Backtesting in forex

Among the essential tools in a trader's arsenal is a process known as "backtesting." Backtesting refers to the systematic process of evaluating a trading strategy's viability by assessing its historical performance using past market data. Essentially, it's a means to travel back in time within the financial markets, applying your trading strategy to historical data, and gauging how it would have fared.

The significance of backtesting cannot be overstated in the forex market. Here's why it is indispensable:

Risk mitigation: By testing your strategy against historical data, you gain insights into potential risks and drawdowns. This helps you fine-tune your approach and develop risk management strategies.

Strategy validation: Backtesting provides empirical evidence of a strategy's effectiveness. It validates or refutes the hypothesis that underlies your trading approach.

Optimizing trading systems: Backtesting allows traders to refine and optimize their trading systems. You can identify where your strategy excels and where improvements are needed, leading to better decision-making.

Manual backtesting

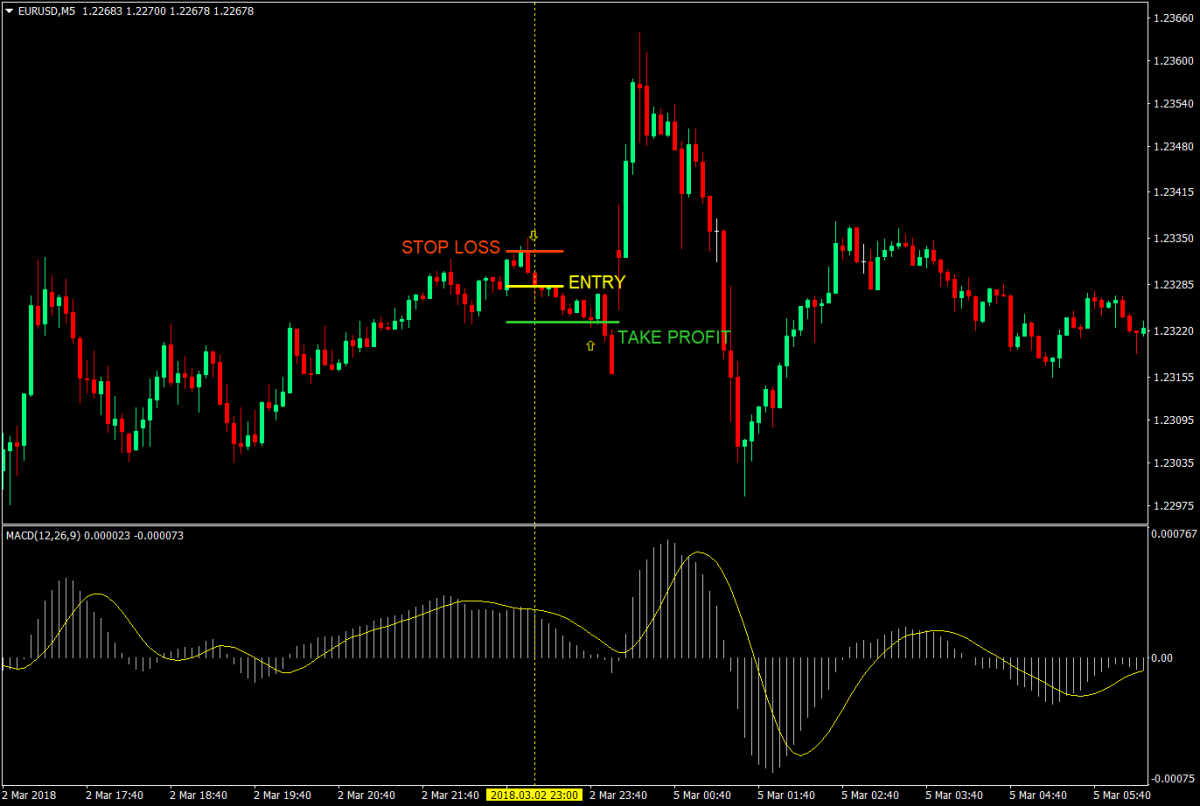

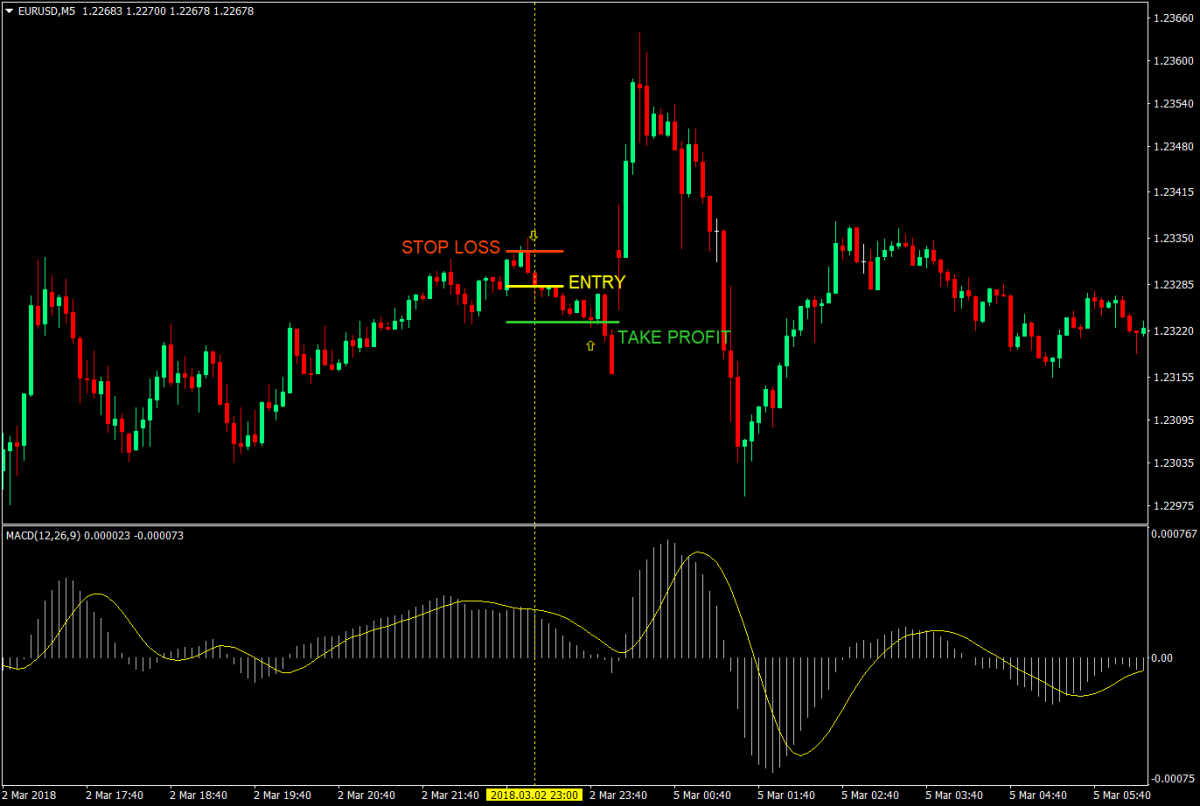

In the world of forex trading, there are two primary approaches to backtesting: manual and automated. Manual backtesting involves a hands-on, retrospective analysis of your trading strategy against historical market data.

Manual backtesting is a meticulous process where traders simulate their trading strategy by analyzing historical price data and making hypothetical trade decisions without the assistance of automated tools. Essentially, you step back in time and meticulously record each trading decision, entry, exit, and stop-loss, adhering to the strategy's rules.

Advantages:

Total control: Manual backtesting offers complete control over every aspect of the testing process, allowing you to account for nuances and market conditions.

Educational: It provides traders with a deep understanding of their strategy, helping them internalize the rationale behind their trades.

Cost-effective: Unlike automated solutions, manual backtesting doesn't require expensive software or data subscriptions.

Limitations:

Time-consuming: It can be labor-intensive and time-consuming, especially when analyzing large datasets.

Subjectivity: Results may vary based on the trader's discretion and interpretation of historical data.

Limited accuracy: It may not account for slippage, spread, and execution delays accurately.

Metatrader 5 (MT5) provides a robust platform for manual backtesting. To use MT5 for manual backtesting, traders can utilize the built-in historical data and charting tools to review past price movements, place trades manually, and assess the strategy's performance. This process allows for a comprehensive evaluation of trading strategies in a controlled environment.

Metatrader 4 (MT4) is another popular platform for manual backtesting. Traders can access historical data and use MT4's charting features to recreate past market conditions and execute trades manually. While MT4 lacks some of the advanced features of MT5, it remains a viable choice for traders seeking to conduct manual backtesting efficiently.

Automated backtesting tools

In contrast to manual backtesting, automated backtesting tools offer traders the efficiency and precision of technology-driven analysis. Forex Strategy Tester is a category of software designed explicitly for automated backtesting. These tools enable traders to evaluate their trading strategies using historical data and are widely employed in the trading community due to their convenience and accuracy.

Metatrader 5 strategy tester

Metatrader 5 (MT5) Strategy Tester is a powerful tool embedded in the MT5 trading platform. It provides traders with a host of features:

Multiple timeframes: MT5 allows testing on various timeframes, aiding in comprehensive strategy analysis.

Optimization: Traders can optimize their strategies by adjusting parameters for maximum performance.

Visual Mode: Users can visualize trades on historical charts, helping to better understand strategy behavior.

How to use MT5 strategy tester:

Data selection: Load historical data for the desired currency pairs and timeframes.

Selecting the strategy: Choose the trading strategy you want to test.

Setting parameters: Define parameters such as lot size, stop-loss, take-profit, and initial deposit.

Run the test: Initiate the backtest and review the results, including performance metrics and equity curves.

Metatrader 4 backtesting

Metatrader 4 (MT4) offers its own backtesting capabilities, albeit with some differences compared to MT5:

User-friendly: MT4's interface is known for its simplicity, making it accessible to traders of all levels.

Visual testing: Traders can visually inspect historical data, helping them make informed decisions.

How to use MT4 backtesting software:

Historical data: Import historical data for the currency pairs and timeframes you intend to analyze.

Strategy selection: Choose the trading strategy to test.

Configuration: Specify parameters such as lot size, stop-loss, take-profit, and starting balance.

Run the test: Initiate the backtest and evaluate the results, including detailed performance statistics.

Automated backtesting tools like Forex Strategy Tester provide traders with a systematic and efficient means of assessing their trading strategies, helping them make informed decisions based on historical data and analysis.

Importance of backtesting in forex

One of the foremost roles of backtesting is risk mitigation. Forex markets are rife with volatility and unpredictability, making risk management paramount. Through backtesting, traders can assess how their strategies would have fared in different market conditions. This evaluation allows them to identify potential pitfalls, set appropriate stop-loss levels, and establish risk-reward ratios that align with their risk tolerance.

Successful trading hinges on having a well-defined strategy. Backtesting serves as the litmus test for these strategies. It enables traders to validate their hypotheses and gauge whether their approach holds water when subjected to historical market data. A strategy that performs consistently well across various scenarios in backtesting is more likely to be robust and reliable when applied in real-time trading.

Continuous improvement is the hallmark of successful traders. Backtesting empowers traders to optimize their trading systems by fine-tuning parameters, tweaking entry and exit conditions, and experimenting with various indicators. By scrutinizing past performance, traders can enhance their strategies and adapt to changing market conditions, thereby increasing their odds of long-term success.

Best practices for effective backtesting

To ensure that backtesting in forex yields accurate and actionable insights, traders should adhere to a set of best practices. These guidelines are designed to enhance the reliability and relevance of backtesting results, ultimately leading to better-informed trading decisions.

The foundation of any meaningful backtest lies in the quality and accuracy of historical data. Traders must use reliable data sources and ensure that the data is free from errors, gaps, or inaccuracies. Subpar data can skew results and mislead traders, rendering the entire backtesting process ineffective.

In the quest for profitable strategies, traders sometimes set unrealistic parameters during backtesting. It's essential to maintain a sense of realism, considering factors like market conditions, liquidity, and trading costs. Overly optimistic settings can create a false sense of security and lead to disappointing real-world results.

Real-world trading involves slippage (the difference between expected and executed prices) and spreads (the difference between the bid and ask prices). To mirror actual trading conditions accurately, backtests should incorporate these factors. Neglecting them can lead to overestimating profits and underestimating losses.

Documenting and archiving backtesting results is a vital practice. This historical record serves as a reference point for analyzing strategy evolution and decision-making processes. It also helps traders track the performance of multiple strategies over time.

Forex markets are dynamic and subject to change. What worked yesterday might not work tomorrow. Traders should regularly update and re-test their strategies to adapt to evolving market conditions.

Selecting the best forex backtesting software

Both MT4 and MT5 are widely adopted platforms, each with its strengths:

MT4 (Metatrader 4): Known for its user-friendly interface and extensive library of custom indicators, MT4 is favored by traders who value simplicity and efficiency. However, it lacks some of the advanced features of MT5, such as multi-currency testing and a built-in economic calendar.

MT5 (Metatrader 5): MT5 offers a broader range of assets, including stocks and commodities, in addition to forex. It boasts superior backtesting capabilities, including multi-currency testing, advanced graphical tools, and improved execution speed. It's often the choice for traders seeking more comprehensive analysis.

Other popular backtesting tools

Beyond MT4 and MT5, several other backtesting tools cater to traders' needs:

NinjaTrader: Known for its comprehensive market analysis tools and compatibility with multiple data providers.

TradeStation: Offers a powerful scripting language for custom strategy development and optimization.

cTrader: Known for its intuitive interface and algorithmic trading capabilities.

Factors to consider when choosing software

When selecting forex backtesting software, consider the following factors:

Compatibility: Ensure the software is compatible with your trading platform and brokerage.

Data quality: Assess the quality and availability of historical data for accurate testing.

Features: Evaluate the software's features, including customization options, optimization capabilities, and support for various asset classes.

Cost: Consider both initial purchase costs and ongoing subscription fees.

Community and support: Look for a software platform with an active user community and reliable customer support.

Carefully evaluate your requirements and preferences to select the software that aligns best with your trading goals and style.

Conclusion

Backtesting in forex is not merely an optional step; it is a crucial aspect of trading. It empowers traders with the ability to:

Mitigate risk: By assessing strategy performance in various market conditions.

Validate strategies: By providing empirical evidence of a strategy's effectiveness.

Optimize trading systems: By fine-tuning and adapting strategies to evolving market dynamics.

This systematic evaluation, whether done manually or through automated tools, offers traders a deeper understanding of their trading approach and equips them with the knowledge needed to make informed decisions.