Buy and hold strategy in forex

Traditionally, forex trading strategies have emphasized short-term gains through strategies like day trading or scalping. However, the buy and hold strategy presents an alternative approach, focusing on long-term investment in currency positions. The buy and hold strategy in forex is based on holding a currency pair for an extended period, anticipating that long-term macroeconomic factors will result in a favorable movement in the currency’s value. This strategy contrasts sharply with more common forex methods that capitalize on short-term market fluctuations.

Understanding the buy and hold strategy

The buy and hold strategy is an investment approach where a trader acquires positions in a currency pair and holds them for a prolonged period, often spanning years. This strategy is predicated on the belief that long-term market trends will produce favorable results, despite short-term market fluctuations.

Contrasting sharply with other forex trading strategies, the buy and hold method diverges significantly from tactics like day trading or scalping. Day trading involves making multiple trades within a single day to capitalize on short-term market movements. Similarly, scalping seeks to exploit minute, momentary price discrepancies. Both strategies require constant market monitoring and quick decision-making. In contrast, buy and hold traders invest with a long-term view, minimizing the stress and time commitment of frequent trading.

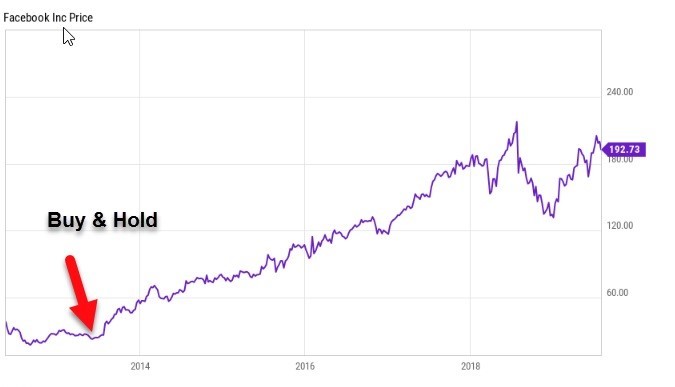

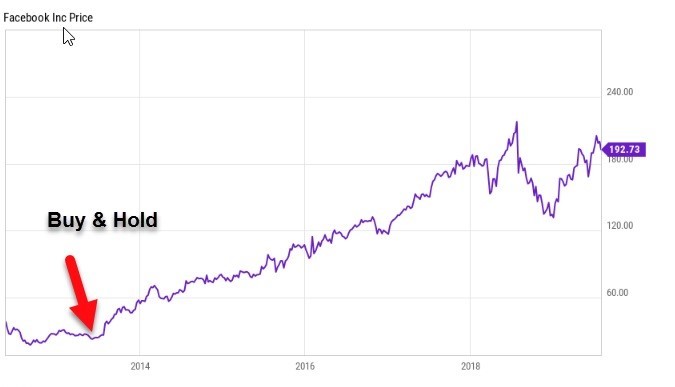

Historically, the buy and hold strategy originates from the stock market, where investors hold equity stakes in companies, expecting their intrinsic value to increase over time. In the forex market, however, applying this strategy involves a nuanced understanding of macroeconomic trends and their impact on currency values, which can be more volatile and influenced by a broader set of global factors. This strategy's effectiveness in forex trading requires a deep understanding of both currency-specific factors and global economic indicators.

Applicability of buy and hold in forex

The forex market is characterized by its high liquidity and extreme volatility, traits that significantly influence the applicability of a buy and hold strategy. Unlike equity markets, where long-term growth is driven by corporate profits and economic expansion, forex markets are primarily influenced by macroeconomic indicators and geopolitical events. These factors can lead to sharp currency fluctuations, impacting the feasibility of a long-term hold.

However, certain market conditions may favor the buy and hold approach. For example, when a currency is expected to strengthen due to consistent economic growth, stable political environment, or positive trade balances, traders might consider a longer-term investment in that currency. Similarly, in cases where a currency is undervalued but poised for a recovery based on fundamental economic improvements, a buy and hold strategy could be effective.

An illustration of this can be seen in emerging market currencies, where longer-term macroeconomic stability may lead to appreciations against developed market currencies. Traders employing a buy and hold strategy in these situations bank on the gradual but steady recovery of an undervalued currency, leveraging prolonged trends rather than short-term fluctuations. This approach requires a robust understanding of global economic trends and the patience to withstand periods of volatility without reacting prematurely.

Pros and cons of buy and hold forex

Benefits:

The buy and hold strategy in forex trading offers several advantages. Primarily, it allows traders to reduce the transaction costs associated with frequent trading, such as spreads and commissions. Moreover, by holding positions over a longer period, traders can capitalize on major economic cycles and trends, potentially yielding significant returns if the market moves favorably. This strategy also benefits from the compound interest effect on earnings, a factor less relevant in short-term trading.

Risks and challenges:

However, the buy and hold approach carries inherent risks. Forex markets are highly susceptible to sudden economic changes and geopolitical crises, which can drastically affect currency values. Long-term forex positions require substantial capital to withstand such volatility without facing a margin call. Additionally, the opportunity cost of locking funds in a single position over an extended period can be high, potentially foregoing more lucrative short-term opportunities.

Psychological aspects:

Psychologically, maintaining a long-term position demands considerable patience and discipline. Traders must resist the urge to react to short-term market movements and maintain their focus on long-term objectives. This can be challenging, especially during prolonged periods of adverse market conditions, which test a trader's emotional resilience and commitment to their initial investment thesis.

Key factors to consider

When employing a buy and hold strategy in forex trading, several critical factors must be meticulously considered to optimize the chances of success.

Importance of currency selection:

Choosing the right currency pairs is paramount. Traders should look for currencies with potential for long-term stability or growth. Factors such as the country's economic health, interest rate policies, and trade balances can significantly influence currency strength. Opting for major currencies might offer more stability, while emerging market currencies might present higher growth potential albeit with increased risk.

The role of macroeconomic factors:

Macroeconomic indicators like GDP growth rates, unemployment data, inflation rates, and monetary policies profoundly impact currency values. A thorough understanding of these factors is essential to predict long-term economic trends and make informed trading decisions. Traders should focus on economies that show consistent growth, stable inflation, and sound fiscal policies to support their buy and hold strategies.

Impact of geopolitical events:

Geopolitical stability or instability can drastically affect currency markets. Events such as political unrest, elections, international disputes, or significant policy changes must be closely monitored. Such events can lead to abrupt and substantial fluctuations in currency values, impacting long-term forex positions. Traders need to stay informed about global events and consider their potential impact on currency markets, adjusting their strategies as necessary to mitigate risks associated with geopolitical changes.

Strategic implementation

Implementing a buy and hold strategy in forex trading involves a structured approach and careful planning. Here’s a step-by-step guide to effectively deploy this strategy:

Currency analysis:

Begin by selecting a currency pair based on thorough analysis of economic indicators and geopolitical stability. Prefer currencies with a long-term outlook of appreciation or stability.

Fundamental analysis:

Utilize fundamental analysis to understand the macroeconomic trends that affect the currencies chosen. This includes studying GDP growth, interest rate policies, inflation rates, and political stability.

Technical tools:

Support your fundamental analysis with technical tools. Long-term trend indicators like moving averages (50-day, 100-day, 200-day) and macroeconomic trend lines can be helpful. Use these tools to identify and confirm trends and potential entry points.

Risk management:

It is crucial to manage risk by setting stop-loss orders and maintaining an appropriate risk-to-reward ratio. Decide in advance the maximum percentage of your portfolio you are willing to risk on a single trade.

Setting expectations:

Set realistic expectations for the potential return and time frame for your investment. Remember, buy and hold in forex is a long-term strategy and requires patience and resilience against market volatilities.

Ongoing monitoring:

Regularly review the economic conditions impacting your held currencies. Adjust your positions as necessary, especially in response to significant economic or geopolitical shifts.

By following these steps, traders can strategically implement a buy and hold approach, leveraging long-term trends while mitigating risks and setting feasible goals.

Case studies and examples

One notable example of a successful buy and hold forex strategy involved the USD/JPY pair during the early 2000s. After the dot-com bubble burst, the USD experienced significant weakness due to aggressive rate cuts by the Federal Reserve. Savvy investors who anticipated a long-term recovery of the U.S. economy bought JPY to hold USD. As the U.S. economy gradually recovered and interest rates started rising again in the mid-2000s, the USD appreciated significantly against the JPY, rewarding those who held onto their positions with substantial returns.

Conversely, the EUR/CHF pair in the early 2010s provides a cautionary tale. Many traders employed a buy and hold strategy with the assumption that the Swiss National Bank (SNB) would maintain the floor of 1.20 against the euro. However, in January 2015, when the SNB unexpectedly removed this cap, the CHF appreciated dramatically against the EUR within minutes, resulting in massive losses for those holding long positions. This incident teaches the importance of considering political and central bank risks in forex trading.

These examples highlight the dual aspects of opportunity and risk in buy and hold forex trading.

Conclusion

The buy and hold strategy in forex trading presents a distinct approach compared to the more common short-term trading strategies. By emphasizing long-term investment in currency pairs, this strategy leverages macroeconomic trends and shifts for potentially substantial returns. It contrasts with the rapid, high-volume trading tactics like day trading and scalping, offering a less stressful and potentially cost-effective alternative.

Key points to remember include the importance of thorough market analysis, the selection of stable currencies, understanding of global economic indicators, and vigilant risk management. The strategy’s success hinges on a deep understanding of geopolitical impacts and macroeconomic factors that influence currency values over extended periods.

However, the viability of the buy and hold strategy requires patience, a robust risk tolerance, and an ongoing commitment to monitoring global economic conditions. It is not without its risks, particularly due to the forex market's inherent volatility and the potential for sudden geopolitical shifts that can radically alter market conditions.