Commodity Channel Index strategy

The Commodity Channel Index (CCI) is a widely used momentum-based technical indicator, designed to identify cyclical trends in various financial markets, including forex. It measures the deviation of an asset’s price from its average price over a specific period, helping traders spot overbought or oversold conditions. By identifying price extremes, the CCI can signal potential reversal points or trend continuations, making it a valuable tool in both trending and ranging markets.

Developed by Donald Lambert in 1980, the CCI was originally created for commodity markets. However, its versatility has led to its widespread adoption across different asset classes, including currencies, stocks, and indices. Lambert’s intention was to identify cyclical movements in commodity prices, but the indicator has since evolved into a multi-purpose tool for modern traders.

Traders in the forex market use the CCI because of its ability to highlight potential entry and exit points with relatively simple calculations. It works well in conjunction with other technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). While these indicators also focus on momentum, the CCI stands out by offering unique insights into price deviations, giving traders another perspective for making informed decisions.

How the Commodity Channel Index Works

The Commodity Channel Index (CCI) is a technical tool that quantifies the price of an asset relative to its historical average. It does this by measuring the deviation of the current price from the moving average, with the assumption that prices tend to revert to a mean over time. The CCI formula is straightforward:

CCI = (Price−SMA) / (0.015×Mean Deviation)

In this formula, the "Price" typically refers to the typical price (average of the high, low, and close), and the "SMA" is the simple moving average of that price over a specified period. The constant 0.015 helps standardize the CCI values, ensuring most readings fall within the -100 to +100 range.

The interpretation of CCI values revolves around overbought and oversold conditions. A CCI reading above +100 signals that the asset may be overbought, indicating a potential price reversal or pullback. Conversely, a reading below -100 suggests that the asset may be oversold, hinting at a possible price rebound.

The CCI's default setting is 14 periods, which balances short-term responsiveness with long-term trend analysis. However, traders often adjust the period based on their strategy. Short-term traders might use a 9-period CCI, while those focusing on longer trends may opt for a 20 or 30-period setting.

Best settings for the CCI indicator in forex

The standard setting for the Commodity Channel Index (CCI) is 14 periods, which offers a balance between responsiveness and trend reliability. This default setting is widely used in forex trading, as it provides a good measure of price momentum over a medium-term horizon. However, depending on a trader’s specific strategy, adjusting the CCI period can optimize performance.

For short-term traders, such as scalpers or day traders, a 9-period CCI may be more effective. The shorter period makes the indicator more sensitive to price changes, offering quicker signals for overbought or oversold conditions. However, this increased sensitivity can also lead to more false signals in volatile markets.

Long-term traders, including swing traders or position traders, might prefer a 20 or 30-period CCI. These settings smooth out price fluctuations and provide more reliable trend signals but are slower to react to sudden market changes.

The optimal setting for the CCI depends on several factors, including market volatility and trading style. In highly volatile forex pairs like GBP/JPY, a longer period might help filter out noise. For more stable pairs like EUR/USD, shorter settings can capture smaller price swings.

The CCI indicator strategy

The Commodity Channel Index (CCI) is primarily used by forex traders to identify overbought and oversold conditions in the market. When the CCI rises above +100, it indicates that the asset may be overbought, signaling a potential price reversal or correction. Conversely, when the CCI falls below -100, it suggests oversold conditions, pointing to a possible price rebound. These extreme values help traders decide when to enter or exit trades, making the CCI a powerful tool for timing market reversals.

One of the key CCI trading strategies is to buy when the CCI crosses above -100, signaling an end to oversold conditions, and to sell when it crosses below +100, indicating a potential downturn in an overbought market. However, traders should be cautious of false signals, which can occur in volatile markets.

Divergence between the CCI and price action is another important signal. A bullish divergence occurs when prices make lower lows while the CCI forms higher lows, suggesting that downward momentum is weakening and a potential upward reversal is likely. A bearish divergence, on the other hand, happens when prices make higher highs, but the CCI forms lower highs, indicating weakening upward momentum.

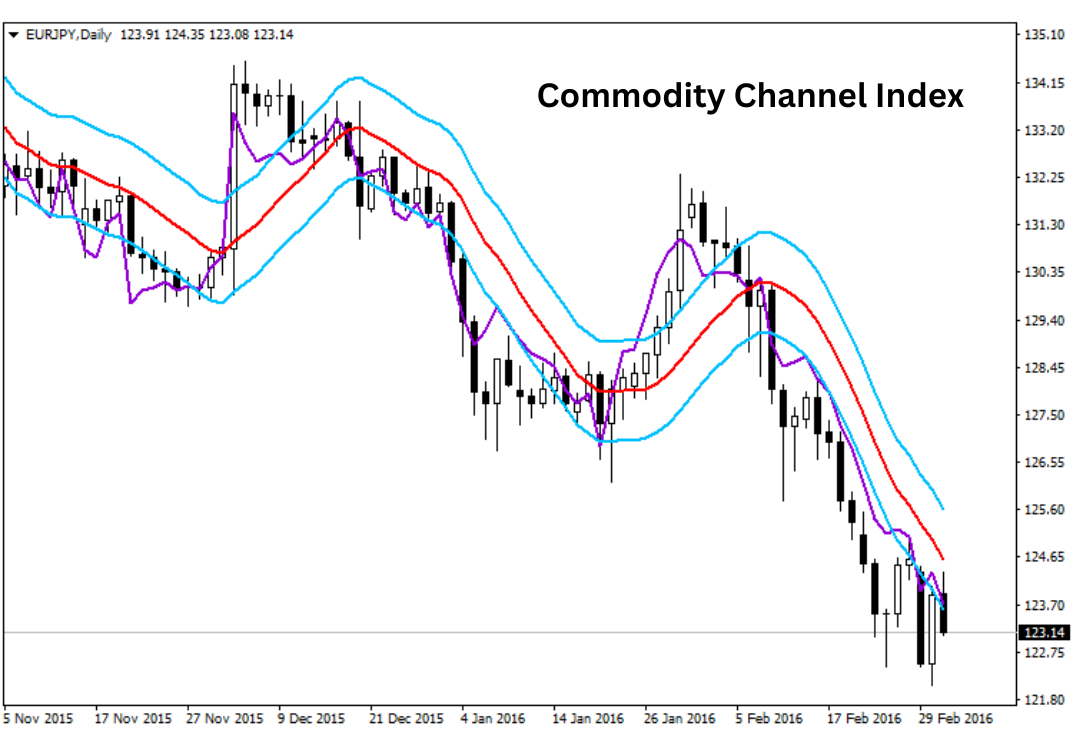

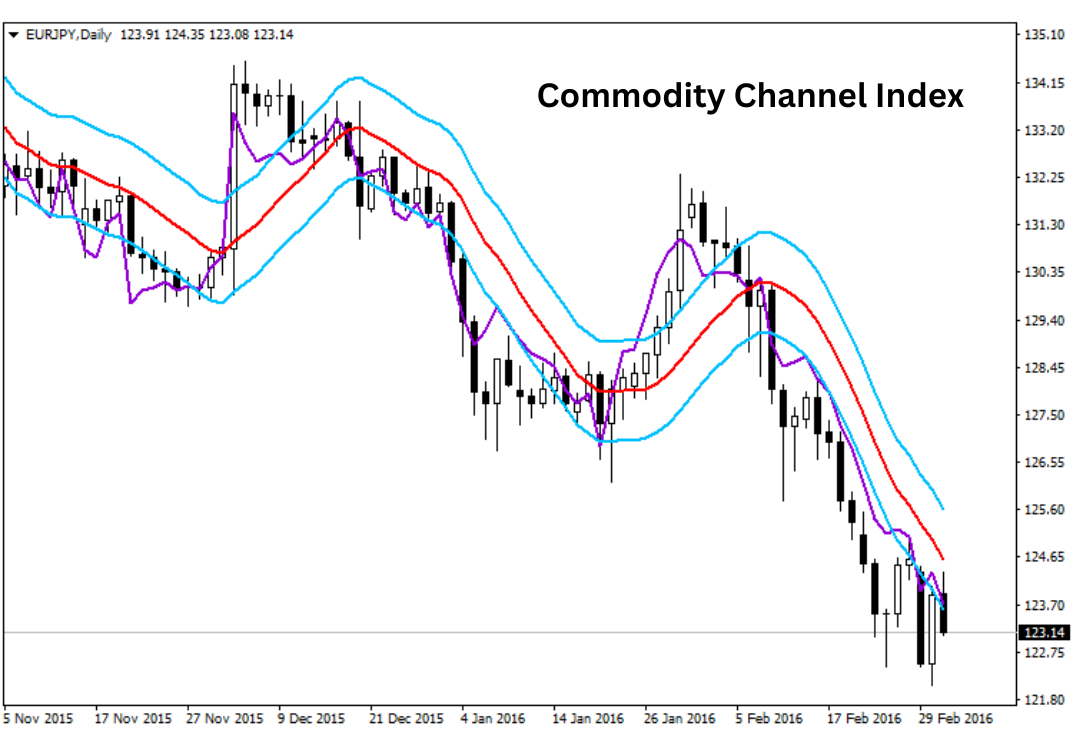

To enhance accuracy, traders often combine the CCI with other indicators like Moving Averages or Bollinger Bands for additional confirmation of trends. For example, a trader might enter a forex trade when the CCI crosses +100, while also checking for confirmation from a moving average crossover to strengthen the buy signal.

Advanced CCI forex strategies

Advanced Commodity Channel Index (CCI) strategies offer traders refined methods for identifying trends, confirming momentum, and managing trades. One such approach is the CCI trend-following strategy, which focuses on identifying strong market trends. In this method, traders look for CCI readings above +100 to confirm a strong uptrend or below -100 to confirm a strong downtrend. These signals help traders align their positions with the prevailing market direction.

Another powerful method is the CCI-Zero Line Crossover strategy. This approach involves taking trades when the CCI crosses the zero line. When the CCI moves from negative to positive territory, it signals bullish momentum, which can be a buying opportunity. Conversely, when the CCI crosses below zero, it suggests bearish momentum, often signaling a selling opportunity. The zero-line crossover is especially useful for confirming the continuation of a trend.

In range-bound markets, the CCI can help traders spot overbought and oversold conditions. When the market lacks a clear trend, traders can use the CCI to buy at oversold levels (below -100) and sell at overbought levels (above +100), capturing price swings within a defined range.

Applying CCI strategies across different forex pairs, such as EUR/USD, GBP/JPY, or AUD/USD, allows traders to adapt to varying volatility levels. Finally, effective risk management is essential, with stop-loss orders placed just beyond support or resistance levels. Proper position sizing should be based on market volatility and individual risk tolerance to protect against excessive losses while using CCI strategies.

How to avoid mistakes when using the CCI Indicator

While the Commodity Channel Index (CCI) is a powerful tool for forex trading, over-reliance on it without considering other factors can lead to costly mistakes. One of the most common errors traders make is ignoring other technical or fundamental analysis and solely focusing on the CCI. This can lead to missing key market influences like news events, economic data releases, or other significant trends that may affect price action.

Another issue arises when traders misinterpret CCI signals in highly volatile markets. Volatile forex pairs, such as GBP/JPY or USD/ZAR, may produce extreme CCI readings more frequently, leading to false overbought or oversold signals. In these situations, it's crucial to adjust the CCI settings to account for increased volatility or use longer time frames to smooth out price fluctuations.

Failing to adjust CCI settings to match market conditions is another common mistake. Using the default 14-period setting in markets with high volatility or low liquidity can produce inaccurate signals. Traders should backtest different settings and adjust the period length depending on the pair and market environment.

To avoid false signals, traders should focus on waiting for confirmation before entering trades. This can be done by combining the CCI with other tools such as volume indicators or price action analysis to verify the strength of a trend. Lastly, relying solely on the CCI without incorporating risk management techniques or other indicators can expose traders to unnecessary risks, making it vital to build a comprehensive trading strategy.

Conclusion

The Commodity Channel Index (CCI) is a versatile and effective tool in forex trading, offering traders insights into momentum and potential trend reversals. By measuring the price's deviation from its historical average, the CCI helps identify overbought and oversold conditions, making it an essential component of many traders' strategies. Whether used in trend-following strategies, zero-line crossovers, or range-bound markets, the CCI indicator provides valuable trading signals that can lead to profitable trades.

However, the effectiveness of the CCI depends on how well traders tailor it to their individual trading goals. Factors like market volatility, time frames, and personal risk tolerance should guide the choice of settings for the CCI indicator. Short-term traders may benefit from using shorter periods for faster signals, while long-term traders may prefer smoother trends by extending the CCI's time frame.

To maximize its potential, the CCI should not be used in isolation. Combining it with other technical indicators such as Moving Averages, Bollinger Bands, or volume indicators can provide confirmation and reduce the risk of false signals. Additionally, integrating the CCI with sound risk management practices, such as stop-loss placement and proper position sizing, can further enhance its effectiveness.