1 minute scalping strategy

Scalping involves trading to profit from small price changes within the 1 to 15 minutes timeframe with the aim of accumulating as many small profits as possible into a cumulatively large profit. Some traders prefer to trade forex pairs on the 1 Minutes (60 seconds) timeframe where they can capitalize and profit from relatively small price movements of the 1 Minutes chart. Every day has 1440 minutes and total trading minutes of 1170 to extract enormous amounts of pips each day from the forex market.

Why scalp the 1-minute chart?

- Limited exposure to risk: The duration of trade on the 1-minute chart from an entry and exit is relatively very short within 5 - 10 or 15 minutes. This brief exposure to the market also reduces the trader's exposure to adverse events and the possibility of assuming more risk.

- Minimal profit objective with less emotion: This is very important because traders might consider setting less ambitious profit targets within a 1-minute trading timeframe, compared to 15-minutes or 4hr because 1-minute profit objective is easier to achieve.

- Smaller pips in price movement are easier and quicker to obtain: you can sit in front of the chart and easily scout the price movement of a 1-minute chart. For example, a forex pair will move 5 to 10 pips faster than it is will move 30 pips.

- Smaller moves are more frequent than larger ones. Take, for instance, a single price expansion of 50 pips has a lot of back and forth small price movement within it that can amount to more than 100 pips. Even during quiet markets, there are many small movements a scalper can leverage to accumulate profits.

- 1-minute scalping strategy, therefore, allows for more frequent trades and entries thus requiring quick decision-making and execution of the trades.

Trader persona requirements for 1-minute forex scalping

Traders always look for different strategies to enhance their trading tactics for better results. This trading style might be for you if your persona tick the following.

- A high level of discipline.

- Ability to follow the process book or plan of a trading system.

- Ability to make very fast decisions without hesitation.

- Scalpers must be flexible and bE able to recognise the differences between a high probable trade from a low probable trade.

- In the end, a successful scalper is a person that’s able to play to the strengths of the market with a very good entry and exit plan.

Indicators that make up the best 1 minute scalping strategy

The best 1-minute scalping strategy uses the candlestick charts in conjunction with 3 technical indicators.

Moving averages

First off, both SMA and EMA are the best indicators for 1 minute scalping.

The Simple Moving Average (SMA) tracks the average closing price of the last number of periods. For example, a 50-day SMA will display the average closing price of 50 trading days, where all of them are given equal weight in the indicator.

The Exponential Moving Average (EMA) is very similar, however, it does differ from the SMA because it gives greater weight to more recent prices, so it is generally quicker to react to the latest changes in the marketplace.

The strategy uses the 50-day exponential moving average (EMA) and 100-day EMA. This is meant to help a trader with trend identification.

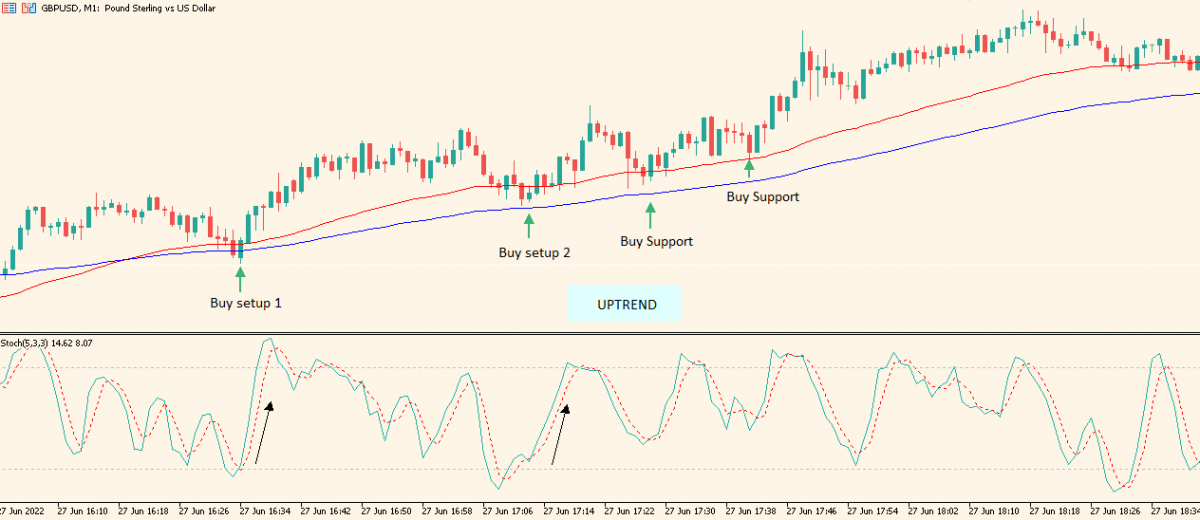

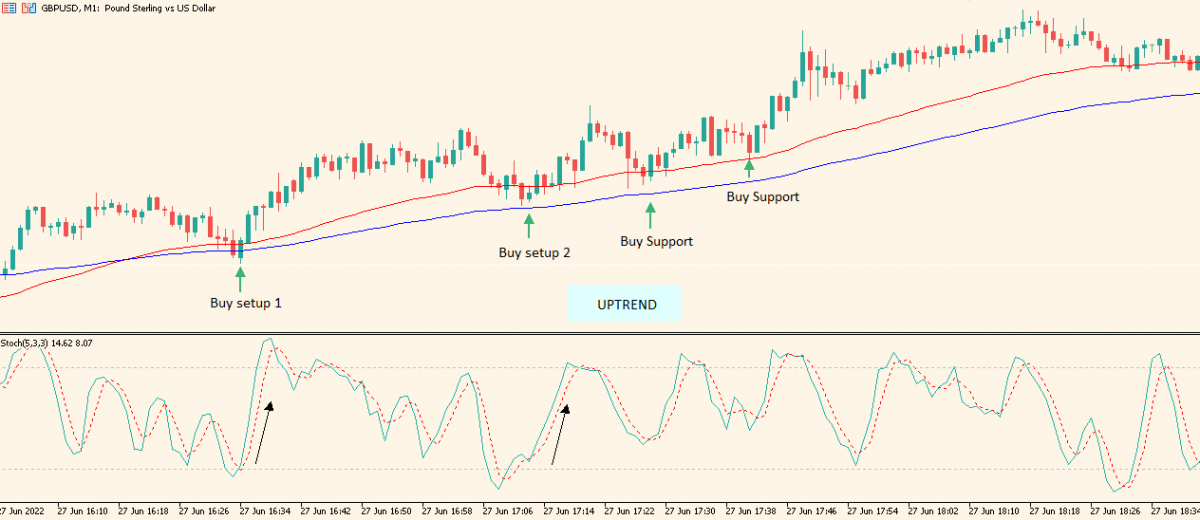

If the current price movement is above both exponential moving averages 50 & 100, that is an indication that the currency pair is in an uptrend. If the 50-day EMA crosses above the 100-day EMA, this further validates the uptrend and a setup for a bullish scalp will be highly probable.

Conversely, If the current price movement is below both exponential moving averages 50 & 100, that is an indication that the given currency pair is in a downtrend. If the 50-day EMA crosses below the 100-day EMA, this further validates the downtrend and a setup for a bearish scalp will be highly probable.

Stochastic oscillator

The third indicator is a simple momentum oscillator that measures oversold and overbought price movement within a range of 0 to 100.

The reading above the 80 level means that the pair is overbought and the reading below the 20 level suggests that the pair is oversold.

The 1 minutes forex scalping system

This is a powerful scalping system that is very easy to learn and can be consistently profitable in both trending and consolidating price movement if used correctly.

The following is required in order to trade the 1 minute scalping strategy.

- Trading Instrument: You ideally want to trade major forex pairs that have very tight spreads like EurUsd.

- Timeframe: Your chart should be set to a one-minute chart time frame.

- Indicators: You will select and plot the 50 EMA and 100 EMA on the 1 minutes chart. Then you will set the stochastic input values to 5, 3, 3.

- Sessions: You only need to hunt for setups in highly volatile New York and London trading sessions.

Buy setup trading plan

To enter a buy position,

- Wait and confirm the 50 EMA (Exponential Moving Average) is above the 100 EMA.

- The next step is to wait for price movement to retest on the 50 EMA or the 100 EMA.

- Lastly, the Stochastic oscillator must break above the 20 level to confirm bullish support on either EMA.

The confirmation of these three factors validates a highly probable 1 minute buy setup.

GbpUsd powerful 1 minute scalping: Buy Setups

Sell setup trading plan

To enter a sell position,

- Wait and confirm the 50 EMA (Exponential Moving Average) is below the 100 EMA.

- The next step is to wait for price movement to retest the 50 EMA or the 100 EMA.

- Lastly, the Stochastic oscillator must break below the 80 level to confirm bearish resistance on either EMA.

The confirmation of these three factors validates a highly probable 1 minute sell setup.

GbpUsd powerful 1 minute scalping: Sell setups

Stop-Loss placement and Take-Profit Objectives

It is important to have a defined risk to reward (stop loss and take profit objective) in every trade setup. The SL and TP levels for this strategy are set out below:

Take-profit: The ideal take-profit objective for this 1-minute scalp is 10-15 pips from your entry.

Stop-loss: Stop-loss should be 2 to 3 pips under or above the most recent change in price movement.

The dilemma of 1 minute scalping system

Competition with High-Frequency trading computers

1 minute scalping puts you in competition with high-frequency trading computers of banks, hedge funds, and quantitative traders. Their software is more equipped with better brainpower and capital. They are also much closer to the relevant exchange provider and have shorter latency.

High volatility news

Although there is limited exposure to risk scalping could be a waste of time in high volatility market because the stop loss or take profit can get easily triggered by the erratic back-and-forth movement of price movement.

Cost: commission and spread

Using this exact scalping strategy, it is important to mention that traders must put into consideration the broker's spread and commission. Some brokers do charge a $5 or $10 fee for trading 1 lot, which is the equivalent of 100,000 units of a given currency.

This ultimate 1 minutes scalping strategy can take on dozens of trades per day. Therefore, commission costs can easily accumulate to a significant amount thus reducing potential payouts. Fortunately, there are plenty of brokers who do not charge commissions for trading.

Another major consideration here is the size of the spreads. 1 minute scalping strategy typically aim at 5 to 15 pip gain, therefore it is important to trade with brokers that have tight spreads and also avoid forex pairs with large spreads like the exotics.

Slippage:

Slippage is the “hidden” cost of getting an order filled. Slippage is more likely to occur in the forex market when volatility is high, perhaps due to news events, or during times when the currency pair is trading outside peak market hours. It kills most scalping strategies and can put scalpers out of business.

If you are a scalper and want to initiate a trade on a breakout at 1.500, you face the challenge of getting a fill when the market shows a bid of 1.502 and an offer of 1.505. You are unlikely to get filled at 1.101. Over time, this slippage accumulates and reduces the potential returns. It is therefore a big hurdle to overcome if you want to make a profit via scalping.

Challenge of good risk-to-reward ratio and profit consistency.

Many Forex traders believe that achieving more than 50% of winning trades is very important for building a successful trading career. However, there is no guarantee that an individual can always achieve this, especially when it comes to such a high stressed environment, such as 1-minute trading.

However, there is one simple way to improve the odds of success. For example, a trader can aim for a 10 pip gain for each position and at the same time limit the stop loss to 5 pips. Clearly, it does not always have to be 2:1 ratio. For example, a market participant can have a goal of winning 9 pips from every trade with a 3 pip stop loss placement.

This approach enables traders to earn decent payouts even in cases where the winning ratio of their trades is 45% or 40%.

Click on the button below to Download our "1 minute scalping strategy" Guide in PDF