for further confirmations before executing a sell market order.

Further confirmations could be

- A successful bearish retest of price movement on the 20, 55 and 120 period exponential moving averages as valid dynamic resistance.

- A break of a previous swing low that indicates a market structure shift to the downside

- Confluences with other indicators or bearish candlestick entry patterns

- Lastly, open a short market order at the retest of the 20, 55 and 120 period EMA.

Risk management practices for 3 EMA scalping strategy trade setups

Stop loss Placement for this strategy should be 5 pip below the 120 period EMA for a long setup or above the 120 period EMA for a short setup.

Alternatively, place a protective stop 20 pip below the open of the long position or trade entry or 20 pip above the open of the short position or trade entry.

Profit objective for this EMA scalping strategy is 20 - 30 pips.

Because this is a scalping strategy, once price move 15 - 20 pips above the open of a long term position entry, traders should protect their profitable trade by adjusting the stop loss up to breakeven and take off 80% partials of the profit should incase the bullish price move is explosive or rallies for a longer period of time.

Conversely, once price move 15 - 20 pips below the open of a short term position entry, traders should protect their profitable trade by adjusting the stop loss to breakeven and take off 80% partials of the profit should incase the bearish price move is explosive or declines for a longer period of time.

Summary

The EMA forex strategy is a universal trading strategy for traders of all kinds (scalpers, day traders, swing traders and long-term position traders) because it works on all timeframes and in all financial market asset classes such as bond, stocks, forex, indices, cryptocurrencies but with the right input values in place. Also, traders should note that the EMA forex strategy only works more favourably in trending markets.

The EMA forex strategy is a very great trading strategy that may not require any other indicator as an add-on to further confirm high probable trade entries because the exponential moving averages is powerful enough to act as a stand-alone indicator.

It is important to note that as with all other technical indicators and trading strategies, there is none that is the holy grail of trading and so the EMA forex strategy can be used as a foundation or further confirmation for other trading strategies.

With this simple forex trading strategy, traders can build wealth and a very successful trading career.

Click on the button below to Download our "EMA forex strategy" Guide in PDF