10 pips a day forex strategy

The "10 pips a day" forex strategy is a popular approach among traders seeking consistent, small daily profits. It revolves around making quick trades with the goal of capturing 10 pips in profit each day. This strategy appeals to various types of traders, including scalpers, beginners, and even experienced traders, because of its simplicity and potential for steady growth.

In forex trading, a "pip" (short for "percentage in point") is the smallest price movement in a currency pair, typically the fourth decimal place for most pairs (e.g., 0.0001). Capturing even small pip gains like 10 pips can translate into meaningful profits, depending on the lot size and leverage used.

Scalping is a fast-paced trading method that aligns well with the 10 pip strategy. Scalpers aim to open and close trades within minutes, capitalizing on tiny price fluctuations in the market. The focus is not on large market swings but rather on making several small, low-risk trades throughout the day. For many traders, this offers a balance between risk and reward, as the strategy prioritizes consistent, attainable profits over high-stakes, high-risk trades. The strategy’s simplicity and potential for daily income make it especially appealing for those looking to build confidence and maintain discipline.

How the 10 pips a day strategy works

The 10 pips a day forex strategy focuses on making small, consistent profits by targeting 10 pips per trade. Unlike strategies that aim for large price movements, this method seeks to capitalize on minor fluctuations within the forex market. The core idea is that by achieving steady, modest gains, traders can accumulate profits while minimizing risk.

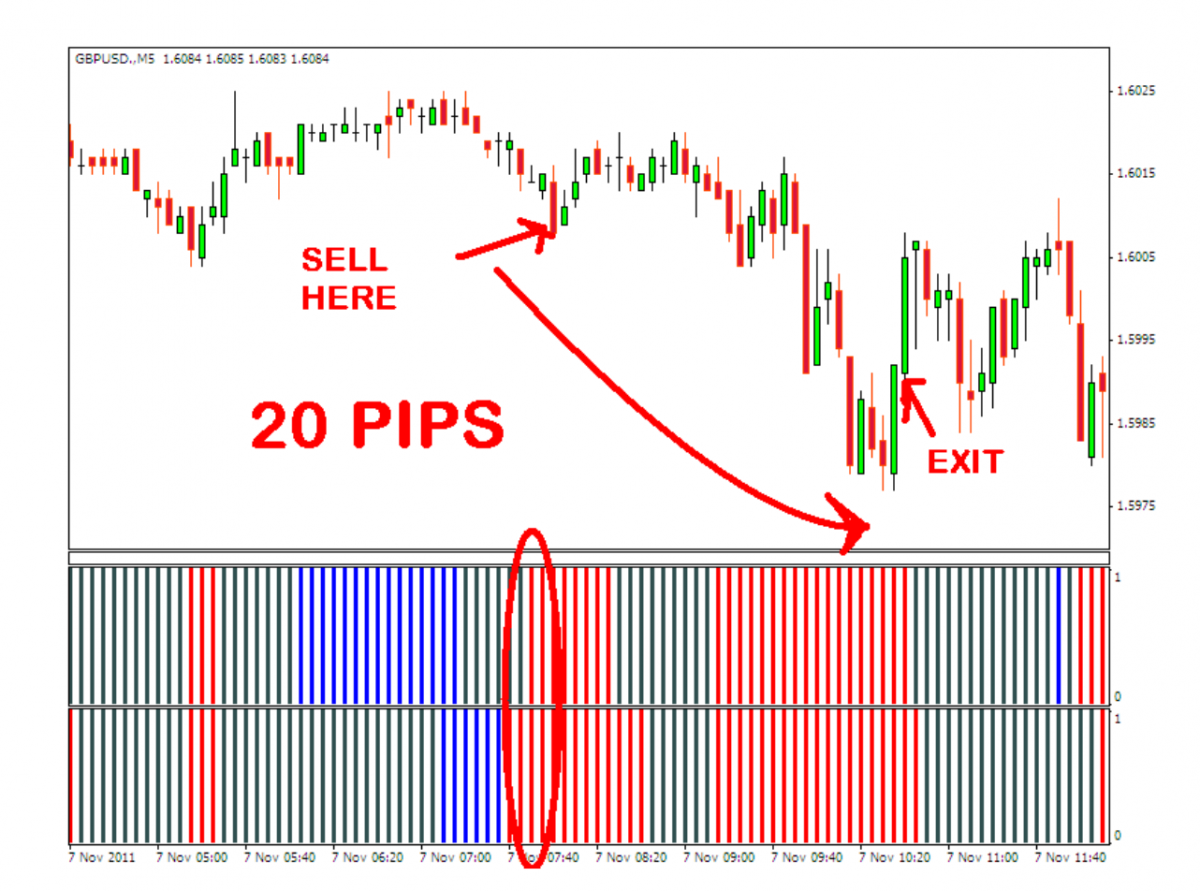

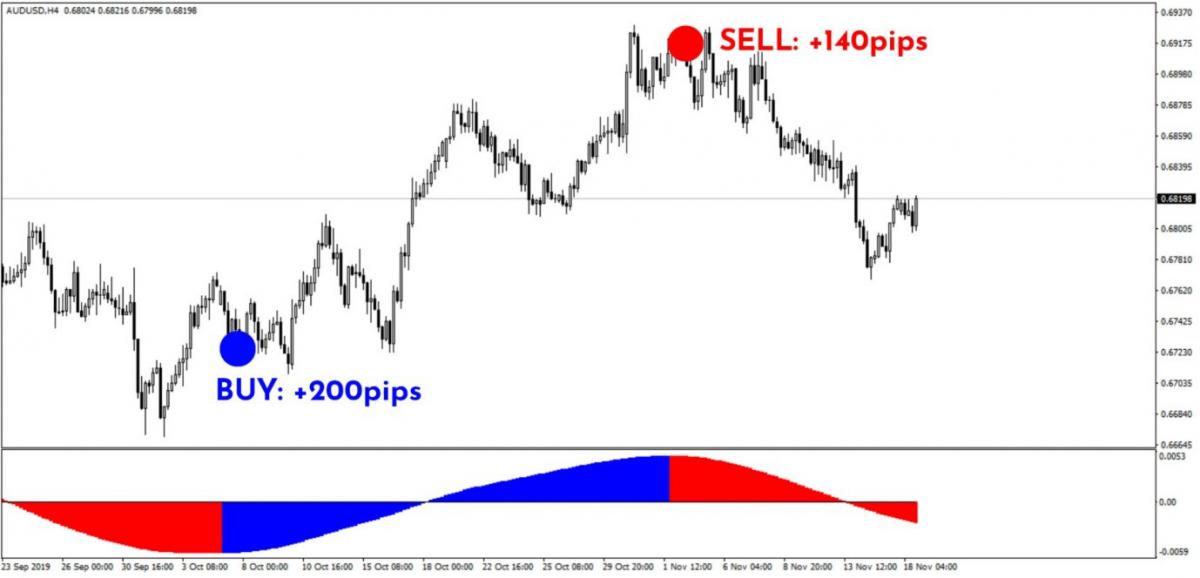

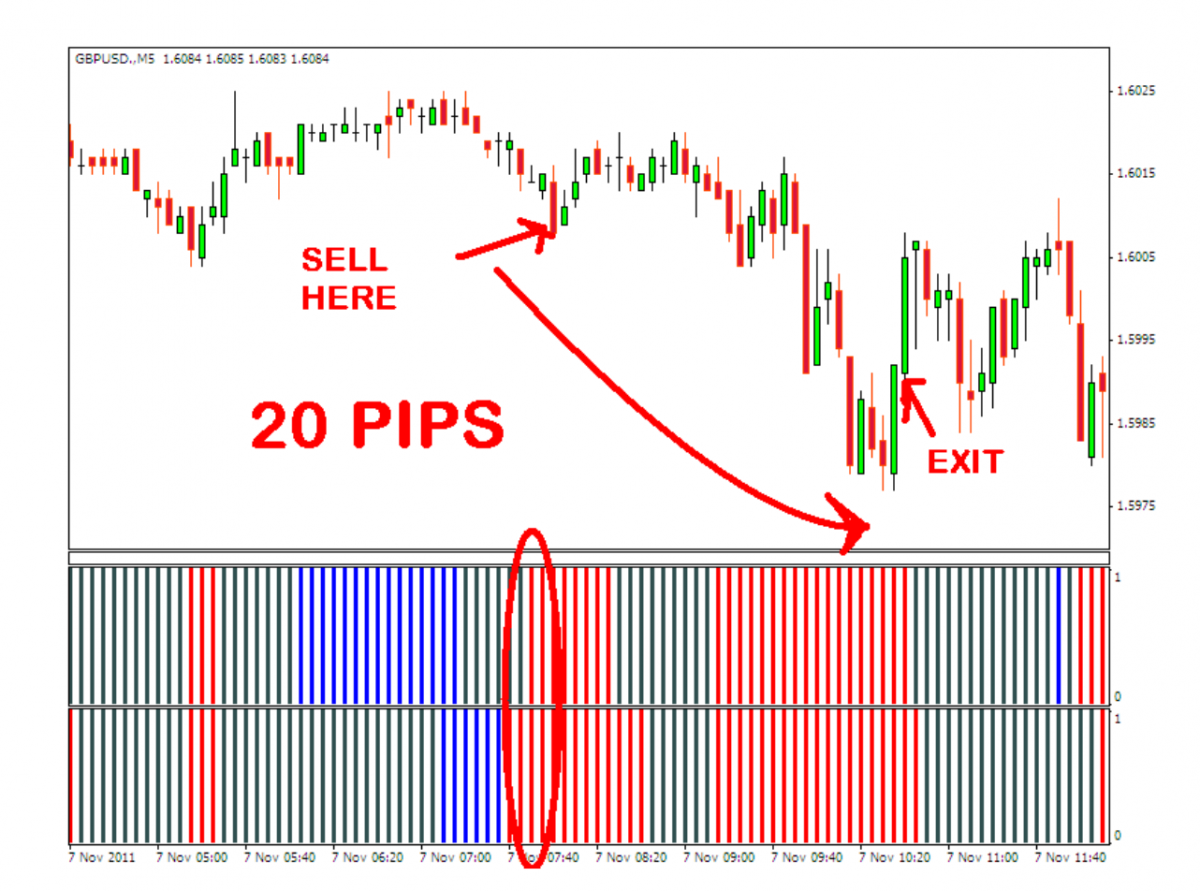

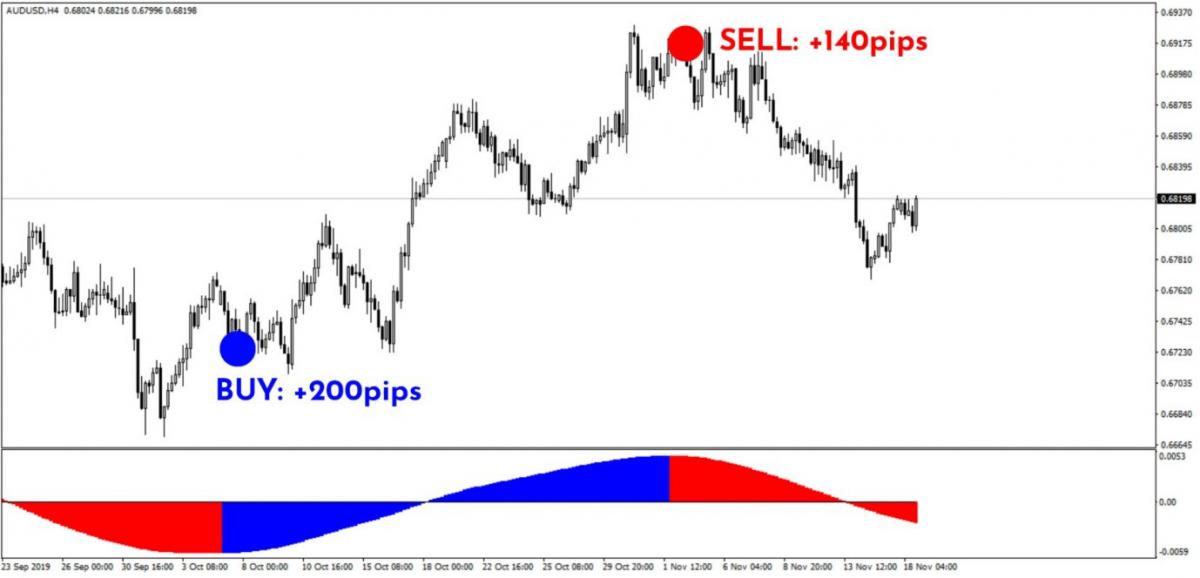

To succeed with this strategy, quick execution is essential, which is why it’s commonly used in scalping. Scalpers typically operate on short timeframes, such as 1-minute or 5-minute charts, to spot opportunities and open trades rapidly. This method requires traders to be highly attentive to market movements, as they must enter and exit positions within minutes to secure their desired pips.

To execute the 10 pips a day strategy effectively, traders need access to fast and reliable trading platforms, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which offer advanced charting tools and real-time data. Key currency pairs, like EUR/USD and GBP/USD, are often favored because of their liquidity and low spreads, making it easier to capture small price movements. These pairs are ideal for scalping, offering frequent opportunities to hit the 10 pip target throughout the trading day.

Advantages of the 10 pip forex strategy

The 10 pip forex strategy offers several advantages, especially for beginner traders. One of the main benefits is its focus on manageable, low-risk trades. Instead of aiming for large market movements, this strategy seeks small, steady gains, which can reduce exposure to market volatility. By targeting just 10 pips per day, traders can focus on consistency rather than high-risk, high-reward trades, which is often more suitable for those new to forex trading.

Another key advantage is the flexibility this strategy provides. Since it operates on short timeframes, it can easily fit into different schedules, making it ideal for part-time traders. Whether you’re trading for a few hours during the day or at night, the 10 pip strategy can be adapted to different trading sessions and market conditions.

This approach also helps build confidence. Traders can learn the ropes of the forex market by making frequent, small trades, which allows them to develop discipline without the pressure of needing massive wins. Compared to swing trading, which involves holding positions for days or weeks, the 10 pip strategy emphasizes speed and precision. While swing traders rely on larger price movements, scalping requires a more hands-on approach, offering quicker feedback and results.

Tools and indicators for the 10 pips per day strategy

Accurate technical analysis is critical for the 10 pips per day strategy, as swift decision-making is necessary to capitalize on small market movements. Traders using this strategy rely heavily on technical indicators to identify optimal entry and exit points in real-time. By using the right tools, traders can reduce guesswork and enhance their chances of success.

Key indicators used in this strategy include Moving Averages (MA), which help traders determine the overall trend direction by smoothing out price data. A common approach is using a short-term MA, like the 10-period MA, to spot quick market shifts. The Relative Strength Index (RSI) is another popular tool that measures market momentum, helping traders identify overbought or oversold conditions that signal potential reversals.

Bollinger Bands are also useful, providing a visual representation of volatility. When prices touch the upper or lower band, it can indicate a breakout or a reversion, offering timely trade opportunities. Similarly, the Stochastic Oscillator helps gauge price momentum, showing when a currency pair may be nearing the end of a trend.

For those seeking automation, custom-built indicators like the "10 pips per day indicator" can simplify the process. These tools are designed to alert traders when specific technical conditions align, enabling more efficient and timely trading decisions.

Key rules and best practices for success with the 10 pip strategy

Success with the 10 pip strategy requires following key rules and best practices. First, it’s essential to set realistic goals. While targeting 10 pips a day may seem straightforward, traders must avoid overtrading in pursuit of higher gains. Overtrading increases exposure to market risk, which can lead to unnecessary losses.

Effective risk management is critical to the strategy. Using stop-loss and take-profit orders ensures that trades are controlled and that losses are limited if the market moves unexpectedly. A typical stop-loss might be set a few pips away from the entry point, minimizing risk while the take-profit order locks in gains at the 10-pip target.

Discipline is another crucial factor for success. Sticking to the plan without being swayed by greed or emotion is key to long-term profitability. This strategy is about consistency, not chasing large profits. Traders should remain patient, even if opportunities seem scarce, to avoid emotional decision-making.

A sample trading plan for the 10 pip strategy might include defining trading hours, selecting specific currency pairs, and establishing clear entry and exit rules based on technical analysis.

Handling market volatility requires careful observation of price trends and avoiding trades during unpredictable events. Unexpected movements, such as those caused by major economic news, can disrupt even well-planned strategies, so staying aware of the market environment is vital.

Common mistakes to avoid in the 10 pip scalping strategy

Traders using the 10 pip scalping strategy often face specific challenges that can undermine their success. One common mistake is over-leveraging, which involves using too much borrowed capital to amplify trades. While leverage can increase profits, it also magnifies losses, making even a small market movement against your position highly risky. Given the small pip targets, over-leveraging can quickly lead to significant losses if not managed properly.

Another pitfall is emotional trading, where fear or greed drives decisions. Traders who deviate from their plan, chasing bigger profits or trying to recover losses, often end up sabotaging their strategy. The 10 pip strategy relies on discipline and sticking to small, consistent wins. Emotional reactions can cause traders to hold positions too long or make impulsive trades, leading to unnecessary risks.

Inconsistent analysis is another major issue. The success of the 10 pip strategy depends heavily on technical indicators, such as Moving Averages or RSI, being used correctly. Ignoring these tools or using them inconsistently can lead to poor entry and exit points, making the strategy less effective.

Finally, failing to understand market conditions can derail this approach. Scalping requires adapting to different forex environments. For example, the strategy works best in range-bound markets but may struggle during strong trending markets. Adjusting techniques based on current market behavior is essential for maintaining profitability.

Realistic expectations and long-term application

The 10 pips a day strategy can be part of a successful long-term trading plan, but it’s important to manage expectations. While this approach focuses on small, consistent gains, it is not a quick path to wealth. The goal is steady account growth, which, over time, can compound into significant profits. However, traders need to recognize that achieving 10 pips every day isn't guaranteed, and there will be days where the market conditions are unfavorable.

For this strategy to generate sustainable income, traders must maintain discipline and stick to their plan. While it can work well as a standalone strategy, many traders find it more effective when combined with other trading methods. For instance, using a 10 pip scalping strategy during range-bound markets and adopting a swing trading approach for trending markets can provide a balanced and diversified approach to trading.

A hypothetical case study might involve a trader starting with a $1,000 account. By consistently earning 10 pips per day on trades with a $1-per-pip position size, the trader could earn $10 daily. Over time, as the account balance grows, they can increase the position size, leading to larger daily profits. Though modest at first, with careful money management and compounding gains, this strategy can potentially grow a small account steadily over time.

Conclusion

In conclusion, it’s highly recommended to practice the 10 pip strategy in a demo account before transitioning to live trading. This allows traders to refine their skills, familiarize themselves with their chosen indicators, and build confidence without risking real capital.

The key to long-term success with this strategy lies in balancing consistency and patience. Traders must focus on steady gains, manage their risk, and avoid the temptation to overtrade or chase larger profits. With time, discipline, and continuous learning, the 10 pip strategy can be a valuable tool in any forex trader’s portfolio.